RF Power Amplifier Market Size & Growth:

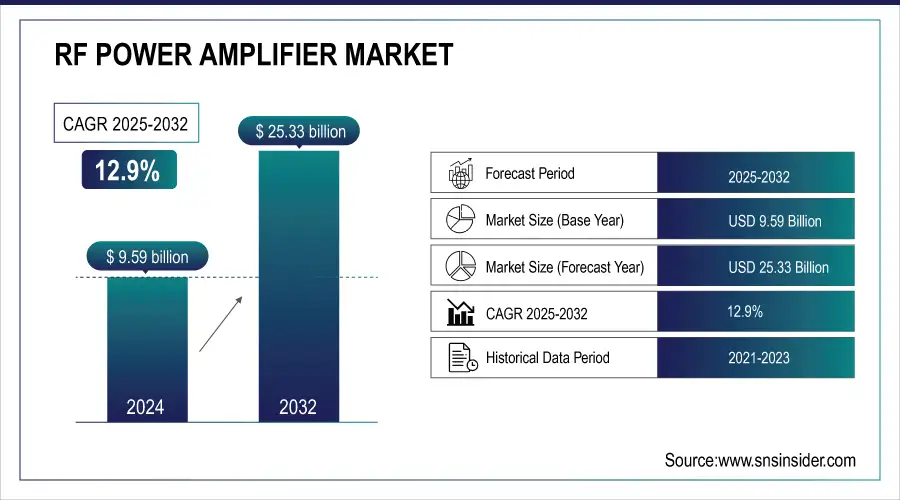

The RF Power Amplifier Market size was valued at USD 9.59 Billion in 2024. It is estimated to reach USD 25.33 Billion by 2032, growing at a CAGR of 12.9% during 2025-2032.

The RF power amplifier market is experiencing significant growth due to the rising demand for wireless communication technologies, consumer electronics, and advancements in various industries that rely on radio frequency (RF) systems. The increasing need for wireless communication technologies, especially 5G networks, is a significant factor in the RF power amplifier market. The significant growth has been backed by large investments from American companies, reaching more than USD 40 billion in 2023 for the advancement of 5G infrastructure. Moreover, the Federal Communications Commission (FCC) has been instrumental in generating large amounts of revenue to support network growth through auctions of spectrum licenses. The popularity of 5G-enabled devices is increasing, with estimates suggesting that over 45% of smartphones sold in the U.S. in 2024 will have 5G capabilities. As 5G infrastructure continues to grow worldwide, there is a growing demand for powerful RF power amplifiers that can handle higher frequencies, wider bandwidth, and improved power efficiency. These amplifiers play a crucial role in preserving signal strength and quality across extensive distances, proving essential in mobile networks, base stations, and satellite communication systems.

Get More Information on the RF Power Amplifier Market - Request Sample Report

RF power amplifiers are being increasingly utilized in the automotive sector, especially for advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, and infotainment systems. These systems depend on strong RF signals to send information, like location, speed, and other important data, between vehicles and infrastructure. With the advancement of self-driving technologies, there will likely be a higher demand for RF power amplifiers to aid in creating safer and more efficient transportation infrastructures. Manufacturers are concentrating on innovation and efficiency to meet the changing needs of various sectors as the demand for high-performance RF systems increases.

RF Power Amplifier Market Size and Forecast:

-

Market Size in 2024: USD 9.59 Billion

-

Market Size by 2032: USD 25.33 Billion

-

CAGR: 12.9% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

RF Power Amplifier Market Trends:

-

Rapid growth driven by advances in wireless communication technologies, including 4G, 5G, and beyond, requiring high-bandwidth and reliable signal transmission.

-

Rising demand in 5G infrastructure deployment due to higher frequency ranges and millimeter-wave bands needing sophisticated RF power amplifiers.

-

Expansion of wireless applications such as satellite communication, Bluetooth, Wi-Fi, radar systems, and IoT devices fueling market growth.

-

Strong adoption in defense and aerospace sectors for radar, satellite communication, UAVs, electronic warfare, and secure communication systems.

-

Challenges in achieving high energy efficiency amid rising power costs and sustainability demands, requiring advanced materials and R&D.

