Robotic Vision Market Size:

Get more information on Robotic Vision Market - Request Sample Report

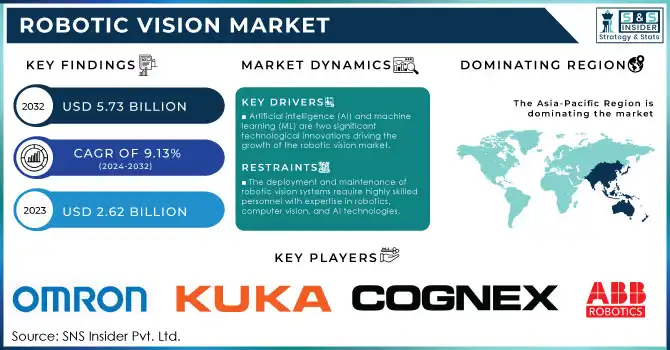

The Robotic Vision Market Size was valued at USD 2.62 Billion in 2023 and is expected to reach USD 5.73 Billion by 2032 and grow at a CAGR of 9.13% over the forecast period 2024-2032.

The robotic vision market is a rapidly growing sector that integrates robotics, artificial intelligence (AI), and computer vision to empower machines with the ability to perceive, interpret, and interact with their environments. This technology is a cornerstone of industrial automation and is witnessing accelerated adoption across diverse industries. One of the primary growth drivers is the increasing demand for automation in industrial manufacturing, where over 3.4 million industrial robots are in use globally as of 2024. With a global robot-to-human ratio of 1:71 in manufacturing and industrial companies dedicating 25% of their capital to automation, the robotic vision market is poised for exponential growth. In manufacturing, robotic vision systems play a critical role in quality control and assembly lines. These systems inspect products for defects, measure dimensions, and ensure consistent production quality. By reducing human error and enhancing productivity, robotic vision significantly optimizes manufacturing processes. For example, in the automotive industry, robotic vision ensures high standards by inspecting welds, detecting paint flaws, and assisting in the assembly of intricate components. These applications not only minimize wastage but also help maintain stringent production standards, fueling the growth of the robotic vision market.

Beyond manufacturing, the adoption of robotic vision is transforming retail and logistics. In warehouses, vision-guided robots streamline operations by identifying and picking items, sorting packages, and managing inventory. These innovations improve supply chain efficiency, cut costs, and accelerate delivery times. Similarly, in retail, robotic vision powers automated checkout systems that recognize and process items without human involvement. The rise of e-commerce has further bolstered the need for vision-guided systems to handle complex order fulfillment and inventory management tasks, driving the adoption of robotic vision technology.

Robotic Vision Market Dynamics

Drivers

-

Artificial intelligence (AI) and machine learning (ML) are two significant technological innovations driving the growth of the robotic vision market.

The capabilities of robotic vision systems have been greatly improved by these advances. Previously, robotic vision systems used basic algorithms and predefined instructions to analyze visual information. Yet, by incorporating AI and ML, robotic vision systems can gain knowledge from data, adjust to different surroundings, and enhance their capabilities steadily. AI-powered robotic vision systems can identify objects, monitor motion, and make instant decisions using visual data, ultimately improving the efficiency and precision of automation procedures. Teaching robots to perceive and comprehend their surroundings is essential for various industries such as manufacturing, logistics, healthcare, and agriculture. One example is within the manufacturing sector, where robotic vision systems utilize AI and ML to Defect Detection in items along a production line, leading to improved efficiency in quality control procedures and decreased chances of human mistakes. With the advancement of AI and ML technologies, robotic vision systems are predicted to increase in capability, leading to a higher demand for them across different industries.

-

The increasing need for automation in various sectors is a major factor in driving the growth of the robotic vision market.

