Cancer Diagnostics Market Report Scope & Overview:

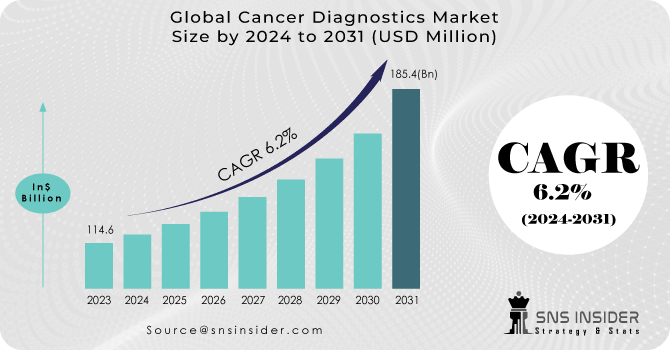

The Cancer Diagnostics Market Size was valued at USD 103.30 Billion in 2023 and is expected to reach USD 176.69 Billion by 2032 and grow at a CAGR of 6.16% over the forecast period 2024-2032. This report indicates the growing incidence and prevalence of cancer, fueling the need for sophisticated diagnostic solutions, and discusses the growing adoption of diagnostic tests in various regions. The research investigates trends in the volume and utilization of diagnostic devices and presents regional differences in availability and technology. Furthermore, it examines healthcare expenditure on cancer diagnosis across government, commercial, private, and out-of-pocket spending, while evaluating the influence of these investments on screening and early detection rates. The report also explores changing consumer and healthcare provider trends, highlighting the move towards non-invasive, quick, and AI-based diagnostic methods, and the influence of digital platforms in enhancing diagnostic accessibility.

Get more information on Cancer Diagnostics Market - Request Sample Report

Market Dynamics

Drivers

-

The cancer diagnostics market is primarily driven by the rising global cancer burden, leading to an increased demand for early detection and advanced diagnostic solutions.

Cancer caused approximately 10 million deaths in 2023, as per the WHO, and was dominated by breast, lung, colorectal, and prostate cancers. The increased awareness and usage of cancer screening programs, along with government support, have significantly accelerated market growth. Liquid biopsy, AI-driven imaging, and next-generation sequencing (NGS) technologies are transforming early detection through non-invasive, highly precise diagnostic methods. Also, growing incorporation of biomarker-based diagnostics and personalized medicine is fueling the demand for precise cancer diagnosis. The growth of telemedicine and remote diagnostic services further expands access, especially in underserved communities. Moreover, growing investment by major industry players and healthcare organizations in R&D for emerging diagnostic technologies are fueling the market. For example, the use of AI-based radiology software has greatly enhanced image accuracy, with up to 30% decrease in false positives in mammography. Increasing partnerships between diagnostic and pharmaceutical companies to create companion diagnostics for targeted therapy are also driving market growth.

Restraints

-

The cancer diagnostics market faces restraints, primarily due to the high cost of advanced diagnostic tests and limited accessibility in low-income regions.

Most advanced diagnostic technologies, including NGS and AI pathology, are expensive and, therefore, inaccessible to most of the world's population. Moreover, reimbursement issues in some countries prevent patients from accessing novel cancer diagnostics. Most insurance companies only partially cover or omit novel diagnostic approaches from their schemes, limiting their use on a large scale. Another significant impediment is the sophisticated regulatory environment, whereby diagnostic tests are required to be under go thorough clinical testing and approvals prior to commercial launch. Regulators such as the FDA and EMA have stringent guidelines, resulting in lengthy approval processes that discourage market entry for new diagnostic technologies. In addition, scarce skilled professionals to man sophisticated diagnostic equipment and decipher complicated genomic information continues to be a hindrance to mass adoption. The absence of standardized procedures in some cancer diagnostics, especially liquid biopsy and multi-cancer early detection (MCED), is also of concern to test accuracy and reliability. These aspects together hold back the fast development of the cancer diagnostics market notwithstanding the growing need for early cancer detection solutions.

Opportunities

-

The rapid advancements in AI-driven diagnostics, liquid biopsy, and multi-cancer early detection (MCED) technologies present significant opportunities in the cancer diagnostics market.

