Intensive Care Unit (ICU) Market Size & Overview:

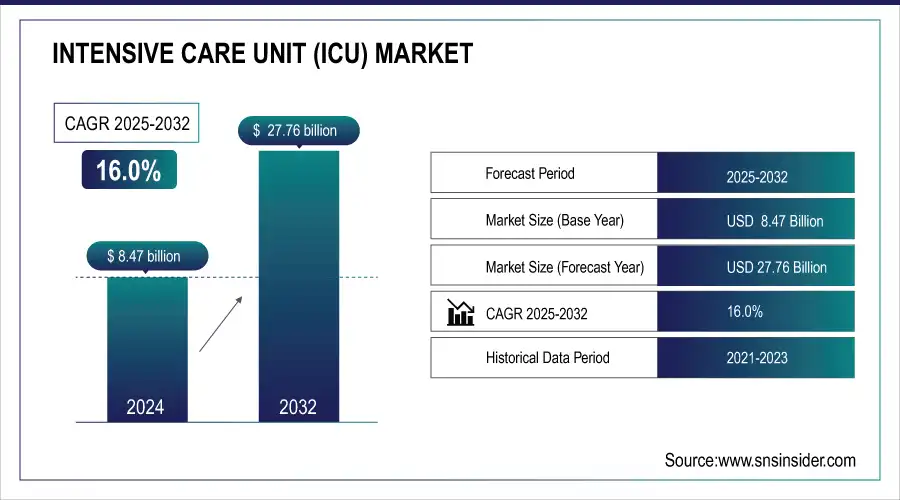

The Intensive Care Unit (ICU) Market Size was valued at USD 8.47 billion in 2024 and is expected to reach USD 27.76 billion by 2032, growing at a CAGR of 16.0% over the forecast period 2025-2032.

The Intensive Care Unit (ICU) market is experiencing significant growth, driven by several key factors. The demand for critical care services is on the rise propelled by factors such as the growing incidence of chronic diseases, an aging demographic, and technological innovations in healthcare. The CDC reported that 6 in 10 adults have a chronic disease and 4 in 10 adults have 2 or more chronic conditions in the U.S. The high rate of chronic diseases is often complicated by serious acute events requiring intensive care. Additionally, the COVID-19 pandemic has highlighted the crucial role of ICUs in healthcare systems worldwide. ICU bed occupancy was above 75% in some states during peak times of the pandemic, according to the U.S. Department of Health and Human Services, demonstrating more necessary and elevated critical care areas.

To Get More Information on the Intensive Care Unit Market - Request Sample Report

Intensive Care Unit (ICU) Market Size and Forecast:

-

Market Size in 2024: USD 8.47 Billion

-

Market Size by 2032: USD 27.76 Billion

-

CAGR: 16% (2025–2032)

-

Base Year: 2023

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Intensive Care Unit (ICU) Market Highlights:

-

Government initiatives and funding, such as India’s National Health Mission and the European Commission’s healthcare resilience programs, are strengthening ICU infrastructure and supporting market growth.

-

Technological advancements, including telemedicine, remote patient monitoring, AI-based intelligent systems, and smart ICU beds, are improving patient outcomes and operational efficiency.

-

Rising prevalence of chronic diseases like cardiovascular and respiratory disorders is driving higher demand for ICU equipment to manage critically ill patients.

-

Continuous innovations, such as portable and wireless monitoring devices, smart ventilators, and advanced algorithms, are enhancing patient care and clinical outcomes in ICUs.

-

High costs of ICU equipment, including purchase, maintenance, and compliance with regulatory standards, can limit adoption, especially in developing regions or low-resource healthcare facilities.

-

Shortage of trained critical care specialists and technicians may hinder the effective utilization of advanced ICU technologies.

In addition to this, market growth is further supported by several government olympiads to improve the healthcare facilities. The National Health Mission of the Indian government aims to strengthen public health systems, including ICU facilities in rural and urban areas. The European Commission has earmarked enormous funds for healthcare system resilience, targeting especially critical care capacity. The increasing trend of telemedicine and remote patient monitoring in the ICUs is positively impelling the market growth. The U.S. Department of Veterans Affairs reported a 1000% increase in video telehealth visits during the pandemic, a trend that has continued in critical care settings. In addition, artificial intelligence intelligent monitoring systems are changing how patients are handled in intensive care units, along with new and innovative inventions like smart ICU beds. These innovations not only help achieve better patient outcomes but also improve operational efficiencies, making them more appealing for healthcare practitioners.

Intensive Care Unit (ICU) Market Drivers:

-

The rise in chronic conditions such as cardiovascular and respiratory diseases has led to a higher demand for ICU equipment to manage critically ill patients.

-

Continuous innovations, including portable and wireless monitoring devices, have enhanced patient care and improved clinical outcomes in ICUs.

