Respiratory Devices Market Overview:

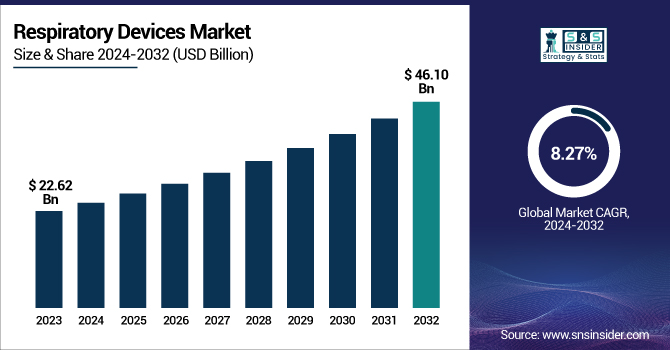

The Respiratory Devices Market Size was valued at USD 22.62 billion in 2023 and is projected to reach USD 46.10 billion by 2032, growing at a robust CAGR of 8.27% during the forecast period of 2024-2032.

Get More Information on Respiratory Devices Market- Request Sample Report

Respiratory devices are essential in helping with breathing by providing oxygen and maintaining proper airflow into the lungs at different pressures. The increasing prevalence of respiratory diseases like (Chronic Obstructive Pulmonary Disease) COPD, asthma, and sleep apnea is greatly fueling the need for these devices. Around 936 million American adults suffer from sleep apnea, creating a large demand for respiratory devices as per the National Council on Aging. The high occurrence of respiratory illnesses requires regular hospital and clinic visits, leading to a higher demand for effective diagnosis and treatment options. This increasing necessity results in an increased requirement for advanced respiratory equipment that can provide efficient treatment for these conditions. The market was significantly affected by the COVID-19 pandemic, with a rise in the need for ventilators, masks, and other respiratory devices as a result of the increased number of patients experiencing respiratory problems related to the virus. This resulted in an increase in the availability and dissemination of respiratory devices, boosting the income of healthcare providers and having a positive impact on the market. An important driver of market growth is the emphasis placed by top manufacturers on developing creative and effective respiratory solutions through technological advancements. For example, the market is projected to expand more due to developments in device technology and a growing focus on respiratory health.

Significant growth and adoption in the respiratory device market are being driven by profound technological advancements. Recent advancements have led to the creation of smaller and more portable oxygen concentrators, improving the ability of patients in need of long-term oxygen therapy to move around easily and conveniently. CPAP machines have been upgraded to include built-in sensors and data analysis capabilities that enhance treatment by automatically adjusting pressure levels according to the patient's breathing patterns. Moreover, improvements in nebulizer technology have resulted in more effective and user-friendly devices, featuring enhanced aerosol delivery systems that enhance the effectiveness of medication. These advancements in technology improve patient comfort and device effectiveness, as well as increase the use of respiratory devices in homes and medical facilities. Approximately 16 million Americans have been diagnosed with COPD, highlighting the importance of advanced respiratory solutions, as stated by the U.S. National Institutes of Health (NIH). Likewise, the World Health Organization (WHO) emphasizes the crucial importance of sophisticated respiratory equipment in treating chronic respiratory illnesses (WHO Respiratory Disease Statistics). Therefore, it is anticipated that the respiratory devices market will maintain its strong growth due to technological advancements meeting the changing demands of patients and healthcare professionals.

Respiratory Devices Market Dynamics

Drivers

-

Increasing occurrence of respiratory conditions drives need for advanced respiratory equipment.

