Rotary Pumps Market Report Scope & Overview:

To Get More Information on Rotary Pumps Market - Request Sample Report

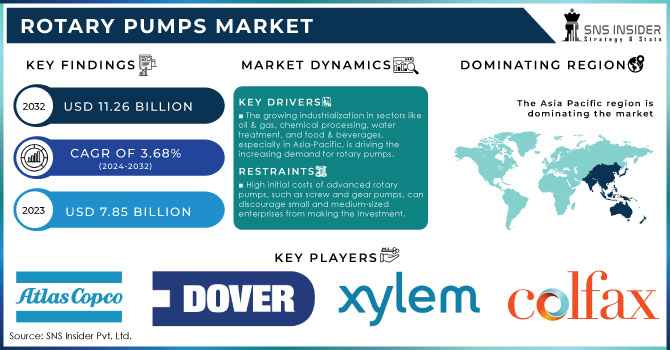

The Rotary Pumps Market size was valued at USD 7.85 Billion in 2023 and is now anticipated to grow to USD 11.26 Billion by 2032, displaying a compound annual growth rate (CAGR) of 3.68% during the forecast Period 2024-2032.

The Rotary pumps are highly regarded for their ability to deliver consistent flow rates, high efficiency, and reliability in transferring various types of fluids, including viscous liquids and slurries. In fact, rotary pumps account for approximately 30% of the total pump market within the oil and gas industry, underscoring their vital role in this sector.

Recent trends highlight a shift towards advanced rotary pump technologies, including smart pumps integrated with IoT capabilities, which facilitate real-time monitoring and predictive maintenance. This trend is partly fueled by the rising emphasis on automation and digitization within industrial processes, leading to enhanced operational efficiency and reduced downtime. The incorporation of IoT technologies in rotary pumps is expected to boost efficiency and minimize downtime by up to 20%, thereby streamlining predictive maintenance practices.

Sustainability is also becoming a key focus for manufacturers, as regulations promoting eco-friendly solutions have driven a 25% increase in demand for energy-efficient rotary pumps in recent years. These energy-efficient pumps can reduce energy consumption by 20-50%, aligning with the growing emphasis on sustainability and regulatory compliance. Moreover, the food and beverage industry are witnessing a surge in demand for hygienic rotary pumps due to stringent health and safety regulations designed to prevent contamination and ensure compliance with industry standards.

The chemical sector is adapting to new formulations and processes that require specialized rotary pumps, resulting in innovations in materials and designs capable of handling corrosive and abrasive fluids effectively. Furthermore, infrastructure development in emerging economies is expected to enhance the demand for rotary pumps by 30% over the next decade, particularly in sectors such as wastewater management and construction. Additionally, the renewable energy sector is poised for significant growth, with biogas production projected to reach 700 terawatt-hours (TWh) by 2030, creating substantial opportunities for rotary pump manufacturers to cater to the increasing demand for pumping systems that can efficiently handle unconventional fluids. This multifaceted growth trajectory in the rotary pumps market reflects a dynamic interplay of technology, sustainability, and industrial advancement.

MARKET DYNAMICS

DRIVERS

- The growing industrialization in sectors like oil & gas, chemical processing, water treatment, and food & beverages, especially in Asia-Pacific, is driving the increasing demand for rotary pumps.

The growing industrialization and infrastructure development, especially in sectors like oil & gas, chemical processing, water treatment, and food & beverages, is significantly driving the demand for rotary pumps. These pumps are crucial in various industrial processes, including fluid transfer, oil extraction, and chemical transportation. As industries expand, so does the need for reliable, efficient pumping systems to handle different materials, from crude oil to chemicals and water.

Developing regions, particularly in Asia-Pacific, are experiencing rapid industrial growth and urbanization. Countries like China, India, and Southeast Asian nations are heavily investing in infrastructure projects to support their expanding economies. This surge in industrialization leads to increased demand for equipment that can sustain heavy-duty operations, with rotary pumps playing a vital role in meeting these requirements. Additionally, the growth of water treatment plants, driven by rising environmental concerns and water scarcity issues, further boosts the demand for rotary pumps to ensure efficient water management.

Moreover, the food & beverages industry, which requires precise and hygienic fluid handling, is also seeing steady growth, contributing to the rising demand for these pumps. Overall, the expansion of industries in developing regions fuels the need for advanced rotary pumps, which are essential for maintaining operational efficiency and supporting the broader infrastructure development in these areas.

- Advancements in pumping technologies, including smart pumps, IoT-enabled monitoring, and design improvements, are boosting efficiency and reliability, driving increased demand for upgraded systems.