-

Increased investments in healthcare infrastructure, especially in emerging economies, are strengthening critical care services and boosting the demand for ICU equipment.

Rapid developments in technology have revolutionized Intensive Care Units (ICUs) with respect to patient management and clinical outcomes. This evolution has been facilitated through innovations like advanced monitoring systems, smart ventilators, and telemedicine integration. Innovative monitoring systems can supply healthcare providers with constant data on patients at risk so that doctors can identify irregularities in the vital signs and act as soon as possible. However, this constant surveillance is an important aspect of both preventing complications and providing optimal recovery outcomes for patients in critical care.

Smart ventilators in conjunction with advanced algorithms help mobilize oxygen delivery in patients with breathing problems enhance comfort overall and also minimize the chances of ventilator-induced injuries. These devices can modulate both the pressure and volume of air continuously and instantaneously to facilitate gas exchange in the lungs. Telemedicine technology for communication and next-generation remote monitoring has successfully ensured the delivery of timely, appropriate, and high-quality care to critically ill patients, especially when providers are unavailable or do not reside in the same physical location. It has specifically proven to be a boon in improving patient outcomes and recovery. All these technological advancements together have resulted in better patient outcomes, fewer complications, and a more efficient delivery of critical care in ICUs.

Intensive Care Unit (ICU) Market Restraints:

-

The substantial expenses associated with purchasing and maintaining ICU equipment can limit adoption, particularly in developing regions.

-

Compliance with rigorous regulatory standards for medical devices can increase the time and cost of bringing ICU equipment to market.

-

A lack of adequately trained critical care specialists and technicians can hinder the effective utilization of advanced ICU equipment.

The high price of ICU equipment acts as a market restraint, especially for healthcare facilities in low and middle-income regions High-tech ICU devices like ventilators, patient monitoring systems, and infusion pumps can require a large amount of investment. In addition to the initial purchase cost, there are ongoing expenses for maintenance, calibration, and software updates to ensure proper functionality and compliance with healthcare standards. This expense can constrain small hospitals and clinics from upgrading and expanding their ICU services. In addition, budget constraints found in public healthcare systems may delay the adoption of modern equipment, eg. high-quality care for critically ill patients. As a result, the high cost of ICU equipment creates disparities in access to advanced healthcare technology, disproportionately affecting under-resourced healthcare providers and their patients.

Intensive Care Unit (ICU) Market Segment Analysis:

By Type

In 2024, the hardware segment held the largest share of the Intensive Care Unit market, as critical care areas are heavily reliant on specialized equipment Some of the factors contributing to the dominance of the segment include continuous innovations in medical devices and rising demand for advanced patient monitoring and life-support systems. Recent data analysis by the U.S. Food and Drug Administration (FDA) demonstrated a 35% increase in new critical care device approvals from 2018 to 2023, reflecting an accelerating cycle of innovation in physiology-based ICU hardware. This hardware segment includes monitors, ventilators, infusion pumps, dialysis machines, and other devices used for severe patients. This need was further accelerated due to COVID-19 as patients with respiratory failure required ICU hardware, especially ventilators. The U.S. Department of Health and Human Services reported that the Strategic National Stockpile distributed over 14,000 ventilators to states during the height of the pandemic, highlighting the critical need for this hardware.

In Europe, funds are available through the European Commission EU4Health program to upgrade hospital facilities, including ICU equipment Also, increasing emphasis on patient safety and the requirement to monitor accurately in an acute care environment have accelerated the adoption of enhanced hardware solutions, securing the segment's dominance within the market. The high market share of the hardware segment in the ICU market highlights the need for advanced medical equipment in the delivery of high-quality critical care. With healthcare systems around the globe keeping focus on their intensive care improvement priorities, the requirement for advanced hardware used in the ICU is likely to continue being in demand.

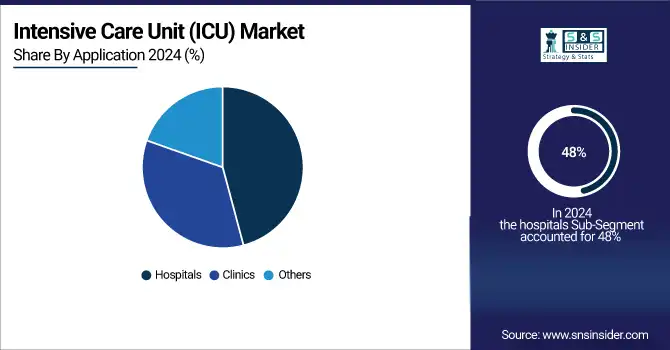

By Application

The Intensive Care Unit market in 2024 was dominated by the hospitals segment with a 48% revenue share which can be attributed to the pivotal role of hospitals in providing critical care services. This primacy is due at least in part to the concentration of physician subspecialists, equipment, and ancillary services present in hospitals. In 2023, the American Hospital Association reported a total of 6,093 hospitals across the United States and 924,107 total staffed beds. This includes around 97,000 ICU beds which reflects the large ICU capacity of hospital systems. Hospital ICUs were already a focus of concern, attention, and innovation before the COVID-19 pandemic with many facilities needing to augment their critical care capacity to meet unprecedented demand and challenged by limited resources. The U.S. Department of Health and Human Services found that more than three-quarters of hospital ICU beds were full in many states during the highest surges of the pandemic, demonstrating the dependence on hospital-centric critical care services.

