Robotic Camera Systems Market Size & Trends:

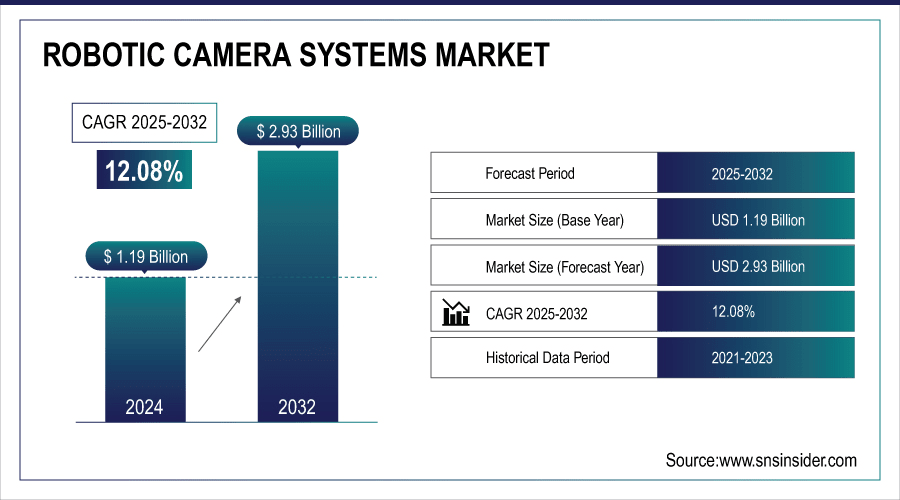

The Robotic Camera Systems Market Size was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.93 billion by 2032 and grow at a CAGR of 12.08 % over the forecast period 2025-2032.

To Get More Information On Robotic Camera Systems Market - Request Free Sample Report

The world market is being driven by workforce safety mandates and the growing use of robotics in markets such as surveillance, industrial inspection and entertainment. With the increasing need for precision in imaging, the advantages of remote control and real time data analytics on the rise, it is foreseen to be a wide-scale adoption in industries like manufacturing, defense, healthcare etc. that is driving market growth in all over the globe.

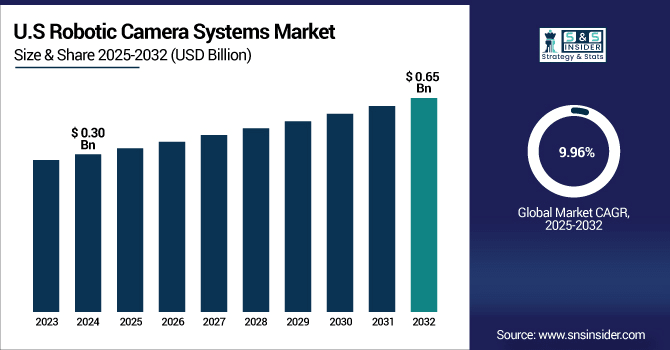

The U.S. Robotic Camera Systems Market size was USD 0.30 billion in 2024 and is expected to reach USD 0.65 billion by 2032, growing at a CAGR of 9.96 % over the forecast period of 2025–2032.

The US robotic camera systems market growth is mainly due to the rising demand for sophisticated surveillance systems in public safety, industrial automation and media end-consumers. Growing usage of AI-based monitoring solutions, advanced image acquisition and real-time data processing technologies are accelerating market adoption in various end-use industries such as security sensitive applications and fully automated productive lines.

According to research, 57% of large-scale manufacturers in the U.S. utilized artificial intelligence solutions in factory automation, highlighting the integration of AI in industrial processes.

Robotic Camera Systems Market Dynamics

Key Drivers:

-

Advancements in AI and automation enhancing imaging and analytical precision in robotic camera systems across industries

Robotic camera systems are becoming more capable with the proliferation of AI and automation technologies. AI allows for real-time image recognition, motion tracking and pattern analysis, greatly increases accuracy and efficiency in surveillance, inspection, and broadcasting. These autonomous agents can react to a changing environment without relying on human intervention,improving the operational accuracy. Furthermore, automation increases efficiency and reduces time and cost in manufacturing and media productions. With industries requiring intelligent imaging systems that are also faster, AI-driven robotic cameras become vital tools for increased precision and better decision-making.

