Sapphire Technology Market Analysis and Overview:

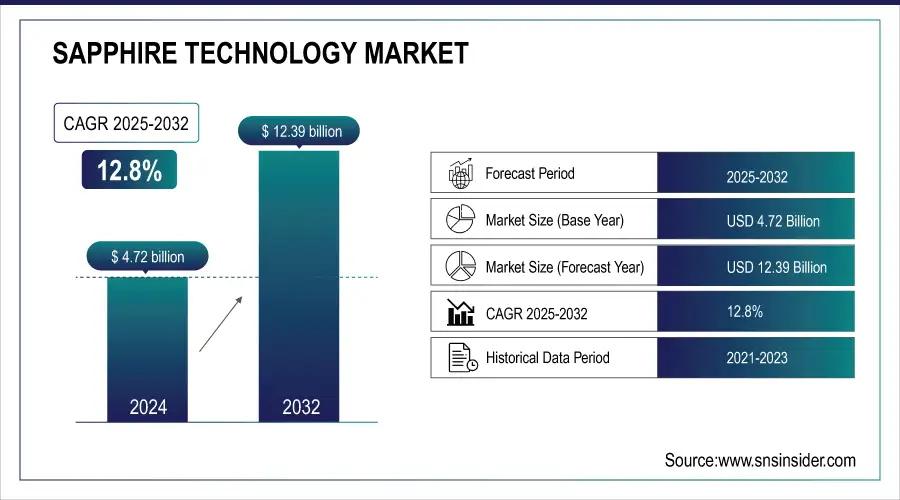

The Sapphire Technology Market size was valued at USD 4.72 billion in 2024 and is expected to reach USD 12.39 billion by 2032, expanding at a CAGR of 12.8% over the forecast period of 2025-2032. Rapid growth of the market is driven by demand across consumer electronics, aerospace, ICT, and power sectors. Its hardness, thermal stability, and optical clarity render sapphire suitable for use in LEDs, semiconductors, and optical components. Recent developments in production techniques, such as Kyropoulos, as well as a transition to larger wafer sizes, are improving quality and cost performance. Polycrystal sapphire is gaining acceptance due to low cost but generally considered a lower quality product. Major production and innovation hubs are based in North America and Asia-Pacific. Market players, such as Rubicon Technology and Monocrystal Inc., have been strengthening capabilities, thus the opportunity for the market will be defended in the years to come.

To Get more information on Sapphire Technology Market - Request Free Sample Report

According to research, nearly 12% of premium smartphones shipped globally in 2024 featured sapphire crystal glass components, up from 8% in 2022.

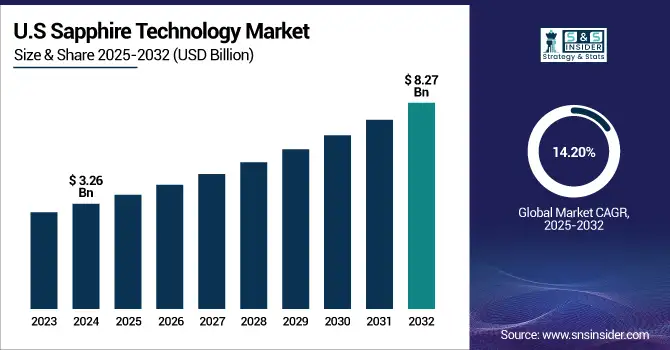

The U.S Sapphire Technology Market size reached USD 1.29 billion in 2024 and is expected to reach USD 3.47 billion in 2032 at a CAGR of 11.78% from 2025 to 2032.

Highly developed semiconductor industry, presence of dominant market players, and extensive R&D investment have led to the US's hold over the sapphire technology landscape. Growth of durable, high-performance materials used in consumer electronics, defense systems, and optical devices drives the demand. Besides, it will also stimulate the further development of the market since sapphire substrates have been used on large areas in the production of LEDs and power electronics. Key drivers of U.S. strength in this market include government support to individual states for defense modernization and the development of 5 G and aerospace infrastructure.

Sapphire Technology Market Dynamics

Drivers:

-

Growing Demand for High-Performance Materials in Consumer Electronics and Optoelectronics Drives Market Expansion.

This is one of the key factors which propelling the market of high-performance, long-lasting materials for consumer electronics and optoelectronics. Sapphire is known for its high hardness and optical transparency, especially for high thermal stability, and is getting a great range of applications, mainly for smartphone screens, LED substrates, and optical lenses. With the growing adoption of wearables, smart devices, etc. Recent advances in crystal growth techniques, such as Kyropoulos have further enhanced the quality and quantity of production.

