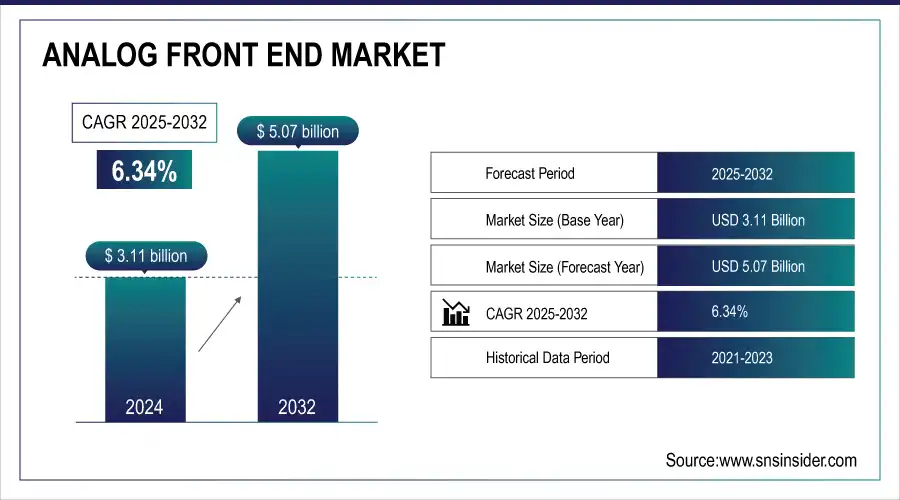

Analog Front End Market Size & Growth:

The Analog Front End Market Size was valued at USD 3.11 billion in 2024 and is expected to reach USD 5.07 billion by 2032 and grow at a CAGR of 6.34% over the forecast period 2025-2032.

To Get More Information On Analog Front End Market - Request Free Sample Report

The global Analog Front End market is witnessing accelerated growth due to increasing requirement of signal processing in wide range of electronic applications. Growing penetration of AFE components in ultramodern wireless communication systems, smart medical devices and wearable products is boosting market growth. Advancements in micronization and low power design are facilitating smaller, multi-functioning electronics. Further, continuous improvement in technology, changing end user preferences, and the trend towards the use of more intelligent devices incorporating sensors are favoring a growing acceptance. These trends are fueling new growth opportunities and driving change in strategic imperatives from the worldwide AFE market.

According to research, over 80% of next-gen medical devices now integrate analog signal chain components to enable real-time biosignal processing.

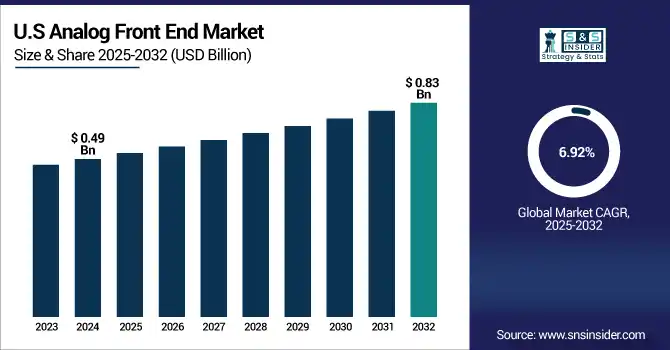

The U.S. Analog Front End Market size was USD 0.49 billion in 2024 and is expected to reach USD 0.83 billion by 2032, growing at a CAGR of 6.92% over the forecast period of 2025–2032.

The U.S. Analog Front End market Growth is due to the increasing adoption of the medical devices, rising investments in medical advanced electronics, increasing demand of the wearable health monitoring devices and the rapid expansion of 5G infrastructure. Further, the domestic R&D, robust semiconductor manufacturing capacity, and the increase in penetration of consumer electronics are boosting market growth in various verticals.

| Growth Factor | Effect on AFE Market |

|---|---|

|

Rising medical device adoption |

Surge in biomedical AFE demand |

|

5G infrastructure expansion |

Increased demand for RF and high-speed analog blocks |

|

Wearable health tech boom |

Need for low-power, high-SNR analog sensors |

|

Increase in smart home devices |

Broader use of audio and signal-conditioning AFEs |

Analog Front End Market Dynamics

Key Drivers:

-

Rapid expansion of IoT ecosystems is significantly increasing the need for compact and efficient signal-processing components.

Analog Front End module play a very vital role in connecting the real world analog signals with the digital system. Increasing use of IOT-enabled devices in industrial automation, healthcare monitoring, smart homes, logistics among others is driving the demand for low-power, high integration AFE solutions. These technologies demand precise and power-effective analog-digital (AD) signal conversion, which AFE systems aim to provide. Moreover, the increasing number of edge computing and sensor networks being implemented at diverse industry markets are broadening the AFE usage and these are becoming essential for real-time data processing and integrated brain in the IoT world.

