Fast Food and Quick Service Restaurant Market Size & Overview:

Get More Information on Fast Food and Quick Service Restaurant Market - Request Sample Report

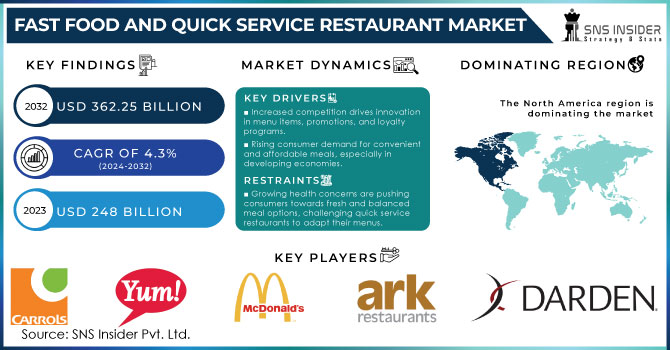

Fast Food and Quick Service Restaurant Market size was valued at USD 248 billion in 2023 and is expected to reach USD 362.25 billion by 2032 and grow at a CAGR of 4.3% over the forecast period 2024-2032.

Busy lifestyles and a desire for grab-and-go meals are fuelling the Fast Food and Quick Service Restaurant (QSR) market. This trend favours Quick Service Restaurants because they offer speedy service and minimal wait times. Technology is further boosting convenience. Mobile ordering apps from major chains like McDonald's and Burger King let customers order ahead and customize their meals, enhancing satisfaction and loyalty. Self-service kiosks are another innovation streamlining the ordering process.

Fast food and Quick Service Restaurant brands are constantly innovating their menus to keep pace with changing customer preferences. This includes introducing healthier options like plant-based alternatives, gluten-free products, and lower-calorie meals. This approach broadens their customer base and caters to dietary trends. The franchise model is another key growth strategy. by franchising, brands can expand geographically with minimal investment and risk, allowing for rapid market penetration.

Concerns about health risks associated with fast food, such as obesity and chronic diseases, are a major hurdle. This has led to increased scrutiny from health organizations and consumer groups, potentially influencing regulations and consumer choices. Additionally, fluctuating prices of essential ingredients like meat and dairy can squeeze profit margins and strain operational costs for QSR operators.

Fast Food and Quick Service Restaurant Market Dynamics:

Key Drivers:

-

Increased competition drives innovation in menu items, promotions, and loyalty programs.

-

Rising consumer demand for convenient and affordable meals, especially in developing economies.

-

Technological advancements like mobile ordering and interactive kiosks streamlining the customer experience.

The rise of technology is revolutionizing how customers interact with Fast Food and Quick Service Restaurants (QSRs). Mobile ordering apps and self-service kiosks are transforming the customer experience by offering convenience, speed, and personalization. Mobile apps allow customers to browse menus, customize orders, and pay for their meals from anywhere, at any time. This eliminates the need to wait in line and provides the flexibility to order ahead for pick-up or delivery. Self-service kiosks, often found within the restaurants, offer a similar advantage. Customers can use touchscreens to browse menus, place orders, and even pay electronically. This not only reduces wait times but also empowers customers to personalize their meals exactly how they like them, with options to add or remove ingredients.

For instance, McDonald's mobile app allows users to save favourite orders and redeem loyalty points, while Domino's app lets customers track their pizza in real-time as it's being made. These advancements not only streamline the ordering process but also cater to the growing tech-savvy generation who value convenience and customization.

Restraints:

-

Growing health concerns are pushing consumers towards fresh and balanced meal options, challenging quick service restaurants to adapt their menus.

-

Rising ingredient costs due to factors like climate change can put pressure on QSRs to maintain menu prices.

-

Rising labour costs can decrease profit margins for restaurants, making it difficult to maintain affordability.

The increasing cost of labour presents a significant hurdle for Fast Food and Quick Service Restaurants (QSRs) in their quest to maintain affordability. A substantial portion of a restaurant's operating expenses goes towards labour costs, encompassing wages, benefits, and other employee-related expenses. When these costs rise, for reasons such as minimum wage increases or a competitive job market for skilled workers, it directly impacts a restaurant's profit margin. The profit margin as the leftover money after covering all the bills, including rent, ingredients, utilities, and most importantly, labour. If labour costs increases without a corresponding rise in sales, restaurants face a situation where their profits decreases or even vanish altogether. To counteract this, QSRs might resort to raising menu prices. However, such a move in a competitive market can deter customers who are already budget-conscious and seeking value for their money. This could lead to a decline in sales volume, further hazarding the profitability.

Fast Food and Quick Service Restaurant Market Segments:

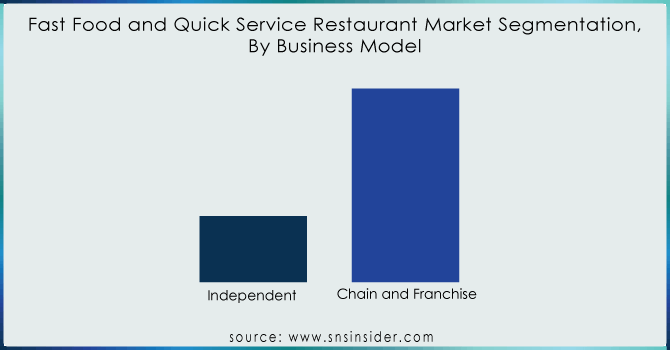

by Business Model

-

Independent

-

Chain and Franchise

Chain and Franchise is the dominating sub-segment in the Fast Food and Quick Service Restaurant Market by business model holding around 65-70% of market share. This dominance can be attributed to several factors. Firstly, established chains benefit from economies of scale, allowing them to negotiate lower prices on ingredients and supplies. This translates to cost savings that can be passed on to consumers through competitive menu pricing. The franchising allows for rapid expansion and brand recognition across wider geographical areas. Standardized operations and training ensure consistent quality and customer experience across different franchise outlets. The large chains often have significant marketing budgets, allowing them to build strong brand loyalty and customer awareness. While independent restaurants offer unique experiences and local flavours, they often struggle to compete with the cost advantages, consistency, and brand reach of established chains.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Service Type

