Sensor-based Gun Systems Market Report Scope & Overview:

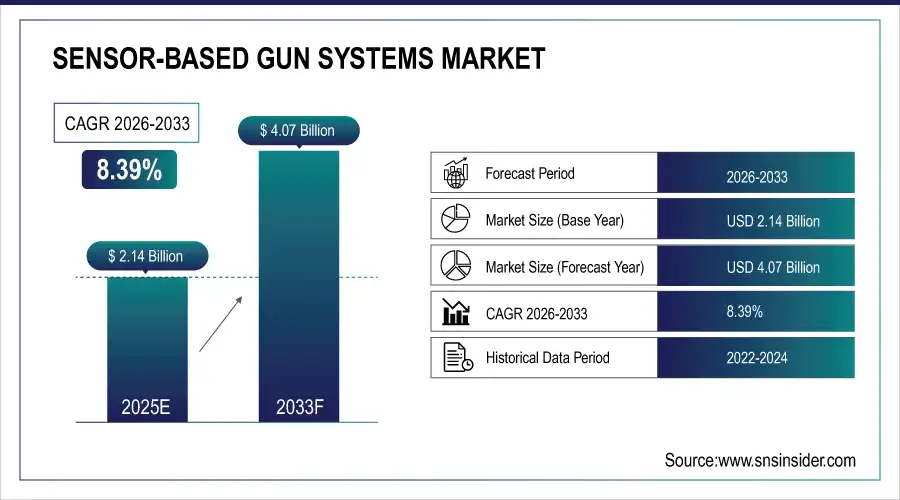

The Sensor-based Gun Systems Market size was valued at USD 2.14 Billion in 2025E and is expected to reach USD 4.07 Billion by 2033, growing at a CAGR of 8.39% during the forecast period 2026–2033.

The market is witnessing strong traction driven by the growing demand for advanced surveillance, border security, and battlefield modernization. Equipped with acoustic, radar, and infrared sensors, these systems enhance targeting accuracy, reduce human error, and enable automated response functions. Rising global defense expenditure, increasing incidences of armed conflict, and modernization programs across military and law enforcement agencies are fueling adoption. Integration with AI, IoT, and autonomous platforms further advances real-time threat detection, precision engagement, and situational awareness.

The Sensor-based Gun Systems Market is experiencing significant growth owing to the rising focus on national security, cross-border threats, and smart weapon modernization. Increasing demand from military and homeland security applications is the primary driver. Key applications range from automated gun turrets to gunshot detection systems in urban policing. Defense collaborations, cybersecurity enhancement, and next-generation sensor integration ensure advanced capabilities for critical missions, defining the market’s evolution toward smart, automated, and integrated gun systems.

Sensor-based Gun Systems Market Size and Forecast:

-

Market Size in 2025: USD 2.14 Billion

-

Market Size by 2032: USD 4.07 Billion

-

CAGR: 8.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Sensor-based Gun Systems Market - Request Free Sample Report

Key Sensor-based Gun Systems Market Trends:

-

Increasing adoption of AI-integrated weapon systems enhances precision, reduces human error, and improves autonomous targeting efficiency.

-

Rising demand for smart defense solutions drives growth in acoustic and radar sensor-equipped automated turrets.

-

Growing application in law enforcement through urban gunshot detection systems improves crime prevention and situational awareness.

-

Defense modernization programs worldwide are accelerating integration of advanced multi-sensor gun systems.

-

Use of IoT and real-time data connectivity ensures enhanced monitoring, control, and battlefield decision-making.

-

Rising global security threats and cross-border tensions are catalyzing procurement of advanced sensor-based weaponry.

