Military Trainer Aircraft Market Report Scope & Overview:

To get more information on KEYWORD Market - Request Free Sample Report

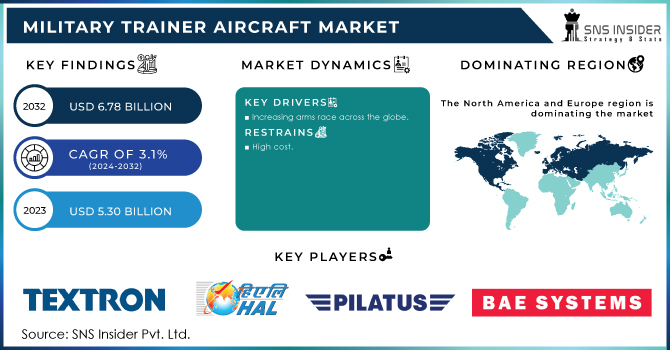

The Military Trainer Aircraft Market Size was valued at USD 5.30 billion in 2023 and is expected to reach USD 6.78 billion by 2032 with a growing CAGR of 3.1% over the forecast period 2024-2032.

On the other hand, the high costs involved in the development of advanced training aircraft may be a challenge for the growth of the players involved in these projects, while the adoption of a basic training aircraft may be challenged due to their lack of capacity to provide air support on regular aircraft. when needed. In addition, simulation-based training technologies have reached the level of technology that can train pilots in complex military situations. Although they may not be able to keep up with current training and reduce the need for training at airports, they may not be able to fully replace the use of trainers, at least during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing arms race across the globe

RESTRAINTS

-

High cost

-

Lack of air support

OPPORTUNITIES

- Lightweight

CHALLENGES

IMPACT OF COVID-19

The impact of COVID-19 on total market earnings was low as there was no decrease in the need for military training and in times of violence. The military now focuses on caring for small but capable aircraft, prompting them to purchase new-generation aircraft with advanced features and sophisticated workplaces. This feature creates the need for pilot training in new aviation environments, thus driving the purchase of a variety of qualified trainers. The outbreak of COVID-19 has had an impact on the supply chain of certain airlines, resulting in delays in delivery by 2020. However, the situation improved in 2021 for the manufacturers of several military aircraft around the world. On the other hand, no significant impact was noted on the orders placed by various armed forces around the world. Some countries that were already struggling economically before the epidemic felt the effects of COVID-19. According to the Stockholm International Peace Research Institute, defense costs by 2020 amounted to USD 1,983 billion, an increase of 2.7% in real terms from 2019.

Currently, part of the fixed aircraft has the highest share of revenue. A growing number of developments in terms of military training aircraft and a growing number of training programs could lead to partial growth. The introduction of a wide variety of new aircraft by manufacturers around the world could lead to countries in need of pilots training their pilots. Based on the model, the global market is divided into fixed-wing and rotary-wing. The fixed wing section is divided into basic jet trainers, mid-flight instructors, advanced flight trainers. The steady winged segment dominated the market in 2022 and is expected to testify to a higher CAGR during the forecast period. The increasing adoption of military training aircraft by developed countries such as the US and the UK is driving partial growth. Based on the type of seats, the global market is divided into one with twins. Half one seat dominated the market in 2022. However, half of the two seats are expected to testify to the higher CAGR during the forecast period due to increased modernization of older military training aircraft. Based on the app, the global market is divided into armed and unarmed.

The armed sector dominated the market in 2022 and is expected to testify to a higher CAGR during the forecast period. Things like the growth of the arms race around the world and the rise of terrorism are encouraging partial growth. Based on the region, the market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America holds the largest market share However, Asia-Pacific is expected to grow with the highest CAGR for the forecast period, 2022 to 2028. The rising military costs of developing countries such as China and India drive market growth in the region. In addition, the rise of cross-border terrorism in countries such as India, China, and Pakistan also encourage government agencies to invest in military training aircraft.

KEY MARKET SEGMENTATION

By Seat Type

-

Single

-

Twin

By Type

-

Fixed Wing

-

Rotatory blade

By System

-

Air-frame

-

Engine

-

Avionics

-

Landing gear system

-

Weapon system

By Application

-

Armed and Unarmed

-

Combat

-

Multi-role

-

Military

-

Transport

-

Maritime patrol

-

Reconnaissance & surveillance

-

Others

REGIONAL ANALYSIS:

Asia Pacific, North America, Middle East and Africa and Latin America, Europe. North America and Europe are expected to be strong during the forecast period. The region includes developed countries such as the U.S. However, countries such as India and China are gradually improving their defense capabilities which are expected to further the need for military training aircraft in the Asia Pacific region.

Need any customization research on KEYWORD Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

Textron Inc., Hindustan Aeronautics Ltd, Pilatus Aircraft Ltd, BAE Systems PLC, and Leonardo SpA are prominent players in the market. Various efforts and innovations are being made by different companies, which help to strengthen their market presence. Boeing is expected to become the largest shareholder in the market as it begins to deliver its flagship trainer, the T-7A Red Hawk, its US-only contract worth USD 9.2 billion, and a planned acquisition of at least 350 units for years the next 15-20. Hurjet and Rostec's Sukhoi simple TAI jets that are well placed in the Middle East, Central Europe, and African countries can play a significant role in the market as their success in these regions could improve their demand in small Asian and Latin American countries., currently dominated by lightweight assault aircraft of the 70s and 80s as well as used aircraft found in coalitions such as the United States, the United Kingdom, France, Israel, India, Singapore, and Australia. The aircraft that attacked Turkish Aerospace Industries (TAI) 's Hurjet’s Hurjet is expected to replace the Northrop T-38 Talon currently in service of the coaching role. The first flight will be expected to be completed by the end of 2022. The development of such new aircraft is expected to support corporate growth in the coming years.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.30 Billion |

| Market Size by 2032 | US$ 6.78 Billion |

| CAGR | CAGR of 3.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Wing, Rotatory blade) • By System (Airframe, Engine, Avionics, Landing gear system, Weapon system) • By Application (Combat, Multirole, Military, Transport, Maritime patrol, Reconnaissance & surveillance, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Textron Inc., Hindustan Aeronautics Ltd, Pilatus Aircraft Ltd, BAE Systems PLC, and Leonardo SpA |

| DRIVERS | • Increasing arms race across the globe |

| RESTRAINTS | • High cost • Lack of air support |