Analog Integrated Circuit Market Size:

Get More Information on Analog Integrated Circuit Market - Request Sample Report

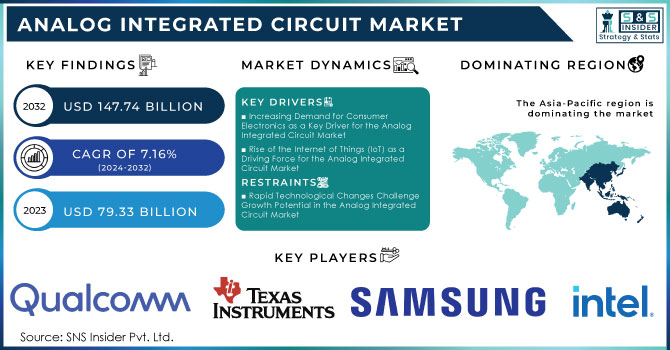

The Analog Integrated Circuit Market Size was valued at USD 79.33 billion in 2023 and is expected to reach USD 147.74 Billion by 2032, and grow at a CAGR of 7.16% over the forecast period 2024-2032.

The analog integrated circuit (IC) market is experiencing significant growth, primarily driven by the rising demand for consumer electronics like smartphones, tablets, and smart home devices. As these technologies become increasingly vital in everyday life, the need for high-performance analog ICs, which are essential for signal processing and power management, has intensified. Recent market analyses suggest that the global analog IC market is set for considerable expansion, spurred by technological innovations and the widespread adoption of Internet of Things (IoT) applications. Additionally, the rollout of 5G networks further fuels the demand for analog ICs, particularly in communication systems that require efficient data transmission. The automotive industry is also a crucial factor in this growth, as the transition to electric vehicles (EVs) and advanced driver-assistance systems (ADAS) amplifies the need for specialized analog ICs. These components are vital for battery management, power distribution, and sensor integration, making them essential in contemporary automotive design. Furthermore, industrial automation is evolving, with increased utilization of analog ICs in robotics, process control, and smart manufacturing. Tower Semiconductor, an Israeli company focused on analog and mixed-signal semiconductors, recently projected a revenue decline for the fourth quarter of 2023, estimating earnings at around USD 350 million—over a 13% decrease compared to the prior year. This decline is mainly due to a supply glut in the semiconductor industry, which has led many companies to reassess their inventories and cut new orders. As a result, Tower's stock dropped nearly 6% in premarket trading. The semiconductor sector is currently undergoing an inventory correction, with companies prioritizing existing orders to stabilize the market amid high interest rates and ongoing inflation. In its third-quarter report, Tower announced revenues of USD 358.2 million, marking a 16% year-over-year decline. Nonetheless, the company recorded an operating profit of USD 362.2 million, bolstered by a termination fee from its halted USD 5.4 billion merger with Intel, which encountered regulatory issues. Looking ahead, Tower plans to collaborate with Intel on foundry services, including investments in Intel's factory in New Mexico. Despite the ongoing geopolitical tensions in Israel, Tower reassures stakeholders of its operational stability and aims to leverage its expertise in analog ICs to navigate current market challenges effectively. This strategic focus on core competencies and partnerships positions Tower Semiconductor to adapt to evolving market dynamics while addressing the pressing demands across various sectors.

Market Dynamics

Drivers

-

Increasing Demand for Consumer Electronics as a Key Driver for the Analog Integrated Circuit Market

The increasing demand for consumer electronics is a primary driver of growth in the analog integrated circuit (IC) market. As the world becomes more interconnected, the proliferation of devices such as smartphones, tablets, smart home technologies, and wearables has accelerated dramatically. These devices rely heavily on high-performance analog ICs for essential functions like signal processing, power management, and sensor integration. The surge in consumer electronics not only demands higher efficiency and functionality but also pushes for compact designs that can fit into smaller devices. For instance, smartphones require sophisticated analog ICs to manage various tasks, from audio amplification to battery charging, ensuring optimal performance while maintaining energy efficiency. Similarly, smart home devices like thermostats, security cameras, and lighting systems depend on analog ICs to process data and communicate seamlessly with other devices in a network. This growing reliance on analog technology is further fueled by innovations in semiconductor manufacturing, allowing for the production of more advanced, compact, and efficient ICs. Consequently, the expansion of consumer electronics is set to significantly influence the analog IC market, driving technological advancements and creating new opportunities for manufacturers to meet evolving consumer demands.