Restraints:

-

High Production Costs and Availability of Alternative Materials Restrain Market Growth

High production cost of synthetic sapphire is one of the major factors hindering sapphire technology market growth. Advanced and energy-intensive growth methods, like the Kyropoulos and Verneuil techniques, raise total production costs. This also pulls demand away from price-sensitive applications for low-cost alternatives like Gorilla Glass. Until the cost of producing sufficient sapphire for mass market penetration decreases, particularly down to the price point required for domestic consumer electronics cash cows, this situation will not change without some technological advancements.

Opportunities:

-

Emerging Applications in Medical Devices and Wearable Technology Offer New Growth Opportunities.

The high biocompatibility, scratch-resistant, and chemical stability properties of sapphire open new opportunities in medical devices and wearables technologies. Its increasing application in surgical instruments, implants, diagnostic sensors, and wearable technology such as smartwatches has been witnessed. Some of the key drivers are increasing health consciousness as well as the effective demand for trustworthy, durable materials used in health tech. Current sapphire technology market trends are sapphire-based biosensors as well as integration in personalized health monitoring systems.

Challenges:

-

Complex Manufacturing Processes and Supply Chain Vulnerabilities Pose Significant Challenges.

The sapphire technology industry is a prominent example of a complex manufacturing process and fragile supply chain. Growing high-purity sapphire requires both sophisticated equipment and technical expertise, upping the operational costs and limiting scalability. Besides, reliance on particular sources of raw materials entails risks associated with geopolitical strains or logistical disruptions. These vulnerabilities have been laid bare by more recent global supply chain issues.

Sapphire Technology Market Segmentation Analysis

By Growth Technology

The Production Method is estimated to have the largest revenue share of 41.30% in 2024. The reason for such clear dominance is the common utilization of known crystal growth Kyropoulos and Czochralski methods that provide a high-quality sapphire substrate for a range of purposes. Even companies like Rubicon Technology have developed an improved Kyropoulos technique to provide higher quality and yield of crystals. GT has developed sapphire substrate manufacturing processes that are economically and physiologically more effective.

The Growth Methods segment is anticipated to grow at the highest CAGR of 15.08% during the forecast period. These services indicate an upward-moving trend driven by developments within the crystal businesses that grow crystals in ways to develop larger, more efficient sapphire. The development of HEM, EFG-related techniques led to bigger and better sapphire wafers. R&D investments are directed at optimizing these approaches with an aim to reduce production costs to match the increasing demand in emerging applications such as power electronics and high-speed optical devices.

By Substrate Wafer

The Substrate Wafer segment has the largest market share of 42.31%. This is due mainly to the widespread use of single-crystal sapphire substrates in high-performance applications. Key players such as Crystalwise Technology Inc. and Rubicon Technology focus on providing PSS of excellent quality, which improves the efficacy of LEDs. Due to its superior thermal conductivity and optical characteristics, it has been an essential component in any application where high durability and precision. Due to high-brightness LEDs and advanced optical device applications, the Types segment continues to dominate the sapphire market.

According to research, the demand for 6-inch and 8-inch sapphire wafers grew by 18% year-over-year in 2024 due to increased LED and RFIC applications.

The Wafer Size segment is also anticipated to experience the fastest CAGR of 15.63%. One of the major driving factors for this growth is the trend in the industry to utilize larger wafer sizes, starting from the same 6-inch to 8-inch sizes, in a bid to maximize and improve production efficiency while reducing the overall cost. Wafers with a larger diameter allow a greater number of devices to be fabricated in a single substrate and better match the needs of high-volume LED and semiconductor manufacturers.

By Devices

Opto-Semiconductor segment dominates the Devices category with a 30.59% revenue share in 2024. This is because optoelectronic devices, such as LEDs, laser diodes, and photodetectors, widely use sapphire substrates. Sapphire has much better optical transparency and thermal stability than other materials for these applications. Sapphire substrates are the focus of companies to increase the performance of optoelectronic devices. With the increasing need for energy-efficient lighting solutions and hardware for speed optical communication systems, the Opto-Semiconductor segment continues to drive growth.

The Power Semiconductor segment is expected to be the fastest-growing with a CAGR of 15.13% for the forecast period. This is mainly due to the rising market penetration of sapphire substrates for power electronic devices needing high thermal conductivity and electrical isolation in the substrate. GaN-on-sapphire technology introduction led to the next level in the power semiconductor performance, which finds new applications for electric vehicles, renewable energy systems, and industrial automation.

