Managed Security Services market Report Scope & Overview:

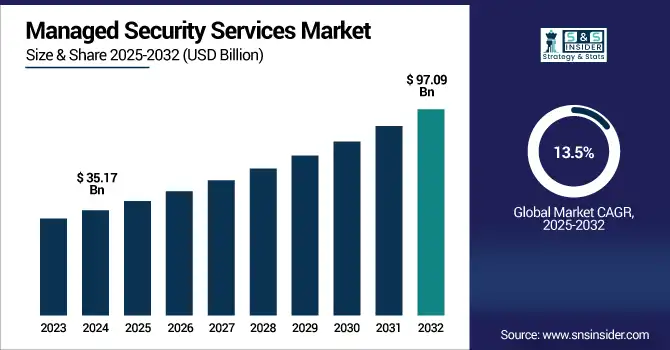

The managed security services market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 97.09 billion by 2032 and grow at a CAGR of 13.5% over the forecast period 2025-2032.

To Get more information on Managed Security Services Market - Request Free Sample Report

The Managed Security Services market will experience high growth due to rising incidences of cyber threats, regulatory compliance, and the growing complexity of digital infrastructures. Managed Security Services (MSS) are third-party solutions that provide outsourced management of security systems, including Managed SIEM, XDR, IAM, and DDoS protection services. MSS is being adopted across various industries, including BFSI, healthcare, manufacturing, and government, for expert around-the-clock protection, cost efficiency, and access to advanced threat intelligence. Further inflating the demand for MSS is the increased use of cloud services, the shift to remote work, and more widespread digital transformation initiatives that require MSS with specific functionalities as cloud security, endpoint security, network security, and data security.

In 2024, under the pressure of increasing cyber threat activity. In particular, the Change Healthcare ransomware attack in February halted U.S. healthcare operations for over 100 million people, for USD 2.87 billion in response costs and payment of USD 22 million ransom. In July, the CrowdStrike outage hit 8.5 million devices worldwide and cost USD 5.4 billion. Such incidents highlight the importance of effective MSS solutions such as Managed SIEM, XDR, and IAM services to improve cyber resilience in industries.

The U.S. Managed Security Services market size was USD 8.77 billion in 2024 and is expected to reach USD 19.43 billion by 2032, growing at a CAGR of 10.43% over the forecast period of 2025–2032.

Factors such as the emergence of advanced cyber threats, growing mandatory compliance requirements such as HIPAA and CCPA, and increasing digital transformation across industries push the demand for U.S. Managed Security Services. Factors like higher adoption of advanced cybersecurity technologies at an early stage by the US, high MSS spending scenes by large enterprises, and the presence of major MSS players, namely IBM, Secureworks (US), are contributing to the dominance of the U.S. in North America.

Market Dynamics

Key Drivers:

-

Rising Cybersecurity Threats and Regulatory Compliance Drive Growth in the Managed Security Services Market

The Managed Security Services marketgrowth is significantly driven by the growing frequency and sophistication of cyberattacks. Organizations across all industries are increasingly becoming targets of ransomware, phishing, and other advanced threats, prompting them to seek round-the-clock protection. Moreover, rising regulatory mandates are pressuring businesses to ensure robust data protection and compliance. MSS providers help organizations meet these requirements by offering real-time monitoring, threat detection, and incident response services. These services reduce the burden on in-house teams while improving security posture. As businesses adopt hybrid work models and migrate sensitive operations to digital platforms, the risk exposure grows, making MSS a strategic investment. The availability of scalable, AI-powered, and industry-specific managed solutions also fuels adoption among enterprises. This growing need for advanced, reliable, and cost-effective cybersecurity measures is expected to drive consistent demand for MSS, establishing it as a critical component of enterprise IT and risk management strategies.

Restraints:

-

High Implementation Costs and Integration Challenges Restrain the Growth of the Managed Security Services Market

Deploying and integrating MSS solutions often require significant upfront investment in tools, platforms, and onboarding processes. This becomes especially burdensome for small and mid-sized enterprises with limited cybersecurity budgets. Furthermore, integrating MSS with existing IT and security infrastructure can be complex, time-consuming, and sometimes disruptive to normal operations. Many businesses also face difficulties in customizing these services to their specific needs, leading to hesitation in adoption. Ongoing maintenance, vendor management, and service-level coordination can add to the operational cost and complexity. These challenges make some organizations reluctant to outsource their security functions, despite recognizing the growing threat landscape. To overcome this, MSS providers must focus on offering more flexible pricing models, streamlined onboarding, and simplified integration to reduce the financial and technical entry barriers for potential customers.

Opportunities:

-

Expansion of Cloud Services and Remote Work Environments Presents Opportunities for Managed Security Services Market Growth

The rapid adoption of cloud computing and the widespread shift to remote work have unlocked significant opportunities for the Managed Security Services market. As businesses increasingly rely on distributed IT environments and cloud-based applications, they face heightened risks around data privacy, unauthorized access, and compliance management. MSS providers are well-positioned to bridge this security gap by offering specialized cloud and endpoint protection services. These solutions enable organizations to monitor access, detect anomalies, and enforce security policies in dynamic, decentralized networks. Remote work also increases the attack surface, making continuous security monitoring and threat response more essential than ever. MSS offerings that combine automation, analytics, and scalable deployment can cater to this need effectively. The ongoing evolution of work environments and digital infrastructure will continue to present new vulnerabilities, but also open doors for MSS providers to offer proactive, flexible, and intelligent security services tailored to modern business needs.

