Respiratory Syncytial Virus Therapeutics Market Size & Overview:

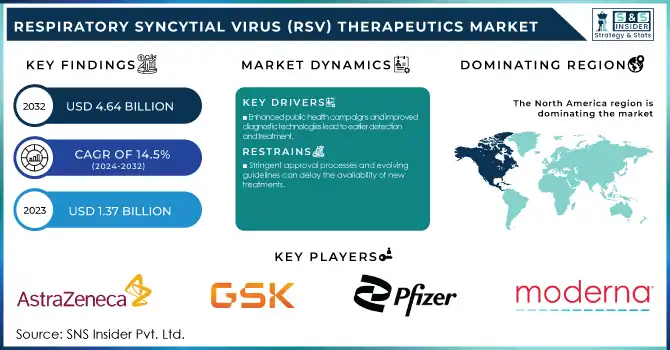

The Respiratory Syncytial Virus (RSV) Therapeutics Market Size was valued at USD 1.37 Billion in 2023 and is expected to reach USD 4.64 Billion by 2032, growing at a CAGR of 14.5% over the forecast period 2024-2032.

Get More Information on Respiratory Syncytial Virus (RSV) Therapeutics Market - Request Sample Report

The Respiratory Syncytial Virus (RSV) Therapeutics Market is growing rapidly owing to rising RSV awareness, which is a comprehensive health threat, and the creation of treatment alternative modes. Respiratory syncytial virus (RSV), is a common cause of respiratory disease, especially in infants and young children, as well as in older adults. In the US, RSV causes around 58,000–80,000 hospitalizations in children under 5 years of age and 60,000–160,000 hospitalizations in adults aged 65 years and older each year, according to the US Centers for Disease Control and Prevention (CDC). RSV's burden has encouraged governments around the world to prioritize its prevention and treatment. In September 2024, the British government rolled out the first-ever national RSV vaccination program in the world, protecting both infants and pregnant women/stage shift. This campaign is intended to lessen any winter pressure on the National Health Service (NHS) and reflects the increasing awareness of RSV as an important public health issue.

The market is further propelled by recent regulatory approvals of novel RSV vaccines and therapeutics. In May 2023, the U.S. Food and Drug Administration (FDA) approved the first RSV vaccines for older adults, marking a pivotal shift in the fight against RSV. These approvals have paved the way for prevention and treatment, which will be further evaluated in research and development. In addition, the COVID-19 pandemic has increased public awareness around respiratory viruses for a multitude of reasons, which will hopefully translate to additional federal dollars made available for RSV research and healthcare programs. Consequently, there is an increasing focus on the development and administration of successful therapeutics for controlling the disease, thus propelling the growth of the global RSV therapeutics market.

Respiratory Syncytial Virus Therapeutics Market Dynamics

Drivers

-

Increasing cases among infants and older adults highlight the need for effective treatments.

-

Recent approvals of vaccines, such as Moderna's mRNA-based RSV vaccine for adults aged 60 and older, enhance prevention strategies.

-

Enhanced public health campaigns and improved diagnostic technologies lead to earlier detection and treatment.

Respiratory Syncytial Virus (RSV) infections play a major role in the burden of disease in both developed and developing countries, particularly in vulnerable groups, including young children and the elderly. The 2020 American Academy of Pediatrics (AAP) report called "Hospitalizations Due to RSV" estimated that approximately 58,000-80,000 RSV-related hospitalizations occur every year in the United States in children under five, according to the U.S. Centers for Disease Control and Prevention (CDC). It accounts for around 177,000 hospitalizations and 14,000 deaths every year in older adults. Such an increase in prevalence highlights an unmet need for more innovative treatment options. The rise of RSV cases can also be attributed to an increase in temperature, which helps viable diseases spread, and the population of elderly people around the world, who are more vulnerable to significant respiratory illness. For example, the 2022-2023 RSV season saw an unusually high number of pediatric hospitalizations in North America, partially attributed to the post-pandemic resurgence of respiratory infections as immunity waned due to prolonged mask use and social distancing.

The industry is further advancing therapeutic options. In November 2024, Moderna announced that the Canadian government had approved its mRNA-based RSV vaccine for adults ages 60 and older, a major advance in the fight against severe disease. Also, monoclonal antibody therapy administered to the infant groups, such as nirsevimab, has proven more than 75% effective in preventing medically attended RSV and may represent a novel preventive strategy. These developments are pivotal in mitigating the virus's growing impact globally.

Restraints

-

The expense associated with RSV therapeutics limits accessibility for some patients.

-

Stringent approval processes and evolving guidelines can delay the availability of new treatments.