Also, government initiatives have a major impact on the hospital ICUs. As an example, the National Health Service (NHS) in the United Kingdom increased its bed capacity in critical care by 50% due to the pandemic mostly in hospital spaces. In India, the Ministry of Health and Family Welfare witnessed a remarkable rise in the number of ICU beds in government hospitals in India from 27,360 in 2019 to more than 36,000 in 2023. Another reason for hospitals' market monopolization of the ICU is the higher concentration of technology and skilled personnel. Hospitals are usually more equipped to deal with complex tertiary problems requiring multi-disciplinary care, high-dependency intervention, and continuous monitoring, so they suit critical care delivery.

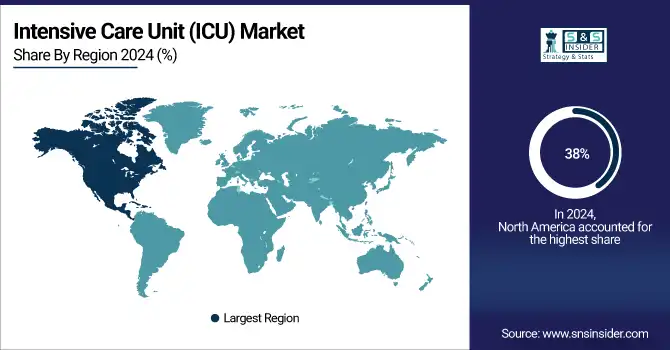

Intensive Care Unit (ICU) Market Regional Analysis:

North America Intensive Care Unit (ICU) Market Trends:

In 2024, North America accounted for approximately 38% of the Intensive Care Unit market. Several reasons contribute to this hegemony such as high healthcare expenditure, advanced healthcare infrastructure, and several top-of-the-line medical technology companies. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending reached $4.3 trillion in 2023, representing 18.3% of the GDP. Such a larger investment led to the construction of advanced ICU units throughout the region. In fact, in 2023, the Society of Critical Care Medicine reported that the United States has some of the highest numbers of ICU beds per capita internationally approximately 34.7 ICU beds per 100,000 population.

Do You Need any Customization Research on Intensive Care Unit Market - Enquire Now

Asia-Pacific Intensive Care Unit (ICU) Market Trends:

On the other hand, the Asia-Pacific region is predicted to be the most rapidly growing region for the ICU market, and it will gain considerable CAGR during the forecast period, 2025-2032. Key factors contributing to this rapid growth include upgrading healthcare infrastructure, growing healthcare expenditure, and the prevalence of chronic diseases. This was due in part to the shift in focus to critical care that the Chinese government had made in response to COVID-19, with the National Health Commission announcing a 15% increase in the 2020–2023 numbers of ICU beds. India too is benefitting from a boom, revealed the Union Ministry of Health and Family Welfare it is expected an impending contribution of over 75,000 ICU beds throughout the country by 2025.

Europe Intensive Care Unit (ICU) Market Trends:

In 2024, Europe accounted for a significant share of the global ICU market, supported by strong government-funded healthcare systems and the presence of established medical device manufacturers. Countries such as Germany, France, and the UK are at the forefront, with well-developed ICU infrastructures and growing adoption of advanced patient monitoring systems. According to Eurostat, healthcare expenditure in the European Union surpassed €1.5 trillion in 2023, reflecting over 10% of GDP. The region also emphasizes improving critical care capacity, with Germany leading Europe with more than 29 ICU beds per 100,000 inhabitants. Increasing demand for elderly care, coupled with innovations in ventilators and infusion systems, continues to boost ICU adoption in the region.

Latin America Intensive Care Unit (ICU) Market Trends:

Latin America is projected to witness steady growth in the ICU market during the forecast period, supported by increasing healthcare investments and government initiatives to expand hospital capacity. Brazil and Mexico dominate the region’s ICU landscape. Brazil’s Ministry of Health has significantly increased funding for ICU expansion in the aftermath of COVID-19, boosting access to ventilators and infusion systems. Mexico is also prioritizing ICU modernization as part of its broader healthcare infrastructure upgrades. While other nations in the region still face challenges in terms of ICU bed availability, regional collaborations and international support are expected to further strengthen critical care facilities.

