Oil & Gas Processing Seals Market Report Scope & Overview:

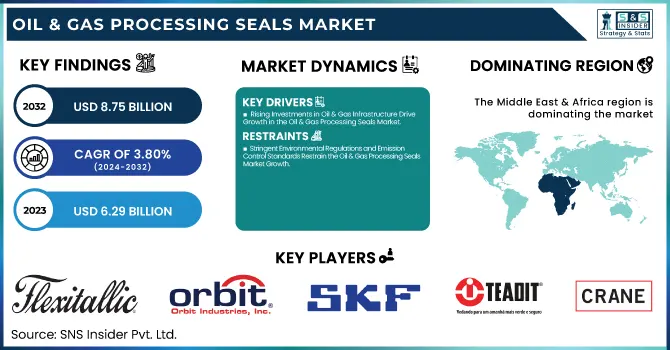

The Oil & Gas Processing Seals Market Size was valued at USD 6.29 Billion in 2023 and is expected to reach USD 8.75 Billion by 2032 and grow at a CAGR of 3.80% over the forecast period 2024-2032.

To Get more information on Oil & Gas Processing Seals Market - Request Free Sample Report

The Oil & Gas Processing Seals Market is registering consistent growth owing to growing energy demand, technological advances in sealing, and rising investments in exploration and refining. The application of seals for leak prevention and operational efficiency in the upstream, midstream, and downstream industry sectors makes it a vital requirement. Some of the important market trends are the use of high-performance elastomers, metal seals for hostile environments, and adherence to strict environmental norms. North America and Asia-Pacific dominate the market because of shale gas output and growing refining capacity.

The U.S. Oil & Gas Processing Seals Market, valued at USD 0.92 billion in 2023, is projected to reach USD 1.54 billion by 2032, growing at a CAGR of 5.99%, driven by shale gas expansion, refinery upgrades, and stringent emission regulations.

The U.S. Oil & Gas Processing Seals Market is being propelled by enhanced shale gas production, growing offshore exploration, and strict environmental rules. The increasing midstream infrastructure of the country, such as pipelines and LNG export terminals, increases demand for high-performance seals. Refining and petrochemical facilities also need advanced sealing solutions to promote efficiency and eliminate leaks. Spiraling trends revolve around using metal and elastomeric seals for harsh applications and increasing concern for sustainable material usage.

Oil & Gas Processing Seals Market Dynamics

Key Drivers:

-

Rising Investments in Oil & Gas Infrastructure Drive Growth in the Oil & Gas Processing Seals Market

The growing investment in oil and gas infrastructure such as drilling platforms, pipelines, refineries, and LNG facilities is fueling the demand for high-performance seals. The American private sector and the government persistently invest aggressively in midstream and downstream infrastructure to boost energy security and efficiency. Seals are critical for ensuring safety, avoiding leaks, and enhancing operation performance in extreme conditions. Besides this, the increasing use of the latest materials like metal seals and high-performance elastomers is also stimulating market growth through increased durability and efficiency in applications related to oil and gas processing.

Restraint:

-

Stringent Environmental Regulations and Emission Control Standards Restrain the Oil & Gas Processing Seals Market Growth

The oil and gas sector is being subjected to stringent environmental regulations, especially in the U.S., where there is a strict limit on emission controls and leak avoidance. Agency regulations by the EPA and OSHA mandate that organizations adopt sophisticated sealing solutions that cut down on fugitive emissions while enhancing sustainability. Adherence to these regulations comes at a high cost of operations, as businesses have to pay for high-performing seals as well as recurring maintenance. Moreover, the shift towards renewable sources of energy and decarbonization projects also restricts the growth of the oil and gas processing seals market further, acting as a constraint to its long-term growth prospects.