Advancements in pumping technologies have significantly transformed the operational landscape, leading to improved efficiency, reliability, and ease of maintenance. The introduction of smart pumps, which are integrated with advanced sensors and automation, allows for real-time monitoring and control, thereby optimizing energy consumption and reducing operational costs. These smart pumps are often equipped with Internet of Things (IoT)-enabled systems that provide remote monitoring capabilities, allowing operators to track performance metrics such as pressure, flow rates, and energy usage from any location. This reduces the likelihood of unexpected breakdowns and enables predictive maintenance, which minimizes downtime and extends the lifespan of equipment.

In addition to smart technology, advancements in pump design have led to more efficient and durable systems. Manufacturers are increasingly focusing on creating pumps that are more energy-efficient, environmentally friendly, and capable of handling a wider range of fluids with minimal wear and tear. These innovations result in pumps that require less frequent maintenance and are more cost-effective over their operational lifetime.

As a result, many industries are choosing to upgrade their existing pumping systems to take advantage of these technological improvements. This growing demand for advanced pumping technologies is driving further innovation and investments in the sector, as companies seek to enhance productivity, lower operational risks, and reduce energy consumption. Overall, advancements in pumping technologies are reshaping industry practices and providing new opportunities for sustainable growth.

RESTRAIN

- High initial costs of advanced rotary pumps, such as screw and gear pumps, can discourage small and medium-sized enterprises from making the investment.

High initial costs represent a significant barrier for small and medium-sized enterprises (SMEs) considering the investment in rotary pumps, particularly advanced models such as screw and gear pumps. These pumps are engineered with intricate designs and superior materials to deliver high efficiency and reliability, contributing to their elevated price point. For many SMEs, the financial burden of purchasing such equipment can be daunting, as they often operate with limited capital resources and tight budgets. The high upfront costs may lead these businesses to opt for less efficient, lower-cost alternatives, which can compromise operational efficiency and long-term productivity. Furthermore, the initial investment in rotary pumps doesn't just encompass the purchase price; it also includes installation, maintenance, and potential training for staff to operate the equipment effectively. This can amplify the financial strain on SMEs, making it challenging to justify the expense against immediate cash flow needs. In addition, the perception that these pumps are primarily designed for larger enterprises may further dissuade SMEs from exploring this option, as they may fear that the equipment won't provide adequate return on investment (ROI) within their operational context. As a result, the reluctance to invest in advanced rotary pumps can hinder SMEs from optimizing their processes, limiting their growth potential and competitiveness in an increasingly demanding market landscape. Addressing these financial barriers is crucial to enable SMEs to leverage advanced pumping technologies for improved operational efficiency and sustainability.

KEY SEGMENTATION ANALYSIS

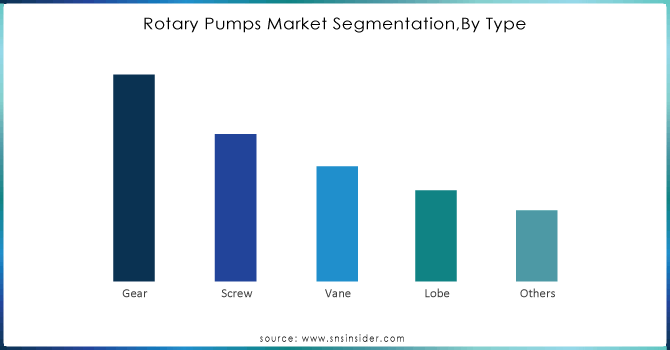

By Type

In 2023, the gear pump sector had the highest market share at 34.3%. A gear pump, which is classified under positive displacement, is a widely used rotary pump. It operates by using rotating gears that interlock to move liquid. The basic concept of gear pumps is to trap and transfer liquid by taking advantage of the spaces created between the teeth of the turning gears. Gear pumps are widely utilized in a range of industries such as hydraulic systems, lubrication systems, fuel transfer, and chemical processing. They are especially well-equipped to manage various fluids with varying corrosiveness, viscosity, and density.

Do You Need any Customization Research on Rotary Pumps Market - Inquire Now

By End-Use

The oil & gas end-use sector contributed the most to the total revenue in 2023, with a share of 28.2%. Rotary pumps are commonly utilized in the oil and gas sector for multiple essential roles because of their dependability, adaptability, and capacity to handle a diverse array of fluids like crude oil and refined products. Moreover, they are utilized for transporting raw oil from wellheads to storage tanks, between two storage tanks, as well as for loading and unloading from tankers and pipelines.

