Rodenticides Market Report Scope & Overview:

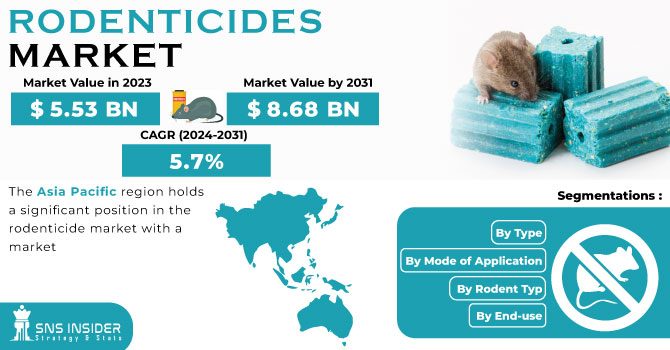

The Rodenticides market size was valued at USD 5.52 billion in 2023 and is expected to reach USD 9.10 billion by 2032, growing at a CAGR of 5.72% over the forecast period of 2024-2032. The Rodenticides market report provides a comprehensive analysis of production volumes and utilization rates across key countries, highlighting supply chain efficiency and capacity trends. It examines raw material price fluctuations by type and region, offering insights into cost dynamics. The report also evaluates the impact of regulatory frameworks on market growth, covering compliance requirements and restrictions. Additionally, it presents environmental and safety metrics, including toxicity levels and disposal practices, along with advancements in biodegradable formulations, innovation trends in next-generation rodenticides and market adoption patterns across industries such as agriculture and urban pest control are also explored.

Get More Information on Rodenticides Market - Request Sample Report

Drivers

Rising Demand for Integrated Pest Management (IPM) Solutions drives the market growth.

The demand for Integrated pest management (IPM), is one of the key factors that are driving up the rodenticides market. Integrated pest management (IPM) is an environmentally sound strategy that uses a combination of practices to control rodent populations in ways that are economical and limit environmental disruption. There is growing governmental and regulatory support for IPM practices as a means to reduce reliance on harmful chemicals and for sustainable pest management in agriculture, urban areas, and food storage. The increasing recognition of the negative impact of conventional rodenticides on non-target species and ecosystems has also exacerbated the uptake of IPM-based rodent control. In addition to rodenticide formulations like non-anticoagulant and biodegradable rodenticides being in line with IPM principles, it promotes adoption across multiple sectors as well.

Restraint

Stringent Regulations on Rodenticide Usage Restrict Market Growth

The rodenticide market is severely restrained by the various stringent regulations set by numerous government authorities and environmental agencies. The use of many rodenticides can potentially harm non-target species such as pets, livestock, and wildlife particularly anticoagulant-based products and such risks have led to increasing restrictions on rodenticide use. Due to restrictions imposed by regulatory bodies including the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), some toxic compounds are limited in their residential and agricultural use. Moreover, growing concerns about chemical residues from food production and water sources have led to bans and restricted use of rodenticides. These regulatory guidelines hold manufacturers up-noteworthy challenges and urge them to innovate alternative and environmentally-friendly solutions that are safe and effective at the same time and do not compromise on the performance of rodent control.

Opportunities

Growing Adoption of Eco-Friendly and Biodegradable Rodenticides Presents Lucrative Opportunities

The demand for rodenticides specifically caters to its sustainability and environmental safety trend which will enhance growth in the market. To stay within strict regulations banning dangerous chemicals, manufacturers are focusing on research and development of botanical and natural rodenticides that can control the rodent population while remaining harmless to the non-target species and the ecosystem. Bio-based formulations, like cholecalciferol and corn-based rodenticides, are also emerging because of the lack of damage to ecosystems. Increasing inclination towards green pest control solutions, particularly in sectors such as agriculture, food storage, and urban pest control is projected to propel demand for sustainable rodenticides, creating new growth opportunities for the market.

Challenges

The development of rodent resistance to conventional rodenticides poses a major challenge to market growth.

One of the challenges being faced in the rodenticides market is resistance of common rodent populations to standard anticoagulant and non-anticoagulant rodenticides. The long and mainstream use of these chemical formulations has resulted in evolution in the rodent population and traditional rodenticides have become less effective. This resistance creates a push for pest control companies and agricultural industries to look for alternative methods, whether that be stronger active ingredients or combined treatments where insecticides will be mixed, both of which bring regulatory and environmental challenges. Consequently, the urgent pursuit of novel formulations and integrative pest management (IPM) strategies for rodent control hinges on a rigorous research and innovation agenda.

Market segmentation

By Product

Anticoagulant rodenticides dominated and held the largest market share around 74%in 2023. It is preferred by consumers owing to its effectiveness over the long term in controlling the rodent population. These types of rodenticides act as anticoagulants to prevent blood clotting in the pests, which results in death after they eventually bleed out internally, making them highly effective in pest control. Their delayed action makes them popular in agricultural, household, and commercial areas, since rodents are not able to associate the bait with immediate damage, resulting in higher consumption rates. Moreover, these anticoagulants are provided in various types like visit pellets, blocks, and powder, which gives multiple options for application necessities.

By Form

Block segment held the largest market share around 38% in 2023. It is because of their better durability over time, extended shelf life, and convenience of use in diverse environments. Block rodenticides are highly weather resistant, so they are more suited for outdoor usage such as in agricultural settings, warehouses, and industrial locations. Because they are in the solid state, there is less chance of spilling or overconsumption which makes them suitable for controlled and efficient rodent elimination. Furthermore, blocks are designed with an attractant that improves palatability in combination with being moisture and mold-stable, making them more efficient in wet or high-humid environments. The ease of position and the ability to securely fasten within bait stations also contribute to their popularity in residential and commercial pest control use.