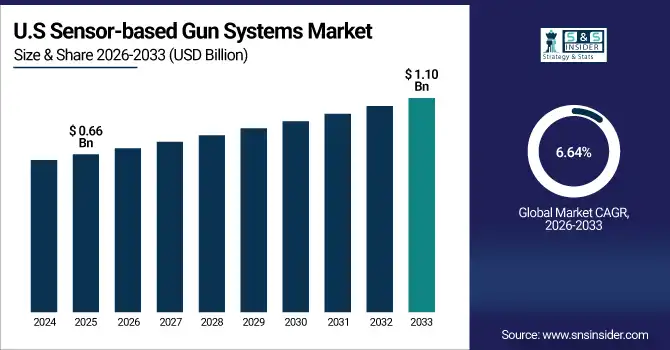

U.S. Sensor-based Gun Systems Market Insights:

The U.S. Sensor-based Gun Systems Market size was USD 0.66 billion in 2025E and is expected to reach USD 1.10 billion by 2033, growing at a CAGR of 6.64% over the forecast period of 2026–2033. According to a study, increasing incidences of mass shootings and urban crime have led to the wider deployment of acoustic and radar-based gunshot detection systems across U.S. cities, which have reduced police response times by up to 30%. This cause, rising criminal activity, effects rapid adoption of smart surveillance and automated gun control platforms.

Sensor-based Gun Systems Market Driver:

-

Growing Global Defense Modernization Programs Fuel Adoption of Advanced Sensor-based Gun Systems.

Defense modernization initiatives across North America, Europe, and Asia are driving high demand for automated, sensor-based weaponry. Rising cross-border tensions and asymmetrical warfare have pushed governments to adopt advanced gun systems with acoustic, radar, and infrared sensors for precision strike capabilities. This cause, increased defense budgets, effects rapid deployment of automated turrets, AI-integrated targeting, and perimeter security systems. Governments are heavily investing in integrating these systems with unmanned platforms and IoT architectures, further enabling real-time surveillance and automated response.

In June 2025, the U.S. Department of Defense unveiled a $1.2 billion contract for deploying AI-enhanced radar-sensor gun systems in border security operations. These systems demonstrated a 40% improvement in target precision and situational awareness, addressing increasing national security threats while enhancing automated law enforcement patrols.

Sensor-based Gun Systems Market Restraints:

-

High Costs and Cybersecurity Challenges Limit Wider Deployment of Sensor-based Gun Systems

Despite their efficiency, the high procurement and maintenance costs of advanced sensor-based gun systems act as a significant barrier, especially for developing economies. This cause, large upfront capital investments, effects slower adoption among budget-constrained defense forces. Furthermore, increasing reliance on IoT and AI integration raises cybersecurity risks that threaten operational reliability. Potential hacking and unauthorized control make governments cautious about large-scale adoption without enhanced encryption and stringent security measures. Rising concerns around autonomous weapons’ legal and ethical use also slow large-scale procurement decisions globally.

In 2024, a European defense cybersecurity audit revealed that 32% of AI-integrated gun systems faced potential vulnerabilities leading to unauthorized access attempts. Such cases have increased demand for improved encryption technologies, delaying certain NATO procurement projects as governments reassess the risks of deploying interconnected automated weapon systems.

Sensor-based Gun Systems Market Opportunities:

-

AI and IoT-enabled Sensor Integration Creates New Growth in Automated Gun Systems.

The integration of AI with IoT is reshaping sensor-based gun systems, enabling predictive analytics, real-time automated response, and enhanced battlefield coordination. This cause, increasing demand for smart interoperability, effects adoption of connected gunshot detection and autonomous target engagement platforms. Governments and security agencies are partnering with defense tech firms to integrate dynamic data systems, lowering error rates and enhancing situational awareness. The opportunity lies in creating cloud-enabled, multi-sensor gun systems that combine radar, acoustic, and infrared technologies for military and homeland security alike.

In March 2025, an Israeli defense tech firm launched a hybrid AI-IoT sensor gun system capable of tracking multiple targets simultaneously in urban zones, reducing civilian casualties by 28%. This advancement highlighted the potential of AI-driven decision-making in defense and law enforcement for faster, more precise engagements.

