Prenatal Care Market Report Scope & Overview:

Get more information on Prenatal Care Market - Request Free Sample Report

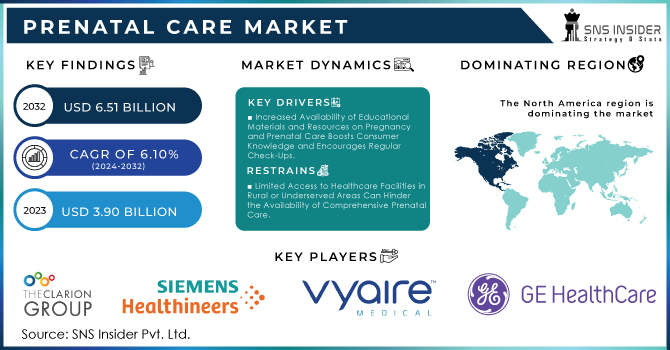

The Prenatal Care Market Size was valued at USD 3.90 Billion in 2023 and is expected to reach USD 6.65 Billion by 2032, growing at a CAGR of 6.10% over the forecast period of 2024-2032.

The Prenatal Care Market is evolving rapidly, fueled by rising awareness, technological advancements, and growing investments. Investment and funding trends reveal strong financial backing for innovations in maternal health solutions. Regulatory frameworks and compliance standards shape product approvals, ensuring safety and efficacy. Increasing healthcare expenditure on maternal and fetal health reflects a global commitment to improved prenatal care. However, prenatal care accessibility in developing regions remains a challenge due to infrastructure gaps and affordability issues. Demographic factors, including shifting birth rates and delayed pregnancies, influence market demand. Additionally, the prevalence of pregnancy-related complications and risks, such as gestational diabetes, drives the need for advanced screening and monitoring. Our report provides a deep dive into these crucial market dynamics.

The US Prenatal Care Market Size was valued at USD 1.14 Billion in 2023 and is expected to reach USD 1.81 Billion by 2032, growing at a CAGR of 5.29% over the forecast period of 2024-2032.

The US Prenatal Care Market is experiencing robust growth, driven by increasing awareness about maternal health, advancements in prenatal diagnostics, and rising healthcare expenditure. The American College of Obstetricians and Gynecologists (ACOG) plays a key role in advocating for comprehensive prenatal care, supporting innovations in diagnostics and monitoring. Moreover, major US-based companies like GE Healthcare and Medtronic are continuously advancing ultrasound and fetal monitoring technologies. Increased adoption of non-invasive prenatal testing (NIPT) and telemedicine for remote consultations further fuels the demand for advanced prenatal care services, reflecting the growing focus on reducing risks and improving maternal health outcomes.

Market Dynamics

Drivers

-

Growing Influence of Corporate Wellness Programs Encourages Employer-Sponsored Prenatal Health Benefits and Maternal Wellness Initiatives

The increasing focus on corporate wellness programs is contributing to the expansion of the prenatal care market, with companies prioritizing maternal healthcare benefits as part of employee well-being initiatives. Many leading corporations in the United States, including Google and Microsoft, offer comprehensive maternity care programs that include access to prenatal screenings, nutrition counseling, stress management, and postpartum recovery services. Employer-sponsored prenatal care programs significantly reduce pregnancy-related complications by providing early interventions and continuous medical support, thereby minimizing high-risk pregnancies and reducing medical costs for both employees and employers. The rise of women-centric workplaces and growing awareness of maternal health disparities have also prompted organizations to partner with healthcare providers and insurance companies to offer specialized prenatal wellness programs. Additionally, remote work policies and flexible maternity leave plans allow expecting mothers to receive continuous prenatal care without disrupting their professional responsibilities. This trend is expected to create a sustainable demand for corporate-sponsored prenatal care solutions, driving further market growth.

Restraints

-

Limited Availability of Skilled Healthcare Professionals Impacts the Quality and Reach of Prenatal Care Services

A significant restraint in the prenatal care market is the shortage of trained obstetricians, maternal-fetal medicine specialists, and skilled sonographers, leading to delayed and inadequate prenatal care services. The American College of Nurse-Midwives (ACNM) reports a growing shortage of midwives and obstetric care providers, particularly in rural areas, where access to specialized prenatal services is already limited. This shortage is further exacerbated by high physician burnout rates, particularly in high-demand maternity hospitals, leading to longer wait times for patients. A lack of skilled healthcare workers also affects the proper utilization of advanced prenatal screening technologies, as some regions lack trained professionals to operate complex diagnostic tools effectively. Although telemedicine and digital health platforms have improved prenatal care accessibility, they cannot fully replace in-person medical examinations, particularly for high-risk pregnancies. Addressing these challenges requires government initiatives, healthcare workforce training programs, and incentives for medical professionals to specialize in prenatal and maternal healthcare, ensuring wider availability of skilled experts.

