Smart Hazardous Gas Monitoring Market Report Scope & Overview:

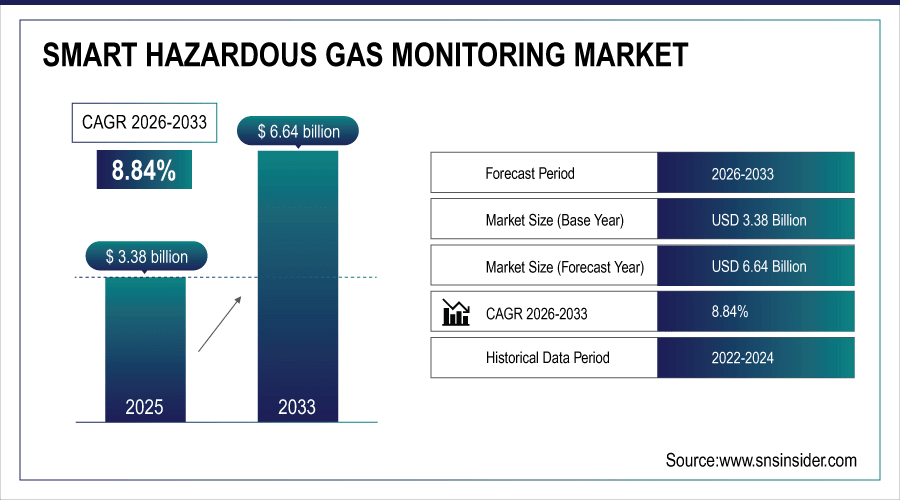

The Smart Hazardous Gas Monitoring Market size was valued at USD 3.38 Billion in 2025E and is projected to reach USD 6.64 Billion by 2033, growing at a CAGR of 8.84% during 2026-2033.

The Smart Hazardous Gas Monitoring Market analysis highlights the growing demand for advanced detection technologies that ensure workplace safety and regulatory compliance. Rising industrialization and stringent government norms are fueling adoption across oil & gas, chemical, and mining sectors. Technological innovations such as IoT-enabled, real-time monitoring are driving market expansion. Increasing focus on predictive maintenance further boosts deployment.

Over 65% of oil & gas facilities globally implemented IoT-enabled hazardous gas monitors in 2024 to meet real-time safety compliance and reduce incident response times by up to 50%.

To Get More Information On Smart Hazardous Gas Monitoring Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.38 Billion

-

Market Size by 2033: USD 6.64 Billion

-

CAGR: 8.84% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Smart Hazardous Gas Monitoring Market Trends

-

Integration of IoT and cloud connectivity in hazardous gas monitors enables real-time data sharing, predictive analytics, and remote monitoring, improving workplace safety and compliance across industries.

-

Rising adoption of wearable and portable gas monitors supports personal worker safety, offering mobility, compactness, and faster detection, especially in mining, oil & gas, and confined environments.

-

Increasing focus on multi-gas detection devices enhances efficiency, allowing simultaneous monitoring of combustible, toxic gases, and oxygen, reducing equipment costs and ensuring comprehensive safety in hazardous industries.

-

Demand for wireless connectivity and smart sensor technologies grows as industries shift toward automation, enabling seamless integration with control systems and improving data-driven decision-making in gas safety.

-

Stricter global safety regulations and standards, such as ATEX and IECEx, accelerate demand for certified devices, pushing manufacturers to innovate and deliver compliant, reliable gas monitoring solutions.

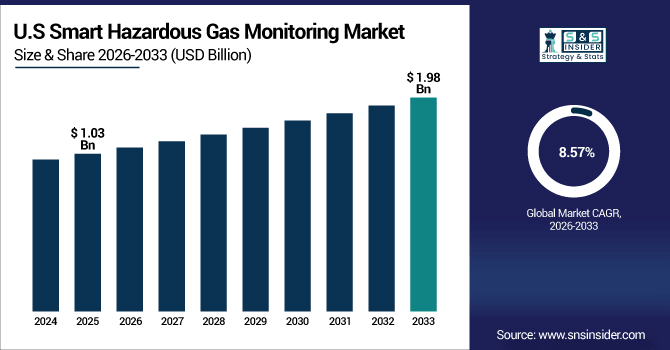

The U.S. Smart Hazardous Gas Monitoring Market size was valued at USD 1.03 Billion in 2025E and is projected to reach USD 1.98 Billion by 2033, growing at a CAGR of 8.57%during 2026-2033. Smart Hazardous Gas Monitoring Market growth is driven by stringent workplace safety regulations, increasing industrialization, rising adoption of IoT-enabled and wireless gas detection systems, and growing demand in oil & gas, chemical, and mining sectors. Advanced portable and wearable monitors further enhance worker safety and operational efficiency.

