Signal Chain Analog Chip Market Size & Trends:

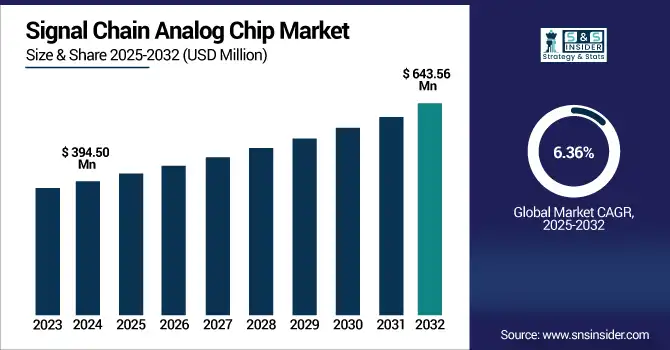

The Signal Chain Analog Chip Market size was valued at USD 394.50 million in 2024 and is expected to reach USD 643.56 million by 2032, growing at a CAGR of 6.36% over the forecast period of 2025-2032.

To Get more information on Signal Chain Analog Chip market - Request Free Sample Report

Signal Chain Analog Chip Market trends are driven by the demand for low-power, high-precision components with high level of integration in the applications, such as 5G, EVs and industrial automation. The increasing proliferation of sophisticated sensor networks and artificial intelligence (AI) enabled edge devices is also helping to speed up architecture’s innovation for analog signal processing.

The demand for precision analog components in medical devices, aerospace systems, and smart infrastructure continues to drive Signal Chain Analog Chip market growth. Its adoption is being driven by increasing demand for high-speed data acquisition and control for high-impact and mission-critical applications. OEMs are also pushing analog chipmakers to deliver higher-reliability, high-temperature, and application-specific analog front-end solutions as edge computing adoption increases and electronics systems are deployed in more lethal environments.

-

The European Space Agency (ESA) and NASA increasingly rely on radiation-hardened analog signal chain components for space-grade data acquisition; as of 2025, over 70% of satellite payloads include custom analog ICs.

The U.S. Signal Chain Analog Chip Market size is estimated to be valued at USD 80.22 million in 2024 and is projected to grow at a CAGR of 6.83%, reaching USD 135.61 million by 2032. Rising need across aerospace, defense, medical diagnostics, and industrial automation along with robust investments into R&D and advanced semiconductor manufacturing capabilities will drive the for the U.S. Signal Chain Analog Chip market.

Signal Chain Analog Chip Market Dynamics:

Key Drivers:

-

Rising Demand for Precision Analog Chips Driven by Automotive Industrial and 5G Communication Advancements.

Continuous development in sensor, smart, and connectable devices in sector, such as automotive, telecommunication, and industrial automation is reason for increase in the global Signal Chain Analog Chip market. Demand for high-performance analog front-end components that can deliver extreme precision in real time has grown in automotive applications, such as advanced driver assistance systems (ADAS), and in industrial applications including IoT sensors and control systems. The growth of 5G infrastructure and increasing data throughput demands are prompting communication systems to incorporate more signal chain ICs as well.

-

In 2024, over 120 million vehicles were produced globally, with more than 70% equipped with at least Level 1 or Level 2 ADAS, requiring multiple precision analog front-end chips for sensors, such as radar, LiDAR, and camera modules.

Restraints:

-

Analog IC Design Complexity Limits Growth Due to High Reliability Demands and Lengthy Development Cycles.

The design complexity of analog ICs has been another play, which is considered a decisive factor that restrains the growth of Signal Chain Analog Chip market. Combining high signal integrity, low noise, and extremely low power is an engineering challenge, especially for automotive, medical and aerospace applications which require high reliability and accuracy. Finally, analog design is still very much slower than digital design, involving manual calibration and repetitive iterative verification.

Opportunities:

-

Emerging Applications and Technological Advancements Drive Growth in Signal Acquisition and Custom Analog IC Development.