-

A scarcity of targeted antiviral options hampers effective management of RSV infections.

Respiratory syncytial virus (RSV) therapeutics are still not widely available or accessible, especially in low-middle-income regions of the world, due to the cost of these treatments. Manufacturing advanced therapeutics like monoclonal antibodies and vaccines is a complicated and cost-prohibitive process. This increases the cost of these therapies and reduces their availability to many of the most susceptible patients, including infants and the elderly. In addition, the expensive nature of healthcare infrastructure, diagnostic tools, and supportive care can impose a significant financial burden on patients and healthcare providers. That means governments and health organizations struggle to subsidize these treatments, in low-resource environments complication. While ongoing innovations aim to optimize production and reduce costs, affordability remains a pressing issue that limits the equitable distribution and utilization of effective RSV therapies globally. Overcoming this restraint will require collaborative efforts from governments, pharmaceutical companies, and global health organizations.

RSV Therapeutics Market Segmentation Analysis

By Drug Type

In 2023, the prophylaxis segment led the market. This incredible dominance is due to the focus on the prevention of RSV, especially in infants and older adults. The expansion of this segment can be attributed to the recent approvals and implementations of new RSV vaccines. According to the CDC, in June 2023, nirsevimab-alip was approved for newborns and infants infected with RSV and children up to 24 months after their second infection. This label expansion has increased the options available for RSV prophylaxis. In addition, in September 2023 the UK Joint Committee on Vaccination and Immunisation (JCVI) advised on a cost-effective program of RSV immunization for infants and older adults. The reason behind the growth in this particular segment is due to this recommendation which is accelerating the uptake of prophylactic measures. The emphasis on prophylaxis is also evident in clinical trials, with several vaccine candidates in late-stage development. For instance, as of 2023, there were at least four companies developing vaccines against RSV, in addition to the already approved products6. This robust pipeline of prophylactic options further solidifies the segment's dominant position in the market.

By Route of Administration

The injectable route segment dominated the market in 2023 and held 58% of the revenue share globally. This predominance is due to the high safety, high accuracy, and high efficacy of injectable RSV therapeutic strategies, especially in the delivery of monoclonal antibodies and vaccines. Recent regulatory approvals and clinical data bolster the preference for injectable administration. For instance, the FDA's approval of Beyfortus (nirsevimab-alip) in July 2023 for the prevention of RSV-related lower respiratory tract disease in infants and young children underscores the importance of injectable therapeutics. The UK national RSV vaccination program, also initiated in September 2024, also only uses injectable vaccines for both pregnant women and older adults. The injectable route's dominance is further reinforced by its ability to provide rapid and systemic protection against RSV. This is especially important for vulnerable groups, such as preterm babies and those who are immunocompromised. Current dependence on injectable RSV prophylaxis is reflected in the CDC's stated recommendation for the use of palivizumab an injectable monoclonal antibody for selected high-risk infants and young children.

By End user

In 2023, the hospital pharmacy segment accounted for the largest share of the RSV therapeutics market owing to the aspects of RSV treatment and the infrastructural framework of the healthcare system. Hospitals are key to solving serious RSV, especially in infants and older adults who may be admitted into intensive care. In the U.S. each year, RSV accounts for 2.1 million outpatient visits in children under 5 years of age, according to the CDC These hospital visits for RSV-related illnesses drive the hospital pharmacy segment, which continually leads in terms of volume. Furthermore, the administration of certain RSV therapeutics, such as palivizumab, often occurs in hospital settings, especially for high-risk infants. Guidance for the role of palivizumab is also available for hospital indications, and the American Academy of Pediatrics (AAP) guidelines state that the hospital pharmacy is an integral part of the management of respiratory syncytial virus (RSV) prophylaxis. The recent availability of RSV vaccines for older adults has also resulted in increased vaccination efforts where people are hospitalized. For example, after the RSV vaccines were approved by the FDA in May 2023, several hospitals started vaccination programs for patients eligible to receive the vaccines, thereby further entrenching the position of hospital pharmacies in the RSV therapeutics market.