-

Online Service

-

Offline Service

Offline is the dominating sub-segment in the Fast Food and Quick Service Restaurant market by service type. This is primarily due to the inherent convenience and affordability associated with traditional dine-in and take-out options. Offline service allows for a more immediate and social dining experience, which is particularly appealing for families and groups. The take-out offers a quick and easy solution for busy consumers on the go. Online ordering and delivery services, while convenient, often come with additional delivery fees that can inflate the overall cost of the meal. However, the online segment is rapidly growing, and as technology advances and delivery models become more efficient, it is likely to play an increasingly important role in the future of the QSR market.

by Cuisine

-

American

-

Chinese

-

Italian

-

Mexican

-

Japanese

-

Turkish & Lebanese

-

Others

by Product Type

-

Burger and Sandwiches

-

Pizzas and Pastas

-

Drinks and Desserts

-

Chicken and Seafood

-

Others

Fast Food and Quick Service Restaurant Market Regional Analyses

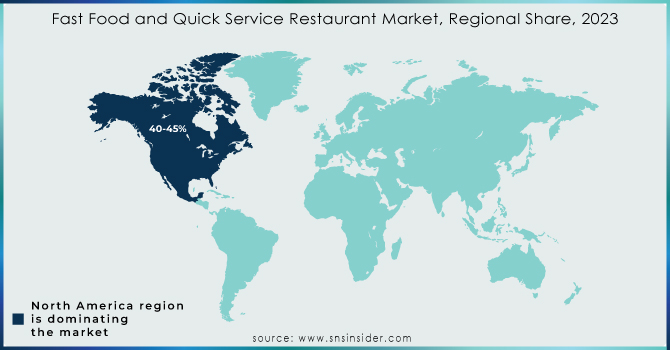

North America is the dominating region in the Fast Food and Quick Service Restaurant market holding around 40-45% of market share. This region has a long history of established fast-food chains with strong brand recognition and extensive franchise networks. The busy lifestyles and a high disposable income in developed economies like the US fuel demand for convenient and affordable meal options. The well-developed infrastructure for food delivery services further contributes to market growth.

Europe is the second highest region in this market, boasting a diverse landscape with established players and regional chains. Europe experiences a high demand for convenient dining options due to busy lifestyles and growing urbanization. European consumers often seek a higher quality and more diverse fast-food experience compared to North America, leading to the success of regional chains with unique offerings.

The Asia Pacific region is experiencing the fastest growth in this market with the CAGR of 6-8%. Rapidly growing middle class with rising disposable incomes creates a demand for convenient and affordable dining options. The urbanization and increased internet penetration fuel the adoption of online food ordering and delivery services. The young population comfortable with technology is driving the growth of the quick service restaurant market in this region.

Regional Coverage:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Fast Food and Quick Service Restaurant Market Key Players

The major key players are Carrols Restaurant Group, Inc., Yum! Brands, Darden Concepts, Inc., McDonald's, Ark Restaurant Corp., DEL TACO RESTAURANT, INC., Restaurant Brands International Inc., Kotipizza Group Oyj, Chipotle Mexican Grill, DD IP Holder LLC, JACK IN THE BOX INC, The Wendy's Company and other key players.

Fast Food and Quick Service Restaurant Market Recent Development

-

In June 2024: Devyani International, a major QSR operator in India, announced a joint venture with PVR Inox, a leading multiplex operator. This partnership aims to develop and manage food courts within shopping malls across India. This development highlights the growing focus on convenience and a wider variety of food options within shopping centres, catering to a captive audience of moviegoers and shoppers.

-

In June 2024: Flipkart, a major e-commerce platform in India, integrating with Open Network for Digital Commerce (ONDC). This integration could potentially allow Flipkart users to order food directly from various QSR and restaurant outlets through the Flipkart app. This development signifies a potential disruption in the online food ordering landscape, with established players like Zomato and Swiggy facing increased competition.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 248 Billion |

| Market Size by 2032 | US$ 362.25 Billion |

| CAGR | CAGR of 4.3 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Business Model (Independent, Chain And Franchise) • By Service Type (Online Service, Offline Service) • By Cuisine (American, Chinese, Italian, Mexican, Japanese, Turkish & Lebanese, Others ) • By Product Type (Burger and Sandwiches, Pizzas and Pastas, Drinks and Desserts, Chicken and Seafood, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrols Restaurant Group, Inc., Yum! Brands, Darden Concepts, Inc., McDonald's, Ark Restaurant Corp., DEL TACO RESTAURANT, INC., Restaurant Brands International Inc., Kotipizza Group Oyj, Chipotle Mexican Grill, DD IP Holder LLC, JACK IN THE BOX INC, The Wendy's Company |

| Key Drivers | • Increased competition drives innovation in menu items, promotions, and loyalty programs. • Rising consumer demand for convenient and affordable meals, especially in developing economies. • Technological advancements like mobile ordering and interactive kiosks streamlining the customer experience. |

| Restraints | • Growing health concerns are pushing consumers towards fresh and balanced meal options, challenging quick service restaurants to adapt their menus. • Rising ingredient costs due to factors like climate change can put pressure on QSRs to maintain menu prices. • Rising labour costs can decrease profit margins for restaurants, making it difficult to maintain affordability. |