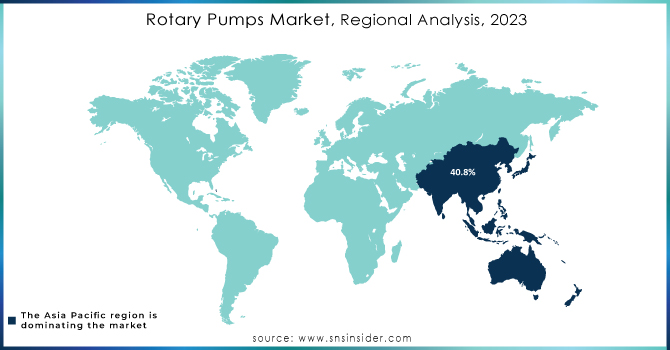

REGIONAL ANALYSIS

In 2023, the Asia Pacific region dominated the rotary pumps market, accounting for the largest revenue share of 40.8%. This growth is primarily driven by rapid industrialization and the increasing demand for fluid handling across various countries such as China and India. The agriculture, chemical, and food processing industries have experienced a notable expansion in the region due to rising urbanization and per capita income. Pumps play a crucial role in the agriculture sector, as they are essential for ensuring adequate water supply to watershed areas, further propelling market growth in Asia Pacific.

Europe represented the second-highest portion of revenue in 2023. The developed industrial sector is predicted to be the main factor driving market growth in this area. Rotary pumps are utilized in different industrial applications, including lubricating, circulating coolants, and powering hydraulic systems, fueling demand on a local level. Additionally, the market growth in this region is also propelled by the need for more efficient rotary pumps to decrease carbon footprint in industrial processes and enhance carbon credit.

KEY PLAYERS

Some of the major key players of Rotary Pumps Market

- Atlas Copco AB: (Compressors, Vacuum Solutions, Air Treatment Systems)

- Dover Corporation: (Industrial Pumps, Refrigeration Systems, Fueling Solutions)

- Xylem Inc.: (Water Treatment Systems, Pumps, Dewatering Solutions)

- Colfax Corporation: (Medical Devices, Fabrication Technology, Pumps)

- IDEX Corporation: (Fluid and Metering Technologies, Health & Science Technologies)

- Flowserve Corporation: (Valves, Pumps, Seals, Flow Management Systems)

- KSB SE & Co. KGaA: (Pumps, Valves, Automation Solutions)

- HMS Group: (Industrial Pumps, Oil & Gas Equipment, Compressors)

- Pentair Ltd.: (Water Treatment Products, Pumps, Filtration Systems)

- SPX Flow: (Pumps, Mixers, Valves, Filtration Equipment)

- Alfa Laval: (Heat Exchangers, Separators, Fluid Handling Systems)

- Gardner Denver Inc.: (Compressors, Blowers, Vacuum Pumps)

- ITT Inc.: (Pumps, Valves, Motion Technologies)

- Roper Technologies Inc.: (Pumps, Valves, Medical & Scientific Imaging Systems)

- Schlumberger Ltd.: (Oilfield Services, Drilling, Pumps)

- Graco Inc.: (Fluid Handling Systems, Sprayers, Pumps)

- Grundfos: (Pumps, Water Technology, Circulators)

- Sulzer Ltd.: (Pumps, Compressors, Separation Technology)

- Weir Group: (Pumps, Valves, Mining & Quarrying Equipment)

- Ebara Corporation: (Pumps, Compressors, Fans)

RECENT DEVELOPMENTS

In 2024: NETZSCH Pumps USA showcased its TORNADO® T1 Generation F rotary lobe pump, designed for high flow at low to medium pressures, featuring a robust and service-friendly design that enhances efficiency and longevity across various industrial applications.

In 2023: Packo launched the ZLC rotary lobe pump, specifically designed for the pharmaceutical, biotech, and cosmetic industries. This pump can handle liquids with viscosities up to 1,000,000 cP and is made from stainless steel 316L, ensuring high standards of hygiene and safety in handling pharmaceutical and cosmetic products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.85 Billion |

| Market Size by 2032 | USD 11.26 Billion |

| CAGR | CAGR of 3.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Gear, Screw, Vane, Lobe, Others) • By End-Use (Agriculture, Construction & Building Services, Water & Wastewater, Power Generation, Oil & Gas, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco AB, Dover Corporation, Xylem Inc., Colfax Corporation, IDEX Corporation, Flowserve Corporation, KSB SE & Co. KGaA, HMS Group, Pentair Ltd., SPX Flow, Alfa Laval, Gardner Denver Inc., ITT Inc., Roper Technologies Inc., Schlumberger Ltd., Graco Inc., Grundfos, Sulzer Ltd., Weir Group, Ebara Corporation. |

| Key Drivers | • The growing industrialization in sectors like oil & gas, chemical processing, water treatment, and food & beverages, especially in Asia-Pacific, is driving the increasing demand for rotary pumps. • Advancements in pumping technologies, including smart pumps, IoT-enabled monitoring, and design improvements, are boosting efficiency and reliability, driving increased demand for upgraded systems. |

| RESTRAINTS | • High initial costs of advanced rotary pumps, such as screw and gear pumps, can discourage small and medium-sized enterprises from making the investment. |