By Application

The Consumer Electronics segment has the largest revenue share of 41% in 2024. Part of this immense domination is attributed to heavy usage of sapphire across many smartphone screens, camera lenses, and wearables. Sapphire is commonly employed in higher-end consumer electronics due to its outstanding scratch resistance and optical transparency. Many sapphire technology market companies have now started embedding sapphire elements to strengthen and beautify their products. Ongoing demand for high-end electronic products and increasing miniaturization will also strongly support the expansion of the Consumer Electronics segment.

The ICT segment is expected highest CAGR of 16.28% during the forecast period. The latter is driven by the rising adoption of sapphire parts in information and communication technologies, such as 5G infrastructure, data centers, and optical networks. Its superior thermal management and electrical insulation properties render sapphire a great fit for high-frequency and high-power applications. To keep pace with the extreme performance demands of today´s ICT systems, companies are innovating sophisticated sapphire but also developing more advanced component architectures.

Sapphire Technology Market Regional Outlook

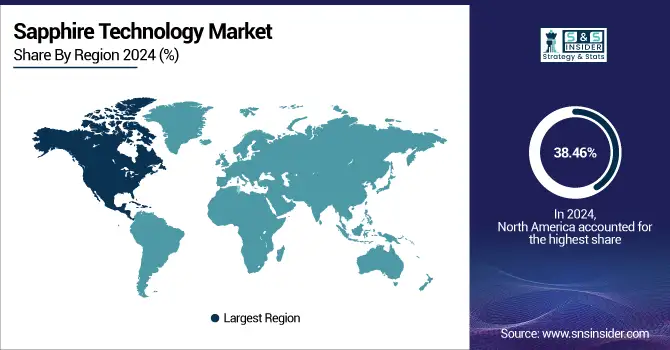

The North America region holds the largest Market share of 38.46% owing to high demand for advanced consumer electronics, strong semiconductor manufacturing infrastructure, and consistent investment in R&D. Moreover, the construction of large enterprises with growing defense and medical applications will boost the market in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. is a region that is driven by technological innovation, a vibrant industrial base, and increasing adoption of sapphire for aerospace, defense, and optical applications.

Europe is growing steadily due to increasing applications in automotive electronic components, healthcare devices, and optoelectronics. A shift towards longer-lasting, more durable, and more sustainable materials, such as synthetic sapphire, is driving adoption as environmental regulations grow stricter in almost every industry.

Germany dominated the European market is primarily by a world leader in engineering, known for its high levels of R&D spend, and a growing presence of sapphire in high-end industrial and medical equipment.

The Asia-Pacific will be the fastest-growing market, at a CAGR of 16.21%, attributed to fast industrialization, high demand in consumer electronics, and bulk production of LED in the region. Some key factors that led to the aforementioned regional growth are government initiatives and increasing manufacturing capacities of the emerging economies.

The Asia Pacific market is led by China, due to its massive electronics production facilities, low-cost labor, and significant investments in semiconductor.

The Middle East & Africa and Latin America is anticipated to be influenced by rapid investments across key industries such as infrastructure, defense, and the renewable sector, particularly in the UAE and Brazil, where improving technologies, coupled with an increase in electronics manufacturing in emerging economies, create significant revenue potential in the sapphire technology market.

Key Players

The major key players of the sapphire technology market are Rubicon Technology, Monocrystal Inc., Namiki Precision Jewel Co. Ltd., GT Advanced Technology, DK Aztec Co. Ltd., Fraunhofer-Gesellschaft, Sapphire Technology Co., Tera Xtal Technology Corporation, ACME Electronics Corporation, Kyocera Corporation, and others.

Key Developments

-

In May 2024, SAPPHIRE Technology Co. has provided the new SAPPHIRE NITRO+ AMD Radeon RX 9070 XT and Radeon RX 9070 Graphics Cards based on the latest AMD RDNA 4 architecture since May 2024. It would then follow up with those products that are more tailored to gamers and creators, all with some serious cooling engineering at play.

-

In December 2024, Rubicon Technology launched a sapphire crystal growth platform that it claimed could grow large optical quality gross windows for military and industrial markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.72 Billion |

| Market Size by 2032 | USD 12.39 Billion |

| CAGR | CAGR of 12.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Growth Technology (Production Method, Sapphire Substrate Process, Growth Methods) •By Substrate Wafer (Types, Wafer Size, Plane Orientation) •By Devices (IC Market, Power Semiconductor Market, Opto-Semiconductor Market) •By Application (Consumer Electronics Applications, Aerospace And Defense Applications, ICT Applications, Power Sector Applications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Rubicon Technology, Monocrystal Inc., Namiki Precision Jewel Co. Ltd., GT Advanced Technology, DK Aztec Co. Ltd., Fraunhofer-Gesellschaft, Sapphire Technology Co., Tera Xtal Technology Corporation, ACME Electronics Corporation, Kyocera Corporation |