Small Molecule API Market Report Scope & Overview:

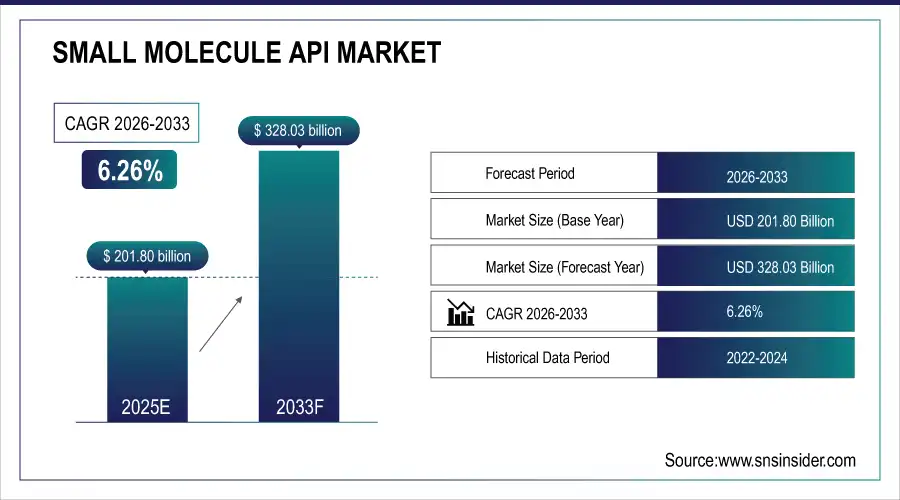

The Small Molecule API Market Size was valued at USD 201.80 billion in 2025E and is expected to reach USD 328.03 billion by 2033, growing at a CAGR of 6.26% over the forecast period of 2026-2033.

To Get more information On Small Molecule API Market - Request Free Sample Report

The Small Molecule API Market is experiencing strong growth due to its critical role in modern therapeutics and the rising global demand for cost-effective, accessible medicines. Small molecule APIs are widely used in treating chronic and lifestyle-related diseases such as cancer, diabetes, cardiovascular disorders, and central nervous system conditions, which continue to rise in prevalence worldwide. Their relatively simple structure, ease of synthesis, and oral bioavailability make them highly preferred over many biologics for mass production and patient compliance. In addition, increasing investment in research and development, coupled with technological advancements in manufacturing processes, is enabling faster and more efficient production of APIs.

The government has approved a USD 2.3 billion deep tech fund of funds to support the next generation of startups and translate innovative ideas into tangible outcomes. In the semiconductor sector, India has allocated USD 1.2 billion to establish a robust semiconductor and display ecosystem, aiming to reduce dependency on imports and enhance domestic manufacturing capabilities.

Market Size and Forecast:

-

Small Molecule API Market Size in 2025E: USD 201.80 Billion

-

Small Molecule API Market Size by 2033: USD 328.03 Billion

-

CAGR: 6.26% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

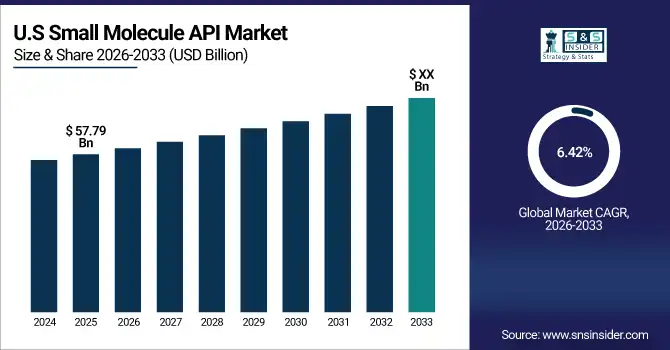

U.S. Small Molecule API Market Insights

The U.S. market is valued at USD 57.79 Billion in 2025 and is projected to grow at a CAGR of 6.42% through 2033. Federal funding, tax incentives, and grants support large-scale API manufacturing, particularly in oncology and cardiovascular therapies. Expansion of biotech and synthetic API production, coupled with R&D in innovative formulations, strengthens market growth. Leading pharmaceutical and biotech companies are investing in modern facilities, continuous flow synthesis, and advanced quality control systems to maintain global competitiveness.