Opportunity:

-

Technological Advancements in High-Performance Seals Create New Opportunities for the Oil & Gas Processing Seals Market

The development of innovative sealing technologies presents significant opportunities for market growth. Advanced materials such as perfluoro elastomers (FFKM), metal bellows seals, and composite polymer seals are enhancing the durability and efficiency of oil and gas processing equipment. These innovations help withstand extreme temperatures, high pressures, and corrosive environments, reducing downtime and maintenance costs. With more and more investments pouring into offshore drilling and deepwater exploration, the need for strong sealing solutions is on the rise. Producers with a focus on R&D to create cost-saving, long service life, and eco-friendly seals are best placed to take advantage of new opportunities in the oil and gas industry.

Challenge:

-

Supply Chain Disruptions and Raw Material Price Volatility Pose Challenges for the Oil & Gas Processing Seals Market

The oil and gas processing seals industry is greatly reliant on the supply of raw materials like rubber, metal, and specialty polymers. Raw material price volatility, influenced by geopolitical instability, trade barriers, and inflation, generates uncertainty about production expenses. Supply chain dislocations generated by international crises, shortages of labor, and traffic congestion also affect the timely delivery of the seals to the oil and gas industry. These issues raise operational risks for end-users and manufacturers, resulting in increased costs and delays in projects. It is important to develop alternative material sourcing strategies and localized supply chains to counter these issues in the market.

Oil & Gas Processing Seals Market Segment Analysis

By Type

Double Seal segment led the Oil & Gas Processing Seals Market in 2023 because it offers better leakage prevention and improved durability in harsh high-temperature and high-pressure applications. Double seals find extensive applications in refineries, offshore drilling platforms, and LNG plants, meeting strict safety and environmental regulations. Organizations such as John Crane launched Type 3740D Dual Cartridge Seal for extreme applications, while EagleBurgmann brought the DF-(DGS) Series Dry Gas Seals to the turbomachinery sector. Such innovations support better operational efficiency and reliability, solidifying the strong market need for double seals in oil and gas processing sectors.

The Single Seal segment will experience the highest CAGR throughout the forecast period due to its ease of maintenance and cost-effectiveness in midstream and downstream applications of oil and gas. Due to growing pipeline expansion and refinery upgrades in North America, single seal demand is on the rise. Chesterton has introduced the Chesterton 1810 Single Cartridge Seal that improves leak protection in rotating machinery, while Flowserve has unveiled high-performance ISC2 Series Single Seals tailored for typical pump service. As the market continues to look for cost-effective and efficient sealing systems, the single seal market is picking up steam in a variety of oil and gas processing applications.

By Material

The metal segment was the leading segment of the Oil & Gas Processing Seals Market in 2023, based on its higher durability, pressure resistance, and better performance under harsh temperature conditions. Metal seals like stainless steel and Inconel-based seals are largely utilized in midstream and upstream operations for the prevention of leakage in extreme conditions. Prominent players such as John Crane and Parker Hannifin have introduced advanced metal seals with better corrosion resistance.

For example, EagleBurgmann launched metal bellows seals for high-pressure service, addressing offshore drilling and refining. Expanding deepwater drilling and LNG projects continue to drive demand for metal seals.

The elastomers segment shall have the highest CAGR through the forecast period with rising usage in sealing applications with demands for flexibility, chemical resistance, and thermal stability at high temperatures. Elastomeric seals, for example, Viton (FKM), perfluoro elastomers (FFKM), and hydrogenated nitrile butadiene rubber (HNBR) are becoming more popular in refineries and LNG plants. With increased investments in shale gas exploration and sophisticated refinery operations, elastomers are progressively replacing conventional materials, leading to high growth in the market.

By Application

The downstream segment led the Oil & Gas Processing Seals Market in 2023, influenced by growing refining capacity and rising petrochemical demand. The U.S. experienced extensive investment in refinery refurbishment, with players such as ExxonMobil and Chevron increasing production to maximize processing efficiency. Advanced gas seals were provided by John Crane to increase performance within high-pressure refining conditions, while Flowserve developed new polymer-based sealing solutions for chemical processing. These advances go in tandem with stringent green laws, accelerating the uptake of high-performance seals to cut emissions and leaks. Increasing demand for trusted sealing solutions remains the driver of revenues in this sector.