-

Rise of the Internet of Things (IoT) as a Driving Force for the Analog Integrated Circuit Market

The surge in Internet of Things (IoT) applications is significantly driving the demand for analog integrated circuits (ICs), as these components are crucial for ensuring efficient, reliable connectivity and enhanced functionality across a multitude of devices. As industries adopt IoT solutions—from smart home technologies and wearable devices to industrial automation systems—the need for high-performance analog ICs increases. These ICs facilitate essential functions such as signal processing, power management, and data transmission, making them indispensable in the development of IoT devices. Additionally, the integration of advanced features, such as sensor interfacing and energy efficiency, further emphasizes the importance of analog components in the IoT landscape. As the market continues to evolve, with projections indicating substantial growth in IoT deployments, manufacturers of analog ICs are poised to benefit from this expanding demand, positioning themselves strategically within this burgeoning sector.

Restraints

-

Rapid Technological Changes Challenge Growth Potential in the Analog Integrated Circuit Market

Rapid technological advancements present a significant restraint for the analog integrated circuit market, necessitating continuous innovation and adaptation from manufacturers. As technology evolves at an unprecedented pace, companies in the analog IC sector are compelled to invest heavily in research and development to stay aligned with shifting consumer preferences and emerging technologies. This constant need for innovation can strain resources, diverting funds from other critical areas like marketing and production efficiency. Furthermore, the pressure to develop new products and features quickly can lead to increased operational costs, potentially limiting profit margins. Companies that fail to keep pace with technological changes risk becoming obsolete, as competitors introduce more advanced and efficient solutions. Additionally, the rapid development cycle can lead to increased complexity in product design, which may require specialized skills and advanced manufacturing techniques. This not only raises production costs but also complicates supply chain management. In summary, while technological innovation is essential for growth, the relentless pace of change poses a formidable challenge for analog IC manufacturers, demanding strategic planning and resource allocation to navigate these constraints effectively.

Segment Analysis

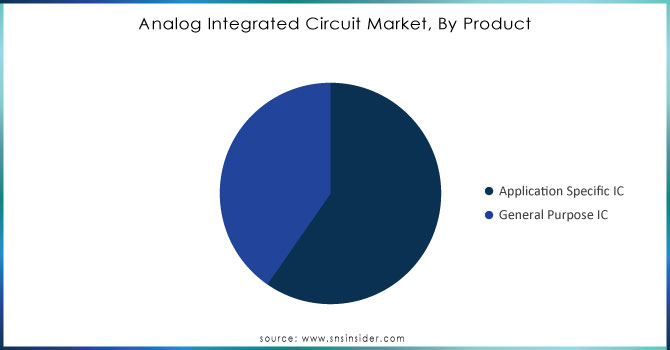

By Product

In the Analog Integrated Circuit (IC) market, Application-Specific Integrated Circuits (ASICs) emerge as a prominent segment, accounting for about 60% of total revenue in 2023. This significant market share reflects the distinct advantages of ASICs tailored for specific applications. Unlike general-purpose ICs, ASICs are custom-engineered for particular tasks, resulting in enhanced efficiency and performance. Industries such as consumer electronics, automotive, telecommunications, and industrial automation increasingly rely on ASICs to satisfy the growing demand for specialized functionalities. For instance, in consumer electronics, ASICs facilitate essential features like high-definition audio, video processing, and connectivity for devices such as smartphones, tablets, and smart home technologies. The expanding Internet of Things (IoT) further drives the demand for ASICs, as these devices require customized solutions to function effectively in varied environments. ASICs offer integrated capabilities that optimize both power consumption and cost, making them attractive across sectors from healthcare to industrial automation. Furthermore, advancements in design tools and manufacturing processes have enabled the creation of more sophisticated ASICs, resulting in quicker time-to-market and improved performance metrics.