-

Vulnerability to global supply chain disruptions, including shortages of semiconductors and key materials like GaN and GaAs, affecting production and pricing.

RF Power Amplifier Market Drivers:

-

Demand Driven by Advances in Wireless Communication Technologies and 5G Expansion.

The RF power amplifier market is being fueled by the swift progress in wireless communication technologies such as 4G, 5G, and beyond. The need for RF power amplifiers is growing due to the increasing dependence of industries and consumers on fast and reliable internet connectivity, which requires high-bandwidth communication for wireless network signal transmission. The demand for RF power amplifiers has significantly risen due to the emergence of 5G technology, particularly in terms of efficiency, power output, and frequency ranges. In contrast to earlier versions, 5G functions at elevated frequencies, like millimeter-wave bands, necessitating sophisticated RF power amplifiers to guarantee uninterrupted communication. Telecom firms are prioritizing the installation of 5G infrastructure worldwide, making the RF power amplifier market an essential component of the progress. Furthermore, the RF power amplifier market is experiencing growth due to the expansion of other wireless communication applications like satellite communication, Bluetooth, Wi-Fi, and radar systems. The increasing number of IoT devices has led to a greater need for efficient wireless communication, which is driving up the demand for these amplifiers. RF power amplifiers are essential in contemporary wireless communication systems as they guarantee long-distance signal transmission without compromising signal strength or quality.

-

Rising Demand for Advanced RF Power Amplifiers in Defense and Aerospace Communication Systems.

The defense and aerospace industries are important customers of RF power amplifiers because they require high-power, high-frequency communication systems. Military technologies like radar, satellite communication, electronic warfare, and secure communication systems rely on RF power amplifiers to send signals across vast distances, frequently in challenging conditions. Progress in RF technology, like the creation of electronic warfare systems and the growing use of UAVs, is leading to a higher need for advanced RF power amplifiers. These amplifiers need to offer top reliability, endurance, and efficiency in harsh conditions like high altitudes and fluctuating temperatures, which are typical in military and aerospace activities. Additionally, contemporary military conflicts are more dependent on sophisticated communication systems that are capable of functioning on different frequency ranges, requiring the utilization of powerful and adaptable RF amplifiers. Governments and defense contractors are making significant investments in enhancing their communication systems, to drive growth in the RF power amplifier market.

RF Power Amplifier Market Restraints:

-

Challenges in achieving power efficiency amid rising energy costs and sustainability demands.

Although RF power amplifiers are necessary for signal transmission, they are notorious for their high power consumption, especially in applications requiring high power levels like base stations and defense systems. Efficiency in power consumption continues to be a significant worry for producers, especially with the increase in energy expenses and the growing importance of sustainability in industries. Enhancing the energy efficiency of RF power amplifiers necessitates extensive research and development endeavors, along with the adoption of pricier materials and manufacturing methods. Achieving a balance between performance and power efficiency can be challenging, especially in markets where costs are a key factor.

-

Impact of global supply chain disruptions

The RF power amplifier market can be significantly affected by disruptions in the highly complex global electronics supply chain. Lack of essential parts, like semiconductors, may cause delays in production and higher expenses for manufacturers. Moreover, the supply of crucial materials like GaN and GaAs for RF power amplifiers can be impeded by geopolitical tensions, trade limitations, and natural catastrophes. Disruptions in the supply chain can result in extended lead times for RF power amplifier products, impacting manufacturers' capacity to meet demand, especially in booming sectors like telecommunications and defense. These interruptions may also result in changes in prices, causing challenges for manufacturers in keeping pricing stable for their products.