New growth opportunities continue to open through applications in healthcare, aerospace, and renewable energy. The trend toward edge computing and AI-enabled devices is driving the need for signal acquisition chips with low power and high accuracy. In addition, the growing trend of custom analog IC development and the rise in investments on next-gen semiconductor fabs are creating new opportunities for innovation and market growth.

-

Over 65% of AI edge devices deployed in 2024 featured onboard signal chain analog ICs for real-time sensing, including noise-optimized op-amps and low-power ADCs.

Challenges:

-

Shortage of Analog Engineers Delays Product Launches and Hampers High-Speed High-Density Deployments.

The limited number of analog design engineers creates a bottleneck and leads to increased time-to-market for new products. Unlike digital, analog development is very dependent on deep expertise and experience in the domain. Moreover, deployment at high-speed and high-density system faces challenges due to long validation cycles, limitations across packaging, and degradation of analog signals through distance.

Signal Chain Analog Chip Market Segmentation Analysis:

By Type

The Signal Chain Analog Chip market share of Data Converters (ADC/DAC) was the largest at 27.4% in 2024 due to their function in converting real-world analog signals into digital data to be processed in 5G infrastructure, automotive ADAS, and medical imaging systems, among others. Owing to their high resolution and speed, they are important in obtaining precise data in precision systems.

The amplifiers segment is anticipated to exhibit the fastest growth rate from 2025 to 2032, due to growing utilization of amplifiers in next-gen automotive systems, industrial automation, and IoT-oriented sensing platforms. With sensor fusion ramping up, amplifiers with low noise and large gain are essential to amplify weak analog signals prior to conversion or signal analysis. In an era of miniaturization and energy efficiency, this transition has fueled invention of ultra-low power consumed, highly temperature stable amplifier designs.

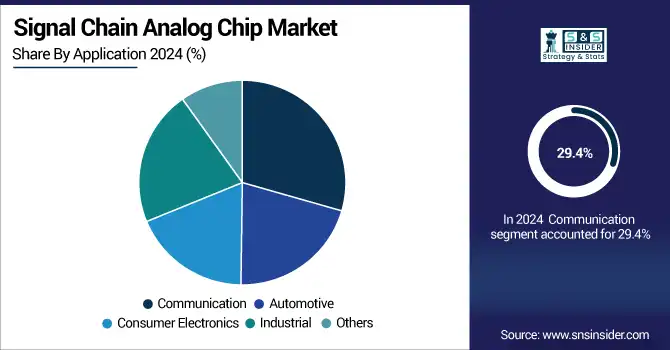

By Application

The Communication segment led the Signal Chain Analog Chip market and accounted for a maximum of 29.4% share in 2024, supported by large-scale implementation of 5G infrastructure, increasing Mobile Data Traffic, and growing high-speed broadband networks. Telecom base stations and network equipment rely on signal chain components, such as ADCs, DACs and amplifiers to enable high-speed, low-latency data transfer.

The Automotive sector is expected to have the highest CAGR over 2025-2032, due to the rise in demand for electric, ADAS and V2X vehicles. Requirements for high-precision and reliable signal processing for real-time sensing and control for these applications is driving the demand for next generation, IEEE-standard, and analog front-end solutions within the modern automotive platform.

Signal Chain Analog Chip Market Regional Outlook:

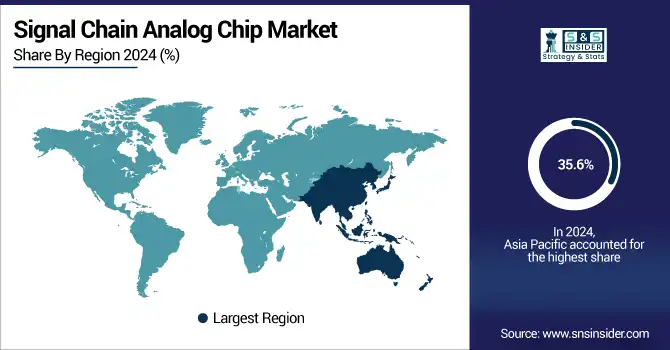

Asia Pacific held the highest share of 35.6% in the Signal Chain Analog Chip market in 2024, aided by a well-established electronics manufacturing ecosystem and sustained demand for home consumer electronics, telecommunications, and industrial manufacturing. The region enjoys massive production plants, a robust supply chain, and large commitments to semiconductor technology. The growing demand for high-performance analog chips driven by the rapid adoption of 5G, IoT devices and automation technologies continues unabated. Further, the growing emphasis on electric mobility and smart infrastructure is also generating demand for precision signal processing components in the region, making Asia Pacific a key center of innovation and consumption for analog semiconductors.

Due to its huge electronics manufacturing base, strong need for consumer devices, quick expansion of 5G, and industrial automation, China led the Signal Chain Analog Chip market in 2024 in Asia Pacific.

The North American region is projected to lead with a CAGR of 7.02% in the signal chain analog chip market over 2025-2032, owing to the increasing aerospace, defense, and medical applications which use high precision and high reliability analog components. Demand for high-performance signal processing solutions is being driven by the region's increasing focus on research and development (R&D), aggressive adoption of edge computing, and rising electric mobility and industrial automation investments. Adding to these influences is the presence of top-tier semiconductor design companies and growing investment in next-generation fabrication facilities driving further innovation, which is positioning North America as a region of fundamental emerging applications in analog and mixed-signal integrated circuit technologies.

North America, led by the U.S., represents the largest market for Signal Chain Analog Chip in 2024, owing to advancements in semiconductor research and development, established presence of signal chain analog chip giants, and well-developed high-tech manufacturing facilities.

The Signal Chain Analog Chip market in Europe witnessed a stable growth in 2024 that can be attributed to high demand from automotive, industrial automation, and renewable energy sectors. The precision quality of analog components for real-time processing and control of signals is in high admiration, as their acquisition is a perfect match for the electrification, smart manufacturing, and sustainability datum in the region. An increase in demand for amplifiers, ADCs and interface chips will be driven by investments in next-generation mobility (EVs and ADAS technologies). Furthermore, focus on R&D activities are encouraging the development of high-reliability and energy-efficient analog solutions.

Strong growth opportunities were seen in Latin America and the Middle East & Africa in 2024 driven by rising investments in telecommunications, smart infrastructure, and industrial automation in these regions. Demand for reliable signal processing solutions is being driven by a gradual expansion of IoT applications and renewable energy projects. Despite lower market maturity relative to other regions, steady growth in both regions is driven by continued digital transformation efforts along with increasing interest in automotive electronics and healthcare technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

Signal Chain Analog Chip Companies are:

Key Players in Signal Chain Analog Chip Market include Texas Instruments, Analog Devices, Infineon, STMicroelectronics, NXP, onsemi, Microchip, Maxim Integrated, Renesas, and Skyworks.

Recent Developments:

-

In December 2024, Texas Instruments secures up to USD 1.6 billion in CHIPS Act funding to build three new 300 mm fabs in Texas (Sherman) and Utah (Lehi), strengthening analog chip manufacturing capacity.

-

In May 2025, Infineon Technologies launches collaboration with Nvidia to develop high-voltage, DC power-delivery chips for AI data centers, improving energy efficiency

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 394.50 Million |

| Market Size by 2032 | USD 643.56 Million |

| CAGR | CAGR of 6.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Amplifiers, Comparators, Interface Chip, Data Converters (ADC/DAC), Clocks and Others) • By Application (Communication, Automotive, Consumer Electronics, Industrial and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, Analog Devices, Infineon, STMicroelectronics, NXP, onsemi, Microchip, Maxim Integrated, Renesas, and Skyworks. |