According to research, AI-powered robotic camera systems have demonstrated up to 95% accuracy in real-time object recognition and motion tracking, compared to 70-80% with traditional methods.

Restrain:

-

Data privacy and security concerns restrict implementation in sensitive environments

Data privacy, cyber security As remote controlled camera systems capture and transmit huge amount of visual data, concerns around the privacy of data and cyber security are growing. For government buildings, healthcare facilities, corporate offices or any other sensitive site, unauthorized access in the form of security abuse, privacy invasion or data theft is a top concern. Without strong encryption, access control, and the ability to comply with data protection rules, companies are reticent to deploy such systems at scale. Such concerns not only slow down adoption, but also lead to higher compliance cost, generating a regulatory bottleneck that has impact on the market potential growth of privacy-critical sectors.

Opportunities:

-

Expansion of smart cities and urban surveillance initiatives creates substantial demand for robotic camera systems

Emerging worldwide demand for smart city development is opening a new market space for robotic camera systems in city planning and security. Intelligent infrastructure equipped with surveillance for traffic management, crime prevention, and emergency response are being heavily invested in by governments. Robotic cameras, which can feature facial recognition and autonomous patrolling with real-time alerts technology, improve situational awareness in busy, dense areas. Integration into city-level IoT-based networks, to enable smooth communication and decision-making, renders them to be key constituents of smart city ecosystems. This evolution of the urban landscape is a high-growth opportunity for manufacturers and system integrators.

According to research, the Implementation of robotic camera surveillance in urban areas has led to a 25–30% decline in crime rates and enhanced emergency response times by up to 40%.

Challenges:

-

Integration complexity and interoperability with existing systems complicate large-scale deployments

Rolling out robotic camera systems on top of existing infrastructure involves several challenges in terms of integration, since the software environments, communication protocols and hardware setups can greatly differ. Most companies are burdened with legacy systems which are not ready for cutting edge robotic technologies. And making sure the data is flowing fluidly, connectivity is real time and command and control is centralized often demands customized interfaces with security and IT departments involved. These complexities stall deployment, particularly for large or multi-site deployments. This also eases the deployment, but there is an absence of any interoperability standard across the industry level which makes the deployment specifications vendor specific which can potentially restrict the supplier choices for the large corporations.

Robotic Camera Systems Market Segment Analysis:

By Type

Mobile Cameras dominated the highest robotic camera systems market share of 32.99% in 2024, because of their flexibility, portability, and extensive usages in commercial as well as security applications. These cameras are frequently installed on drones or unmanned robots to enable users to traverse difficult or inaccessible terrain in ease. One of the main players on the market, DJI, the world’s largest drone manufacturer, has also played its role in the segmentation, by implementing highly developed mobile camera systems in drones to offer advanced real-time streaming and remote control. Their flexibility and lower cost of operation also underpin their position as the leading global robotic camera systems provider.

Pan-and-Tilt Cameras are expected to grow at the fastest CAGR of 13.58% from 2025 to 2032, due to growing deployment in applications that demand high accuracy targeting including perimeter security, industrial inspection, and live event broadcasting. Network cameras have been boosted by major players like Axis Communications, providing motorized tilt and pan mechanisms in ground-breaking offerings that cover large fields of view and follow up with automation. With the development of AI and motion detection technology, pan and tilt function is becoming one of the smart systems offering much prompter and higher utilizing rate than before.

By Technology

Image Recognition dominated the market with the highest share of 34.71% in 2024, because it significantly improves the accuracy and automation of robotic camera systems. It allows for real-time object identification, facial recognition, and anomaly detection, making it essential in security, retail analytics, and quality control. Entities such as Cognex remain the driving force in image recognition technology, offering powerful solutions that minimize human mistakes and improve productivity. Their cloud analytics and mobile platform integration expands use cases, cementing leadership in the tech sub-segment.

Machine Learning and AI Integration is expected to grow at a CAGR of 13.11% from 2025 to 2032, as the need for intelligent decision making abilities in robotics camera systems increases between. AI Computing Platforms Leader Accelerating this trend is NVIDIA, a leader in AI computing platforms, which provides the powerful GPUs and AI frameworks that underpin real-time analysis, adaptive capabilities, and contextual awareness in robotic cameras. These qualities are critical for autonomous navigation, predictive maintenance, and behavior analytics, driving AI integration as the cornerstone of next-generation camera solutions.