Regional Analysis

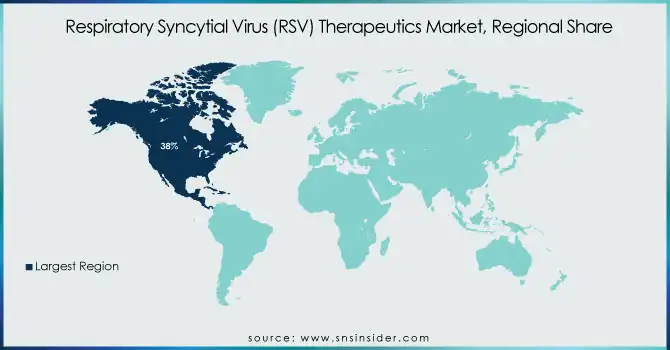

North America held a significant share of the RSV therapeutics market with over 38% share of the global market in 2023. The presence of developed healthcare infrastructure, greater awareness of RSV, and early uptake of novel therapeutics are among the factors that are contributing to this dominance. The United States, in particular, has been at the forefront of RSV research and treatment. According to the CDC, RSV leads to an average of 2.1 million outpatient visits and 58,000-80,000 hospitalizations among children younger than 5 years old annually in the U.S. This high disease burden has driven significant investment in RSV therapeutics and prevention strategies. The region's takedown of the market is cemented by its lead in regulatory approvals, including May 2023's authorization of the first RSV vaccines for older adults by the FDA.

On the other hand, Asia Pacific will register the fastest CAGR during the forecast period. The high growth is attributed to increased awareness and advancing healthcare infrastructure and the large patient population associated with RSV. The burden of RSV among older adults is substantial in many countries, including Japan, with approximately 65,600 RSV cases among older adults in 2023 contributing to USD 403.5 million in direct medical costs. Demand for pediatric health to boost the market in the region in coming years As countries like China and India are densely populated, the focus on pediatric health is growing which is subsequently driving the market growth swiftly across the region. Growing Focus on RSV Prevention and Treatment Countries in the Asia Pacific have realized the burden of RSV-related deaths over the years, and governments are increasingly implementing strategies to prevent and treat this disease, which in turn is driving the growth of this market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Key Service Providers/Manufacturers

-

Moderna, Inc. (mRNA-1345, Spikevax RSV)

-

Pfizer, Inc. (Abrysvo, RSVpreF)

-

GlaxoSmithKline plc (GSK) (Arexvy, RSVPreF3 OA)

-

AstraZeneca (Beyfortus, Synagis)

-

Sanofi S.A. (Beyfortus, RSV Fusion Protein Nanoparticles)

-

Merck & Co., Inc. (MK-1654, RSV-LP Vaccine)

-

Johnson & Johnson (Janssen Pharmaceuticals) (RSV Vaccine Candidate, RSV Adult Vaccine)

-

Novavax, Inc. (RSV F Vaccine, ResVax)

-

Bavarian Nordic (MVA-BN RSV, BN-RSV)

-

Alnylam Pharmaceuticals (ALN-RSV01, siRNA RSV Treatment)

Key Users

-

Hospitals and Clinics

-

Specialized Pediatric Care Centers

-

Long-Term Care Facilities

-

Pharmaceutical Distributors

-

Government Health Departments

-

Health Maintenance Organizations (HMOs)

-

Contract Research Organizations (CROs)

-

Academic and Research Institutions

-

Non-Governmental Organizations (NGOs)

-

Global Health Initiatives

Recent Developments

-

In May 2023, GSK plc announced that the U.S. Food and Drug Administration (FDA) had approved Arexvy (respiratory syncytial virus vaccine, adjuvanted) for the prevention of lower respiratory tract disease (LRTD) due to RSV in people aged 60 years and older.

-

In September 2024 the UK Government introduced the world's first national RSV vaccination program to protect both infants and older adults. The plan covers vaccines for pregnant women later than 28 weeks so that newborns get protection, a new for those aged over 75, and a one-off program for 75- to 79-year-olds.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.37 Bn |

| Market Size by 2032 | US$ 4.64 Bn |

| CAGR | CAGR of 14.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Prophylaxis, Treatment ) • By Patient Type (Adult, Pediatrics) • By Route of administration (Oral, Injectable, Intranasal, Other route of administrations) • By End User ( Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Moderna, Inc., Pfizer, Inc., GlaxoSmithKline plc (GSK), AstraZeneca, Sanofi S.A., Merck & Co., Inc., Johnson & Johnson (Janssen Pharmaceuticals), Novavax, Inc., Bavarian Nordic, Alnylam Pharmaceuticals |

| Key Drivers | • Increasing cases among infants and older adults highlight the need for effective treatments. • Recent approvals of vaccines, such as Moderna's mRNA-based RSV vaccine for adults aged 60 and older, enhance prevention strategies. • Enhanced public health campaigns and improved diagnostic technologies lead to earlier detection and treatment. |

| Market Restraints | • The expense associated with RSV therapeutics limits accessibility for some patients. • Stringent approval processes and evolving guidelines can delay the availability of new treatments. • A scarcity of targeted antiviral options hampers effective management of RSV infections. |