Automation provides multiple advantages such as higher productivity, lower operational expenses, and enhanced consistency and accuracy. To improve production processes and operational efficiency, industries are increasingly relying on robotic systems with advanced vision technologies. In manufacturing, automation is changing traditional assembly lines by substituting manual labor with robots that can complete tasks quicker, more precisely, and without getting tired. Robotic vision systems allow robots to conduct visual inspections, detect flaws, and verify that products adhere to quality standards without requiring human involvement. The complexity of products is increasing, leading to a greater demand for systems with advanced inspection and handling capabilities. Furthermore, there is an increasing use of robotic vision systems due to the requirement for robots to manage hazardous or monotonous tasks. Robots equipped with vision systems can carry out inspections and maintenance tasks in risky settings like chemical plants or mines, ensuring the safety of human workers. Likewise, robots are being utilized in industries such as food processing and logistics for tasks like sorting, packaging, and palletizing that require precision and speed.

Restraints

-

The deployment and maintenance of robotic vision systems require highly skilled personnel with expertise in robotics, computer vision, and AI technologies.

However, the demand for such talent often exceeds the available supply, leading to a skills gap in the industry. The lack of a skilled workforce can delay the implementation and adoption of robotic vision systems, as companies may struggle to find qualified engineers and technicians. The need for specialized knowledge in machine learning, computer vision algorithms, and sensor technology can further complicate the recruitment process. As a result, companies may face challenges in fully utilizing their robotic vision systems, which could impact their overall performance and return on investment. In industries where skilled labor is scarce, the shortage of trained professionals could be a significant barrier to the widespread adoption of robotic vision technologies.

Robotic Vision Market Segmentation

By Type

The 3D segment dominated with a 57% market share in 2023, offers a more complex and advanced level of object recognition and interaction. This allows for more intricate tasks such as precise object manipulation, autonomous navigation, and enhanced quality control in environments where 2D systems fall short. The 3D segment is expanding rapidly due to its critical role in sectors like healthcare, robotics, and automotive. For example, KUKA Robotics applies 3D vision systems for advanced manufacturing automation, including the precision assembly of automotive components, showcasing the segment’s growing demand and its potential for innovation across industries.

The 2D segment is anticipated to have the fastest CAGR during 2024-2032. These systems typically use cameras and sensors to analyze the environment, identify objects, and provide critical information for tasks like inspection, sorting, and object recognition. In applications such as manufacturing, logistics, and automotive, 2D vision systems are primarily used for quality control, material handling, and automation in assembly lines. An example of 2D robotic vision is Cognex, a company providing machine vision solutions for industries like food and beverage, automotive, and electronics, which utilizes 2D vision technology for automated inspection and traceability in production lines.

By Components

The hardware segment dominated in 2023 with a 57% market share. These components enable robots to capture images, process visual data, and make decisions based on real-time feedback. Hardware advancements in image processing, sensor resolution, and system integration are driving market growth. Companies like ABB and KUKA Robotics utilize advanced vision systems in their robotic arms for tasks like pick-and-place, quality control, and assembly line inspections. The demand for precise, high-quality imaging hardware in manufacturing and logistics applications is fueling the growth of this segment.

The software segment is going to be the fastest-growing during 2024-2032, driven by advancements in artificial intelligence (AI), machine learning, and deep learning. The software enables robots to process the visual data captured by hardware, identify objects, and make complex decisions. It is pivotal in improving robot autonomy and accuracy in dynamic environments. For example, FANUC and Universal Robots integrate AI-driven software to enhance the capabilities of their robotic arms, enabling functions like real-time object detection, navigation, and task adaptation.