Opportunities

-

Growing Consumer Demand for Organic and Natural Prenatal Nutritional Supplements and Skincare Products Boosts Market Growth

The rising preference for organic and natural prenatal care products is driving demand for non-toxic, chemical-free alternatives in nutritional supplements and maternity skincare. Pregnant women are increasingly opting for plant-based prenatal vitamins, minerals, and essential fatty acid supplements, as concerns over synthetic ingredients and potential fetal exposure to harmful chemicals grow. In response, brands such as Expanscience Laboratories and Clarion Brands have introduced organic pregnancy-safe skincare lines, offering solutions for stretch marks, dark spots, and dry skin. The clean-label movement has further influenced purchasing behavior, leading to the rise of vegan prenatal supplements and herbal pregnancy teas, which are free from artificial additives. With social media awareness and endorsements from medical professionals promoting these products, the demand for safe, natural prenatal care solutions continues to rise. Moreover, increasing regulations on harmful chemicals in personal care products have encouraged manufacturers to invest in sustainable, non-toxic formulations, presenting new growth opportunities for businesses catering to this expanding organic prenatal care segment.

Challenge

-

Ethical and Privacy Concerns Associated with Genetic Screening and Fetal Health Data Sharing Impact Market Adoption

As genetic screening and fetal health monitoring technologies advance, concerns over patient privacy, data security, and ethical considerations are becoming more pronounced, impacting the market’s adoption rate. Many expecting parents worry about the implications of non-invasive prenatal testing (NIPT), fearing data misuse, genetic discrimination, or unauthorized third-party access. Organizations such as the U.S. Food and Drug Administration (FDA) and Genetic Information Nondiscrimination Act (GINA) enforce strict regulations to protect genetic data, yet concerns persist regarding how fetal DNA information is stored, shared, and potentially commercialized. Ethical dilemmas also arise over selective pregnancies, where certain fetal abnormalities may lead to controversial medical decisions. With healthcare data breaches becoming more frequent, patients are increasingly hesitant to opt for advanced genetic screening without robust data protection assurances. Addressing these concerns requires transparent policies, patient consent protocols, and stronger legal frameworks to foster trust and ensure that fetal health innovations align with ethical and privacy standards, allowing for wider adoption of these critical technologies.

Segmental Analysis

By Type

Stretch Marks Minimizers dominated the prenatal care market in 2023 with a 38.2% market share, driven by the increasing concern among pregnant women about skin elasticity, scarring, and post-pregnancy skin recovery. The American Pregnancy Association (APA) highlights that over 90% of pregnant women experience stretch marks due to rapid skin expansion during pregnancy, fueling the demand for specialized creams and serums. Leading brands such as Bio-Oil, Palmer’s Cocoa Butter, and Mustela have expanded their product portfolios with clinically proven formulations featuring hyaluronic acid, vitamin E, and shea butter, further propelling market growth. Additionally, dermatologist-recommended formulations have gained popularity, with major pharmaceutical and skincare companies investing in R&D to develop hypoallergenic, pregnancy-safe products. The rising influence of social media and e-commerce platforms has also amplified product awareness, contributing to the segment’s dominance in the prenatal care market.

By Equipment

Ultrasound and Ultrasonography Devices held the largest market share of 45.7% in 2023, primarily due to the widespread adoption of ultrasound imaging as a standard diagnostic tool for fetal monitoring. The Centers for Disease Control and Prevention (CDC) and the American College of Obstetricians and Gynecologists (ACOG) recommend routine ultrasound screenings during pregnancy to detect fetal anomalies, growth patterns, and placenta positioning, reinforcing their necessity in prenatal care. The U.S. Food and Drug Administration (FDA) has also approved several portable and AI-assisted ultrasound devices, such as GE Healthcare’s Voluson series, which enhance diagnostic accuracy. Furthermore, government healthcare programs, including Medicaid and Medicare, cover ultrasound procedures, making them more accessible. The rising number of high-risk pregnancies has also driven demand for advanced 3D and 4D ultrasound technology, further cementing this segment’s dominance.

