Sarcoma Drugs Market Report Scope & Overview:

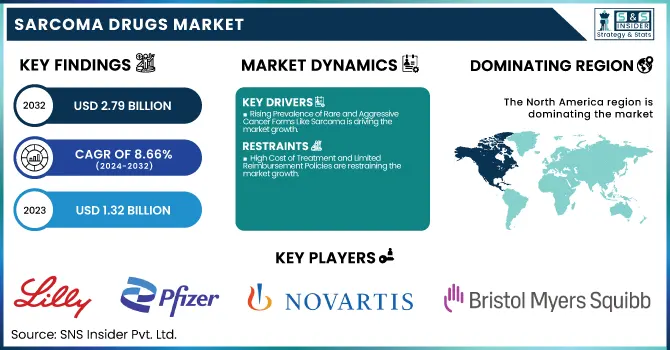

The Sarcoma Drugs Market was valued at USD 1.32 billion in 2023 and is expected to reach USD 2.79 billion by 2032, growing at a CAGR of 8.66% from 2024-2032.

To Get more information on Sarcoma Drugs Market - Request Free Sample Report

This Sarcoma Drugs Market report provides data-driven information. It includes comprehensive data on sarcoma incidence and prevalence, by type and by region, and regional prescription patterns for drugs, emphasizing therapy choice and adoption rates. Exclusive attention is provided for oncology drug expenditures in the case of sarcoma by types of payers—government, commercial, private, and out-of-pocket. The report also includes a detailed overview of the current clinical trial environment and pipeline activity, combined with trends in regulatory and market access, like orphan drug approval and post-marketing surveillance, providing unparalleled strategic insight.

The U.S. Sarcoma Drugs Market was valued at USD 0.52 billion in 2023 and is expected to reach USD 1.08 billion by 2032, growing at a CAGR of 8.47% from 2024-2032. The United States is a leading player in the North American sarcoma drug market due to the high incidence of sarcoma cases, strong R&D setup, early uptake of innovative therapies, and supportive FDA policies for orphan drug approvals. Large U.S.-based pharmaceutical companies are heavily involved in sarcoma clinical trials and the development of drugs for rare cancers, such as different types of sarcoma. Moreover, initiatives and funding provided by the government for research related to rare diseases also contribute to market growth. The availability of specialized cancer care centers and increased access to emerging therapies also increase the country's leading position within the region.

Market Dynamics

Drivers

-

Rising Prevalence of Rare and Aggressive Cancer Forms Like Sarcoma is driving the market growth.

The rising frequency of rare cancers, especially soft tissue and bone sarcomas, is a main impetus for drug development and marketing. The American Cancer Society estimates that in 2023 alone, there would be about 13,400 new cases of soft tissue sarcoma in the U.S. Sarcomas account for less than 1% of adult cancers, placing them among the rare disease market, which tends to attract orphan drug designations and regulatory incentives. This increasing incidence has prompted leaders such as Eli Lilly, Bayer, and Bristol Myers Squibb to bolster their oncology pipelines with sarcoma-centric therapies. In August 2024, for example, the FDA approved Adaptimmune's afamitresgene autoleucel (Tecelra) for synovial sarcoma with accelerated approval, demonstrating the need to satisfy this unmet clinical need and the market receptivity to demand for rare oncology treatment.

-

Regulatory Support and Orphan Drug Designation Incentives are propelling the market growth.

The encouraging regulatory climate for rare disease treatments, particularly through orphan drug designations and expedited approvals, is heavily propelling innovation in the sarcoma drugs market. The U.S. FDA, EMA, and Japan's PMDA provide incentives such as tax credits, market exclusivity, and fast-track review to pharmaceutical firms working on treatments for rare cancers. As of 2023, more than 40 sarcoma-related treatments had been granted orphan designation by the FDA. This support has yielded numerous breakthroughs, such as the December 2024 FDA approval of Opdivo Qvantig™, a subcutaneous dosing for multiple solid tumors, such as sarcoma. These regulatory improvements shorten time to market, improve investor confidence, and enable it to become economically feasible to target smaller patient populations, leading to faster availability of treatment to sarcoma patients worldwide.

Restraint

-

High Cost of Treatment and Limited Reimbursement Policies are restraining the market growth.

One of the significant restraints in the market of sarcoma drugs is that the cost of advanced therapies is extremely high, and there is limited reimbursement support, especially in middle- and low-income nations. Immunotherapies and targeted therapies for sarcoma, like Keytruda, Yervoy, or afami-cel, range from tens to hundreds of thousands of dollars per patient annually. Despite the existence of orphan drug designations, the treatments are still limited by tight reimbursement requirements and coverage restrictions by both public and private payers. For instance, although drugs such as Opdivo and Tecelra have gained regulatory approvals, their implementation is usually hindered by delayed payer negotiations and formulary placement. In areas that do not have proper healthcare infrastructure, several patients have to depend on out-of-pocket expenses, thus leading to huge differences in access and outcomes of treatment across geographies.

Opportunities

-

Expansion of Cell and Gene Therapies in Sarcoma Treatment creates a significant market opportunity.