Liquid biopsy, an non-invasive diagnostic technique, is poised to transform cancer screening by enabling real-time monitoring of tumors using circulating tumor DNA (ctDNA) and exosomes. Guardant Health and Grail Inc. are heavily investing in MCED tests with the goal of identifying several types of cancer in one test. The rising use of companion diagnostics in precision oncology is another large opportunity, with pharmaceutical firms partnering with diagnostic companies to create targeted treatments. The expanding use of wearable and home-based cancer screening devices, like smart biosensors and artificial intelligence-based skin cancer detection apps, is increasing market reach. Moreover, the rise in government grants and private investment in oncology research is driving market trends. The growth of cancer diagnostics in emerging markets, where the healthcare infrastructure is growing rapidly, is offering untapped growth prospects. Additionally, cloud-based digital pathology solutions are also facilitating remote diagnosis in real time, solving issues of accessibility in rural and underdeveloped areas. All these technological advances and rising investments will propel strong growth opportunities in the future years.

Challenges

-

One of the major challenges in the cancer diagnostics market is ensuring high accuracy and reliability in emerging diagnostic methods such as liquid biopsy and AI-powered imaging.

Although these technologies promise much, widespread clinical validation and standardization pose a challenge. Liquid biopsy, for example, continues to struggle with false positives and false negatives, affecting diagnostic confidence. The incorporation of AI in imaging diagnostics also needs large datasets to effectively train models and, depending on differences in data quality, can be impacted by performance. Another problem is the data security and privacy issues in cloud-based cancer diagnostic platforms because patient genetic and medical information must adhere to rigid compliance with laws such as HIPAA and GDPR. Additionally, the lengthy clinical trial periods for new cancer diagnostic technologies hinder commercialization and implementation. The escalating regulatory compliance burden in extensive validation for novel biomarkers and diagnostic tests also represents a major challenge. Also, logistical challenges in sample transportation, especially for liquid biopsies and complex molecular tests, result in sample degradation, impacting test accuracy. The reluctance of healthcare professionals to embrace new technologies, owing to the high learning curve and necessary infrastructure upgrades, further hinders market adoption despite technology improvements.

Segmentation Analysis

By Product

The Consumables segment was the market leader in 2023 with 53.4% of the overall market. The reason for this dominance is due to the strong demand for reagents, test kits, and assay consumables due to the requirement of these products for recurrent and repeated cancer diagnostic procedures. The rising usage of biomarker-based testing, liquid biopsies, and high-molecular diagnostics has also further stimulated demand for consumables, and hence they have become a vital element of cancer diagnostics. Further, growth in automation and precision medicine has driven more advanced and high-throughput consumables with increased specialisation, contributing to the market share.

The Services segment is anticipated to grow at a considerable rate during the forecast period because of the increasing demand for outsourced diagnostic services, telepathology, and AI-driven cancer screening. As the complexity of cancer detection increases, hospitals and laboratories are increasingly depending on specialized diagnostic service providers to deliver precise and early diagnosis. Apart from that, increased utilization of telepathology-based diagnostics and increased implementation of AI-powered analytics-based pathology services is poised to bolster this market growth further.

By Type

The In Vitro Diagnostics (IVD) category led the cancer diagnostics market in 2023 with a share of 52.0%. The extensive use of IVD tests, such as molecular diagnostics, immunoassays, and liquid biopsies, has made it the leading category. The rise in the adoption of non-invasive and early detection tests has also enhanced the market for IVD. Furthermore, the regulatory clearance for advanced IVD technologies, along with rising awareness regarding cancer screening programs, has boosted its growth. The capability of IVD tests to offer quick, precise, and economical detection of cancer has positioned them as the preferred option among healthcare providers.

Meanwhile, Laboratory Developed Tests (LDTs) are expected to develop at the most rapid pace based on the increased demand for cancer diagnostics personalized. The expanding intricacy of cancer mutations created a demand for personalized testing solutions, fueling the use of LDTs. LDTs also offer the advantage of test development flexibility through the ability of laboratories to customize and validate tests specific to the type of cancer, an aspect important in selecting targeted therapy.