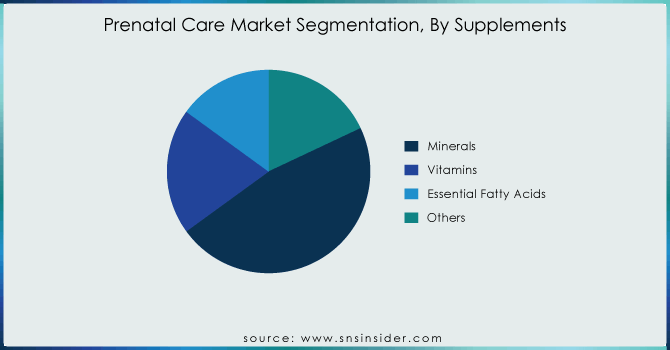

By Supplements

Vitamins dominated the prenatal care market in 2023, accounting for 50.3% market share, driven by the increasing awareness of maternal nutrition and fetal development. The American Academy of Pediatrics (AAP) and the U.S. Food and Drug Administration (FDA) strongly advocate for prenatal vitamins, particularly folic acid, iron, and DHA, as essential for preventing neural tube defects and supporting brain development. Companies such as Bayer (One A Day), Nestlé (Garden of Life), and Nature Made have expanded their prenatal vitamin lines with non-GMO, organic, and allergen-free formulations, catering to the growing demand for clean-label supplements. The rising popularity of gummy vitamins and personalized nutrition solutions, offered by Ritual and Perelel Health, has further fueled market expansion. Additionally, government-backed maternal health programs, such as the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), have increased accessibility to prenatal vitamins, reinforcing their dominant market position.

By Distribution Channel

Online Pharmacies distribution channel dominated the prenatal care market in 2023 with a 38.4% market share, owing to the growing consumer preference for digital healthcare solutions and doorstep delivery services. E-commerce platforms such as Amazon, Walgreens, and CVS Pharmacy have experienced surging sales of prenatal supplements, maternity skincare products, and diagnostic kits, driven by discounted pricing, subscription models, and access to a wide range of brands. The COVID-19 pandemic accelerated digital adoption, with major pharmaceutical companies launching direct-to-consumer (DTC) platforms for prenatal care products. Moreover, telemedicine integration with online pharmacies has enabled expecting mothers to consult doctors virtually and receive prescribed prenatal supplements conveniently. The U.S. Department of Health and Human Services (HHS) has also supported online pharmacy growth by expanding telehealth reimbursements, making digital healthcare solutions more accessible and strengthening the dominance of online pharmacy sales in the prenatal care market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

North America dominated the prenatal care market in 2023 with a 42.6% market share, driven by advanced healthcare infrastructure, high prenatal care awareness, and strong government initiatives supporting maternal health. The Centers for Medicare & Medicaid Services (CMS) has played a pivotal role in funding prenatal screenings and maternal health programs, ensuring accessibility to prenatal diagnostics and supplements. The region also boasts high adoption rates of cutting-edge technologies such as 3D and 4D ultrasound imaging, non-invasive prenatal testing (NIPT), and AI-powered fetal monitoring systems, further propelling market growth. The United States emerged as the leading country, accounting for over 70% of North America's market share, fueled by strong regulatory support, rising fertility rates through assisted reproductive technologies (ARTs), and increased consumer spending on prenatal nutrition and skincare. Companies like Abbott, Pfizer, and Johnson & Johnson dominate the prenatal vitamin market, while GE Healthcare and Siemens Healthineers lead in prenatal diagnostics. Canada, the second-largest market, has witnessed growing government investments in maternal healthcare, with the Canada Prenatal Nutrition Program (CPNP) improving accessibility to prenatal supplements and screening tests. Mexico, though a smaller market, is experiencing rapid growth due to expanding healthcare coverage and increasing medical tourism for prenatal care services.

Asia Pacific is emerged as the fastest-growing region in the prenatal care market, with a significant growth rate during the forecast period of 2024 to 2032. It is driven by the rising birth rates, increasing government healthcare spending, and growing awareness of maternal and fetal health. Countries such as China, India, and Japan are experiencing surging demand for prenatal supplements, ultrasound devices, and digital health solutions. In China, the National Health Commission (NHC) has introduced policies promoting prenatal screenings and maternal healthcare programs, significantly expanding the market. The Indian government's Janani Suraksha Yojana (JSY) initiative has improved accessibility to hospital-based prenatal care, driving demand for vitamins, fetal monitoring devices, and maternity skincare products. Japan, with its aging population, is witnessing a rise in assisted reproductive technology (ART) procedures, increasing demand for advanced prenatal diagnostics and nutritional supplements. Additionally, the expansion of e-commerce platforms such as Alibaba’s Tmall and India’s 1mg has enabled easier access to prenatal care products, boosting market growth. The rising focus on nutritional awareness, government-backed maternal healthcare initiatives, and increasing urbanization positions Asia Pacific as the fastest-growing region in the prenatal care market.

