Ultrasound Gels Market Size & Overview

Get More Information on Ultrasound Gels Market - Request Sample Report

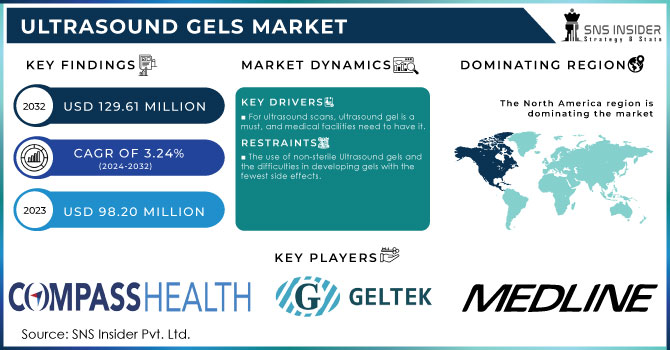

The Ultrasound Gels Market Size was valued at USD 98.20 Million in 2023 and is expected to reach USD 130.84 Million by 2032, growing at a CAGR of 3.24% over the forecast period of 2024-2032.

The ultrasound gels market is undergoing a transformative phase, shaped by key healthcare dynamics. Our report delves into government procurement and tender share, revealing how public sector contracts drive bulk demand. It also explores the frequency of ultrasound procedures globally, linking the rise in imaging diagnostics to increased gel usage. Market fluctuations are addressed through an analysis of raw material pricing index, emphasizing cost implications for manufacturers. In parallel, the report highlights regulatory approval and certification trends, focusing on the impact of global compliance standards. Additionally, the influence of healthcare reimbursement policies is examined, showing how insurance coverage affects purchasing behavior. These insights collectively offer a data-rich perspective on the evolving market landscape.

The US Ultrasound Gels Market Size was valued at USD 28.33 Million in 2023 with a market share of around 78% and growing at a significant CAGR over the forecast period of 2024-2032.

The US ultrasound gels market is experiencing significant growth, driven by increasing demand for diagnostic imaging and advancements in healthcare technology. As healthcare institutions, including those backed by organizations like the American College of Radiology (ACR), continue to expand imaging services, the need for ultrasound gels has risen. Additionally, the rise in outpatient services, particularly within Ambulatory Surgery Centers (ASCs), has further fueled demand. US-based companies like Parker Laboratories, Inc. and Medline Industries, Inc. are contributing to market growth with innovative, high-quality products that meet stringent regulatory standards set by the FDA and other US bodies, ensuring consistent supply and high adoption rates across healthcare settings.

Ultrasound Gels Market Dynamics

Drivers

-

Widespread Adoption of Point-of-Care Ultrasound Devices Across Emergency and Remote Healthcare Facilities

The rising integration of point-of-care ultrasound devices in emergency rooms, ambulances, and remote clinics is creating new demand for ultrasound gels. These compact imaging systems enable rapid diagnostics outside of traditional radiology departments and are increasingly used in time-sensitive scenarios such as trauma, cardiac arrest, and rural care. Point-of-care ultrasound often requires mobile and single-use gel packaging for hygiene and convenience, which pushes manufacturers to innovate in product design and delivery systems. Emergency healthcare professionals favor gels that can be easily stored, transported, and used without preparation. Additionally, increasing government investment in mobile healthcare and telemedicine services supports this growing adoption trend. As hospitals and clinics expand their use of these devices, the need for compatible ultrasound gels that provide efficient acoustic coupling and patient comfort will rise. This is further supported by U.S. initiatives to improve healthcare access in underserved areas, where portable ultrasound units are proving especially beneficial.

Restraints

-

Increasing Concern Over Chemical Allergens in Conventional Gel Formulations Limits Product Adoption in Sensitive Patient Groups

A growing number of healthcare providers are raising concerns over the presence of potential allergens and skin irritants in standard ultrasound gel formulations. Ingredients such as parabens, propylene glycol, or certain synthetic fragrances can cause adverse reactions, especially in sensitive populations like neonates, elderly patients, or individuals with chronic skin conditions. As awareness around chemical sensitivity and patient safety increases, hospitals are reevaluating their supply choices. In some cases, facilities are reducing use of generic or low-cost gels in favor of specialized hypoallergenic variants, which may be more expensive or harder to source consistently. This shift adds complexity to procurement processes and limits purchasing flexibility. Furthermore, patients who report skin reactions during or after ultrasound procedures may delay or avoid follow-up imaging, potentially impacting care delivery. As these safety concerns continue to gain traction, manufacturers that do not address allergen content may face reduced market access or reputational risk in clinical settings.