The advent of cell and gene therapies offers a revolutionary solution in the sarcoma drug market, particularly for sarcoma patients with poor responses to standard therapies. Novel modalities like T-cell receptor (TCR) therapies and CAR-T cell therapies are being increasingly investigated in clinical trials for many sarcoma subtypes. A prime example is the FDA's fast-track approval in August 2024 of Adaptimmune's afamitresgene autoleucel (Tecelra), a TCR therapy for synovial sarcoma. These treatments engage tumor-specific antigens with specificity, providing enhanced survival and decreased systemic toxicity. With biotech companies continuing to push the boundaries and regulatory agencies fast-tracking rare cancer drugs, the industry stands to gain from enhanced investment, joint research, and a pipeline of new-generation treatments customized to the genetic and molecular profile of sarcoma tumors.

Challenges

-

Diagnostic Delays and Tumor Heterogeneity are challenging the market growth.

One of the main challenges in the sarcoma drug market is delayed diagnosis and high heterogeneity of sarcoma tumors, which make treatment planning and effectiveness challenging. Sarcomas have more than 70 subtypes, each with unique molecular and histological profiles, making early and correct diagnosis challenging. Patients tend to suffer from misdiagnosis or delayed referral because of the rarity and complexity of symptoms, leading to late-stage detection. In addition, tumor heterogeneity restricts the universal application of some drugs, necessitating tailored treatment regimens that are not generally available or approved. This not only impacts clinical outcomes but also increases the cost and duration of drug development. Overcoming this challenge necessitates improved diagnostic tools, wider access to genomic testing, and subtype-specific research to inform precision therapy strategies in the clinic.

Segmentation Analysis

By Disease Indication

The Soft Tissue Sarcoma (STS) segment dominated the sarcoma drugs market with a 68.50% market share in 2023 because of its greater incidence in comparison to other forms of sarcomas, and the greater presence of targeted treatments as well as immunotherapeutics uniquely intended for this condition. Soft tissue sarcomas account for a considerable percentage of all sarcoma diagnoses, with over 13,000 new cases diagnosed each year in the U.S. alone. Since STS covers a wide variety of subtypes, it has drawn significant research and development investment. Moreover, the approval of various new therapies, including tyrosine kinase inhibitors (e.g., Pazopanib) and immune checkpoint inhibitors (e.g., pembrolizumab), has increased treatment options, enhancing patient outcomes. This, combined with the increasing interest of pharmaceutical companies in STS as a prime target, further entrenched its market dominance.

By Treatment

The Targeted Therapy segment dominated the Sarcoma Drugs Market with a 36.14% market share in 2023 because it can target cancer cells specifically and cause less harm to normal tissues, providing better efficacy and fewer side effects than conventional therapies such as chemotherapy. Targeted therapies, including tyrosine kinase inhibitors (e.g., pazopanib) and monoclonal antibodies, have emerged as primary choices for the treatment of many sarcoma subtypes, especially soft tissue sarcomas. These treatments target molecular and genetic defects present in sarcoma cells, providing a more personalized and targeted treatment regimen. The rise in the number of FDA approvals and clinical trials for targeted therapies, as well as their proven efficacy in enhancing survival rates, further intensified their dominance in 2023. The trend has attracted much attention because of its potential for optimal treatment results and increased popularity of precision medicine in oncology.

By Drug Type

The Branded segment dominated the sarcoma drugs market with an 82.16% market share in 2023 through the sustained use of innovative, patented treatments that ensure better treatment options for patients with sarcoma. Branded medications, which are mostly linked with new and latest therapies, are in vogue for their greater efficacy, safety profiles, and the clinical approval they gain from regulatory organizations like the FDA and EMA. In the instance of sarcoma, proprietary drugs like pazopanib, lenvatinib, and pembrolizumab have been proven to exhibit major clinical benefits and have emerged as first-line therapy for different subtypes of sarcoma. The branding of such drugs also typically involves heavy marketing, patient support programs, and reimbursement support, thus making them more available to healthcare professionals and patients. All these factors, along with the regular clinical trials taking place that continually affirm the efficiency of branded medicines, cemented their dominance in the market through 2023.

By Distribution Channel

The Hospital Pharmacy segment dominated the sarcoma drugs market with a 48.20% market share in 2023 because of the vital role played by hospitals in the delivery of sophisticated and specialized care for sarcoma patients. Hospital pharmacies possess the infrastructure and medical capabilities required to handle the highly specialized and often intensive drug regimens needed to treat sarcoma, such as chemotherapy, targeted therapies, and immunotherapy. Most sarcoma medications, including pembrolizumab and pazopanib, need to be closely monitored, accurately dosed, and in some instances, administered intravenously, so hospital facilities are the most appropriate place for their administration. Hospitals are also referral points for care for those patients in need of multidisciplinary treatment regimens, involving surgery, radiation, and chemotherapy, which frequently involve intense collaboration with pharmacy staff. Consequently, hospital pharmacies serve as the major distribution point for these drugs, pushing them to lead the market.