Sensor-based Gun Systems Market Segmentation Analysis:

By Type of Sensor: Acoustic Sensors Lead; Radar Sensors Register Fastest Growth

The Acoustic Sensors segment dominates the Sensor-based Gun Systems Market by holding the largest revenue share of 35% in 2025E. This cause, rapid deployment in urban surveillance and law enforcement, effects widespread adoption of gunshot detection systems and perimeter security solutions. Acoustic sensors enable real-time identification of firearm discharge events, alerting authorities within seconds and reducing response times significantly. Continued product development has focused on improving accuracy, expanding coverage, and minimizing false alarms through AI-based sound recognition. With increasing gun violence and heightened security needs in metropolitan areas, acoustic sensor-equipped gun systems have become vital for proactive crime mitigation and safeguarding public spaces.

Radar Sensors are experiencing the fastest CAGR at 11.30% over the forecast period due to rising demand for automated targeting solutions in defense and critical infrastructure protection. This cause, enhanced range and all-weather reliability, effects widespread usage in remote-controlled weapon stations and border security turrets. Advanced radar sensors allow tracking of moving targets at extended distances, even under adverse conditions such as fog, smoke, or night operations. Product development efforts are focusing on miniaturization, spectrum expansion, and integration with AI for threat classification. By enabling precise, automated engagement capabilities, the radar segment is fueling transition to smarter, more resilient gun systems for military and law enforcement agencies.

By Technology: Smart Weapon Systems Lead; Gunshot Detection Systems Register Fastest Growth

The Smart Weapon Systems segment accounts for the largest revenue share, reaching 45% in 2025E. This cause, strong preference for AI-enabled targeting and fire control, effects adoption of integrated smart gun platforms in military modernization programs. Smart weapon systems leverage sensor fusion to improve accuracy, reduce collateral damage, and enable semi-autonomous or remote operation modes. Continuous development in embedded sensors, encrypted wireless communications, and adaptive algorithms drives product evolution. Military and defense contractors are launching advanced models that support network-based situational awareness, automated aiming, and real-time diagnostics, strengthening the segment’s dominance in the Sensor-based Gun Systems Market.

Gunshot Detection Systems are registering the fastest CAGR of 11.32% within the forecast period, driven by the escalating need for urban crime reduction and public safety enhancement. This cause, increased law enforcement readiness, effects rapid installation of gunshot detection arrays in cities, schools, and transit centers. Technological advances have improved sensor sensitivity and coverage, allowing instant acoustic event classification and automated dispatch alerts. Product innovations now feature advanced signal processing, cloud-based data analytics, and integration with city surveillance networks. By providing actionable intelligence for first responders, this segment is increasingly pivotal for crime deterrence and rapid incident response.

By Application: Military Leads; Law Enforcement Registers Fastest Growth

The Military segment dominates with the largest share of revenue, at 52% in 2025E. This cause, growing investment in battlefield automation and soldier safety, effects widespread deployment of sensor-based gun systems in armed forces worldwide. These systems excel at remote operation, threat identification, and defensive perimeter control, reducing risks for personnel. Product enhancements focus on robust weatherproofing, multi-threat tracking, and seamless integration with command-and-control networks. The adoption of advanced sensor technologies in next-generation weapons, such as unmanned ground vehicles and automated turrets, reinforces the military segment’s central role in global market expansion.

The Law Enforcement segment is growing at the largest CAGR in the forecasted period, reflecting increasing urbanization and the need to combat gun-related violence. This cause, heightened public demand for safe communities, effects integration of portable sensor-based systems in patrol vehicles, public transport, and city infrastructure. Law enforcement agencies emphasize fast response times and situational awareness, benefiting from real-time data from acoustic, radar, and IoT-enabled sensors. Continuous product upgrades support mobile deployment, encrypted communications, and integration with citywide networks, positioning law enforcement as a dynamic, rapidly expanding application segment.

