Slide Stainer Market Size & Overview:

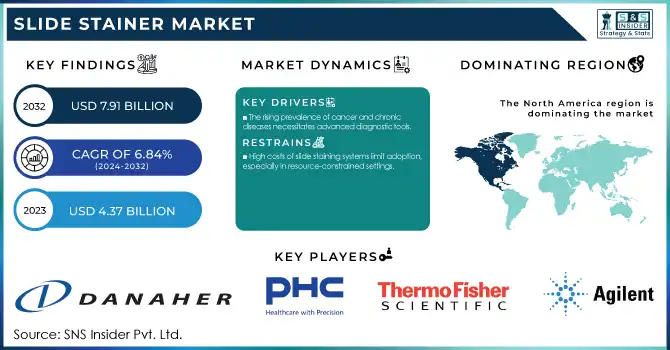

The Slide Stainer Market Size was valued at USD 4.37 Billion in 2023 and is expected to reach USD 7.91 Billion by 2032, growing at a CAGR of 6.84% over the forecast period 2024-2032.

To get more information on Slide Stainer Market - Request Free Sample Report

The report on the Slide Stainer Market provides a detailed analysis of the slide stainer market and offers comprehensive insights into key aspects like market trends, market share of histopathological diseases, and trends at the global level that are expected to propel the growth in the overall market. It analyzes the global and regional adoption rate and highlights the market penetration among hospitals, diagnostic labs, and research institutions. The report also provides a detailed analysis of device shipment volume and installed base trends across the key devices, together with average cost analysis and price trend assessment. Also covered are enforcement of regulatory compliance and standards adoption by region, as well as trends in healthcare spending from government, commercial, and private sectors. This data-driven analysis helps stakeholders understand market growth dynamics, investment trends, and evolving technology adoption in the slide stainer industry.

Slide Stainer Market Dynamics

Drivers

-

The rising prevalence of cancer and chronic diseases necessitates advanced diagnostic tools.

Growth in Cancer and Chronic Disease Cases Globally to Fuel Demand for Slide Stainer Market As cancer and chronic diseases become increasingly common all over the world, the demand for Slide Stainers increases along with the prevalence of these conditions as advanced detection of these diseases often requires advanced diagnostic tools. According to the World Health Organization, in 2022 there were an estimated 20 million new cancer diagnoses made worldwide, which means this number could rise to 35 million by 2050. This increase is due to population aging, growth, and increased exposure to risk factors including unhealthy diets, physical inactivity, alcohol consumption, and tobacco use. The increasing number of cases of chronic diseases, especially diabetes, is also augmenting the growth of demand for diagnostic innovations. According to the Global diabetes atlas, about 830 million people worldwide are diagnosed with diabetes.

The high prevalence emphasizes the importance of accurate and efficient diagnostic tools, like slide stainers, for the rapid identification and successful treatment of diabetes-related complications. Histopathological analysis of tissue samples is a result of an increasing number of samples due to the rising incidence of these diseases. As slide stainers are paramount in automating the staining process of such tissue samples, they are widely used to ensure higher diagnostic accuracy and efficiency. For example, in cancer diagnostics, timely and accurate staining of biopsy samples is crucial for identifying malignancies and developing appropriate treatment plans. When it comes to chronic diseases like diabetes, slide stainers play a vital role in identifying tissue abnormalities early, allowing for timely treatment and better patient outcomes.

Restraints:

-

High costs of slide staining systems limit adoption, especially in resource-constrained settings.

Slide stainers are prohibitively expensive devices with a cost barrier that prevents their general adoption, especially in smaller laboratories and facilities with limited budgets. Moreover, import data also showcases preferential pricing of advanced models like the TISSUE-TEK PRISMA PLUS Automated Slide Stainer from the Netherlands is imported at $ 32,607.07 to India. These large initial investments can pose a substantial barrier for many institutions. In addition, the technical nature of these devices requires steady maintenance, which requires servicing training, thus adding to the operating cost. As seen in developing parts of the world, where budgets for healthcare are often stretched thin, this can be crippling financially. As a result, the prohibitive expense of slide stainers prevents their widespread adoption, restricting the use of these modern diagnostic instruments in low-resource environments.