RF Power Amplifier Market Segment Analysis:

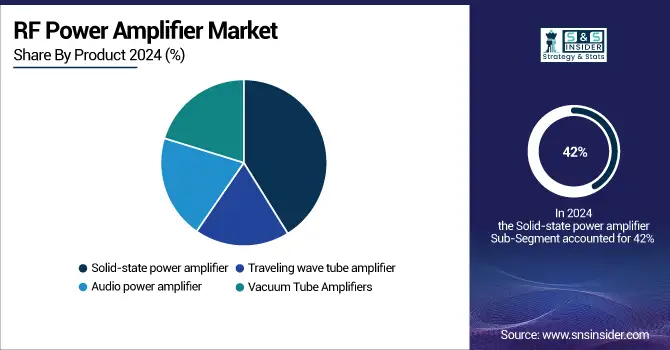

By Product

The solid-state power amplifier (SSPA) dominated the market with 42% in 2023 due to its energy efficiency, reliability, and compact size. SSPAs are used extensively in communication systems, satellite uplinks, radar, and defense systems. These amplifiers offer higher efficiency and longer operational lifespans compared to vacuum tube amplifiers, making them popular in critical applications. Their ability to support higher frequencies has further enhanced their adoption. For instance, companies like Qorvo and Analog Devices use SSPAs in satellite communications and radar systems for military and aerospace applications, showcasing the segment's versatility. Their broad applicability in 5G infrastructure also contributes to their growing market dominance.

The traveling wave tube amplifier (TWTA) segment is going to be the fastest-growing segment during 2024-2032, particularly in space and defense applications, due to its capability to amplify high-frequency signals with greater power output. TWTAs are used in satellite communication systems, deep space probes, and electronic warfare. Companies like Communications & Power Industries (CPI) use TWTAs for satellite transponders, providing high power levels over wide frequency ranges. The rise in space exploration, communication satellites, and defense initiatives has accelerated the demand for TWTAs, driving growth in this segment.

By Class

Class AB dominated in 2023 with a 32% market share because they combine efficiency and linearity, which suit various applications, particularly in telecommunication systems. These amplifiers blend the characteristics of Class A and Class B amplifiers to decrease distortion while enhancing power efficiency. They are commonly utilized in cellular base stations, radio broadcasting, and satellite communications. Qorvo Inc. and NXP Semiconductors utilize Class AB amplifiers in 5G infrastructure and wireless communication networks. Class AB amplifiers are crucial for maintaining strong signal integrity in mobile networks due to their capability to handle high power levels and operate across a wide frequency range.

Class D amplifiers are experiencing a rapid growth rate during the forecast period in the RF Power Amplifier Market due to their higher efficiency and reduced physical footprint. They utilize pulse-width modulation (PWM) to decrease energy loss in signal transmission, making them well-suited for power-sensitive tasks. The growth of this sector is driven by its usage in consumer electronics like smartphones, as well as new IoT devices. Class D amplifiers are utilized in the military and aerospace sectors for amplifying RF signals. Companies such as Broadcom Inc. and Infineon Technologies AG incorporate Class D amplifiers into upcoming wireless systems, improving battery life and data transmission speeds in devices such as routers and smart home devices.

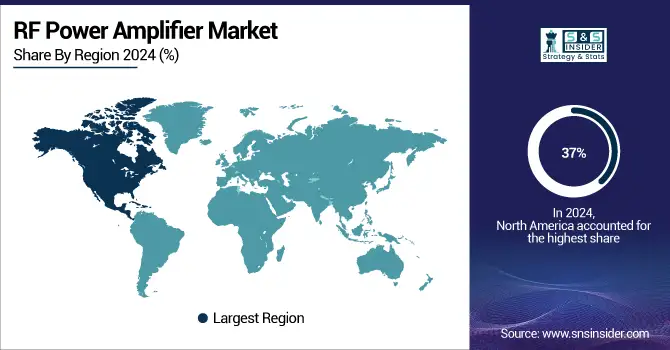

North America RF Power Amplifier Market Trends

North America led the market in 2023 with a 37% market share because of its sophisticated telecommunications infrastructure and substantial investments in deploying 5G. The area is advantaged by the prominent existence of leading tech firms like Qualcomm, Texas Instruments, and Broadcom, all of which hold a substantial portion of the market. The growing defense and aerospace sectors in North America are driving market demand for high-performance RF amplifiers needed in radar and communication systems. Moreover, the increase in IoT applications and advancements in wireless communication technologies are significant factors in promoting the adoption of RF power amplifiers.