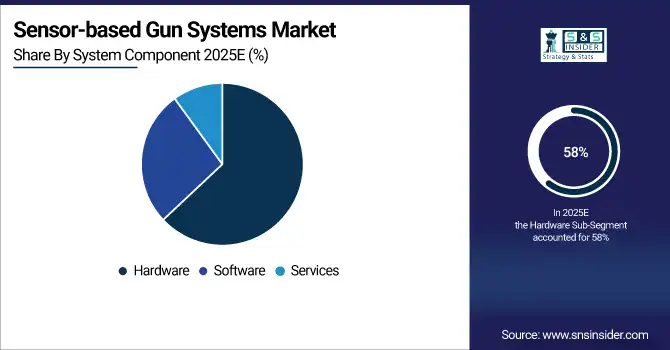

By System Component: Hardware Leads; Services Register Fastest Growth

The Hardware segment leads market revenue with a dominant 58% share in 2025E. This cause, high demand for reliable physical components including sensors, processors, and gun mounts, effects robust manufacturing and deployment across defense and security projects. Product innovation centers on ruggedization, miniaturization, and platform compatibility to withstand harsh environments and ensure system uptime. Investments in high-quality hardware support both stationary and mobile gun platforms, reinforcing the segment’s foundational role in the Sensor-based Gun Systems Market. Continued focus on hardware reliability and user-friendly interfaces drives sustained growth and operational adoption.

The Services segment is registering the fastest CAGR within the forecasted period owing to growing needs for installation, training, maintenance, and cybersecurity support. This cause, complexity of integrating sensor-based gun systems into existing security infrastructure, effects expanding demand for value-added service contracts. Service providers are developing customized training programs and regular system audits to boost performance and minimize operational risks. Enhanced after-sales support, remote monitoring, and preventative maintenance packages build user trust and optimize system lifecycle, making services an essential component for wide-scale market growth.

By End-User: Government Agencies Lead; Private Security Firms Register Fastest Growth

Government Agencies hold the largest revenue share, at 50% in 2025E, reflecting strong procurement by military, defense, and law enforcement departments. This cause, strategic focus on national security and border protection, effects significant investment in sensor-based gun systems for public safety, counterterrorism, and crime prevention. Agencies benefit from direct supplier relationships, bulk purchasing, and integrated deployment across multiple operational environments. Continued advancements in multi-sensor platforms allow governments to maintain technological superiority, fulfilling critical security needs and cementing their dominant end-user position.

Private Security Firms are growing at the fastest CAGR in the forecasted period, responding to heightened demand for asset protection, event security, and corporate risk management. This cause, increased threat awareness in commercial and residential sectors, effects rising adoption of mobile and stationary sensor-based gun systems for private premises. Security providers seek advanced, scalable solutions that feature remote monitoring, automated alarms, and real-time threat analysis. B2B partnerships with technology innovators help firms deploy customized security platforms, meeting diverse client requirements and expanding market reach for sensor-based gun systems.

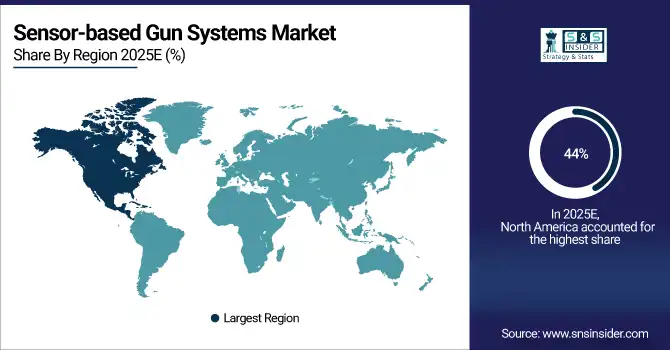

Sensor-based Gun Systems Market Regional Analysis

North America Dominates Sensor-based Gun Systems Market in 2025E

In 2025E, North America holds an estimated 44% market share, driven by rapid technological adoption and sustained defense investment. This causes widespread deployment of automated sensor-based weapon systems and advanced surveillance networks, which effects enhanced operational readiness, faster threat response, and comprehensive strategic security coverage across the region, reinforcing North America’s position as the dominant market for sensor-based gun systems globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States Leads North America’s Sensor-based Gun Systems Market

The U.S. dominates due to strong government funding for research, procurement programs, and collaborations with defense technology firms. Federal agencies prioritize real-time urban gunshot detection, smart targeting, and AI-integrated networks for border and homeland security. Modernization initiatives have accelerated multi-sensor deployments in urban and rural areas. The established defense supply chain, competitive innovation environment, and key manufacturer partnerships solidify the U.S. as North America’s leading contributor to market revenue and technological advancement.