Need Any Customization Research On Analog Integrated Circuit Market - Inquiry Now

By Application

In the Analog Integrated Circuit (IC) market, the Communication application has emerged as a prominent segment, accounting for approximately 35% of total revenue in 2023. This significant share reflects the rapid advancements in communication technologies and the escalating demand for high-quality connectivity solutions. As global interconnectivity increases, the requirement for reliable and efficient analog ICs in communication devices has become more critical.

Communication applications cover a diverse array of technologies, including mobile phones, wireless networks, and data transmission systems. Analog ICs are essential in these devices, performing vital functions such as signal amplification, modulation, and conversion. The rollout of 5G networks and the proliferation of the Internet of Things (IoT) have driven an urgent need for advanced communication solutions, further increasing the demand for sophisticated analog ICs. The transition toward smarter communication systems, including cloud computing and edge technology, necessitates efficient analog ICs capable of managing heightened data processing and transmission demands. These ICs play a crucial role in optimizing power consumption, enhancing signal integrity, and boosting overall system performance. The incorporation of cutting-edge technologies like digital signal processing (DSP) and mixed-signal solutions is also enhancing the application of analog ICs in communication.

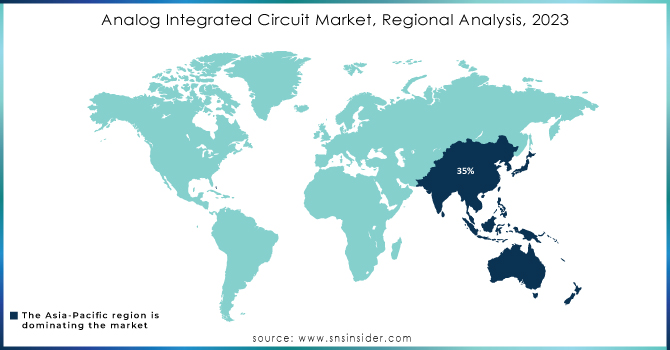

Regional Analysis

In the Analog Integrated Circuit (IC) market, the Asia-Pacific region has emerged as a leading force, accounting for approximately 35% of total revenue in 2023. This dominance is largely due to the rapid expansion of the consumer electronics sector in countries such as China, Japan, and South Korea, where major electronics manufacturers are integrating advanced analog ICs to boost product functionality and performance. The growing demand for smartphones, tablets, and smart home devices underscores the need for efficient power management and signal processing, which critical functions are provided by analog ICs.Recent product launches further highlight the region's crucial role in analog IC innovation. For instance, Texas Instruments has introduced a new line of precision analog ICs aimed at industrial applications, focusing on enhanced signal integrity and power efficiency. Infineon Technologies has also rolled out high-performance analog solutions targeting the automotive sector, especially for electric and hybrid vehicles. Additionally, the ongoing 5G rollout is driving investments in telecommunications infrastructure, prompting companies like NXP Semiconductors to launch RF analog ICs designed for faster data transmission. The burgeoning Internet of Things (IoT) market is also fueling demand for specialized analog ICs across various industries, including healthcare and industrial automation. The Asia-Pacific's skilled workforce and robust manufacturing capabilities further solidify its position as a global leader in the analog IC market.

In 2023, North America has established itself as the second fastest-growing region in the Analog Integrated Circuit (IC) market, benefiting from various factors that bolster its competitive edge and innovation potential. The region's emphasis on research and development, coupled with a robust technological infrastructure and a well-entrenched consumer electronics industry, drives the demand for advanced analog IC solutions. This growth is largely fueled by the increasing integration of cutting-edge technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT), all of which necessitate sophisticated analog ICs for effective power management, signal integrity, and data processing. For example, Analog Devices has rolled out high-performance analog ICs specifically designed to enhance 5G applications, facilitating faster data transfer and improved connectivity. Meanwhile, Qualcomm has developed innovative analog solutions tailored for IoT devices, which are essential for smart city initiatives and connected infrastructure. Additionally, the automotive sector is experiencing a transformation toward electric and autonomous vehicles, prompting companies like Texas Instruments to create specialized analog ICs that improve power management and sensor integration. The healthcare sector is also a key driver of growth, with the rise of telehealth and remote monitoring systems generating demand for high-performance analog ICs that support medical devices and ensure reliable data transmission, as seen with Maxim Integrated’s specialized offerings.

