Amplifiers Market Size

get more information on Amplifiers Market - Request Sample Report

The Amplifiers Market Size was valued at USD 29.75 billion in 2023 and is expected to grow at a CAGR of 7.2%, reaching USD 55.62 billion by 2032.

The amplifier market is raising demand in market by the advancements which are being driven by the need to power ever-more sophisticated consumer electronics and by the demands of new technologies like 5G and the Internet of Things (IoT).

People are demanding better sound and picture quality from their TVs and speakers and that means needing amplifiers that can handle the complex signals from all these fancy electronics. This constant push for innovation creates a never-ending need for more advanced amplifiers. But it's not just about entertainment. The advance world of super-fast 5G networks needs powerful amplifiers to handle the huge amounts of data that lets watch sharp live streams or experience mind-blowing home entertainment. And the Internet of Things (IoT) is adding even more growth to the fire. With all these smart speakers and gadgets talking to each other there's a growing need for special amplifiers to keep them all communicating clearly. As governments around the world invest in building out these next-generation networks and encouraging smart technology, the amplifier market is poised to keep growing for a long time.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Product (Transistor Amplifier, Direct Coupled Amplifier, Video Amplifier, Buffer Amplifier, Operational Amplifier, Audio Frequency Amplifier, Intermediate Frequency Amplifier, Ultrasonic Amplifier, Wideband Amplifier, Radio Frequency Amplifier) • By Type (Power Amplifier , Voltage Amplifier, Current Amplifier) • By Class (Class-A, Class-B, Class-A/B, Class-G&H, Class-D, Other) • By Industry (Consumer Audio, Automotive Audio, Computer Audio, Enterprise Audio, Telecommunication, Healthcare, Aerospace, Military & Defense, Other) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co Ltd, Qualcomm Inc, Infineon Technologies AG, Xilinx Inc, Texas Instruments Inc, STMicroelectronics, Yamaha, Qorvo, Toshiba Corporatio, Broadcom Inc., Maxim Integrated, NXP Semiconductors, Analog Devices Inc, Infineon Technologies, Analog Devices |

Amplifiers Market Dynamics:

KEY DRIVERS:

-

The trend towards premium audio and video experiences

-

Fancier electronics surround sound, high-def TVs demand more advanced amplifiers to handle their complex signals.

The demand for premium audio and video experiences is fueling the amplifier market. As consumers chase immersive entertainment with surround sound systems and high-definition TVs, the need for powerful amplifiers to handle complex signals from these advanced electronics is growing. This constant innovation in consumer electronics creates a ripple effect, requiring ever-more sophisticated amplifiers to keep pace.

RESTRAINTS:

-

The large size and bulk of traditional amplifiers can pose a significant challenge especially for those who are short on space in their homes or prioritize a sleek and modern aesthetic

-

Traditional amplifiers are big and heavy it costs more to move them around at every stage of the process from factories to stores and even to your home.

OPPORTUNITIES:

-

With the expanding reach of 4G and the growth of 5G networks we are witnessing a significant transformation in the way we access and consume data

-

Voice assistants like Alexa and Google Home demand amplifiers for clear voice control.

The amplifier market is being amplified by next-generation connectivity. As 5G networks roll out more powerful amplifiers are needed to handle the richer data streams that enable high-definition live experiences and immersive home entertainment. Beyond entertainment the ever-expanding Internet of Things creates a demand for specialized amplifiers to ensure clear communication between the growing network of interconnected devices from smart speakers like Alexa to a variety of industrial applications.

CHALLENGES:

-

Streaming and Bluetooth speakers mean fewer people need separate amplifiers.

-

The rise of streaming services like music and video platforms has led to a shift in how consumers experience audio and visual content potentially reducing their dependence on traditional dedicate amplifiers.

IMPACT OF RUSSIA-UKRAINE WAR

The war between Russia-Ukraine is causing problems for companies which makes amplifiers. Even though stereos and speakers are the most popular kind of amplifier sold for things like home entertainment. Most of the amplifiers are actually used in cell phones and other mobile devices are more than a quarter of all amplifiers. This is the area that will likely be hurt the most by the war. Russia is the major supplier of important materials like platinum which is used in parts of amplifiers called sensors and makes up 10% of the world's supply is no longer selling these materials to many countries. This disruption combined with potential gas shortages in Europe which supplies more than half of the energy used in the European Union and could impact the production of computer chips creates a very difficult situation for companies that make amplifiers.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown could hit the impact on amplifier market by showing thing like when times get difficult the companies making amplifiers might wait to buy new machines with fancy features like AI. This could slow down the market's growth since new technology is a big selling point for electronics. Also people might be less likely to go all out on top-of-the-line amplifiers with the best sound and picture. This means fewer people buying the powerful amplifiers needed for those features which again hurts the market.