By Application

The pest control segment held the largest market share around 56% in 2023. It is owing to the growth in demand for effective rodent control management in the residential, commercial, and industrial sectors. Increasing population flow towards urban areas coupled with rising concern towards cleanliness and food security has further driven the pest control market. Also, regulations that compel the food processing and hospitality industries to keep their surroundings rodent-free have spurred market growth. Rodenticides are used extensively by pest control companies because they are cheaper, easy to handle and work effectively for a long-period of time to control infestations. Additionally, improvements in bait formulations and integrated pest management (IPM) strategies have made rodenticides more efficient and they are now regarded as the first-line tool in large-scale rodent control initiatives.

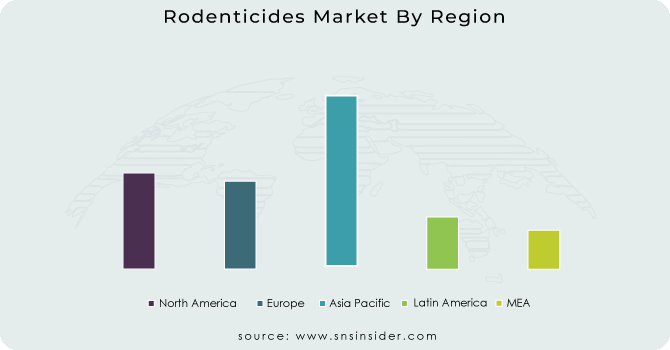

Regional Analysis

Asia Pacific held the largest market share around 34% in 2023. The growing agricultural activities and rising food security concerns in the region. In China, India, and Japan, the high density of population with increased production of garbage, rainfall, and other favorable weather conditions have led to an increase in the number of rodent infections. Rodenticides are also widely used in the agricultural sector, as rodents are a known threat to crops across the Asia-Pacific region, making rodent control an important agricultural activity producing economic loss. Moreover, increasing awareness regarding cleanliness and pest control, accompanied by governmental policies encouraging rodent control within food processing and storage units, has been another major factor bolstering market growth. The presence of the key rodenticide-producing companies and their growing adoption of integrated pest control management (IPM) solutions has proved vital in Asia-Pacific for being the regional market leader.

North America held a significant market share and growing in the forecast period. This is owing to the stringent regulation policies, rising worry about rodent-borne diseases, and higher demand for effective pest control solutions. There is a rich legacy of pest management in the region whereby rodenticides are extensively used across domestic, commercial, and agricultural arenas. Demand for rodenticides is also propelled by the strict need for pest management in the food processing, food storage, and hospitality sectors due to stringent food safety and sanitation regulations in the U.S. and Canada. Furthermore, urbanization and the growth of urban infrastructure have resulted in higher rodent strikes which create the need for more sophisticated rodent control methods. The leading position in this region can also be attributed to the presence of major pest control service providers and increasing investment in eco-friendly rodenticide research and development.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Bayer AG (Racumin, Klerat)

-

Syngenta (Talon, Weatherblok)

-

BASF SE (Storm, Selontra)

-

Anticimex (Smart Pest Control, Rodent Bait Stations)

-

UPL Ltd. (Ratol, Brodifacoum Bait)

-

Rollins (Orkin Bait, Orkin Traps)

-

Abell Pest Control (Rodent Bait Stations, Abell Snap Traps)

-

Truly Nolen (Rodent Shield, Exclusion Bait)

-

Liphatech Inc. (Generation, Maki)

-

JT Eaton (Bait Block, Nectus)

-

Pelgar International (Roban, Rodex)

-

Neogen Corporation (Havoc, CyKill)

-

Bell Laboratories (Contrac, Ditrac)

-

Senestech Inc. (ContraPest, Rodent Fertility Control)

-

Ecolab (Rodent Bait Stations, Multi-Catch Traps)

-

Impex Europa (Rodenticide Bait Blocks, Pellets)

-

Rentokil Initial Plc (Rodent Control Baits, Trap Systems)

-

Terminix (Rodent Defense, Bait Stations)

-

Lipatech (FirstStrike, Resolv)

-

Motomco (Jaguar, Tomcat)

Recent Development:

-

In October 2024, BASF SE relaunched its Neosorexa rodenticide brand with flocoumafen as the new active ingredient, enhancing its effectiveness against various rodent species. This move aims to improve rodent control solutions while ensuring regulatory compliance.

-

In May 2023, World Pest Control partnered with Rentokil North America to enhance its pest control services by utilizing Rentokil's vast network and industry expertise. This collaboration aimed to strengthen service offerings and expand market reach.

-

In July 2023, Syngenta made an exciting announcement regarding the launch of their latest product, the Talon Soft XT concentration. This innovative rodenticide, built upon their renowned brodifacoum formula, promises exceptional efficacy in combating resistance while adhering to regulatory requirements. By reducing the concentration of the active ingredient, Syngenta has successfully met the demands set by governing bodies without compromising on its effectiveness.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.52 Bn |

| Market Size by 2032 | US$ 9.10 Bn |

| CAGR | CAGR of 5.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Anticoagulant, Non-anticoagulant), • By Outlook (Pellets, Blocks, Powder) • By Application (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Household) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bayer AG, Syngenta, BASF SE, Anticimex, UPL Ltd., Rollins, Abell Pest Control, Truly Nolen, Liphatech Inc., JT Eaton, Pelgar International, Neogen Corporation, Bell Laboratories, Senestech Inc., Ecolab, Impex Europa, Rentokil Initial Plc, Terminix, Lipatech, Motomco |