Asia Pacific is the Fastest-Growing Region in Sensor-based Gun Systems Market in 2025E

The Asia Pacific region is projected to grow at a CAGR of 12.02%, driven by rising defense budgets, rapid urbanization, and increasing demand for border security and crime-prevention systems. This causes accelerated adoption of sensor-based gun systems for military modernization, law enforcement automation, and critical infrastructure protection, which effects robust market expansion. Investments in AI-enabled weapons, acoustic and radar technologies, and government-backed security programs further strengthen the region’s position as the fastest-growing contributor in the global market.

-

China Leads Asia Pacific’s Sensor-based Gun Systems Market

China dominates the Asia Pacific market due to massive defense modernization, large-scale deployment of acoustic and radar-based technologies, and adoption of AI-enabled weapons systems. National digitization policies, security challenges, and growing defense-tech startups drive market expansion. Government investments in homeland security and law enforcement automation have strengthened China’s market presence, positioning it as the largest and fastest-growing contributor in Asia Pacific.

Europe Sensor-based Gun Systems Market Insights, 2025E

Europe accounted for a significant share in 2025E, supported by strict security regulations, sustainability goals, and cross-border cooperation on crime prevention and anti-terrorism. This causes emphasis on collaborative defense and regulatory enforcement, which effects strong adoption of advanced gunshot detection and autonomous turret solutions across the region.

-

Germany Leads Europe’s Sensor-based Gun Systems Market

Germany dominates due to its long-term defense modernization strategy, research-intensive ecosystem, and partnerships with leading sensor manufacturers. High deployment rates in law enforcement and real-time urban surveillance focus on reducing violent incidents and enhancing public safety. Regulatory leadership and commitment to cybersecurity best practices reinforce Germany’s position as Europe’s dominant market for sensor-based gun systems.

Middle East & Africa and Latin America Sensor-based Gun Systems Market Insights, 2025E

In 2025, the Middle East & Africa and Latin America regions exhibited steady growth in the Sensor-based Gun Systems Market, fueled by persistent security challenges, rising defense budgets, and modernization initiatives. Governments and private agencies are investing in advanced sensor-based weapon systems to address urban crime, border security, and critical infrastructure protection. These efforts, combined with regional collaborations and technology upgrades, are enhancing operational efficiency, threat response capabilities, and overall adoption of sensor-based defense solutions across both regions.

-

Brazil and UAE Lead Latin America and MEA Markets

In Latin America, Brazil stands out for extensive border surveillance and large-scale urban gunshot detection installations, supported by regional anti-crime initiatives and public safety system upgrades. In the Middle East & Africa, the UAE leads through sensor-based automated perimeter systems to protect critical infrastructure and assets. Government investment in integrated defense technologies and rapid urban security upgrades ensures strong market positioning and steady growth in both regions.

Competitive Landscape for the Sensor-based Gun Systems Market

Armatix

Armatix is a renowned German innovator in smart firearm systems, specializing in sensor-enabled, electronic gun safety and secure weapon management solutions. The company’s advanced products feature RFID, biometric, and wireless communication modules to ensure only authorized users can operate firearms, mitigating risks of misuse, theft, and unauthorized access. Armatix’s sensor-based technology is integrated across military, law enforcement, and private security segments, offering reliable operational safety and compliance with strict weapon control regulations. The company’s continued investment in miniaturization and platform compatibility cements its role as a key pioneer in intelligent gun control, aligning with next-generation defense requirements.

-

In April 2025, Armatix announced the deployment of its latest smart handgun platform, featuring biometric grip recognition and rapid-response locking modules for law enforcement trials in major European cities.