Opportunities:

-

Integration of artificial intelligence enhances automation and diagnostic accuracy in slide staining processes.

Machine Learning with artificial intelligence (AI) integrated slide stainer systems reveals a new opportunity where diagnostic accuracy and efficiency can be drastically improved in pathology. A comprehensive meta-analysis published in June 2023 evaluated AI's performance in digital pathology, encompassing over 152,000 whole slide images across various diseases. The results showed a mean sensitivity of 96.3% and a mean specificity of 93.3% for AI applications, highlighting the potential for AI to enhance diagnostic accuracy. Roche expanded its digital pathology platform in September 2024 by adding more than 20 new AI algorithms from eight partners to its platform. This project is said to improve cancer diagnostics and precision medicine and is part of a wider trend of using AI to improve patient outcomes. By integrating AI technologies into the slide staining process, diagnostic accuracy has been improved, lab workflows have been streamlined, and efficiency has increased. For instance, pathology laboratories observed a reduction in the turnaround time by 50% with the integration of AI-powered automated slide stainers, enabling higher activity levels at lower operational costs. With growing investments in advanced diagnostic tools at healthcare facilities, the integration of AI into slide stainer systems is set to become the norm, which will ultimately lead to enhanced diagnostic precision and operational efficiency.

Challenges:

-

Intense market competition requires continuous innovation and differentiation among key players.

One of the main challenges in the Slide Stainer Market is the competition among key players, which forces companies to constantly innovate & differentiate. This competitive environment is driven by the presence of numerous players offering similar products, leading to price wars that can erode profit margins. To maintain market position, companies have to invest in R&D for new functionality like integration with smart know-how, real-time monitoring, and increased automation. Moreover, the increasing need for green solutions is driving manufacturers to build products with low reagent consumption and waste generation. The market also reports the increasing prevalence of portable slide stainer products, which target laboratories with limited space. Moreover, the competitive landscape within the market faces challenges in this domain from the threat of substitutes as well the above-mentioned factors such as rapid staining techniques and the increasing development of imaging technologies such as digital pathology, exemplify a large amount of competitive threat in the marketplace.

Slide Stainer Market Segmentation Insights

By Product

The Reagents & kits segment led the market and contributed 60% of the share. This large market share is due to various factors, such as the growing need for specialized staining techniques in histopathology and cytology. In October 2023, the U.S. Food and Drug Administration (FDA) started approving various novel reagents and kits for staining slides, thereby improving the overall laboratory diagnosis. For example, in 2024, several novel immunohistochemistry (IHC) reagents were approved by the FDA for cancer diagnosis, which is anticipated to boost segment growth.

The Cancer Moonshot initiative by the National Cancer Institute has allocated significant funding for research in cancer diagnostics, including the development of novel stains that enhance detection capabilities. The increasing utilization of its specialized reagents and kits in research laboratories and diagnostic centers has been a major factor in driving this market. Moreover, particularly within the realm of diagnostic tests, a data point noting a 5% year-over-year growth in histopathology and cytology tests has been reported by CDC up to October 2023. The increase in testing volume is by definition related to the higher consumption of reagents and kits. In addition, the increasing focus on personalized medicine has led to the need for more specialized staining reagents, thereby fueling the growth of the advanced reagents market. The National Institutes of Health (NIH) has reported a 15% increase in funding for precision medicine research, which has indirectly boosted the reagents and kits market in slide staining applications.

By Technology

The hematoxylin and eosin (H&E) segment dominated the market and accounted for a revenue share of 29% in 2023. H&E staining is the most predominant because it is one of the foundations of histopathology and has vast application areas in disease diagnosis. According to the National Center for Health Statistics, nearly 80% of the first-time examination of tissue in pathology laboratories in the United States is performed by H&E staining. H&E's widespread use comes from its clarity in visualizing tissue structures, which is a necessity for diagnosing many conditions, especially cancers. As the National Cancer Institute stated, "H&E staining is an essential consideration for the diagnosis and staging of cancer, where it is the gold standard for initial tissue evaluation," implementing H&E staining technology vital for accurate cancer diagnostics. In the United States alone, nearly 1.9 million new cancer cases were diagnosed in 2024 according to the US government data, and most of these new cases require multiple H&E-stained slides for a diagnosis and further treatment plan. In addition, the Centers for Medicare & Medicaid Services (CMS) has also indicated a gradual increase in reimbursement rates for histopathology services, including H&E stained procedures, which has motivated laboratories to sustain and enhance their H&E staining capabilities.