By Application

Security and Surveillance dominated the application segment with a 34.32% market share in 2024, due to the increasing demand of real-time threat detection and public safety. Hikvision, leading the high-definition network camera market, has exerted its influence in the segment and has provided the most cutting-edge robotic camera systems with AI analytics and night vision. Their systems are in use in commercial, governmental and residential environments for proprietary and emergency response applications. Increased spending on smart cities and safeguarding critical infrastructure continue to drive growth in this segment.

Search and Rescue Operations is expected to grow at a CAGR of 13.66% from 2025 to 2032, fueled by the demand of disaster or hard-to-read zone efficient monitoring. Robotic camera systems companies like FLIR Systems (which makes thermal imaging equipment) have pushed things forward in this space with cameras that can walk into a dangerous situation to find victims and determine what's happening. Combined with GPS and live video feed, robotic camera systems are an invaluable search and rescue tool in humanitarian and emergency services around the globe.

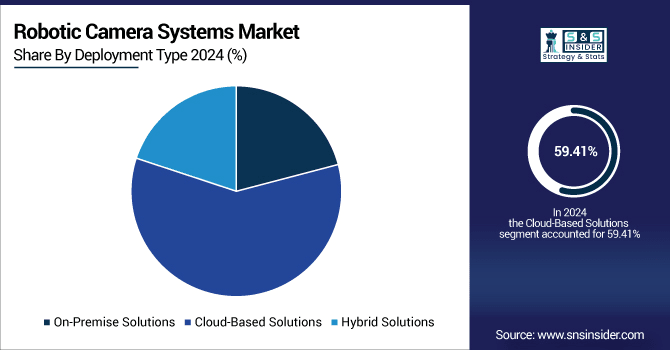

By Deployment Type

Cloud-Based Solutions dominated the highest market share of 59.41% in 2024 due to its scalability, availability, and centralization in predetermined data storage. AWS supports this sector by providing cloud platforms that allow remote monitoring in real-time and data storage. Its interoperability with AI including analytics and mobile allows ease of operations and scalability across sites. The cloud deployment type is widely adopted by enterprises as it is a cost-effective option and also supports smart technology integration, making it the most popular mode of deployment.

On-premises solutions are expected to grow at the fastest CAGR of 13.58% from 2025 to 2032, due to increasing concerns on the protection of data and network security in such important operations.II. IBM offers robust on-premise infrastructure and cyber security services, allowing industry sectors like defense or healthcare to keep data under control and comply with the laws. The on-premise deployment provides better data security, customization, and lower latency that fulfills the requirement of the industry with strict privacy policies which is leading to the growth of this segment.

By End-User Industry

Manufacturing dominated the segment with a 37.76% market share in 2024, fueled by the industry’s increasing use of robotic cameras for quality inspection, equipment monitoring and safety. The development has been facilitated by Siemens, which has been incorporating robot vision in smart factory facilities as part of AI to increase defect inspection, assembly accuracy and predictive maintenance. The Industry 4.0 trend continues to fuel demand for smart imaging solutions in factory automation, which solidifies the segment’s lead.

Healthcare is expected to grow at the fastest CAGR of 13.72% from 2025 to 2032 as robotic cameras are increasingly being utilized in surgery, diagnostics and monitoring of patients. Intuitive Surgical, one of the best known for the robotic surgery system, has a momentum in the segment with a high-definition image quality and precision for minimal invasive surgeries. Telemedicine and remote monitoring are also increasing, and the benefits of robotic camera systems as an effective tool to enhance patient care and operating effectiveness are becoming more recognised amongst healthcare providers.

