Rum Market Report Scope & Overview:

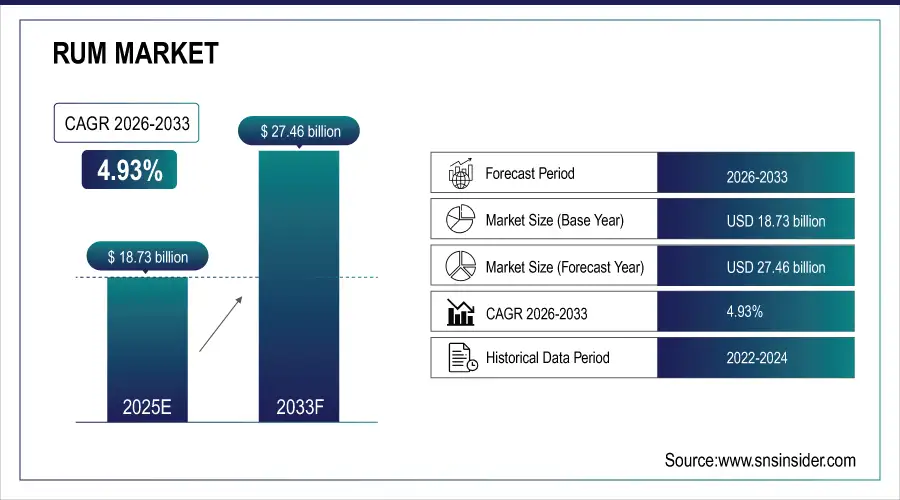

The Rum Market Size was valued at USD 18.73 Billion in 2025E and is projected to reach USD 27.46 Billion by 2033, growing at a CAGR of 4.93% during the forecast period 2026–2033.

The Rum Market analysis report observes growth driven by increasing consumption, rising popularity of premium and craft rums, the proliferation of cocktail culture, and accelerating demand from the hospitality and retail industries. Market growth is further supported by escalating consumer demand for flavored and aged rum varieties.

Rum production reached 45 million cases in 2025, driven by rising premium and flavored demand, expanding cocktail culture, and growing bar, restaurant, and retail consumption.

Market Size and Forecast:

-

Market Size in 2025: USD 18.73 Billion

-

Market Size by 2033: USD 27.46 Billion

-

CAGR: 4.93% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Rum Market - Request Free Sample Report

Rum Market Trends:

-

Increasing demand for super, spiced and flavored rums is aiding the overall consumption, especially from bars, restaurants and retail outlets.

-

Building of cocktail culture and mixology trends are adding to the demand for varied rum types and new creations.

-

E-commerce and the rise of modern retail are improving access, lifting sales in urban and developing markets.

-

An increase in the interest of aged, craft and sustainably produced rums is leading to investment in traditional methods of production and sustainable industry practices.

-

Market will consolidate as bias toward premiumization, brand differentiation and need for customized solutions to satisfy changing consumer preference continues.

U.S. Rum Market Insights:

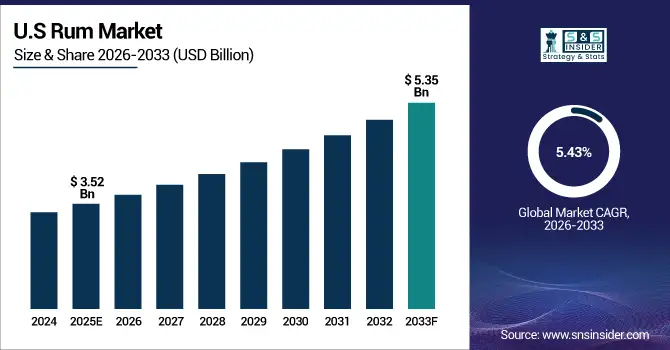

The U.S. Rum Market is projected to grow from USD 3.52 Billion in 2025E to USD 5.35 Billion by 2033, at a CAGR of 5.43%. Growth in the market is expected to be fueled by growing consumer taste for high-end, flavored and aged rums, expanding cocktail culture along with rising consumption at retail and hospitality channels.

Rum Market Growth Drivers:

-

Rising demand for premium and flavored rums, fueled by cocktail culture, is driving market growth.

