Oxygen Therapy Market Size & Overview:

Get More Information on Oxygen Therapy Market - Request Sample Report

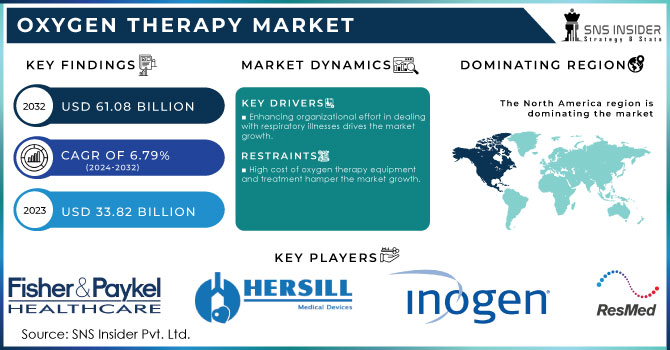

The Oxygen Therapy Market Size was valued at USD 33.82 billion in 2023 and is expected to reach USD 61.08 billion by 2032 and grow at a CAGR of 6.79% over the forecast period 2024-2032.

The oxygen therapy market is growing due to the expansion of home healthcare services, primarily by the COVID-19 pandemic. Due to the increasing number of patients, physical hospitals and agencies have acquired home-based oxygen therapy services increasingly. It has allowed patients to receive treatment where they find the most comfort and is less crowded. Thus, the demand for respiratory and other related oxygen therapy equipment is rising in suited to in-home applications.

Moreover, home healthcare homecare oxygen therapies are more portable and user-friendly. Majorly, developed regions, where healthcare facilities are advanced, such as North America, have such services on the rise. There is an increased availability of advanced home healthcare technologies as there are supportive policies in terms of reimbursement plans. Thus, patients can now efficiently handle respiratory reduction in homecare settings with adequate training.

For instance, The U.S. Centers for Medicare & Medicaid Services has implemented various reimbursement policies for home oxygen therapy. For example, the CMS expanded coverage for oxygen therapy equipment in 2020, ensuring that more patients could access necessary home-based treatments. This policy change has significantly impacted market growth in the U.S.

Moreover, the major factor contributing to the growth of the oxygen therapy market is the increased awareness of early diagnosis and treatment of respiratory conditions. Public health campaigns and numerous educational events helped educate people about untreated respiratory diseases, such as chronic obstructive pulmonary disease and asthma. At the same time, advanced diagnostic tools, such as accurate and easily accessible pulmonary function tests and imaging machines augment healthcare specialists’ ability to identify early respiratory conditions.

For instance, in 2023 Invacare launched the "Invacare Platinum Mobile Oxygen Concentrator," which features an extended battery life and enhanced portability. The product was developed in response to the increasing need for reliable and mobile oxygen therapy options for patients with chronic respiratory conditions.

Additionally, advances in portable and smart oxygen therapy devices have made it easier for patients to manage their conditions, leading to greater adoption. These devices allow for better mobility and real-time monitoring, enhancing patient comfort and compliance.

Drivers

-

Enhancing organizational effort in dealing with respiratory illnesses drives the market growth.

The growth of the oxygen therapy market is significantly driven by enhanced organizational efforts to combat respiratory illnesses. Governments and healthcare organizations worldwide have intensified their focus on addressing respiratory conditions, which are among the leading causes of death globally. According to the World Health Organization (WHO), chronic respiratory diseases accounted for nearly 7% of global deaths in 2022.

Moreover, in response, many countries have implemented robust healthcare policies and increased funding for respiratory care. For instance, the U.S. Department of Health and Human Services allocated over USD 4 billion in 2023 to improve respiratory care services. Moreover, key players in the oxygen therapy market have been actively expanding their product portfolios to meet the growing demand. In 2023, Philips introduced a new range of portable oxygen concentrators, which offer enhanced mobility and comfort for patients, aligning with the increasing need for at-home respiratory care solutions. These combined efforts from governments and industry are driving the market's expansion.

Restrain

-

High cost of oxygen therapy equipment and treatment hamper the market growth.

While oxygen therapy is essential for managing chronic respiratory conditions, the expenses associated with purchasing and maintaining devices like oxygen concentrators, cylinders, and liquid oxygen systems can be prohibitive for many patients. Additionally, insurance coverage for oxygen therapy varies widely across different regions, with some patients facing high out-of-pocket costs. For example, in the United States, Medicare coverage for home oxygen therapy is limited, often leading to financial burdens for patients who require continuous treatment.

Oxygen Therapy Market Segmentation Insights

By Product

Oxygen source equipment held the highest share of 62.44% in 2023. This is due to the high availability of oxygen concentrators, compressed gas systems, cylinders, and liquid oxygen products in the medical industry. Since these devices are important for initiating therapy, and the driver of the industry.

Based on this segment, oxygen concentrators are to register the fastest growth in the market, due to the introduction of new and energy-efficient products in the market. For instance, in May 2023, Drive DeVilbiss Healthcare launched the 1060AW, which is a 10-liter oxygen concentrator. This product is very popular in rural & semi-urban healthcare facilities and is known for its reliability, durability, and energy efficiency.