Key Players

Some of the major players in Analog Integrated Circuit with their Product:

-

Intel Corporation (Microprocessors)

-

Samsung Electronics (Memory Chips)

-

Texas Instruments (Analog Integrated Circuits)

-

Qualcomm (Snapdragon Processors)

-

NVIDIA (Graphics Processing Units)

-

Broadcom (Wireless Communication Chips)

-

Micron Technology (DRAM and NAND Flash Memory)

-

Analog Devices (Signal Processing Solutions)

-

Infineon Technologies (Power Semiconductors)

-

STMicroelectronics (Microcontrollers and Sensors)

-

Renesas Electronics (Automotive Microcontrollers)

-

Advanced Micro Devices (AMD) (Processors and GPUs)

-

Skyworks Solutions (RF and Analog Semiconductors)

-

Marvell Technology Group (Storage and Networking Solutions)

-

NXP Semiconductors (Automotive and Security Solutions)

-

ON Semiconductor (Power Management Solutions)

-

Microchip Technology (Embedded Control Solutions)

-

MediaTek (Smartphone SoCs)

-

Xilinx (FPGA Devices)

-

Cypress Semiconductor (Embedded System Solutions)

List of Potential Customers across various sectors that utilize analog integrated circuits (ICs):

1. Consumer Electronics

-

Apple Inc.

-

Samsung Electronics

-

Sony Corporation

2. Automotive Industry

-

Ford Motor Company

-

General Motors

-

Toyota Motor Corporation

3. Industrial Automation

-

Siemens AG

-

Rockwell Automation

-

Honeywell International Inc.

4. Telecommunications

-

Cisco Systems

-

Nokia Corporation

-

Ericsson

5. Healthcare and Medical Devices

-

Medtronic

-

Philips Healthcare

-

GE Healthcare

6. Aerospace and Defense

-

Boeing

-

Lockheed Martin

-

Raytheon Technologies

7. Renewable Energy

-

Siemens Gamesa

-

First Solar

-

Tesla Inc.

8. Smart Home Technology

-

Nest Labs

-

Amazon

-

Philips Hue

9. Computing and Data Centers

-

Intel Corporation

-

IBM NVIDIA Corporation

10. Consumer Appliances

-

Whirlpool Corporation

-

LG Electronics

-

Electrolux

Recent Development

-

On September 24, 2024, Georgia Tech and Texas Instruments announced a collaboration to enhance analog circuit education, providing students the opportunity to design chips that will be manufactured at TI's 300mm semiconductor fabrication plant in North Texas. This initiative aims to offer hands-on experience in integrated circuit design.

-

On September 24, 2024, Shockley Semiconductor Laboratories announced the launch of a new initiative aimed at advancing the development of analog devices, fostering innovation in semiconductor manufacturing processes to meet the growing demands of modern technology.

-

On November 13, 2023, Tower Semiconductor projected a quarterly revenue decline of over 13%, estimating around USD 350 million for Q4 2023, as the semiconductor industry grapples with a supply glut. This forecast led to a nearly 6% drop in its U.S.-listed shares, while the company also plans to invest USD300 million in Intel's New Mexico factory after the termination of their USD 5.4 billion merger deal.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 79.33 Billion |

| Market Size by 2032 | USD 147.74 Billion |

| CAGR | CAGR of 7.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Application Specific IC, General Purpose IC) • By Application (Communication, Consumer Electronics, Automotive, Industrial, Medical and Health Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TSMC, GlobalFoundries, ASE Group, Amkor Technology, STATS ChipPAC, NXP Semiconductors, Silicon Labs, Keysight Technologies, Cadence Design Systems, Synopsys, Mentor Graphics, Rohde & Schwarz, Ansys, Macom Technology Solutions, Teradyne, Lattice Semiconductor, Dialog Semiconductor, Infineon Technologies, Tensilica, and Microchip Technology. |

| Key Drivers | • Increasing Demand for Consumer Electronics as a Key Driver for the Analog Integrated Circuit Market • Rise of the Internet of Things (IoT) as a Driving Force for the Analog Integrated Circuit Market |

| Restraints | • Rapid Technological Changes Challenge Growth Potential in the Analog Integrated Circuit Market |