By Application

In 2023, disease diagnostics accounted for the highest share of revenue at 64%. This significant market share is largely fueled by a proliferating global disease burden and the importance of diagnosis in the treatment process. The Centers for Disease Control and Prevention (CDC) reports that chronic diseases are the leading causes of death and disability in the United States, accounting for 7 out of 10 deaths annually. With such a high prevalence of chronic conditions, effective diagnostics are essential, with slide staining being a key part of this process. The National Institutes of Health (NIH) has ramped up funding for diagnostic research dramatically, particularly in the context of improving early detection modalities for diseases of mortality such as cancer, cardiovascular disorders, and neurodegenerative conditions. The NIH funded over $6 billion for cancer research alone in 2024 with part of that money going directly to improving diagnostic tools like advanced slide staining methods.

In fact, the U.S. Food and Drug Administration (FDA) has been proactively spurring the development of new diagnostic tools via its Breakthrough Devices Program. This initiative has resulted in the approval of several new slide-staining technologies, enabling the diagnosis of disease. In 2024, the number of diagnostic devices granted since breakthrough designation at the FDA increased by 20% from the same period the previous year, which suggests that there is an increasing acknowledgment of the need for timely diagnosis to treat various diseases.

By End Use

The hospitals and diagnostics laboratories held the largest market share of 34% in 2023. This significant market share can be attributed to the central role these institutions play in healthcare delivery and disease diagnosis. In a country with more than 6,000 hospitals performing millions of diagnostic procedures every year, according to the American Hospital Association, this is no small concern. According to the Centers for Disease Control and Prevention (CDC), hospital laboratories across the U.S. perform more than 7 billion clinical lab tests annually, a large percentage of which includes slide staining protocols. In 2023, the Centers for Medicare & Medicaid Services (CMS) adopted policies to enhance the quality and efficiency of diagnostic care in hospitals and laboratories. Thus, these initiatives are driving investment in advanced diagnostic technologies like state-of-the-art slide stainers. CMS data shows that reimbursement rates for many diagnostic procedures have been adjusted to account for the use of more sophisticated equipment, incentivizing hospitals and labs to adopt newer technologies. In addition, market trends toward laboratory consolidation and large, consolidated diagnostic centers are also increasing, according to the College of American Pathologists (CAP). This has allowed hospitals and diagnostic laboratories to purchase high-throughput slide-staining systems, entrenching their market dominance.

Slide Stainer Market Regional Analysis

In 2023, North America held a 40% share of the slide stainer market. North America's dominance can be attributed to its advanced healthcare infrastructure, high healthcare spending, and strong presence of key market players. According to the U.S. Department of Health and Human Services, a whopping $4.3 trillion dollars was spent on national health expenditure in 2024, which amounts to 18.3% of GDP, this denotes a significant amount of money invested in the new healthcare technologies for diagnostic purposes. The National Institutes of Health (NIH) has consistently increased funding for biomedical research, with a significant portion allocated to improving diagnostic technologies. In 2024, the NIH budget for research grants exceeded $32 billion, fostering innovation in areas such as slide-staining techniques and automated diagnostic systems.