Smart Hazardous Gas Monitoring Market Growth Drivers:

-

Rising Adoption of Smart Gas Monitoring Systems Across Industrial and High-Risk Work Environments

The market is driven by increasing industrial safety awareness and stricter regulatory requirements across oil & gas, chemical, mining, and manufacturing sectors. Advanced IoT-enabled, wireless, portable, and wearable monitors allow real-time detection of combustible, toxic gases, and oxygen levels. Companies are investing in automated monitoring systems to reduce workplace accidents, enhance operational efficiency, and ensure compliance with international safety standards.

In 2024, over 60% of large chemical plants adopted wearable gas monitors, reducing worker exposure incidents by 45% through real-time alerts for toxic and oxygen-deficient environments.

Smart Hazardous Gas Monitoring Market Restraints:

-

High Initial Costs and Maintenance Challenges Limit Adoption Among Small-Scale Industries

Despite technological benefits, smart hazardous gas monitoring systems involve high capital expenditure, ongoing maintenance, and calibration costs. Small and medium enterprises face budget constraints, while lack of technical expertise can hinder proper deployment. Complex integration with existing safety protocols and infrastructure further slows adoption, especially in developing regions, restraining overall market growth.

Smart Hazardous Gas Monitoring Market Opportunities:

-

Integration of AI, Cloud, and IoT for Predictive Gas Monitoring Creates Growth Potential

Emerging technologies such as AI-driven analytics, cloud connectivity, and IoT-enabled devices offer predictive monitoring capabilities. These innovations enable remote supervision, early hazard detection, and reduced downtime, appealing to industries with hazardous environments. Expanding industrialization in emerging economies, combined with growing safety compliance awareness, presents significant opportunities for smart gas monitoring system manufacturers to capture new markets globally.

In 2024, 68% of smart gas monitoring systems in hazardous industries integrated AI-driven analytics to predict gas leak risks 2–4 hours before critical thresholds were breached. Cloud-connected gas detectors saw a 60% adoption surge in 2024, enabling centralized safety dashboards for multinational operators managing facilities across 10+ countries in real time.

Smart Hazardous Gas Monitoring Market Segment Analysis

-

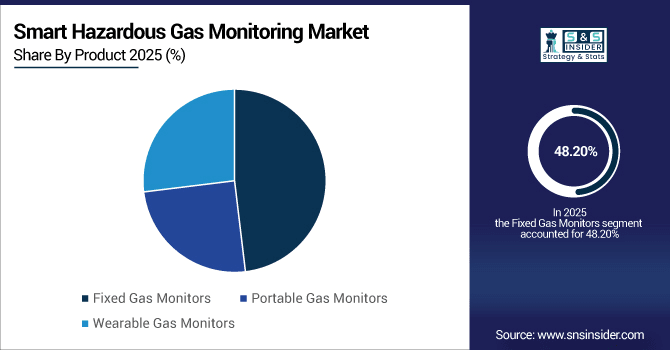

By product, fixed gas monitors led the market with a 48.20% share in 2025E, while wearable gas monitors are expected to be the fastest-growing segment with a CAGR of 9.50%.

-

By application, industrial applications dominated the market with a 41.50% share in 2025E, whereas healthcare applications are projected to grow the fastest at a CAGR of 9.20%.

-

By type, combustible gas monitors accounted for the largest share at 52.30% in 2025E, while toxic gas monitors are expected to register the fastest growth with a CAGR of 8.80%.

-

By end-user, manufacturing held the largest market share at 39.90% in 2025E, while the oil & gas sector is projected to grow the fastest with a CAGR of 9.70%.

By Product, Fixed Gas Monitors Leads Market While Wearable Gas Monitors Registers Fastest Growth

Fixed gas segment dominates the market due to their widespread adoption in industrial facilities, providing continuous detection of hazardous gases in fixed locations. They ensure regulatory compliance, operational safety, and real-time monitoring. Meanwhile, wearable gas monitors are experiencing the fastest growth, driven by the need for portable, personal safety devices. Rising use in mining, healthcare, oil & gas, and confined-space operations supports their adoption, enhanced by IoT and wireless connectivity features.