Rising demand for premium and flavored rums is the primary driver of Rum Market growth. Growing consumer demand for craft, aged and speciality rums is driving uptake in bars, restaurants and retail channels. Cocktail culture and mixology trends have opened up even wider, thanks to e-commerce and contemporary retail. Enterprising production, maturing and environmental innovations have improved quality, diversification and brand differentiation reinforcing long-term market expansion.

Premium and flavored rum sales grew 6% in 2025, driven by rising cocktail culture and increasing bar, restaurant, and retail consumption.

Rum Market Restraints:

-

Strict alcohol regulations, high taxation, and rising production costs are constraining large-scale expansion of the Rum Market.

Strict alcohol regulations, high taxation, and rising production costs are key restraints for the Rum Market. The producers face complex logistics due to different regulation and licensing in the regions. Due to hefty excise and import duties, pricing is not as flexible which has impacted sales growth, especially in emerging markets. In addition, costs of quality ingredients, aging and sustainable production practices also inhibit further expansion, making it difficult for new and existing market entrants to become a major player in the market.

Rum Market Opportunities:

-

Increasing demand for craft, aged, and sustainable rums presents opportunities for innovation in premium production and branding.

Increasing demand for craft, aged, and sustainable rums presents a major opportunity for market expansion. Savvy sippers desire authentic, distinct flavors and quality drinking experiences, so producers are experimenting with aging processes, native ingredients and sustainability. Sustainable packaging and ethically sourced products are also becoming necessary more in keeping with environmental advances. This change toward premiumization and sustainability in turn will drive product differentiation, brand value and long-term growth in the Rum Market.

Craft and premium rum varieties accounted for 22% of total rum innovations in 2025, driven by growing demand for aged, sustainable, and artisanal products across markets.

Rum Market Segmentation Analysis:

-

By Type, Dark Rum held the largest market share of 38.72% in 2025, while Flavored Rum is expected to grow at the fastest CAGR of 6.14%.

-

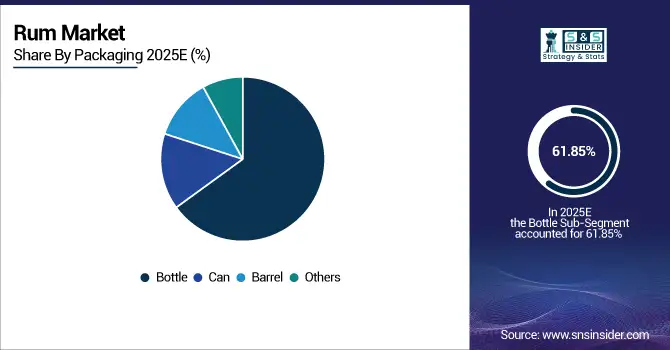

By Packaging, Bottles dominated with a 61.85% share in 2025, while Barrels are projected to expand at the fastest CAGR of 5.27%.

-

By Alcohol Content, ≤40% accounted for the highest market share of 54.23% in 2025, and 40–50% is expected to record the fastest CAGR of 5.02%.

-

By Distribution Channel, Off-Trade held the largest share of 49.58% in 2025, while E-Commerce is projected to grow at the fastest CAGR of 7.11%.

-

By End-Use Industry, Bars & Restaurants held the largest share of 42.37% in 2025, while Personal Consumption is expected to grow at the fastest CAGR of 6.48%.

By Packaging, Bottles Dominate While Barrels Expand Rapidly:

Bottles segment dominated the market as they are easy to use, keep the product fresh and enjoy wide availability through retail and hospitality channels. They offer branding opportunities where producers can highlight premium and heritage labels, thus brands receive visibility and supported by consumer preference. Barrels are the fastest growing segment, propelled by demand for aged, craft and artisanal rums. There is a shift in consumer demand toward meaningful, or authentic experiences, and barrel packaging highlights craft and tradition, motivating premium purchases to the long term.