The Asia Pacific region is anticipated to be the fastest-growing with the fastest CAGR from 2024 to 2032. The rapid growth of the Asia Pacific region is attributed to a strengthening healthcare infrastructure, rising government expenditure on healthcare, and the increasing prevalence of chronic diseases. The World Health Organization reports that non-communicable diseases are responsible for 71% of all deaths globally, with a significant burden in Asia Pacific countries. This has led to increased demand for advanced diagnostic tools, including slide stainers. According to the National Health Commission of China, China's health expenditure increased by 12% year-on-year in 2024, and the majority of the spending was used for upgrading diagnostic testing capabilities of hospitals and laboratories. Likewise, the National Health Policy of India aims to raise public health expenditure to 2.5% of GDP by 2025 this is anticipated to increase the uptake of advanced medical technologies in the country, such as slide strainers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

F. Hoffmann-La Roche Ltd. (Switzerland): [Ventana BenchMark ULTRA, Ventana HE 600]

-

Danaher Corporation (US): [Leica ST5020, Leica ST5010]

-

PHC Holdings Corporation (Japan): [Tissue-Tek Prisma Plus, Tissue-Tek DRS 2000]

-

Thermo Fisher Scientific Inc. (US): [Shandon Varistain Gemini, Shandon Varistain 24-4]

-

Agilent Technologies, Inc. (US): [Dako CoverStainer, Dako Autostainer Link 48]

-

Merck KGaA (Germany): [Merck HistoStar, Merck SlideStainer]

-

Becton, Dickinson and Company (US): [BD PrepStain, BD Cytology Stainer]

-

Siemens Healthineers AG (Germany): [Siemens Hematek 3000, Siemens Hematek Slide Stainer]

-

Biocare Medical, LLC (US): [intelliPATH FLX, ONCORE Pro]

-

ELITechGroup (France): [Aerospray Hematology Slide Stainer, Aerospray Gram Slide Stainer]

-

Sakura Finetek USA, Inc. (US): [Tissue-Tek Prisma, Tissue-Tek DRS 2000]

-

SLEE medical GmbH (Germany): [MAS Stainer, MTS Stainer]

-

Amos Scientific Pty Ltd. (Australia): [Histo-Pro 300, SlideMaster 300]

-

MEDITE Medical GmbH (Germany): [TST44 C, TES99]

-

CellPath Ltd. (UK): [CellStain, SlideMaster]

-

Diapath S.p.A. (Italy): [Donatello Series, Galileo Series]

-

Bio SB, Inc. (US): [TintoStainer, PolyDetector Plus]

-

Rockland Immunochemicals, Inc. (US): [ImmunoStainer, HistoStain]

-

Cell Signaling Technology, Inc. (US): [SignalStain, IHC Autostainer]

-

Diagnostic BioSystems, Inc. (US): [AutoStainer, PolyStain]

Recent Developments

-

In September 2024, Leica Biosystems launched a new line of eco-friendly staining reagents to help meet the increasing demand for sustainable laboratory practices. They are designed to be more environmentally friendly without compromising on the quality of staining.

-

In January 2025, Danaher Corporation launched a small, high-throughput slide staining instrument under its life sciences division, focusing on small to medium-sized laboratories and driving market penetration into this segment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.37 Billion |

| Market Size by 2032 | USD 7.91 Billion |

| CAGR | CAGR of 6.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents & Kits {Stains, Probes, Diluents & Buffers, Blocking Sera & Reagents, Mounting Media, Fixative Reagents, and Embedded Media, Antibodies}, Equipment {Automated and Semi-automated Slide Stainer, Manual Staining Set}, Consumables & Accessories) • By Technology (Hematoxylin and Eosin, Immunohistochemistry, Special Stains, Cytology, Microbiology, In-situ Hybridization, Hematology) • By Application (Disease Diagnostics {Breast Cancer, Lymphoma, Prostate Cancer, Non-small Lung Cancer, Gastric Cancer, Others}, Medical Research) • By End-use (Hospitals and Diagnostics Laboratories, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd., Danaher Corporation, PHC Holdings Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Merck KGaA, Becton, Dickinson and Company, Siemens Healthineers AG, Biocare Medical, LLC, ELITechGroup, Sakura Finetek USA, Inc., SLEE medical GmbH, Amos Scientific Pty Ltd., MEDITE Medical GmbH, CellPath Ltd., Diapath S.p.A., Bio SB, Inc., Rockland Immunochemicals, Inc., Cell Signaling Technology, Inc., Diagnostic BioSystems, Inc. |