DoDaaM Systems

DoDaaM Systems, headquartered in South Korea, is a leader in remote-controlled weapon stations and unmanned defense systems equipped with multi-sensor architecture. Its flagship smart gun platforms incorporate acoustic, radar, and infrared sensors for automated detection, dynamic target tracking, and real-time engagement in both stationary and mobile deployments. DoDaaM’s systems are pivotal for border security, military vehicles, and sensitive infrastructure sites, offering robust performance in extreme environments. The company is recognized for integrating advanced AI algorithms and reliable cybersecurity features, addressing rising demands for autonomous defense solutions across Asia and the Middle East.

-

In July 2025, DoDaaM Systems unveiled a next-gen border surveillance turret with adaptive AI target classification, boosting effectiveness of perimeter defense programs in cross-border zones.

Hanwha Techwin

Hanwha Techwin, a prominent South Korean defense manufacturer, provides comprehensive sensor-based weapon stations and surveillance platforms. The company specializes in scalable gun systems combining radar, thermal, and electro-optical sensors for heightened battlefield awareness and unmanned engagement. Hanwha Techwin’s product suite is designed for both national defense and urban security, enabling automated detection and tracking of threats in real time. Known for robust integration with C4ISR and smart city networks, Hanwha continues to advance miniaturization, energy efficiency, and AI-based analytics to meet global defense modernization standards.

-

In May 2025, Hanwha Techwin announced deployment of a networked surveillance and gunshot detection solution in major South Korean metropolitan areas, supporting law enforcement and counterterrorism initiatives.

Rafael Advanced Defense Systems

Rafael Advanced Defense Systems, based in Israel, is a premier provider of integrated sensor-based gun and missile defense platforms. Renowned for innovation in multi-sensor fusion, Rafael’s systems combine radar, acoustic, and electro-optical sensors for automated turret operation, precision targeting, and rapid threat response. The company’s advanced weapon stations are deployed globally in border defense, armored vehicles, and homeland security applications, facilitating network-centric warfare and real-time battlefield data sharing. Rafael’s ongoing investment in AI-connected weapon systems positions it as a strategic enabler of next-generation autonomous combat and perimeter solutions.

-

In June 2025, Rafael introduced a new AI-powered multi-sensor turret for the European defense market, enhancing interoperability with NATO command systems and significantly upgrading force protection and situational awareness.

Sensor-based Gun Systems Market Key Players:

-

Armatix

-

DoDaaM Systems

-

Hanwha Techwin

-

Rafael Advanced Defense Systems

-

Saab

-

TrackingPoint

-

Adunok

-

Kalyani Group

-

Yardarm Technologies

-

iGun Technology Corporation

-

Thales Group

-

Lockheed Martin Corporation

-

Northrop Grumman Corporation

-

Raytheon Technologies Corporation

-

BAE Systems

-

Elbit Systems

-

General Dynamics

-

L3 Technologies

-

Rheinmetall AG

-

Leonardo S.p.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | US$ 2.14 Billion |

| Market Size by 2032 | US$ 4.07 Billion |

| CAGR | CAGR of 8.39 % From 2025 to 2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Sensor (Optical Sensors, Acoustic Sensors, Magnetic Sensors, Infrared Sensors, Radar Sensors) • By Technology (Smart Weapon Systems, Gunshot Detection Systems, Integrated Weapon Systems, Target Acquisition Systems) • By Application (Military, Law Enforcement, Sporting and Recreational Shooting, Self-Defense) • By System Component (Hardware, Software, Services) • By End-User (Government Agencies, Private Security Firms, Military Organizations, Civilians) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Armatix, DoDaaM Systems, Hanwha Techwin, Rafael Advanced Defense Systems, Saab, TrackingPoint, Adunok, Kalyani Group, Yardarm Technologies, iGun Technology Corporation, Thales Group, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, BAE Systems, Elbit Systems, General Dynamics, L3 Technologies, Rheinmetall AG, and Leonardo S.p.A. |