By Type, Dark Rum Dominates While Flavored Rum Expands Rapidly:

Dark rum dominated the market with its rich taste, heritage and large consumer base that ensures on-trade and off-trade pub shelf space for this popular drink. Its popularity mixed, straight and high-end guarantees continued demand. Flavored Rum are the fastest-growing segment, driven by innovation in flavor profiles, including tropical fruits, spices and other exotic flavors. The younger consumers and cocktail lovers are influencing its rapid uptake and help in accelerating the growth of the market.

By Alcohol Content, ≤40% Dominates While 40–50% Expands Rapidly:

≤40% segment dominated the market on account of their versatility, light flavor and application in cocktail and mixed drinks. This category has also been influenced by legal limits in a number of places, really driving high consumption across bars, restaurants and retail. 40–50% is the fastest-growing segment, fuelled by premiumisation, age and craft trends. Demand for these higher-alcohol alternatives is being driven by consumers looking for full on flavour, extra bite and a unique drinking experience.

By Distribution Channel, Off-Trade Dominates While E-Commerce Expands Rapidly:

Off-Trade segment dominated the market as supermarkets and liquor stores, including retail chains, offered wide accessibility. This channel allows for sustained sales of premium and standard rums, keeping the brand in front of consumers as they shop. E-Commerce is the fastest growing segment, which is on a fast pace to grow with focus on convenience, personalization and digital marketing. The internet is providing an outlet for craft, aged and flavored rums directly to consumers, thus entering the markets of technophiles and city dwellers while furthering market penetration.

By End-Use Industry, Bars & Restaurants Dominate While Personal Consumption Expands Rapidly:

Bars & Restaurants segment dominated the market due to their highest consumption points making standard and premium rums most demanded. Their strength in cocktails, long drinks and on-trade activations guarantees sustainable sales and visibility. Personal Consumption is the fastest growing segment due to trend of home bartending, culture of cocktails and increase in disposable income. A focus on at-home experimentation of craft, flavored, and aged rums by consumers is further broadening the retail and direct-to-consumer markets, providing robust opportunities in all regions.

Rum Market Regional Analysis:

Asia-Pacific Rum Market Insights:

The Asia-Pacific Rum Market dominates with a 36.42% market share in 2025, driven by rising consumption, growing cocktail culture, and increasing demand for premium and craft rums. Growth is driven largely by rising hospitality and retail sectors in countries including China, India, Japan and Australia. The increasing consumer demand for flavoured, aged and premium rums combined with rapid urbanisation and rising disposable income is facilitating regional market leadership while fostering sustained growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Rum Market Insights:

The China Rum Market growth can be attributed to increased disposable income, growing hospitality and retail industries along with consumer inclination toward premium, craft and flavored rums. Increased cocktail culture, urbanization and uptake of foreign rum and craft spirits is driving the demand making China’s one of the largest revenue contributors to Asia-Pacific market dominance.

North America Rum Market Insights:

North America is the fastest-growing Rum Market with a CAGR of 5.82%, driven by rising premium and craft rum consumption across bars, restaurants, and retail channels. Rise in cocktail culture, higher disposable income and rising inclination toward flavored & aged rums is driving the market growth. Increasing e-commerce presence and at home trends are expected to further drive adoption, solidifying the region’s profile and creating a firm foundation for long-term growth in North American rum.

U.S. Rum Market Insights:

The U.S. Rum Market is anticipated to be driven by growing consumers’ preference toward premium, crafted and flavored rums in bars, restaurants and retail outlets. Increase in cocktail culture, increase in hospitality industry, growth in disposable income and rise in home consumption trend fuel the market along with e-commerce adoption and brand innovation.

Europe Rum Market Insights:

Europe Rum Market is witnessing strong growth due to surging innovation in premium, aged and flavored products being realized across bars, restaurants and retail channels. Primary markets are the UK, Germany and France. Expansion is driven by the growing cocktail culture, rising disposable income, increasing home consumption and e-commerce penetration. Brand innovation, craft production and sustainability initiatives formants will increasingly consolidate their market presence in the coming years as changing consumer preference fuels longer term growth throughout the region.

U.K. Rum Market Insights:

The U.K. is a key market for Rum, with strong demand in bars, restaurants, and retail channels. Growth will be driven by a growing taste for mature, top-end and flavoured rums and buoyant cocktail culture. Aided by brand-led innovation, the craft sector and a more quality and sustainability focussed consumer market is helping to drive this further.