Regional Analysis

North America dominated the sarcoma drugs market with a 50.14% market share in 2023 based on its well-developed healthcare infrastructure, strong health awareness for rare cancers, and extensive presence of major biotechnology and pharmaceutical industries. The area is favored with high levels of investment in oncology research, sophisticated diagnostic technologies, and early uptake of novel therapies, such as immunotherapies and targeted therapies. The U.S. Food and Drug Administration (FDA) also plays a critical role by providing orphan drug designations and expedited approvals, which promote accelerated market entry and innovation. Further, the presence of comprehensive cancer care centers and patient assistance programs contributes to widespread access to novel sarcoma treatment options throughout the region.

Asia Pacific is becoming the fastest-growing region in the sarcoma drugs market with 9.17% CAGR over the forecast period, fueled by a fast-growing patient population, rising healthcare spending, and expanding access to cancer diagnosis and treatment. China, India, and Japan are seeing growing cancer awareness, rising clinical trial activity, and encouraging government policies that support drug development for orphan diseases. The increasing cancer burden, coupled with enhanced insurance coverage and access to specialty medicines, is further driving market growth. Moreover, international pharmaceutical firms are increasingly collaborating with local players to extend their presence and leverage the unmet medical requirements of this high-potential market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Eli Lilly and Company (Lartruvo, Gemzar)

-

Pfizer Inc. (Doxil, Inlyta)

-

Novartis AG (Votrient, Glivec)

-

Bristol-Myers Squibb Company (Opdivo, Yervoy)

-

Merck & Co., Inc. (Keytruda, Temodar)

-

Bayer AG (Stivarga, Nexavar)

-

Eisai Co., Ltd. (Lenvima, Halaven)

-

Roche Holding AG (Avastin, Rozlytrek)

-

Daiichi Sankyo Company, Limited (Vanflyta, Enhertu)

-

Amgen Inc. (Kyprolis, Blincyto)

-

Takeda Pharmaceutical Company Limited (Adcetris, Alunbrig)

-

Karyopharm Therapeutics Inc. (Xpovio, Selinexor)

-

Exelixis, Inc. (Cabometyx, Cometriq)

-

Blueprint Medicines Corporation (Ayvakit, Gavreto)

-

Deciphera Pharmaceuticals (Qinlock, DCC-3014)

-

Innovent Biologics, Inc. (Tyvyt, IBI-306)

-

Seagen Inc. (Tukysa, Padcev)

-

Zymeworks Inc. (ZW49, ZW25)

-

Epizyme, Inc. (Tazverik, EZM0414)

-

Adaptimmune Therapeutics plc (Afami-cel, Leu-cel)

Suppliers (These suppliers commonly provide active pharmaceutical ingredients (APIs), biologics manufacturing services, cell culture media, and sterile fill-finish solutions, which are critical for the research, development, and commercial production of sarcoma drugs.) In the Sarcoma Drugs Market.

-

Thermo Fisher Scientific

-

Lonza Group

-

Catalent, Inc.

-

WuXi AppTec

-

Samsung Biologics

-

Boehringer Ingelheim BioXcellence

-

Fujifilm Diosynth Biotechnologies

-

MilliporeSigma (Merck KGaA)

-

Sartorius AG

-

Eurofins Scientific

Recent Developments

-

In August 2024, the U.S. Food and Drug Administration (FDA) approved afamitresgene autoleucel (commercialized as Tecelra, or afami-cel) for accelerated use in the treatment of adult patients with synovial sarcoma, a rare soft tissue cancer. This approval represents an important step forward in the treatment of sarcomas, offering a new therapeutic choice for patients with few treatment options.

-

In September 2024, Novartis reported that the U.S. The Food and Drug Administration (FDA) has approved Kisqali (ribociclib) combined with an aromatase inhibitor (AI) for the adjuvant treatment of adults with hormone receptor-positive/human epidermal growth factor receptor 2-negative (HR+/HER2-) stage II and III early breast cancer (EBC) who remain at high risk of recurrence, including patients with node-negative (N0) disease.

-

In December 2024, Bristol Myers Squibb reported that Opdivo Qvantig (nivolumab and hyaluronidase-nvhy co-formulation) received approval from the U.S. Food and Drug Administration (FDA) for subcutaneous administration.

Sarcoma Drugs Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 1.32 Billion Market Size by 2032 US$ 2.79 Billion CAGR CAGR of 8.66 % From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Disease Indication (Soft Tissue Sarcoma, Bone Sarcoma)

• By Treatment (Chemotherapy, Targeted Therapy, Immunotherapy, Other Treatments)

• By Drug Type (Branded, Generic)

• By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Eli Lilly and Company, Pfizer Inc., Novartis AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Bayer AG, Eisai Co., Ltd., Roche Holding AG, Daiichi Sankyo Company, Limited, Amgen Inc., Takeda Pharmaceutical Company Limited, Karyopharm Therapeutics Inc., Exelixis, Inc., Blueprint Medicines Corporation, Deciphera Pharmaceuticals, Innovent Biologics, Inc., Seagen Inc., Zymeworks Inc., Epizyme, Inc., Adaptimmune Therapeutics plc, and other players.