By Application

The Breast Cancer segment led the cancer diagnostics market in 2023, holding 12.2% of the overall revenue share. The reason for this leadership is largely because of the high prevalence and death rate of breast cancer across the globe, thus early detection becomes imperative. Government-sponsored screening programs, increasing awareness campaigns, and advances in mammography, ultrasound, and MRI have been instrumental in early detection and diagnosis of breast cancer. The growing availability of liquid biopsy tests and biomarker-based diagnostics has further improved early-stage detection, resulting in improved patient outcomes.

At the same time, Colorectal Cancer is projected to expand at the highest rate during the coming years. The rising incidence of colorectal cancer, combined with an increasing focus on regular screening, is fueling this growth. The use of stool-based DNA tests, non-invasive screening tests, and AI-enabled colonoscopy procedures is driving the growth of the segment. Furthermore, government campaigns supporting colorectal cancer screening programs and increasing awareness among people above 50 years of age are likely to drive the demand for diagnostic solutions in this segment.

By Test Type

The Others segment, comprising molecular diagnostics, liquid biopsy, and imaging-based tests, controlled the cancer diagnostics market in 2023. The popularity of non-invasive and precision-based diagnostic methods has contributed to its large market share. The growing dependence on sophisticated imaging modalities such as PET-CT, AI pathology, and biomarker-based screening technologies has fueled the growth of this segment. These technologies ensure high accuracy and early detection features, which make them crucial for successful cancer management.

The Biopsy segment, on the other hand, is anticipated to expand at the highest rate during the forecast period. Even with the advancement in non-invasive diagnostics, biopsies are still the criterion standard for precise cancer diagnosis. The surging adoption of minimally invasive biopsy methods, including liquid biopsy and image-guided biopsy, has contributed to the growth of the segment. Growing need for targeted therapies and precision medicine further underpins biopsy-based diagnostics since they yield important information about tumor behavior and genetic makeup.

By Coverage

The Public Insurance segment accounted for the largest portion of the cancer diagnostics market in 2023 due to government-sponsored cancer screening initiatives and healthcare policies. Public health programs focused on enhanced early detection of cancer, especially breast, cervical, and colorectal cancer, have helped establish the segment's leadership position. Public insurance covers vital cancer diagnostic tests in most developed and emerging markets, making them more accessible to the broader population. The growing uptake of national cancer screening plans and growing government investments in the health infrastructure have also strengthened the public insurance segment.

The Private Insurance segment is likely to expand considerably over the next few years as more people adopt private healthcare plans. The growing incidence of cancer and the increasing demand for personalized diagnostic services have made people opt for full-fledged private insurance coverage. Private insurance companies are also increasing their coverage for advanced diagnostic tests such as genetic screening and precision oncology, which will fuel the growth of this segment.

By End use

The Laboratories segment controlled the cancer diagnostics market in 2023 and held 49.5% of the total market share. This is because more diagnostic laboratories are now having advanced technologies to detect cancer. Laboratories are central to the processing of various types of diagnostic tests, such as molecular diagnostics, liquid biopsies, and histopathology. The increasing need for high-throughput screening, specialized pathology services, and AI-based diagnostic solutions has been the driving force behind the growth of this segment. The trend of outsourcing cancer diagnostics to specialist laboratories has also boosted this segment's position further.

The Others segment, covering home-based cancer diagnostic tests and point-of-care testing, is expected to develop at the highest rate. The transition towards decentralized testing, rising use of home-based cancer screening kits, and technological developments in wearable diagnostics have driven this growth. Self-testing convenience, growing consumer knowledge and demand for fast results, and the resultant increase in home-based cancer diagnostics adoption have been contributing factors. Moreover, the rise in telehealth and remote patient monitoring technology will further drive the growth of this segment.