Amplifiers Market Segment Overview:

By Type

The power amplifiers hold the dominant position in the market. This is driven by the high demand for strong audio experiences in consumer electronics like smartphones, home theaters and car audio systems. These devices rely on power amplifiers to boost weak signals for clear and powerful sound.

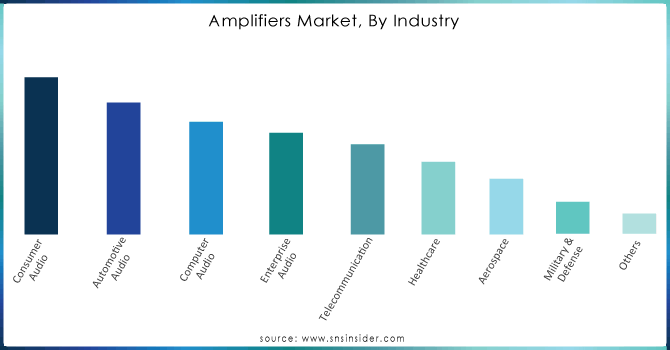

By Industry

The consumer audio market dominates the amplifier market driven by the rising popularity of music streaming services, home entertainment systems and portable speakers. The increasing demand for high-quality audio experiences fuels the need for powerful and efficient amplifiers in these consumer electronics.

To Get Customized Report as per your Business Requirement - Request For Customized Report

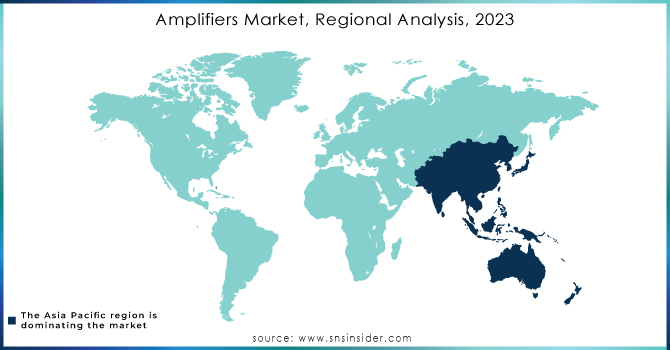

Amplifiers Market Regional Analysis:

The Asia Pacific region is dominant in the amplifier market driven by a confluence of factors. Its massive population especially in increasing economies like China and India creates a vast potential consumer base for electronics that rely on amplifiers. These growing economies in Asia mean people have more money to spend on things they want like fancy electronics with speakers that need amplifiers. And lots of big electronics companies already make their products in Asia so it's an easy place to sell more amplifiers.

The North America is a fastest growing region for top-notch audio experiences driving demand for powerful and complex amplifiers during the forecast periods. Europe has a well-established consumer electronics market with a high emphasis on quality audio experiences which translates to a steady demand for amplifiers.

KEY PLAYERS :

The key players in amplifiers are Samsung Electronics Co Ltd, Qualcomm Inc, Infineon Technologies AG, Xilinx Inc, Texas Instruments Inc, STMicroelectronics, Yamaha, Qorvo, Toshiba Corporation, Broadcom Inc., Maxim Integrated, NXP Semiconductors, Analog Devices Inc, Infineon Technologies, Analog Devices and Other.

RECENT DEVELOPMENT

In February 2024: Big news for industrial designers is the STMicro, ADI, and Rohm released new op amps boasting low offset, low drift and wide gain bandwidth - perfect for next-gen industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 29.75 Billion |

| Market Size by 2032 | US$ 55.62 Billion |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • The trend towards premium audio and video experiences • Fancier electronics surround sound, high-def TVs demand more advanced amplifiers to handle their complex signals. |

| Restraints | • The large size and bulk of traditional amplifiers can pose a significant challenge especially for those who are short on space in their homes or prioritize a sleek and modern aesthetic • Traditional amplifiers are big and heavy it costs more to move them around at every stage of the process from factories to stores and even to your home. |