The midstream business segment is likely to register the highest CAGR over the forecast period driven by growing pipeline infrastructure, LNG export, and improving storage capacity. Players such as Baker Hughes and AESSEAL have unveiled the latest mechanical seals that are applicable under extreme pressure applications in the transportation of oil and gas. Emerson has also unveiled sealing technologies with real-time monitoring to enhance pipeline safety. With the U.S. bolstering its LNG export terminals and building out its pipeline infrastructure, demand for reliable, leak-free sealing solutions is on the rise. This swift expansion underscores the importance of midstream sealing technology in maintaining operational efficiency.

Oil & Gas Processing Seals Market Regional Outlook

The Middle East & Africa (MEA) market dominated the Oil & Gas Processing Seals Market in 2023, contributing 32.34% to overall revenue globally. This leadership is attributed to vast oil reserves, growing refinery expansions, and growing investments in petrochemical projects. Players such as John Crane launched innovative dry gas seals to maximize efficiency in Saudi Aramco's refining processes, and Flowserve designed corrosion-resistant elastomeric seals for high-temperature use in the UAE. Also, AESSEAL introduced sealing solutions specifically for severe desert environments. As continuous oil production and downstream expansion exist, persistent demand for hard-wearing, high-performance seals remains in the MEA region.

North America is expected to register the highest CAGR of 6.24% with growing shale gas production, LNG exports, and expansion of midstream infrastructure. The U.S. and Canada are heavily investing in pipeline networks, necessitating high-quality sealing solutions to avoid leaks and ensure safety. Baker Hughes introduced advanced mechanical seals for high-pressure pipelines, and Emerson introduced real-time monitoring systems for improved leak detection. Moreover, EagleBurgmann also created LNG-optimized gas-lubricated seals. These advancements service the region's growing energy market, fueling the need for efficient oil and gas processing seals in North America's increasing infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Flexitallic – (Vermiculite High-Temperature Seals, Change Gasket)

-

ORBIT Industries – (API-682 Mechanical Seals, High-Pressure Rotary Seals)

-

SKF – (Hydraulic Seals, Rotary Shaft Seals)

-

Smiths Group – (End-Face Mechanical Seals, Non-Contacting Gas Seals)

-

Teadit – (PTFE-Based Gaskets, Spiral Wound Gaskets)

-

Performance Seals – (Custom Elastomeric Seals, High-Temperature Polymer Seals)

-

Garlock Sealing Technologies – (Klozure Oil Seals, Iso-Gard Bearing Isolators)

-

Crane Co. – (Turbomachinery Dry Gas Seals, Bellows Seals)

-

EagleBurgmann – (Cartex Cartridge Seals, CobaSeal Gas Seals)

-

Chesterton – (Chesterton 442C Cartridge Seals, DualPac Packing Seals)

-

Rubbtec – (Rubber Expansion Joints, Industrial Gaskets)

-

Walter Meier – (Hydraulic Sealing Solutions, High-Performance O-Rings)

-

John Crane UK – (Type 28 Dry Gas Seals, Metastream Couplings)

-

Parker Hannifin – (Parker Prädifa PTFE Seals, Resilon Polyurethane Seals

-

Freudenberg – (Simmering Shaft Seals, Merkel Hydraulic Seals)

Recent Trends

-

November 2023– Flexitallic Launched Change HT Gasket, an enhanced version of their Change Gasket for high-temperature sealing applications in refineries and chemical plants.

-

March 2024 – ORBIT Industries Introduced API 682 Compliant Mechanical Seals for improved performance in oil and gas processing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.29 Billion |

| Market Size by 2032 | US$ 8.75 Billion |

| CAGR | CAGR of 3.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type - (Single Seal, Double Seal) • By Material - (Metal, Elastomers, Seal Face Materials, Others) • By Application - (Upstream, Midstream, Downstream) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Flexitallic, ORBIT Industries, SKF, Smiths Group, Teadit, Performance Seals, Garlock Sealing Technologies, Crane Co., EagleBurgmann, Chesterton, Rubbtec, Walter Meier, John Crane UK, Parker Hannifin, Freudenberg, Others |