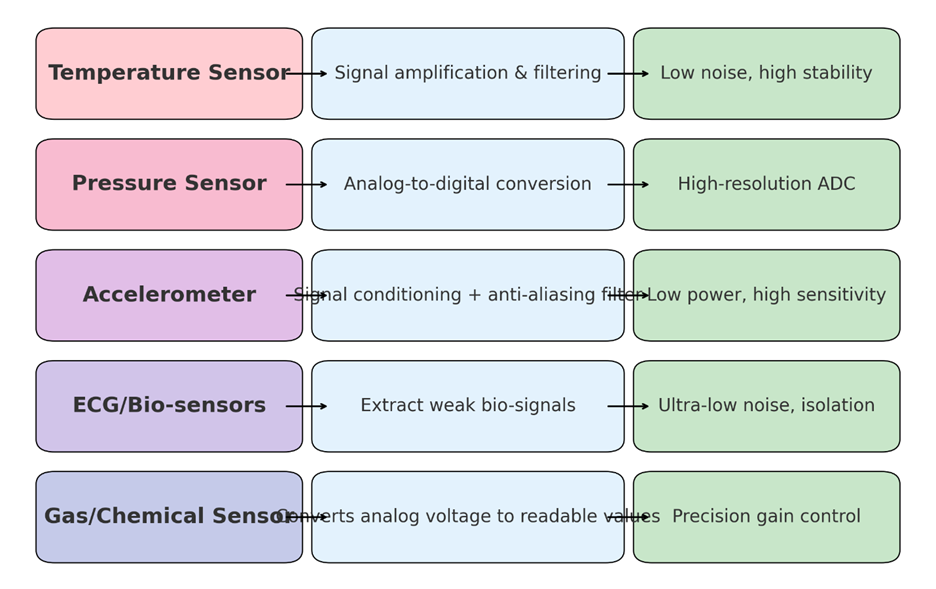

AFE Functions Across Sensor Types:-

Restrain:

-

High integration complexity of AFE components increases design challenges and prolongs product development cycles.

Compacting, making multifunctional, and reducing power of AFE modules become more difficult in recent electronics. Engineering the AFE systems which optimally carry the signal fidelity, power consumption and cross-component interoperability is a complex task and requires advanced engineering capabilities and simulation tools. Programs are very sensitive to small design mistakes, which can result in a poorly performing or non-working program causing the need for repeated development cycles. This long time-to-market with high non-recurring engineering (NRE) costs may delay market entry by manufacturers, decrease profit margins and deter small-sized manufacturers from acquisition of advanced AFE technologies, especially for cost-sensitive applications.

Opportunities:

-

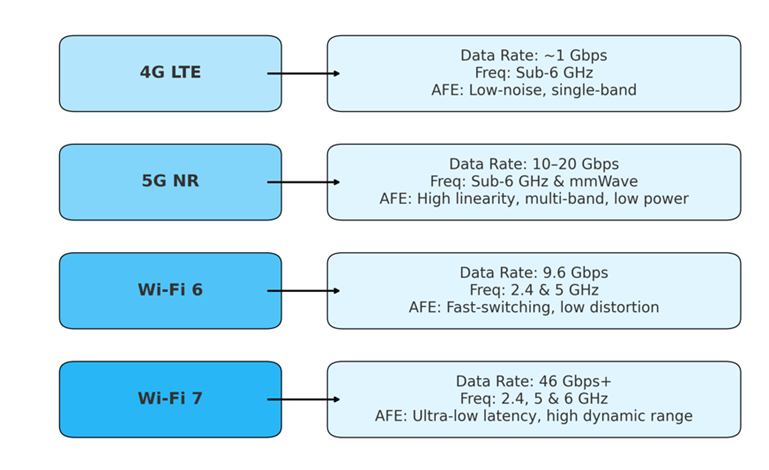

Proliferation of 5G and next-gen wireless devices is driving demand for adaptive and scalable AFE modules.

With the arrival of 5G system and the progress of Wi-Fi 6/7 standard, high-performance AFE modules are becoming more popular for high speed RF signal transmitting and receiving. New generation of wireless devices such as smartphones, AR/VR gadgetries, and IoT gateways demand highly linearized low-power AFE to operate in multiple bands and dynamic signal environments. With the proliferation of base station deployments and mmWave technologies, the need for scalable multi-gig AFEs with high performance will only increase. Manufacturers using software-defined radio technologies combined with configurable AFE architectures can take advantage of this emerging opportunity in telecommunications, automotive and industrial businesses.