On the other hand, oxygen delivery devices are the segment to register the fastest growth, with a CAGR of 9.0% over the forecast period, as it offers a wide variety of devices designed to meet patients’ inspiratory and physiologic needs.

By Application

The chronic obstructive pulmonary disease segment held the highest market share in 2023. The growing chronic obstructive pulmonary disease patient population is fuelling the clinical need for treatment, thereby contributing to the segment growth. As per the data by the American Lung Association, in 2022, as many as 11.7 million people, or 4.6% of adults, reported a diagnosis of chronic obstructive pulmonary disease, which included chronic bronchitis and emphysema. Furthermore, the World Health Organization estimated that potentially fatal respiratory diseases such as chronic obstructive pulmonary disease, lung cancer, and tuberculosis are expected to account for almost one in five deaths globally by 2030.

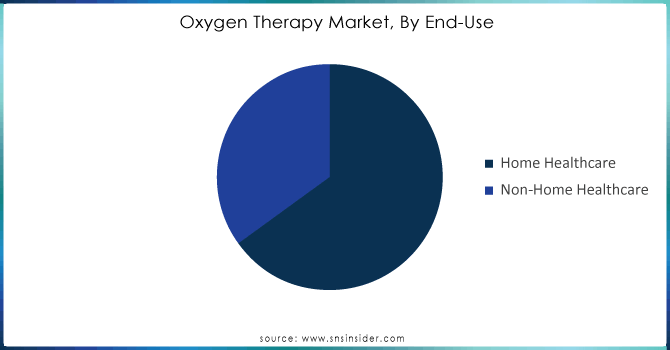

By End-use

The home healthcare held the largest market share around 68.65. This is due to the growing preference for at-home treatment among patients with chronic respiratory diseases. This trend is driven by the increasing elderly population, who are more prone to conditions like COPD and require long-term oxygen therapy. Home-based care offers greater comfort, convenience, and independence for patients, reducing the need for frequent hospital visits and minimizing healthcare costs.

Need any customization research on Oxygen Therapy Market - Enquiry Now

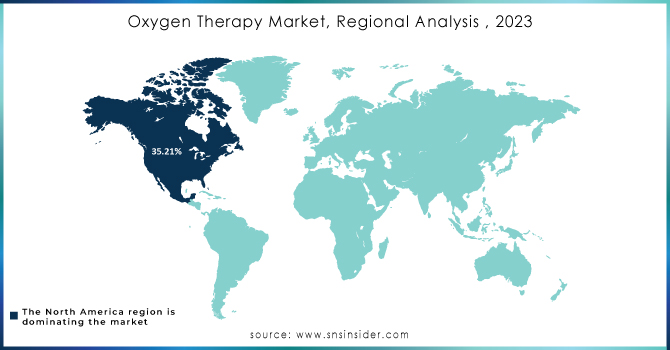

Oxygen Therapy Market Regional Analysis

North America held the highest market share in the oxygen therapy market around 35.21% in 2023. The dominating position of the North American region with respect to the sales of oxygen therapy products is supported by the highly developed healthcare infrastructure and high quality of life. Particularly, the healthcare delivery and equipment systems in the United States and Canada can be characterized by their advanced level of development, and significant investments in medical technologies, and respiratory therapeutics. Chronic respiratory diseases, such as chronic obstructive pulmonary disease and asthma, are prevalent across the region instigating a high demand for oxygen therapy products. Particularly, the American Lung Association reports that over 16 million Americans were diagnosed with COPD.

Key Players

The Major Players are ResMed, Inogen, Inc., Fisher & Paykel Healthcare Limited, HERSILL S.L., Tecno-Gaz Industries, Allied Healthcare Products, Inc., Teleflex Incorporated, Chart Industries, Rhythm Healthcare, OMRON Healthcare, and Others

Recent Developments:

-

In 2024, Brezan Technologies introduced the Brezan 360 home oxygen system. This new system integrates advanced AI algorithms to optimize oxygen delivery and provide real-time data on patient usage and needs, improving both efficacy and patient compliance.

-

In 2023, Philips launched the EverFlo Q portable oxygen concentrator, designed for home use. This new model offers improved portability, efficiency, and user-friendly features, addressing the growing demand for at-home oxygen therapy solutions.

-

In 2023, ResMed introduced the AirSense 11 CPAP machine, which incorporates advanced oxygen therapy features. The device includes integrated connectivity and patient management tools, enhancing the ease of use and monitoring for respiratory patients.

| Report Attributes | Details |

| Market Size in 2023 | US$ 33.82 Billion |

| Market Size by 2032 | US$ 61.08 Billion |

| CAGR | CAGR of 6.79 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Oxygen Source Equipment, Oxygen Delivery Devices) •By Application (Chronic Obstructive Pulmonary Disease, Asthma, Obstructive Sleep Apnea, Respiratory Distress Syndrome, Cystic Fibrosis, Pneumonia, Others) •By End-user (Home Healthcare, Non-Home Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Masimo, Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, Nonin, Diamedica (UK) Limited, EDAN Instruments, Inc., Dragerwerk AG & Co. KGaA, Dow Inc., Baxter, and others. . |

| Key Drivers | •Enhancing organizational effort in dealing with respiratory illnesses drives the market growth. |

| RESTRAINTS | •High cost of oxygen therapy equipment and treatment hamper the market growth. |