The increasing occurrence of respiratory disorders like sleep apnea, COPD, and asthma is a major factor fueling the growth of the worldwide market for respiratory devices. With the rise in prevalence of these conditions, there has been a growing need for diagnosis and treatment options, prompting a greater dependence on respiratory devices in different healthcare environments. Based on a report from NHLBI in 2023, around 16 million American adults have COPD, highlighting the increasing demand for better management and treatment choices. This rise in respiratory illnesses is not just increasing the number of diagnoses but also prompting healthcare organizations to put in place strategic efforts to promote awareness of respiratory health. These efforts, along with an increased emphasis on detecting and treating illnesses early, are leading to a greater need for cutting-edge respiratory equipment. The increased need for advanced devices has led respiratory equipment companies to concentrate on creating and launching innovative products that meet the changing requirements of patients and healthcare providers. An example would be the noticeable rise in the creation of portable and easy-to-use equipment, like compact oxygen concentrators and advanced CPAP machines that improve patient comfort and treatment effectiveness. Additionally, the growing healthcare infrastructure in developing countries such as China and India is predicted to help boost the use of these advanced respiratory devices. These nations are experiencing a rise in healthcare funding, which is enabling the incorporation of state-of-the-art respiratory technologies into their healthcare systems. Consequently, the respiratory devices market is set to experience significant growth in the foreseeable future, propelled by the combination of rising disease rates, technological progress, and healthcare infrastructure expansion. There is a predicted increase in focus on respiratory health and ongoing advancements in device technology.

-

Increasing Respiratory Conditions Leading to Growth in the Worldwide Respiratory Equipment Industry

The respiratory devices market is growing substantially due to the increasing prevalence of respiratory disorders globally. Long-term diseases like Chronic Obstructive Pulmonary Disease (COPD) and asthma have become significant health problems, impacting millions of people in developed and developing areas. COPD has seen a significant increase in becoming a top cause of death worldwide, as emphasized by the World Health Organization (WHO). As per a WHO document published in March 2023, more than 200 million individuals are affected by COPD, leading to 3.23 million fatalities in just 2019, with 65 million people having moderate-to-severe variations of the condition. The increasing occurrence of respiratory diseases is strongly connected to various factors, such as rising air pollution, a growing elderly population, and changes in lifestyle like smoking and less physical activity. Additionally, sleep-disordered breathing impacts about 1-6% of adult’s worldwide, totaling more than 100 million individuals, highlighting the importance of reliable respiratory treatment. The increase in respiratory illnesses is driving the need for innovative treatments and diagnostic methods, establishing the respiratory devices market as an essential part of worldwide healthcare systems. The urgent requirement to control and reduce the impact of respiratory illnesses has pushed device producers to broaden their range of products, providing creative solutions like advanced ventilators, portable oxygen concentrators, and state-of-the-art Continuous Positive Airway Pressure (CPAP) devices. These improvements are not just improving patient results but are also addressing the increasing need from healthcare providers managing a larger population of respiratory patients. Therefore, the worldwide respiratory devices market will keep growing due to the rising number of respiratory disorders and the need for advanced medical technologies to treat this pressing issue.

Restraints

-

Shortage of skilled labor in developing markets presents a hurdle to the growth of the respiratory devices market.

The increasing presence of respiratory illnesses like COPD and asthma is boosting the worldwide respiratory devices market, but it is hindered by a shortage of qualified workers in developing nations. As respiratory disorders become more common, the need for diagnosis and treatment is increasing, but there is a lack of qualified respiratory therapists causing a bottleneck in healthcare services. In 2022, the British Thoracic Society revealed that the United Kingdom had a deficit of respiratory therapists, with only around 4,000 professionals available to address the increasing demands of patients with respiratory illnesses. This lack is even more noticeable in developing countries, where the healthcare system is still growing and there is a more severe shortage of trained professionals. The inadequate number of skilled respiratory therapists is a barrier to accurately diagnosing and treating respiratory conditions, resulting in a greater burden of disease and unaddressed patient needs. Furthermore, the scarcity of professionals significantly influences the uptake and use of respiratory devices. Lack of proper clinical guidance and support can lead to lower adherence to prescribed treatments, worsening the problem. A recent 2022 study released by the National Center for Biotechnology Information (NCBI) revealed that the adherence rates for treatments of obstructive pulmonary disease vary from 10% to 40%, indicating a notable disparity in patient adherence. This lack of compliance, combined with the insufficient number of experienced respiratory professionals, is projected to hinder the expansion of the respiratory devices market, especially in areas where healthcare resources are already overstretched. Addressing the workforce shortages and improving patient adherence will be essential in sustaining the market's growth amid increasing demand for respiratory care. Without these essential actions, the opportunity for market expansion could be hindered, even though.