Key Players

-

Atom Medical Corporation (Infant Incubators, Neonatal Phototherapy Units, Transport Incubators)

-

Becton, Dickinson and Company (BD) (Prenatal Screening Tests, Amniocentesis Needles, Blood Collection Systems for Maternal Testing)

-

Clarions Group (Fetal Monitors, Maternal Health Solutions, Neonatal Resuscitation Systems)

-

CooperSurgical Inc. (Fetal Dopplers, Cervical Ripening Balloons, Assisted Reproductive Technology Solutions)

-

Drägerwerk AG & Co. KGaA (Neonatal Ventilators, Infant Warmers, Fetal Monitoring Systems)

-

Expanscience Laboratories Inc. (Stretch Mark Creams, Maternity Skincare Products, Perineal Massage Oils)

-

Fisher & Paykel Healthcare (Infant CPAP Systems, Neonatal Humidification Therapy, High-Flow Oxygen Therapy for Newborns)

-

FUJIFILM Holdings Corporation (Prenatal Ultrasound Imaging Systems, Digital Radiography for Fetal Assessment, Diagnostic Imaging Solutions)

-

GE Healthcare (Voluson Ultrasound Systems, Fetal Monitors, Maternal-Infant Care Solutions)

-

Getinge AB (Neonatal Intensive Care Incubators, Birthing Beds, Perinatal Monitoring Systems)

-

Illumina, Inc. (Non-Invasive Prenatal Testing, Whole Genome Sequencing for Fetal Diagnosis, Genetic Screening Panels)

-

Masimo Corporation (Neonatal Pulse Oximeters, Fetal Oxygen Saturation Monitoring, Maternal-Fetal Monitoring Systems)

-

Medtronic PLC (Maternal & Fetal Monitoring Systems, Obstetric Surgical Instruments, Neonatal Respiratory Support Devices)

-

Mindray Medical International Limited (Prenatal Ultrasound Systems, Fetal Monitors, Neonatal Ventilators)

-

Natus Medical Incorporated (Newborn Hearing Screening Devices, Neonatal Brain Monitoring Systems, Infant Phototherapy Solutions)

-

Natera, Inc. (Panorama Non-Invasive Prenatal Testing, Carrier Screening for Genetic Disorders, Fetal Chromosomal Abnormality Testing)

-

PerkinElmer, Inc. (Newborn Screening Tests, Maternal Serum Screening, Prenatal Diagnostic Assays)

-

Philips Healthcare (EPIQ and Affiniti Ultrasound Systems, Avalon Fetal Monitors, Neonatal Incubators)

-

Siemens Healthineers (Acuson Ultrasound Systems, Maternal-Fetal Diagnostics, Prenatal Genetic Testing Solutions)

-

Vyaire Medical (Neonatal Ventilators, Oxygen Therapy Systems for Newborns, Infant Resuscitation Solutions)

Recent Developments

-

April 2025: Planned Parenthood of Southwest and Central Florida launched prenatal services to address the OB-GYN shortage, improving access to maternity care in underserved areas.

-

February 2025: Maternity care platform Millie secured $12M to enhance its digital health tools, expanding personalized prenatal support for expecting mothers.

-

November 2024: UAMS expanded its group prenatal care program to Phillips County, improving maternal health access and support in rural communities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.90 Billion |

| Market Size by 2032 | USD 6.65 Billion |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Body Restructuring Gels, Stressed Legs Products, Stretch Marks Minimizers, Dark Spots Treatment Creams, Skin Toning Lotions) •By Equipment (Ultrasound and Ultrasonography Devices, Fetal Dopplers, Fetal Monitors, Fetal Magnetic Resonance Imaging) •By Supplements (Minerals, Vitamins, Essential Fatty Acids, Others) •By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Supermarkets, Drug Stores) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clarions Group, Siemens Healthcare, Vyaire Medical, Expanscience Laboratories Inc., GE Healthcare, Getinge AB, Medtronic PLC, Natus Medical Incorporated, Atom Medical Corporation, Philips Healthcare and other key players |