Challenges:

-

Shortage of Skilled Cybersecurity Professionals Challenges the Expansion of the Managed Security Services Market

The market is an ongoing shortage of skilled cybersecurity professionals. As cyber threats become more complex, the demand for talent in roles such as security analysts, incident responders, and threat hunters has surged. However, the talent pool is not growing fast enough to meet this demand, creating a significant resource gap. This shortage impacts MSS providers' ability to scale operations and deliver consistent, high-quality services to clients. Organizations relying on MSS may also experience delays or inconsistencies in service delivery due to staffing limitations.

Additionally, the lack of cybersecurity expertise makes it difficult for some customers to effectively manage and collaborate with their MSS partners. While automation and AI-driven tools can reduce some dependency on human resources, they cannot entirely replace skilled professionals. Addressing this challenge will require long-term investments in education, training, and workforce development to ensure the MSS market can sustain its growth and meet evolving security needs.

Segmentation Analysis:

By Security

In 2024, the Data Security segment led the Managed Security Services market, holding 30% of the total revenue share. This dominance is driven by the critical need to protect sensitive enterprise data against rising cyber threats and data breaches. Organizations are increasingly investing in encryption, data masking, and secure access management tools. MSS providers are expanding their portfolios with advanced data loss prevention and insider threat monitoring services. This heightened focus on safeguarding intellectual property and customer data is boosting the demand for managed data security solutions across industries.

The Cloud Security segment is growing at the highest CAGR of 17.17% during the forecast period due to widespread cloud adoption. As businesses migrate to hybrid and multi-cloud environments, the risk of unauthorized access, misconfiguration, and data leaks rises. MSS vendors are responding with advanced cloud-native security solutions, offering real-time monitoring, access control, and automated compliance management. Cloud security services are becoming integral to MSS offerings, helping enterprises secure virtual infrastructures while accelerating digital transformation. This shift positions the segment as the fastest-growing in the MSS market.

By Enterprise Size

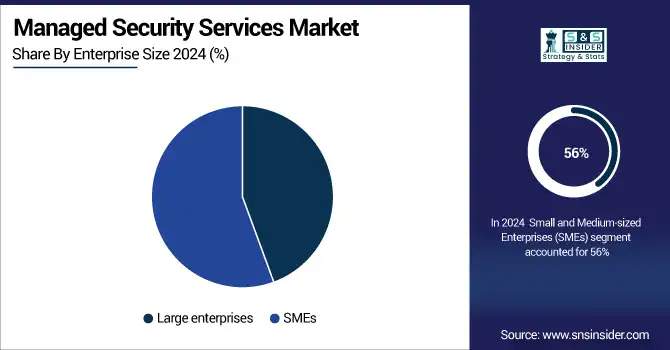

In 2024, Small and Medium-sized Enterprises (SMEs) accounted for 56% of the revenue share in the MSS market. SMEs face heightened cyber risks due to limited internal resources and lack of dedicated IT security teams. MSS providers are addressing this demand by offering cost-effective, scalable, and fully managed security packages tailored to SMEs. These include endpoint protection, threat detection, and compliance services. As a result, SMEs are increasingly outsourcing their security operations, driving growth and revenue dominance in this segment.

Large enterprises are expected to grow at the fastest CAGR of 15.75% during the forecast period due to their complex and distributed IT infrastructures. These organizations require comprehensive MSS solutions for unified threat management, centralized policy enforcement, and regulatory compliance. MSS providers are delivering integrated platforms that combine automation, analytics, and AI to support large-scale operations. The growing digital footprint of large enterprises, along with increasing investments in cybersecurity modernization, fuels this segment’s rapid growth.

By Services

In 2024, the Managed Risk & Compliance segment dominated the MSS market with a 22% revenue share. Organizations are focusing on proactive risk management and adhering to evolving regulatory frameworks. MSS providers offer continuous risk assessment, compliance audits, and reporting services that help businesses maintain security governance. As regulatory pressures intensify across sectors, enterprises are relying on MSS partners to monitor, document, and enforce compliance, establishing this segment as the most revenue-generating within the MSS service spectrum.

The Managed DDoS segment is projected to grow at the highest CAGR of 21.06% in the forecast period, driven by the increasing frequency and scale of DDoS attacks. These attacks disrupt online services and damage brand reputation. MSS providers are deploying advanced DDoS mitigation systems, offering real-time traffic monitoring, anomaly detection, and rapid response capabilities. Businesses across sectors are prioritizing DDoS protection, making it a critical component of managed security services and the fastest-growing service category.