Robotic Vision Market Regional Analysis

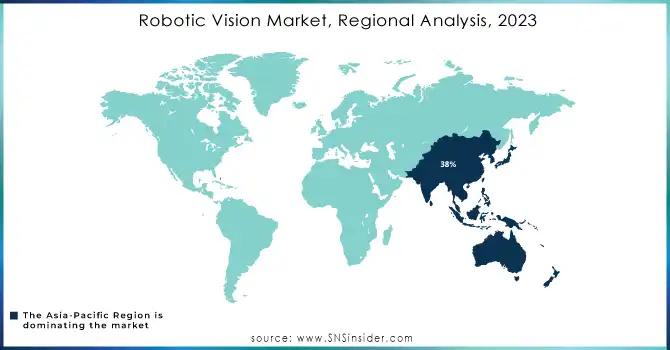

In 2023, Asia-Pacific dominated with a 38% market share and is expected to continue its growth rate during 2024-2032 in the robotic vision market, credited to quick industrial growth, technological progress, and the existence of important manufacturing centers such as China, Japan, and South Korea. The area also enjoys a strong use of robotics in sectors such as automotive, electronics, and consumer goods. The growing need for automation in manufacturing and logistics, which lowers labor expenses and enhances operational efficiency, is contributing to APAC's market expansion. Major corporations such as Fanuc Corporation in Japan and KUKA Robotics in Germany are heavily involved in the APAC region, utilizing robotic vision technologies for assembly line and material handling processes. Furthermore, Omron Corporation and Keyence Corporation are also providing automation solutions that integrate vision systems for quality control and product inspection within factory settings. Government incentives that encourage advanced technologies and manufacturing processes support regional dominance.

Need any customization research on Robotic Vision Market - Enquiry Now

Key Players

The major key players in the Robotic Vision Market are:

-

ABB Robotics (YuMi, IRB 6700)

-

Cognex Corporation (In-Sight 7000, VisionPro)

-

KUKA Robotics (LBR iiwa, KUKA AGILUS)

-

OMRON Corporation (F150 Vision Sensor, OMRON V-SERIES)

-

Fanuc Corporation (R-30iB Plus Controller, iRVision)

-

Keyence Corporation (CV-X200, CV-5000 Series)

-

Basler AG (ace 2, dart Series)

-

SICK AG (Visionary-T, SICK InspectorP)

-

Teradyne (Universal Robots) (UR5, UR10e)

-

National Instruments (NI Vision Builder AI, LabVIEW Vision)

-

Denso Robotics (VS-050, VP-Series)

-

MVTec Software GmbH (HALCON, MERLIC)

-

Sony Corporation (XCL-SG, IMX Series Sensors)

-

Teledyne Technologies (JAI Spark, Teledyne Dalsa Genie Nano)

-

Intel Corporation (Intel RealSense D435i, Intel RealSense LiDAR Camera L515)

-

LMI Technologies (Gocator 3500, Gocator 2000 Series)

-

Matrox Imaging (Matrox 4Sight GP, Matrox Solios)

-

Epson Robotics (Epson G-Series, Epson C-Series)

-

Zebra Medical Vision (Zebra Medical Vision AI, VisionAI platform)

-

STMicroelectronics (VL53L1X, VL53L0X)

Recent Development

-

June 2024: ABB Robotics released OmniCore, a smart automation platform that is quicker, more accurate, and more eco-friendly, to empower, improve, and futureproof businesses.

-

January 2024: STMicroelectronics introduced the VL53L8CX, its newest 8 x 8 time-of-flight ranging sensor. The latest sensor includes dual metasurface lenses, a 940 nm vertical cavity surface emitting laser, a multizone single-photon avalanche diode array, and an optical system with filters and diffractive optical elements.

-

November 2024: Teledyne FLIR introduced a new software tool called the PRISM AIMMGen AI model generator. The dual-purpose AI model generator is a new tool that enables automatic generation of AI models using datasets unaffected by International Traffic In Arms (ITAR) restrictions, offering cost and time savings for the user.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.62 Billion |

| Market Size by 2032 | USD 5.73 Billion |

| CAGR | CAGR of 9.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (2D, 3D) • By Components (Hardware, Software) • By Industry (Automotive, Electrical & Electronics, Chemical, Rubber, & Plastic, Metals & Machinery, Food & Beverages, Precision Engineering & Optics, Pharmaceuticals & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Robotics, Cognex Corporation, KUKA Robotics, OMRON Corporation, Fanuc Corporation, Keyence Corporation, Basler AG, SICK AG, Teradyne (Universal Robots), National Instruments, Denso Robotics, MVTec Software GmbH, Sony Corporation, Teledyne Technologies, Intel Corporation, LMI Technologies, Matrox Imaging, Epson Robotics, Zebra Medical Vision, STMicroelectronics |

| Key Drivers | • Artificial intelligence (AI) and machine learning (ML) are two significant technological innovations driving the growth of the robotic vision market. • The increasing need for automation in various sectors is a major factor in driving the growth of the robotic vision market. |

| RESTRAINTS | • The deployment and maintenance of robotic vision systems require highly skilled personnel with expertise in robotics, computer vision, and AI technologies. |