Opportunities

-

Rising Demand for Biodegradable and Single-Use Ultrasound Gel Packaging in Infection-Controlled Clinical Environments

Infection control has become a top priority for hospitals and diagnostic facilities, especially after the COVID-19 pandemic. This shift is opening doors for biodegradable and single-use ultrasound gel packaging formats that support safety and sustainability. Single-use sachets or applicator tubes reduce the risk of cross-contamination during imaging procedures and appeal to infection control departments looking to standardize hygiene practices. Biodegradable packaging is also gaining favor in green-certified healthcare institutions focused on reducing medical waste. There is growing support from U.S. healthcare providers and purchasing groups for products that meet both clinical and environmental standards. Manufacturers offering eco-friendly, disposable packaging solutions are likely to win competitive bids and gain long-term contracts with leading hospital networks. Additionally, regulatory momentum around sustainable medical packaging creates an innovation-friendly environment. This trend represents a strategic opportunity for ultrasound gel suppliers to enhance their product offerings while aligning with the evolving priorities of healthcare administrators and policymakers.

Challenge

-

High Transportation and Cold Chain Costs for Bulk Gel Shipments Impact Profit Margins for Large-Volume Distributors

Ultrasound gels, especially those supplied in large drums or gallon containers, can be heavy and temperature-sensitive. Maintaining the right viscosity and consistency during shipping often requires temperature-controlled logistics, particularly in extreme climates. This adds to shipping and handling costs, which can be significant for bulk orders delivered to hospitals or distributors. As freight rates remain volatile and cold-chain capabilities remain limited in some areas, manufacturers must invest in specialized packaging and monitoring systems. These costs eat into margins, especially in contracts with public hospitals or government tenders where pricing is tightly regulated. Additionally, delays in logistics can affect product usability, leading to wastage and customer dissatisfaction. U.S.-based distributors, particularly those serving rural or cross-border regions, are increasingly concerned about the financial and operational impact of these logistical constraints. Addressing this challenge requires supply chain innovations, better forecasting, and possibly regional manufacturing hubs to reduce dependency on long-haul shipping routes.

Ultrasound Gels Market Segmentation Analysis

By Type

The non-sterile segment of the ultrasound gels market is the dominant category, holding a significant share of 63.5% in 2023. This segment is expected to maintain its lead due to its widespread use in routine diagnostic imaging procedures, where sterility is not a critical requirement. Non-sterile ultrasound gels are preferred in standard medical settings like clinics, diagnostic centers, and ambulatory centers, offering cost-effective solutions for healthcare providers. For example, the American Medical Association and other health organizations highlight the importance of cost-efficiency and availability, which supports the preference for non-sterile options in routine procedures. Additionally, the versatility and ease of use in non-sterile gels make them suitable for use with portable devices, particularly in point-of-care settings. The rising adoption of these devices, particularly in emergency medical services, further drives demand. With a more affordable price point, non-sterile gels are a preferred choice for various medical applications.

By End-User

In the ultrasound gels market, hospitals dominate the end-user segment with a significant share of 47.2% in 2023. Hospitals continue to be the primary consumers of ultrasound gels due to their comprehensive diagnostic capabilities, which require the use of ultrasound in various medical fields, including obstetrics, cardiology, and emergency care. For example, hospitals like the Cleveland Clinic or Mayo Clinic are constantly integrating advanced ultrasound systems for diagnostics, driving the demand for gels in clinical settings. Additionally, hospitals often feature larger departments with higher patient throughput, further solidifying their position as the key end-users. The increased prevalence of chronic diseases, the rising need for prenatal care, and the expansion of emergency care departments have led to a consistent demand for ultrasound gels. As hospitals invest in more advanced imaging technologies, the requirement for ultrasound gels continues to grow, especially in high-volume imaging procedures like cardiac and musculoskeletal imaging.

Ultrasound Gels Market Regional Outlook

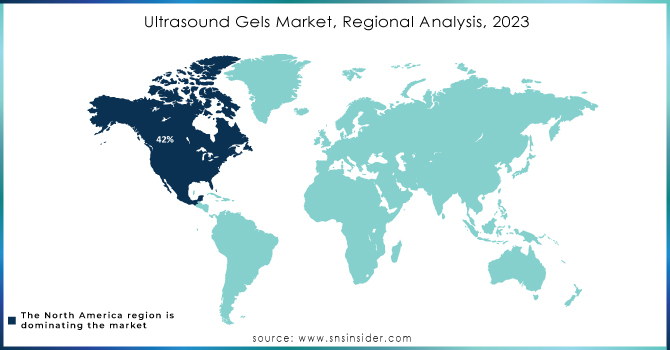

North America, with a market share of 36.8% in 2023, dominated the ultrasound gels market due to its advanced healthcare infrastructure, high demand for diagnostic imaging, and substantial investments in medical technologies. The U.S., in particular, plays a crucial role in the growth of this market. According to the American Hospital Association (AHA), hospitals in the U.S. are increasingly adopting ultrasound for diagnostic and therapeutic purposes, contributing to the steady demand for ultrasound gels. Moreover, the region benefits from a strong regulatory environment and frequent product innovations, fostering market growth. For example, organizations like the FDA oversee the rigorous approval of ultrasound gel products, ensuring quality and safety standards that boost consumer confidence. Canada also contributes significantly with its robust healthcare system, while Mexico's growing medical tourism industry presents a rising demand for diagnostic procedures, further supporting the regional dominance of North America.