Latin America Rum Market Insights:

The Latin America Rum Market is growing with the demand of premium, craft, and flavored rums. Growth is driven by the proliferation of bars, restaurants and retail outlets and growing disposable consumer income. Growth through production, aging and sustainability practices is creating opportunities in key markets such as Brazil, Mexico and Argentina.

Middle East and Africa Rum Market Insights:

The Middle East & Africa Rum Market will rise with growth of consumption at bars, restaurants and retail outlet. Increasing disposable income, rising hospitality industry and preference for premium and flavored rums are the key factors boosting market growth. Brand innovations, e-commerce penetration and cocktail culture add to market growth.

Rum Market Competitive Landscape:

Tanduay, established in 1854 in the Philippines, is the world’s best-selling rum brand, with over 23 million cases sold annually. Its market dominance is driven by a rich heritage, high-quality production, and strategic international expansion. The company leverages innovative distillation techniques, effective marketing, and a strong distribution network to reach consumers. Balancing tradition with modern branding, Tanduay’s affordability, consistency, and flavor quality have solidified its leadership position in the competitive rum industry.

-

In January 2025, Tanduay launched a limited-edition rum for the Year of the Snake. The release features unique labeling and packaging, highlighting Tanduay’s barrel-aging process and offering refined, complex flavors that appeal to collectors, enthusiasts, and connoisseurs.

Bacardi, founded in 1862 in Cuba, is a leader in the spirits industry with a portfolio exceeding 200 brands. Its dominance comes from strategic acquisitions, robust distribution networks, and continuous product innovation. By emphasizing sustainability, quality, and brand equity, Bacardi successfully targets both premium and mass-market segments. Recognition, strong marketing, and consistent performance have cemented Bacardi as one of the most dominant rum brands, appealing to a diverse consumer base.

-

In October 2025, Bacardi unveiled a limited-edition Halloween bottle with a striking skeleton design. The release promotes festive cocktails, immersive activations, and brand engagement, targeting consumers during the holiday season and encouraging social sharing.

Captain Morgan, launched in 1982 and owned by Diageo, is one of the world’s most recognized spiced rum brands, selling over 11 million cases annually. Its leadership is driven by distinctive flavor offerings, innovative marketing campaigns, and extensive distribution. By engaging younger consumers, supporting cocktail culture, and maintaining high product quality, Captain Morgan has secured a strong competitive position in the international rum market, becoming a trusted and influential brand.

-

In May 2025, Captain Morgan introduced "Muck Pit," blending Original Spiced Gold with tropical mango and subtle hop notes. This gently sparkling, flavor-forward drink provides a refreshing alternative to traditional beverages, appealing to consumers across bars, restaurants, and retail channels.

Rum Market Key Players:

Some of the Rum Market Companies are:

-

Tanduay

-

Bacardi

-

Captain Morgan

-

McDowell’s No. 1

-

Havana Club

-

Ron Barceló

-

Appleton Estate

-

Santa Teresa

-

Planter’s

-

Banks

-

Diplomático

-

Don Q

-

El Dorado

-

Chairman’s Reserve

-

Rhum Clément

-

Foursquare

-

Worthy Park

-

Ron del Barrilito

-

CamiKara

-

Black Frost Distilling

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 18.73 Billion |

| Market Size by 2033 | USD 27.46 Billion |

| CAGR | CAGR of 4.93% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Light Rum, Dark Rum, Spiced Rum, Flavored Rum, Others) • By Packaging (Bottle, Can, Barrel, Others) • By Alcohol Content (≤40%, 40–50%, >50%) • By Distribution Channel (On-Trade, Off-Trade, E-Commerce) • By End-Use Industry (Bars & Restaurants, Hospitality, Retail, Personal Consumption, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tanduay, Bacardi, Captain Morgan, McDowell’s No. 1, Havana Club, Ron Barceló, Appleton Estate, Santa Teresa, Planter’s, Banks, Diplomático, Don Q, El Dorado, Chairman’s Reserve, Rhum Clément, Foursquare, Worthy Park, Ron del Barrilito, CamiKara, Black Frost Distilling |