According to research, over 85% of flagship smartphones now include on-device AI, requiring efficient analog interfaces for sensors and voice/video inputs.

Challenges:

-

Short product life cycles in electronics markets limit ROI on AFE development and pressure manufacturers for faster innovation.

In areas such as consumer electronics and wearables, the pace of technological change is so high that product lifetimes decline, in some cases, to less than a year. This creates a significant burden on makers of analog components to develop and introduce new AFE solutions rapidly. Nevertheless the design of AFE konwn as complicate mixed-signal digital design need time costing validation and optimization. Timing mismatch between development and market windows leads to poor investment returns, inefficiencies in the supply chain, and increasing inventory obsolescence risks, particularly for small and medium AFE manufacturers.

Analog Front End Market Segment Analysis:

By Technology

The wireless communication segment dominated the highest analog front end market share of about 37.31% in 2024, fueled by the pervasive requirement for seamless connectivity on mobile phones, infrastructure for 5G, and IoT gadgets. Analog front ends are key components to guarantee signal quality and useful data transmission. The continued proliferation of wireless-enabled consumer and industrial electronics combined with accelerated 5G deployments across the globe is driving demand for this segment and helping it stay in the forefront of the global market.

The sensor interface segment is expected to grow at the fastest CAGR of about 7.84% from 2025 to 2032 owing to the rising proliferation of sensors in wearable devices, smart homes, automotive solutions, and medical devices. These interfaces are essential for accurate analog signal treatment from a set of sensors. Analog front end companies like Texas Instruments providing AFE sensor solutions present in various guises are pursuing technological advances to create ultra-low power, high precision AFE optimized for IOT and industrial applications is helping in this space growing at a high pace.

By Application

The wearable technology segment led the Analog Front End Market in 2024 with a dominant revenue share of about 54.16%, owing to the prevalence of smartwatches, fitness trackers, and other health-metric devices. Small and low-power AFE modules are necessary for wearables with the processing capability to be integrated with biometric and wireless communications. Analog Devices, Inc., offers custom AFE solutions that deliver the highest precision at the lowest power for wearable health and fitness devices, in response to growing requests for next-gen wearables to include these integrated solutions.

The medical devices segment is projected to register the fastest CAGR of about 7.52% from 2025 to 2032, driven by the growing demand for portable diagnostic and monitoring devices. and ECG, EEG, and other life-critical applications. Special-purpose AFEs for medical instrument Front-ends such as the one provided by Maxim Integrated for medical instrumentation enables real-time signal acquisition as well as miniaturization of device form factor, both of which are essential for modern telehealth and point-of-care solutions.

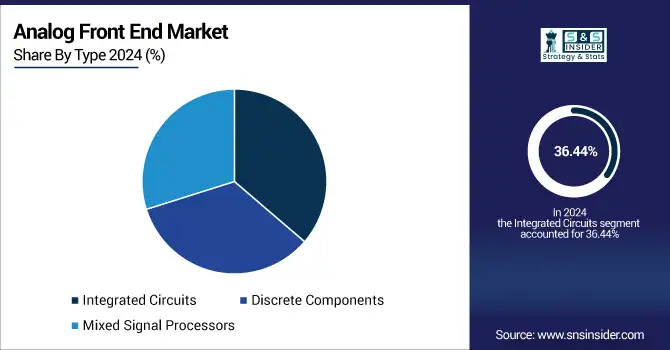

By Type

The integrated circuits segment held the highest revenue share of about 36.44% in 2024, mirroring the industry focus on small, scalable, and cost-effective AFE solutions. Integrated circuit (IC)-based analog front ends are more integrated, consume less power, and create simpler PCBs. STMicroelectronics is a major supplier of flexible AFE ICs used in consumer electronics and industrial equipment, and has helped drive their rapid spread by enabling performance reliability and straightforward integration at system level.

The discrete components segment is expected to grow at the highest CAGR of about 7.72% from 2025 to 2032, because of their design flexibility and their precision in specialized applications. Discrete analog front ends are commonly used in automotive, industrial, and aerospace applications, which require customized analog processing. Moving forward with discrete analog component designs, Infineon Technologies has similarly been pushing the airframe, particularly in high-reliability and automotive-grade applications, expanding in use cases demanding customized analog performance.

By End-Users

The consumer electronics segment led the Analog Front End Market in 2024 with the largest revenue share of about 39.35%, owing to high-volume demand for smartphones, tablets, and smart home devices. For controlling power, audio, wireless connectivity and signal conditioning in these devises, AFEs are a critical part. With its most advanced chipset platforms, Qualcomm has integrated advanced AFE capabilities enabling a broad array of consumer electronics devices, further solidifying connectivity and processing performance leadership in this segment.