Respiratory Devices Market Segmentation Analysis

By Type

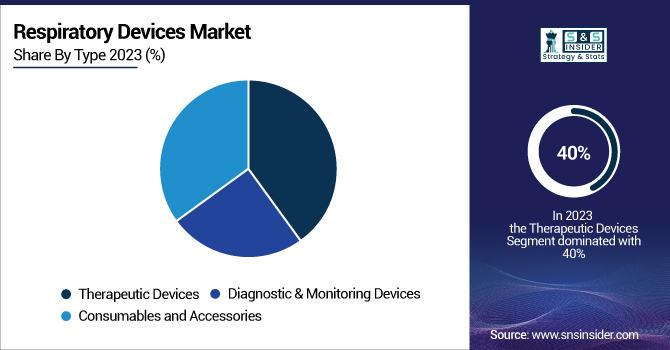

Based on Type, Therapeutic Devices capturing the largest share revenue in Respiratory Devices with 40% of share in 2023. This control is due to major technological improvements in different airway tools, like airway clearance devices, which are becoming more popular and accepted by patients. The increased emphasis on research and development by key industry players is boosting the market presence of therapeutic devices, resulting in the introduction of innovative respiratory therapy devices like ventilators and inhalers. In January 2023, Getinge AB launched the Servo-c ventilator, created for adult and pediatric patients with respiratory diseases, intending to broaden its range of ICU products. Innovations play a crucial role in fueling the growth of the sector by meeting the changing needs of patients and healthcare providers. Furthermore, there will be significant growth in the diagnostic and monitoring devices segment, fueled by the rising rates of diagnosis for respiratory conditions such as COPD and asthma. This trend is resulting in an increased need for diagnostic devices, as companies are concentrating on mergers, partnerships, and developing new products to enhance their market position. Likewise, there is an expected growth in the consumables and accessories sector, driven by key players taking strategic actions to increase awareness of respiratory devices. The demand for necessary items like masks, nasal cannulas, and other accessories is increasing as a result. Businesses are more frequently introducing new products and organizing information drives to boost the usage of these devices among patients, additionally fueling the overall expansion of the respiratory devices industry. Collaborative work in innovation, product development, and strategic partnerships is essential for sustaining the market's growth in these areas.

By End User

Based on End User, Hospitals and ASCs is capturing the largest share revenue in Respiratory Devices market with 39% of share in 2023. The increasing patient admissions for treating sleep apnea, asthma, and other respiratory disorders are the main reason for this dominance in these settings. The rising occurrence of respiratory disorders, along with the increasing amount of hospitals and ASCs, is a major factor in driving the growth of this sector. An instance is when, as per data released by above & beyond Therapy in 2023, there are a total of 7,335 operational hospitals in the United States, showcasing the vast resources allocated for respiratory treatment. The growth of hospitals and ASC facilities is increasing the need for respiratory devices and prompting manufacturers to develop innovative solutions specific to these settings. Businesses are more and more creating specialized respiratory solutions for use in hospitals and clinical settings. Companies such as Philips and ResMed are always coming up with new ideas for their CPAP machines and ventilators, which are designed to meet the needs of both hospitalized and non-hospitalized patients. Furthermore, the specialty clinics sector is expected to experience significant expansion, particularly in developing countries like Brazil, China, and India, as the quantity of specialty clinics is increasing. These clinics are seeing more patients with respiratory disorders, resulting in an increase in both inpatient and outpatient admissions. At the same time, the home care settings sector should also see an increase, fueled by the release of items such as Cipla's Spirofy, a portable spirometer with wireless capabilities launched in November 2021. These advancements are simplifying the way patients can control their respiratory issues at home, which is also broadening the market for respiratory devices. As the need for respiratory products for home care increases, it will likely contribute to the increasing use of these devices, along with the strong growth seen in hospitals and clinics.