Key Small Molecule API Market Trends

-

Rising adoption of generic and specialty small molecule APIs, driven by increasing prevalence of chronic and lifestyle-related diseases globally.

-

Growth in outsourcing API production to CDMOs to optimize costs, enhance scalability, and access advanced manufacturing technologies.

-

Increasing government incentives, grants, and funding for domestic API manufacturing, particularly in North America, Europe, and Asia-Pacific, to promote self-reliance and reduce import dependency.

-

Expansion of advanced synthesis and continuous manufacturing technologies for small molecule APIs, improving efficiency, yield, and compliance with stringent regulatory standards.

-

Rising collaboration between pharmaceutical companies, biotechnology firms, and contract manufacturers to develop integrated drug supply chains and accelerate time-to-market.

-

Integration of digital solutions, AI-enabled process monitoring, and predictive analytics to optimize API production, ensure quality, and maintain regulatory compliance.

Small Molecule API Market Growth Driver

- Government Incentives and Policy Support Drive Market Growth

Governments worldwide are actively promoting domestic API production to reduce dependency on imports and strengthen healthcare security. For instance, India’s Production Linked Incentive (PLI) scheme offers financial incentives to pharmaceutical manufacturers, boosting investment in high-value API production and supporting R&D initiatives. Similarly, the Bulk Drug Parks scheme, with an allocation of INR 69.4 billion (~USD 800 million), provides infrastructure and funding support for API manufacturing clusters. These government measures stimulate market growth by encouraging manufacturers to invest in new facilities, adopt advanced manufacturing technologies, and expand production capacity, while also fostering innovation in high-potency and specialty APIs.

Small Molecule API Market Restraint

- High Capital and Operational Costs May Hamper Market Growth

Small molecule API manufacturing requires large upfront investments in facilities, equipment, and stringent quality compliance systems. For example, setting up a GMP-compliant API plant can cost tens of millions of USD. Operational expenses, such as high-cost raw materials, energy-intensive production processes, and skilled labor, further increase the total cost of production. Companies must also invest heavily to comply with global regulatory standards, including US FDA, EMA, and ICH guidelines. These high costs can delay new product launches or expansion projects, particularly for small and mid-sized companies. In Asia, despite government incentives, the reliance on imported precursors increases costs, while in North America and Europe, energy and labor costs add to operational challenges. This financial burden remains a significant restraint on rapid market expansion, especially in emerging economies where funding access may be limited.

Small Molecule API Market Opportunity

- Expansion into Emerging Markets and Industrial Applications Creates Opportunities

Emerging economies such as India, China, Brazil, and Southeast Asian countries present high growth potential due to rising healthcare demand, increasing chronic disease prevalence, and government initiatives supporting local API manufacturing. In Europe, countries like Germany and Spain are developing integrated pharmaceutical clusters that combine API production with finished dosage formulation, supported by multi-billion-euro grants. North American companies are also expanding API manufacturing capacities to cater to growing domestic and export demand. Beyond pharmaceuticals, APIs are increasingly used in specialty chemical, agrochemical, and cosmetic industries, offering new revenue streams.

Small Molecule API Market Segment Highlights:

-

By Technology: Synthetic – 87% share (largest); Biotech fastest-growing at 6.8% CAGR; global market share 6.26%.

-

By Manufacturing Type: In-house – 60% share (largest); Outsourced fastest-growing at 7.2% CAGR; global market share 6.44%.

-

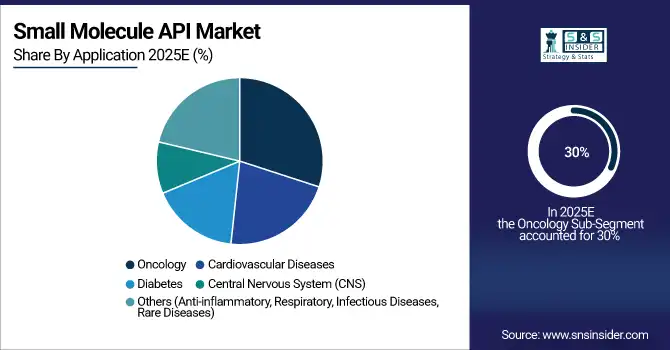

By Application: Oncology – 30% share (largest); Cardiovascular Diseases fastest-growing at 8.5% CAGR; global market share 6.33%.