Need any Customization as Per Your Business Requirement on RF Power Amplifier Market - Enquiry Now

Asia Pacific RF Power Amplifier Market Trends

APAC is to account for a faster CAGR during 2024-2032, due to fast industrialization, expanding the telecom sector, and increasing 5G rollouts in China, Japan, and South Korea. The market growth is driven by the widespread utilization of RF amplifiers in the defense, telecommunications, and automotive industries in the region. The increasing demand for RF amplifiers is largely driven by the expanding market for consumer electronics, especially smartphones and wireless devices. Furthermore, the robust manufacturing sector for semiconductors and electronic components in APAC positions it as a crucial center for worldwide production.

Europe RF Power Amplifier Market Trends

Europe held a notable market share in 2023, supported by investments in next-generation wireless networks, smart infrastructure, and defense systems. Countries like Germany, France, and the UK are major adopters, with market growth aided by increasing IoT deployment and aerospace applications.

Latin America RF Power Amplifier Market Trends

Latin America is witnessing steady market growth, driven by telecom network expansion, rising demand for smartphones and wireless devices, and increased government initiatives in defense and public safety communication systems. Brazil and Mexico are key contributors.

Middle East & Africa RF Power Amplifier Market Trends

MEA’s market is expanding due to investments in telecom modernization, defense communication systems, and smart city projects. The growth is particularly strong in the UAE, Saudi Arabia, and South Africa, supported by the adoption of 4G/5G networks and rising industrialization.

Key RF Power Amplifier Companies are:

-

Qualcomm Inc

-

Toshiba Corporation

-

Broadcom Pte. Ltd

-

Mitsubishi Corporation

-

Skyworks Solutions Inc.

-

Analog Devices Inc

-

NXP Semiconductors NV

-

ETL Systems Ltd

-

Analogic Corporationm

-

OPHIR RF

-

CML Microsystems Plc

-

Qorvo Inc

-

MACOM Technology Solutions

-

STMicroelectronic

-

Texas Instruments

-

Cree, Inc. (Wolfspeed)

-

Nokia Corporation

-

Rohde & Schwarz

RF Power Amplifier Market Competitive Landscape:

Analog Devices Inc (ADI), founded in 1965, is a global leader in high-performance analog, mixed-signal, and digital signal processing (DSP) technologies. The company designs and manufactures innovative semiconductor solutions for industrial, automotive, communications, and healthcare applications, enabling enhanced performance, energy efficiency, and connectivity across diverse electronic systems worldwide.

-

In May 2024, ADI introduced a series of Gallium Nitride RF power amplifiers, which are designed for defense applications like military radars and electronic warfare. These amplifiers offer high power density with high efficiency, and robustness to the harsh working environment to meet the defense requirements.

NXP Semiconductors NV, founded in 2006 and headquartered in the Netherlands, is a global leader in secure connectivity solutions for automotive, industrial, and IoT applications. The company develops advanced semiconductor technologies, including RF, mixed-signal, and microcontroller products, enabling energy-efficient, high-performance, and reliable electronic systems worldwide.

-

In April 2024, NXP introduced a new family of LDMOS RF PA for the new generation wireless communication infrastructure, such as 5G mMIMO networks. The advantages of these new devices are enhanced power efficiency and coverage.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.59 Billion |

| Market Size by 2032 | USD 25.33 Billion |

| CAGR | CAGR of 12.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Traveling wave tube amplifier, Audio power amplifier, Solid-state power amplifier, Vacuum Tube Amplifiers) • By Class (Class A, Class B, Class AB, Class C, Class D, Others) • By Technology (Silicon, Silicon germanium, Gallium arsenide, Others) • By End-User (Consumer electronics, Industrial, Telecommunication, Military & Defense, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Qualcomm Inc, Toshiba Corporation, Infineon Technologies, Broadcom Pte. Ltd, Mitsubishi Corporation, Skyworks Solutions Inc., Murata Manufacturing Co. Ltd, Analog Devices Inc, NXP Semiconductors NV, ETL Systems Ltd, Analogic Corporation, OPHIR RF, CML Microsystems Plc, Qorvo Inc, MACOM Technology Solutions, STMicroelectronics, Texas Instruments, Cree, Inc. (Wolfspeed), Nokia Corporation, Rohde & Schwarz. |