Moreover, the Asia Pacific region emerged as the fastest growing region in the ultrasound gels market, with a significant growth rate during the forecast period of 2024 to 2032. This rapid growth is driven by the expanding healthcare infrastructure in countries like China, India, and Japan, where the demand for medical imaging is rising due to the increasing prevalence of chronic diseases and a growing elderly population. India, for instance, is significantly investing in healthcare modernization, as stated by the Indian Ministry of Health and Family Welfare, leading to higher adoption rates of diagnostic ultrasound. China's National Health Commission supports innovations in medical technologies, including ultrasound imaging, which drives the demand for compatible ultrasound gels. Additionally, government initiatives in these countries, along with the rising number of diagnostic centers and hospitals, are fueling the expansion of the market. The region’s large and diverse population also presents a vast potential customer base, contributing to the market's rapid growth.

Need any customization research on Ultrasound Gels Market - Enquiry Now

Key Players in the Ultrasound Gels Market

-

Parker Laboratories, Inc. (Aquasonic 100, Clear Image Ultrasound Gel)

-

HR Pharmaceuticals, Inc. (HR Ultrasound Gel, HR Lubricating Gel)

-

Medline Industries, LP (Medline Ultrasound Gel, Medline Echo Ultrasound Gel)

-

ECO-MED PHARMACEUTICAL INC. (EcoGel Ultrasound Gel, EcoGel 200)

-

National Therapy Products Inc. (NTP Ultrasound Gel, NTP Electrotherapy Gel)

-

Ultragel Hungary 2000 Kft. (Ultragel Ultrasound Gel, Ultragel Contact Medium)

-

Sonogel Vertriebs GmbH (Sonogel Ultrasound Gel, Sonogel Clear Gel)

-

Trivitron Healthcare Pvt. Ltd (Trivitron Ultrasound Gel, Trivitron Echo Gel)

-

Phyto Performance Italia S.R.L (Phyto Performance Ultrasound Gel, Phyto UltraGel)

-

Scrip Inc. (Scrip Ultrasound Gel, Scrip Clear Gel)

-

Cardinal Health, Inc. (Cardinal Health Ultrasound Gel, Clear Image Ultrasound Gel)

-

NEXT Medical Products Company (NEXT Ultrasound Gel, NEXT Echo Gel)

-

Safersonic (Safersonic Ultrasound Gel, Safersonic Clear Gel)

-

Telic Group (Telic Ultrasound Gel, Telic Clear Gel)

-

Steroplast Healthcare Limited (Steroplast Ultrasound Gel, Steroplast Clear Gel)

-

EDM Medical Solutions (EDM Ultrasound Gel, EDM Clear Ultrasound Gel)

-

P.W. Coole & Son Ltd Trading (Coole Ultrasound Gel, Coole Clear Gel)

-

AiM Medical Technologies, LLC (AiM Ultrasound Gel, AiM Clear Gel)

-

Rohdé Produits (Rohdé Ultrasound Gel, Rohdé Clear Gel)

-

Ceracarta S.p.A. (Ceracarta Ultrasound Gel, Ceracarta Clear Gel)

Recent Developments

-

February 2024: HR Pharmaceuticals Inc. rebranded and changed its name to reflect growth and innovation. This new identity aligns with its expanded focus on advancing patient care solutions, demonstrating a commitment to future healthcare needs and the company’s vision for continued leadership in the pharmaceutical industry.

-

September 2023: Parker Laboratories introduced new ultrasound innovations at the ENA Annual Meeting. The UltraDrape II UGPIV Barrier and Securement Dressing, along with Tristel ULT High-Level Disinfectant Foam, aim to improve patient safety, reduce healthcare costs, and enhance efficiency in emergency departments using ultrasound for vascular access.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 98.20 Million |

| Market Size by 2032 | USD 130.84 Million |

| CAGR | CAGR of 3.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Non-sterile, Sterile) •By End-User (Hospitals, Clinics, Diagnostic Center, Ambulatory Center) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Parker Laboratories, Inc., HR Pharmaceuticals, Inc., Medline Industries, LP, ECO-MED PHARMACEUTICAL INC., National Therapy Products Inc., Ultragel Hungary 2000 Kft., Sonogel Vertriebs GmbH, Trivitron Healthcare Pvt. Ltd, Phyto Performance Italia S.R.L, Scrip Inc. and other key players |