-

By End-User: Pharmaceutical Companies – 70% share (largest); Biotechnology Companies fastest-growing at 9.0% CAGR; global market share 6.12%.

Small Molecule API Market Segment Analysis

By Technology

Synthetic Small Molecule APIs dominate the market with an 87% share in 2025, attributed to their well-established manufacturing processes, cost efficiency, and widespread use in therapeutic applications across oncology, cardiovascular, and CNS treatments. Biotech-derived small molecules are the fastest-growing segment, with a CAGR of 6.8%, driven by increasing demand for high-potency, targeted therapies and biologically-inspired compounds. Growth is further supported by rising R&D investments, advanced synthesis technologies, and strategic partnerships between pharmaceutical and biotech companies. Emerging technologies, such as continuous flow synthesis and AI-assisted drug design, are enabling more efficient and scalable production.

By Manufacturing Type

In-house manufacturing holds the largest share at 60% in 2025, reflecting pharmaceutical companies’ preference for maintaining strict quality control and regulatory compliance. Outsourced manufacturing is the fastest-growing segment, growing at a 7.2% CAGR, fueled by contract development and manufacturing organizations (CDMOs) offering cost-effective production, flexibility, and access to advanced technologies. Increasing outsourcing is also supported by global expansion of CDMOs and rising collaboration between pharmaceutical companies and specialized manufacturing partners.

By Application

Oncology accounts for the largest share at 30% in 2025, driven by growing cancer prevalence, innovation in targeted therapies, and high demand for chemotherapeutic APIs. Cardiovascular diseases are the fastest-growing segment, with a CAGR of 8.5%, fueled by increasing prevalence of heart disorders, adoption of novel small-molecule drugs, and government initiatives to improve cardiovascular health. Diabetes, CNS, and other therapeutic areas also contribute steadily to market growth due to rising chronic disease incidence and increasing API consumption in combination therapies.

By End-User

Pharmaceutical companies dominate with a 70% share in 2025, leveraging in-house R&D, formulation, and large-scale production capabilities. Biotechnology companies are the fastest-growing end-user segment, expanding at 9.0% CAGR, driven by rising biotech drug pipelines, innovative small-molecule therapeutics, and strategic investments in drug development. CDMOs and other end-users, including research institutions and academic labs, are playing an increasing role by providing specialized synthesis, process optimization, and regulatory support.

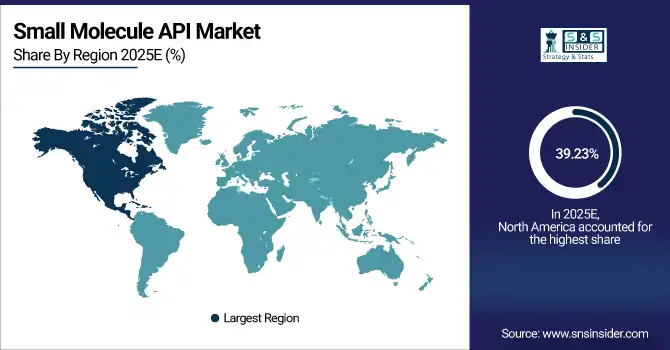

Small Molecule API Market Regional Analysis

North America Small Molecule API Market Insights

North America accounts for 39.23% of the market in 2025, with the U.S. leading regional growth. Strong regulatory frameworks, robust pharmaceutical infrastructure, and high R&D investment drive the market. Government policies, such as tax incentives for API manufacturing and support for biotechnology innovation, encourage private investment. Companies are focusing on expanding synthetic and biotech API production, particularly for oncology, cardiovascular, and CNS applications, while integrating advanced process technologies and compliance protocols.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Small Molecule API Market Insights

Europe held the significant global market with a 19.11% share in 2025, supported by strong government policy frameworks promoting pharmaceutical R&D, manufacturing excellence, and regulatory compliance. Germany, France, and Switzerland are leading countries, investing heavily in synthetic and biotech API production facilities. Well-established infrastructure, skilled workforce, and government incentives for pharmaceutical innovation drive adoption. Collaborations between private companies and research institutions further strengthen Europe’s position as a hub for high-quality API manufacturing and export.