Regional Analysis

In 2023, North America led the world in cancer diagnostics market share with 38.9% of the total revenue. The region's highly developed healthcare system, high penetration of cutting-edge diagnostic technologies, and government support for cancer screening and early detection are the reasons behind the dominance of the region. Advanced market players, strong R&D commitments, and supportive reimbursement policies have also boosted the position of North America. Moreover, the increasing incidence of cancer, especially breast, lung, and colorectal cancer, has driven the need for novel diagnostic technologies like liquid biopsy, AI-based imaging, and molecular diagnostics. The U.S. is the largest contributor in the region because of its extensive cancer screening programs and increasing use of personalized medicine.

Asia-Pacific is likely to be the fastest-growing region during the forecast period. The escalating rate of cancer, mounting healthcare spending, and raising awareness about the early detection of cancer are major drivers of growth in the region. Nations such as China, India, and Japan are seeing an increasing use of innovative diagnostic technologies due to growing healthcare infrastructure and initiatives of cancer control programs initiated by the government. Also, the growing availability of affordable diagnostic solutions and the expanding presence of private diagnostic centers are likely to drive market growth in Asia-Pacific. The trend toward digital pathology and AI-based diagnostics also complements the growth of the cancer diagnostics market in this region.

Key Players in the Cancer Diagnostics Market and Their Products

-

Abbott – Alinity m, Vysis FISH, RealTime PCR Assays

-

F. Hoffmann-La Roche Ltd – Cobas EGFR Mutation Test, Ventana HER2 Assay, AVENIO ctDNA Assays

-

GE Healthcare – Discovery MI PET/CT, Senographe Pristina, LOGIQ E10

-

QIAGEN – therascreen KRAS Kit, QIAseq Targeted DNA Panels, NeuMoDx Systems

-

BD (Becton, Dickinson and Company) – BD Onclarity HPV Assay, BD MAX System, BD FACSLyric

-

Koninklijke Philips N.V. (Philips) – IntelliSite Pathology, Vereos PET/CT, EPIQ Ultrasound

-

Siemens Healthcare GmbH – Biograph Vision PET/CT, ADVIA Centaur, MAGNETOM MRI Series

-

Hologic, Inc. – Genius 3D Mammography, Panther Fusion, Aptima HPV Assay

-

Thermo Fisher Scientific, Inc. – Ion Torrent NGS, Oncomine Dx Target Test, QuantStudio 5

-

Illumina, Inc. – TruSight Oncology, NovaSeq 6000, MiSeqDx

-

bioMérieux SA – BIOFIRE FilmArray, VIDAS Tumor Markers, EMAG System

Recent Developments

In Feb 2025, Avitia, a Montréal-based AI health tech startup, secured USD 5 million in seed funding from PacBridge Capital Partners to enhance its AI-powered cancer diagnostics platform. The funding will support market expansion and advanced molecular testing solutions for faster, cost-effective cancer mutation detection.

In Feb 2025, Apollo Hospitals and TECHEAGLE launched drone-based medical sample transport to reduce delays in cancer diagnostics. This initiative aims to expedite the transfer of liquid biopsy samples from collection centers to labs, significantly improving early detection and treatment timelines.

| Report Attributes | Details |

| Market Size in 2023 | USD 103.30 billion |

| Market Size by 2032 | USD 176.69 billion |

| CAGR | CAGR of 6.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Instruments (Pathology-based Instruments, Imaging Instruments, Others), Consumables (Antibodies, Kits & reagents, Probes, Others), Services] • By Type [IVD (By Type, By Technology), LDT, Imaging (Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Positron Emission Tomography (PET), Mammography, Ultrasound, Others)] • By Application [Breast Cancer, Colorectal Cancer, Cervical Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Ovarian Cancer, Others] • By Test Type [Biopsy (Fine-needle Aspiration, Core Biopsy, Surgical Biopsy, Skin Biopsy /Punch Biopsy, Others), Others] • By Coverage [Public Insurance, Private Insurance] • By End use [Hospitals, Laboratories, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, F. Hoffmann-La Roche Ltd, GE Healthcare, QIAGEN, BD (Becton, Dickinson and Company), Koninklijke Philips N.V. (Philips), Siemens Healthcare GmbH, Hologic, Inc., Thermo Fisher Scientific, Inc., Illumina, Inc., bioMérieux SA. |