Middle East & Africa Intensive Care Unit (ICU) Market Trends:

The Middle East & Africa region is expected to show gradual but uneven growth in the ICU market. In the Middle East, countries like Saudi Arabia, the UAE, and Qatar are heavily investing in healthcare modernization programs, expanding ICU bed capacity, and adopting advanced monitoring technologies. Government-backed initiatives, such as Saudi Vision 2030, are key drivers of ICU infrastructure development in the Gulf states. In Africa, South Africa has the most developed ICU capacity; however, access remains limited across much of sub-Saharan Africa, with only 1–3 ICU beds per 100,000 population. Despite these limitations, rising international funding, non-governmental partnerships, and private sector investments are expected to gradually improve ICU infrastructure across the region.

Intensive Care Unit (ICU) Market Competitive Landscape:

GE Healthcare, established in 1991, is a global leader in medical technology, providing advanced solutions for patient monitoring, imaging, and critical care. Its ICU-focused products, such as the Carescape Monitor B850 and MAC VU360 ECG System, enhance patient outcomes through real-time monitoring, data integration, and innovative technologies supporting efficient critical care.

-

In March 2024, GE HealthCare launched its new AI-powered ICU Management System to improve patient outcomes and enhance workflow for care providers in critical care settings. With its combination of next-level tracking functionality and predictive analysis for rapid identification of patient declines.

Philips Healthcare, established in 1891, is a leading global provider of medical technologies and solutions. The company focuses on patient monitoring, imaging, and respiratory care, with ICU products like the IntelliVue MX850 Monitor and Trilogy 202 Ventilator. These solutions improve patient outcomes through advanced monitoring, data integration, and efficient critical care management.

-

In January 2024, Philips Healthcare announced a new series of ICU ventilators with improved connectivity and remote monitoring facilities. These ventilators are designed to support the growing trend of tele-ICU services, enabling intensivists to manage patients remotely.

Medtronic, established in 1949, is a global medical technology company specializing in innovative healthcare solutions. Its ICU-focused products, including the Puritan Bennett 980 Ventilator and Capnostream 35 Portable Monitor, support critical care by providing advanced respiratory management, continuous patient monitoring, and data-driven insights, enhancing efficiency and improving patient outcomes in intensive care settings.

-

Medtronic gained FDA approval for a next-gen ICU patient monitoring system in November 2023 designed to provide continuous, real-time patient data to healthcare providers with the help of wearables and wireless features. The system is designed to minimize critical care adverse events through timely varicocele intervention.

Intensive Care Unit (ICU) Market Key Players:

Key Service Providers/Manufacturers

-

GE Healthcare (Carescape Monitor B850, MAC VU360 ECG System)

-

Medtronic plc (Puritan Bennett 980 Ventilator, Capnostream 35 Portable Monitor)

-

Philips Healthcare (IntelliVue MX850 Monitor, Trilogy 202 Ventilator)

-

Drägerwerk AG & Co. KGaA (Evita V600 Ventilator, Infinity Acute Care System)

-

Baxter International Inc. (Spectrum IQ Infusion Pump, PrisMax Hemodialysis System)

-

Fresenius Medical Care AG & Co. KGaA (MultiFiltratePro, 4008S Hemodialysis Machine)

-

Becton, Dickinson and Company (BD) (Alaris Infusion Pump, Pyxis Medication Management System)

-

Mindray Medical International Limited (BeneVision N22/N19 Patient Monitor, SV300 Ventilator)

-

Siemens Healthineers AG (Biograph mCT PET/CT Scanner, Atellica Laboratory Analyzer)

-

Getinge AB (Servo-U Ventilator, Cardiohelp System)

Key Users in the ICU Market:

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Massachusetts General Hospital

-

NewYork-Presbyterian Hospital

-

Singapore General Hospital

-

Apollo Hospitals Enterprise Ltd.

-

Fortis Healthcare Limited

-

King Faisal Specialist Hospital & Research Centre

-

Tokyo Medical University Hospital

| Report Attributes | Details |

| Market Size in 2024 | USD 8.47 Billion |

| Market Size by 2032 | USD 27.76 Billion |

| CAGR | CAGR of 16% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Hospitals, Clinics, Others) • By Component (Hardware, Software) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GE Healthcare, Medtronic plc, Philips Healthcare, Drägerwerk AG & Co. KGaA, Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Becton Dickinson and Company (BD), Mindray Medical International Limited, Siemens Healthineers AG, Getinge AB, Nihon Kohden Corporation, Hamilton Medical AG, Fisher & Paykel Healthcare, Smiths Medical (ICU Medical Inc.), Zoll Medical Corporation, Schiller AG, Masimo Corporation, Edwards Lifesciences Corporation, Spacelabs Healthcare, Hill-Rom Holdings Inc. |