Asia-Pacific Small Molecule API Market Insights

Asia-Pacific holds 24.32% of the global market in 2025 and is the fastest-growing region due to rapid industrialization, rising healthcare demand, and government initiatives promoting domestic API production. Countries like India, China, and Japan are investing in large-scale manufacturing facilities, R&D centers, and advanced biotech API technologies. Government subsidies, grants, and favorable trade policies encourage private-sector expansion. The region’s growth is further boosted by low-cost manufacturing, availability of skilled labor, and increasing pharmaceutical exports.

Latin America (LATAM) and Middle East & Africa (MEA) Small Molecule API Market Insights

LATAM (7.34% share) and MEA (10% share) are emerging regions with increasing pharmaceutical manufacturing activities and rising demand for APIs in chronic disease treatments. Brazil leads LATAM with investments in synthetic API facilities, while Argentina and Chile are focusing on biotech APIs. In MEA, countries like UAE and Saudi Arabia are developing large-scale API production plants and industrial clusters, supported by government incentives, trade agreements, and collaborations with international pharmaceutical companies. Private investments and partnerships are accelerating growth in these regions.

Competitive Landscape for Small Molecule API Market:

Pfizer Inc.

Pfizer is a leading global pharmaceutical company, producing a wide range of small molecule APIs for oncology, cardiovascular, and infectious diseases.

-

In March 2025, Pfizer announced the expansion of its biologics and small molecule API manufacturing facility in Kalamazoo, Michigan, investing USD 250 million to increase production capacity for oncology and cardiovascular drugs.

Novartis AG

Novartis develops and manufactures synthetic and biotech APIs, with a strong focus on innovative therapies and generics.

-

In June 2025, Novartis inaugurated a state-of-the-art API R&D and production center in Basel, Switzerland, to enhance high-potency API production for global markets.

Cipla Ltd.

Cipla is an Indian multinational pharmaceutical company specializing in APIs for respiratory, cardiovascular, and anti-infective therapies.

-

In January 2025, Cipla commissioned a new high-capacity small molecule API plant in Indore, India, with an annual output of 500 tons, supported by government incentives for pharmaceutical exports.

Dr. Reddy’s Laboratories Ltd.

Dr. Reddy’s manufactures a broad portfolio of generic APIs and custom synthesis APIs for regulated markets.

-

In April 2025, the company invested USD 120 million to expand its API manufacturing facility in Hyderabad, India, to meet rising demand for oncology and CNS APIs.

Small Molecule API Market Key Players

Some of the Small Molecule API Companies

-

Pfizer Inc.

-

Merck & Co., Inc.

-

AbbVie Inc.

-

Bristol-Myers Squibb Company

-

Albemarle Corporation

-

Boehringer Ingelheim International GmbH

-

Cipla Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Viatris Inc.

-

Dr. Reddy’s Laboratories Ltd.

-

Aurobindo Pharma,

-

Sun Pharmaceutical Industries Ltd.

-

Lonza Group AG

-

Cambrex Corporation

-

GSK plc.

-

Novartis AG

-

Gilead Sciences Inc.

-

Hoffmann-La Roche Ltd.

-

Sanofi,

-

Novo Nordisk

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 201.80 Billion |

| Market Size by 2033 | USD 328.03 Billion |

| CAGR | CAGR of6.26% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Synthetic, Biotech) • By Manufacturing Type (In-house, Outsourced) • By Application (Oncology, Cardiovascular Diseases, Diabetes, Central Nervous System (CNS), Others – Anti-inflammatory, Respiratory, Infectious Diseases, Rare Diseases) • By End-User (Pharmaceutical Companies, Biotechnology Companies, CDMOs, Others – Research Institutions, Government Agencies, Academic Labs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Pfizer Inc., Merck & Co., Inc., AbbVie Inc., Bristol-Myers Squibb Company, Albemarle Corporation, Boehringer Ingelheim International GmbH, Cipla Inc., Teva Pharmaceutical Industries Ltd., Viatris Inc., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Lonza Group AG, Cambrex Corporation, GSK plc., Novartis AG, Gilead Sciences Inc., Hoffmann-La Roche Ltd., Sanofi, Novo Nordisk |

| Language | Report Title |

|---|---|

| Spanish | Molécula pequeña API Mercado |

| French | API de petites molécules Marché |

| German | Markt für niedermolekulare Wirkstoffe |

| Japanese | 低分子API市場 |

| Korean | 소분자 API 시장 |