Robotic Camera Systems Market Regional Overview:

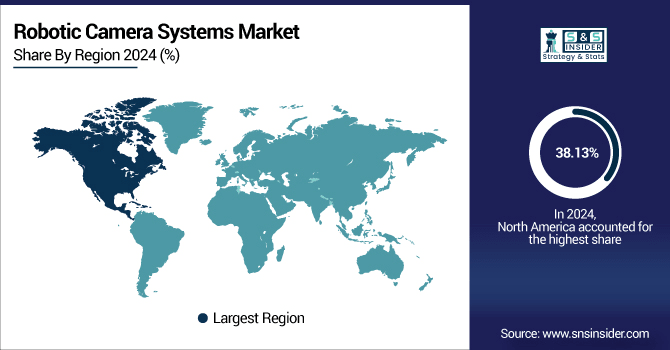

North America dominated the Robotic Camera Systems Market with the highest revenue share of 38.13% in 2024, due to the dominance of prominent players, developed technology infrastructure, and high deployment of automation in the defense, manufacturing, and entertainment industries. The market in this region is anticipated to rise significantly on the back of significant R&D investments being made including by companies such as FLIR Systems and Boston Dynamics, which are leading the way in market development and in the roll out of robotic camera solutions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American Robotic Camera Systems Market due to its advanced technological ecosystem, robust defense and surveillance investments, strong presence of leading manufacturers, and high demand for automation across industries like manufacturing, healthcare, and entertainment.

Asia Pacific is projected to grow at the fastest CAGR of 13.34% from 2025 to 2032, driven by the industrialization initiative, smart city initiatives and increase adoption of robotics in manufacturing & public safety. Nations like China, Japan and South Korea are spending massively on automation and surveillance tools. Besides, local tech companies and startups are turning out as main contributors in the market due to favorable government supports that make market spread rapidly at really rapid pace.

-

China is the dominant player in the APAC Robotic Camera Systems Market due to its booming industrial automation sector, a comprehensive surveillance network, government initiatives, and the presence of several key AI and robotics companies accelerating innovation in manufacturing, public safety, and smart cities.

The European market also has a considerable share in the Robotic Camera Systems Market due to favorable market conditions in end-user verticals, such as automotive, healthcare, and public safety. The market is propelled by high capabilities in R&D and supportive regulations for advanced technologies along with growing expenditure in the AI-powered surveillance systems. Germany, France, UK are leading adopters, focusing on precision, safety, and industrial efficiency using the robotic camera integration.

-

Germany is the largest market for the Robotic Camera Systems Market. It is also led by a strong industrial base, mainly in automotive and manufacturing, and heavy investment in automation, robotics, and AI. Germany is at the forefront of the Industry 4.0 movement and is home to leading companies in robotics/automation and camera inspection systems.

Middle East & Africa market is led by UAE owing to strong expenditure in smart cities, security infrastructure, and advanced technology adoption in the government as well as commercial sector. In Latin America, Brazil is the leading market, driven by the rising demand for industrial automation, growing needs for surveillance, and government projects for public safety and modernizing infrastructure.

Robotic Camera Systems Companies are:

Major Key Players in Robotic Camera Systems Market are Cognex Corporation, Keyence Corporation, FANUC Corporation, ABB Ltd., SICK AG, Teledyne DALSA, Omron Corporation, Sony Corporation, Panasonic Corporation, DJI Innovations and others.

Recent Development:

-

In May 2025, Teledyne DALSA launches 8k resolution Piranha4 3D line scan cameras, enabling high-speed, ultra-precise robotic inspection for semiconductor and electronics manufacturing.

-

In May 2025, ABB integrates AI into RobotVision, enabling robots to handle dynamic sorting and adaptive inspection tasks, accelerating automation in logistics and manufacturing sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.19 Billion |

| Market Size by 2032 | USD 2.93 Billion |

| CAGR | CAGR of 12.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Cameras, Mobile Cameras, Pan-and-Tilt Cameras, Autonomous Cameras, Specialized Cameras) • By Application (Security and Surveillance, Industrial Inspection, Agriculture and Farming, Entertainment, Search and Rescue Operations) • By Technology (Machine Learning and AI Integration, Image Recognition, 3D Imaging, Infrared and Night Vision, Real-Time Data Streaming) • By End-User Industry (Government and Defense, Manufacturing, Agriculture, Transportation and Logistics, Healthcare) • By Deployment Type (On-Premise Solutions, Cloud-Based Solutions, Hybrid Solutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cognex Corporation, Keyence Corporation, FANUC Corporation, ABB Ltd., SICK AG, Teledyne DALSA, Omron Corporation, Sony Corporation, Panasonic Corporation, DJI Innovations. |