By Vertical

In 2024, the BFSI (Banking, Financial Services, and Insurance) vertical led the MSS market with a 25% revenue share. High transaction volumes, sensitive customer data, and regulatory mandates make the sector a top target for cyber threats. MSS providers support BFSI institutions with 24/7 threat monitoring, fraud detection, and compliance management services. The increasing digitalization of banking services is pushing firms to outsource their cybersecurity operations, reinforcing the BFSI segment’s leadership in the MSS market.

The Healthcare segment is expected to grow at the highest CAGR of 17.6% during the forecast period due to rising cybersecurity incidents and data protection concerns. Digital health records, telemedicine, and connected medical devices create complex security challenges. MSS providers are offering specialized services for HIPAA compliance, endpoint protection, and incident response tailored to healthcare needs. With growing awareness and investment in cybersecurity, healthcare organizations are increasingly relying on MSS, driving the segment’s rapid expansion.

Regional Analysis:

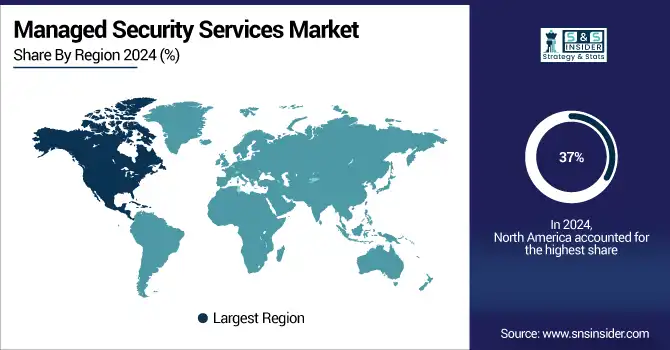

The North America region dominated the Managed Security Services Market share in 2024 with an estimated market share of around 37%. The main driving factor is the presence of advanced cybersecurity infrastructure and stringent regulations ensuring data protection. The United States is the dominant country in North America due to its highly digitized economy, extensive adoption of cloud technologies, and growing cybersecurity awareness among enterprises. U.S.-based MSS providers invest heavily in innovation, offering comprehensive solutions that address sophisticated cyber threats, regulatory compliance, and advanced persistent threats, solidifying the region’s market leadership.

The Asia Pacific region is the fastest-growing in the Managed Security Services Market in 2024, with an estimated CAGR of approximately 18.4%. The growth is driven by rapid digital transformation, increased cloud adoption, and rising cybercrime incidents. China leads the Asia Pacific market, fueled by massive investments in IT infrastructure, government initiatives to enhance cybersecurity, and a surge in cloud service usage among enterprises. These factors contribute to a robust demand for managed security services across diverse industries.

In 2024, the Europe region holds a significant share in the Managed Security Services Market, driven by stringent data privacy laws like GDPR and increasing cyber threats. Stringent data privacy regulations and increased focus on critical infrastructure protection. Germany is the dominating country, owing to its strong industrial base and emphasis on cybersecurity for critical infrastructure. European enterprises are increasingly adopting MSS to ensure regulatory compliance and protect intellectual property. The region’s focus on innovation, combined with government support for cybersecurity initiatives, is accelerating MSS market growth.

In 2024, the Middle East & Africa and Latin America regions are emerging markets for Managed Security Services. Growing digital adoption, increasing cyber threats, and rising awareness about data security drive market growth. Governments in these regions are prioritizing cybersecurity frameworks, encouraging enterprises to adopt MSS. The demand is particularly strong in sectors like banking, government, and telecommunications, where the protection of sensitive data and regulatory compliance are critical. These regions offer promising growth opportunities despite infrastructure challenges.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The managed security services market companies are IBM, NTT, Accenture, DXC Technology, Secureworks, Trustwave, Atos, Orange Cyberdefense, Fujitsu, AT&T, and Others.

Recent Developments:

-

In May 2024, IBM announced the sale of its cloud-based QRadar cybersecurity software to Palo Alto Networks. This move is part of IBM's broader strategy to focus on generative AI security solutions. The partnership aims to integrate IBM's Watsonx AI models with Palo Alto's Cortex XSIAM platform, enhancing AI-powered security offerings.

-

In March 2023, NTT Ltd. introduced its cloud-native Managed Detection and Response (MDR) security service. Built on Microsoft Sentinel, the service combines AI, automation, and threat intelligence to provide enhanced threat visibility, proactive hunting, and rapid response capabilities.

-

In November 2024, Accenture expanded its cybersecurity services by integrating generative AI, deepfake protection, and quantum-safe data security solutions. The company introduced new capabilities to help clients become more cyber-resilient organizations. Notably, Accenture launched Cyber Future Centers in Brussels, Washington, D.C., Bengaluru, and Málaga, focusing on AI and quantum security.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 35.17 Billion |

| Market Size by 2032 | USD 97.09 Billion |

| CAGR | CAGR of 13.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Security (Cloud Security, End-point Security, Network Security, Data Security, Others) • By Services (Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk & Compliance) • By Enterprise Size (Large enterprises, SMEs) • By Vertical (BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Defense/Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM, NTT, Accenture, DXC Technology, Secureworks, Trustwave, Atos, Orange Cyberdefense, Fujitsu, AT&T, and Others. |