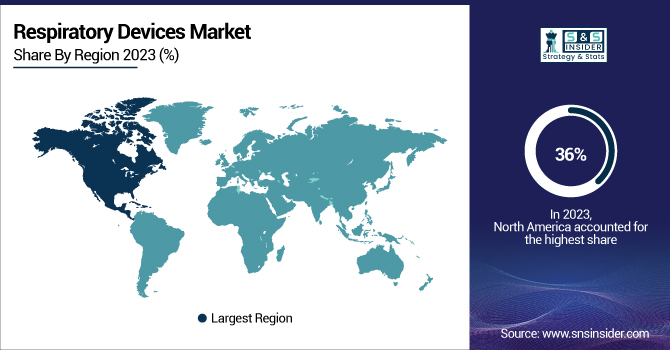

Regional Insights

North America dominate the Respiratory Devices market with 36% of share in 2023. Fueled by various factors such as the increasing need for therapeutic and diagnostic & monitoring equipment, a strong lineup of leading companies pursuing regulatory clearances, and strategic efforts to raise awareness of advanced respiratory technologies. Healthcare organizations in the area are actively promoting the advantages of modern respiratory devices, which reinforces the region's leading position. In November 2023, Vivos Therapeutics was granted U.S. FDA approval for its Vivos CARE oral appliance aimed at addressing obstructive sleep apnea, highlighting the area's emphasis on innovation and regulatory progress. Having major players like Philips Respironics and ResMed in North America also helps in maintaining the region's dominance in the market. These companies lead in creating innovative solutions like advanced CPAP machines and portable ventilators for the rising need for respiratory care at home and in clinical settings.

The Asia-Pacific region is also expected to experience considerable growth in the respiratory devices market in the coming years. This growth will be driven by the increasing number of elderly individuals who are at higher risk of respiratory issues like asthma and infectious diseases. The growth in the region is especially significant in nations such as China and India, where the increasing number of elderly people is boosting the need for advanced respiratory devices. The Government of China's 2023 data show around 297 million individuals aged 60 and older, a group that is increasingly in need of respiratory support. The increasing need is pushing major players to prioritize mergers, acquisitions, and partnerships to enhance their market influence in the area. For instance, Fisher & Paykel Healthcare and Air Liquide are increasing their presence in Asia Pacific in order to take advantage of the growing market. These companies are launching new, cutting-edge products like sophisticated humidifiers and respiratory masks designed specifically for the elderly population.

Need any customization research on Respiratory Devices market - Enquiry Now

Key Players in the Respiratory Devices Market

The Major Players are Koninklijke Philips N.V., Medtronic, ResMed Inc., Fisher & Paykel Healthcare Limited, Masimo, Getinge AG, GE HealthCare, Baxter, OMRON Corporation, Xplore Health Technologies Pvt. Ltd. & Others Players

Recent Developments

-

In May 2024, Medline Industries, Inc. released Hudson RCI TurboMist, a compact nebulizer designed for administering medication to patients, in order to enhance its range of products.

-

In March 2024, Berry Global introduced the BerryHaler, a dry powder inhaler with a dose counter, designed to facilitate the efficient administration of combination medications to patients.

-

In November 2023, GE Healthcare and Masimo partnered to introduce SET pulse oximetry on the portrait mobile platform of the wireless and wearable company, enhancing its worldwide reach.

-

In September 2022, Onera Health introduced a service for polysomnography to diagnose sleep disorders in patients, with the goal of expanding its footprint in Germany and the Netherlands.

-

In May 2022, Max Ventilator introduced versatile Non-Invasive (NIV) ventilators with integrated oxygen therapy to satisfy the increasing patient needs.

| Report Attributes | Details |

| Market Size in 2023 | USD 22.62 Billion |

| Market Size by 2032 | USD 46.10 Billion |

| CAGR | CAGR of 8.27 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Therapeutic Devices [Positive Airway Pressure (PAP) Devices, Airway Management Devices, Ventilators, Inhalers, Nebulizers, Others], Diagnostic & Monitoring Devices [Spirometers, Polysomnography Devices, Pulse Oximeters and Others], and Consumables and Accessories [Masks, Nasal Cannula and Others]) • By Application (Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Asthma, Infectious Diseases, and Others) • By End-User (Hospitals & ASCs, Specialty Clinics, Home Care Settings, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Koninklijke Philips N.V., Medtronic, ResMed, Inc., Fisher & Paykel Healthcare Limited, Masimo, Getinge AG, GE HealthCare, Baxter, OMRON Corporation, Xplore Health Technologies Pvt. Ltd. & Others |

| Key Drivers | • Increasing occurrence of respiratory conditions drives need for advanced respiratory equipment. • Increasing Respiratory Conditions Leading to Growth in the Worldwide Respiratory Equipment Industry |

| RESTRAINTS | • Shortage of skilled labor in developing markets presents a hurdle to the growth of the respiratory devices market. |