The automotive segment is projected to experience the fastest CAGR of about 7.62% from 2025 to 2032, due to the increasing penetration of electric cars, ADAS devices, and infotainment systems. For the area of battery monitoring and radar/lidar sensing and in-vehicle networking, analog front ends are important parts in signal processing. AFE continues to gain importance in the automotive sector and NXP Semiconductors is leading the way with new innovations and solutions to address the demanding automotive signal quality and safety requirements, as we continue our fast growth in this dynamic market space.

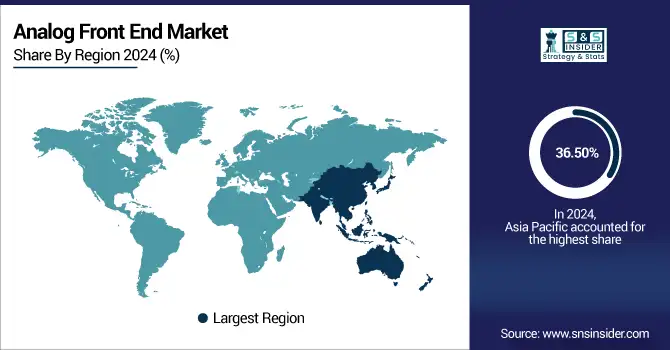

Analog Front End Market Regional Analysis:

Asia Pacific dominated the Analog Front End Market in 2024 with the highest revenue share of about 36.50%, due to strong electronics manufacturing base and high demand from countries such as China, Japan and South Korea. The area is aided by competitive manufacturing costs, strong government investment in semiconductors and a robust market for consumer electronics. These, together with swift technological developments as well as an export-oriented economy, result in the region playing a precedence role in the worldwide AFE market.

-

China leads the Asia Pacific analog front end market due to the massive electronics manufacturing base in the country coupled with fast industrialisation and domestic consumption of smart devices and aggressive government push to become semiconductor self-sufficient and technology advanced.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America is anticipated to witness the fastest CAGR of about 7.75% from 2025 to 2032, fueled by progress of medical devices, EVs, aerospace systems, and 5G infrastructure. The area has a thriving innovation ecosystem, significant R&D investment, and ready access to high-tech industries. Increasing demand for advanced electronics and surge in demand for high-performance, power-efficient systems are the major factors responsible for the rise in the adoption of analog front end across different applications.

-

The United States dominates the North American analog front end market due to advanced technology ecosystem, early adoption of latest electronic and high investment in 5G, IoT and medical devices among others. The leadership is also even more solid with Hi-tech manufacturers as well as innovation capabilities.

In Europe, such demand from the automotive, industrial automation and healthcare sectors has propelled the automotive front end market. Countries such as Germany and France are among early adopters, given their mature electronics trading blocs and growing investment in electric vehicles and renewable energy networks. Furthermore, there is growing regulation focus on energy-efficient and precision technologies that is forcing manufacturers to design-in these advanced AFE components into future solutions.

-

Germany is a key player in the European analog front end because of its large automotive and industrial segments. Demand there for precision analog front end components is driven by the country’s emphasis on electric vehicles, automation, advanced manufacturing and large R&D investment.

In the Middle East & Africa, UAE is the biggest market for analog front end market owing to the faster adoption technology, smart city initiatives, and heavy investments in healthcare and telecom sector. Latin America: Brazil will continue to lead, fueled by a growing electronics industry, burgeoning automotive demand and increasing investment in digital infrastructure.

Analog Front End Companies are:

Major Key Players in Analog Front End Market are Analog Devices, Inc. , Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Maxim Integrated, ON Semiconductor, Microchip Technology Inc., Renesas Electronics Corporation, ROHM Semiconductor and others.

Recent Development:

-

In November 2023, Renesas Electronics Corporation introduced its RX23E‑B microcontroller series featuring high-precision integrated AFEs, optimized for industrial sensor systems.

-

October 2024, Analog Devices, Inc. Launched a suite of intelligent-edge hardware/software tools, including integrated AFE subsystems and developer tools like CodeFusion Studio.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.11 Billion |

| Market Size by 2032 | USD 5.07 Billion |

| CAGR | CAGR of 6.34% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Wireless Communication, Sensor Interface, Data Acquisition, Audio Processing) • By Application (Medical Devices, Smart Homes, Wearable Technology) • By Type (Integrated Circuits, Discrete Components, Mixed Signal Processors) • By End-Users(Consumer Electronics, Telecommunication, Automotive, Industrial Automation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Maxim Integrated, ON Semiconductor, Microchip Technology Inc., Renesas Electronics Corporation, ROHM Semiconductor. |