By Application, Industrial Dominate While Healthcare Shows Rapid Growth

The industrial segment holds the largest market share due to stringent workplace safety regulations in manufacturing, chemicals, and oil & gas. Continuous gas monitoring is critical for accident prevention and operational safety. Healthcare applications, however, are growing rapidly, fueled by rising awareness of indoor air quality, occupational safety in laboratories, and hospital environments. Portable and wearable monitors for healthcare staff and patients are driving adoption, supported by advancements in smart and connected gas detection technologies.

By Type, Combustible Gases Lead While Toxic Gases Registers Fastest Growth

Combustible gas dominates the market because of their critical role in preventing fires and explosions in industrial settings such as oil refineries, chemical plants, and manufacturing units. Toxic gas monitors are the fastest-growing segment, driven by heightened safety concerns and regulatory compliance for gases like carbon monoxide, hydrogen sulfide, and ammonia. Innovations in multi-gas detection and real-time alerts further accelerate the adoption of toxic gas monitoring solutions across industrial and healthcare applications.

By End-User, Manufacturing Lead While Oil & Gas Grow Fastest

Manufacturing segment holds the largest share in the smart hazardous gas monitoring market due to high safety requirements and regulatory compliance mandates. Continuous monitoring of flammable and toxic gases ensures operational safety and reduces accidents. The oil & gas sector, however, is the fastest-growing end-user segment, propelled by increasing exploration activities, offshore operations, and adoption of wearable and portable gas monitors for worker safety in hazardous environments. Advanced IoT integration boosts real-time monitoring efficiency.

Smart Hazardous Gas Monitoring Market Regional Analysis:

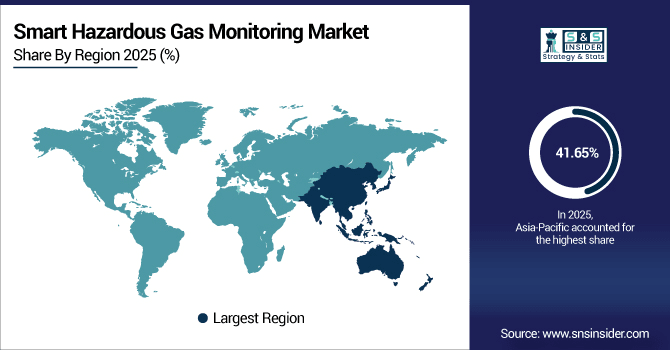

Asia-Pacific Smart Hazardous Gas Monitoring Market Insights

In 2025E Asia-Pacific dominated the Smart Hazardous Gas Monitoring Market and accounted for 41.65% of revenue share, this leadership is due to the early adoption of advanced monitoring technologies and stringent occupational safety regulations. The U.S. is the largest contributor, driven by oil & gas, chemicals, and healthcare sectors. High industrial automation and deployment of IoT-enabled gas detection systems enhance market growth. Frequent safety audits and government incentives encourage adoption.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Smart Hazardous Gas Monitoring Market Insights

The U.S. market growth is propelled by strict OSHA and EPA regulations, requiring comprehensive hazardous gas monitoring. Industrial facilities, healthcare institutions, and oil & gas operations are major adopters. Rising adoption of wearable and portable devices ensures real-time worker safety.

Asia-Pacific Smart Hazardous Gas Monitoring Market Insights

Asia-Pacific is expected to witness the fastest growth in the Smart Hazardous Gas Monitoring Market over 2026-2033, with a projected CAGR of 9.45% due to rapid industrialization and growing chemical, oil & gas, and manufacturing sectors. Strong government regulations for workplace safety drive demand. Rising awareness of occupational health and increasing installation of smart and wireless monitors boost growth. Industrial hubs in India, Japan, and South Korea contribute significantly. The region is expected to maintain strong growth with increasing investments in Industry 4.0 and smart factory initiatives.

China Smart Hazardous Gas Monitoring Market Insights

China is a key market within Asia-Pacific, driven by stringent government safety standards and rapid expansion in manufacturing, chemical, and energy sectors. Smart hazardous gas monitoring adoption is accelerating in urban and industrial hubs.

Europe Smart Hazardous Gas Monitoring Market Insights

Europe shows steady growth, led by Germany, the U.K., and France. Strong industrial safety standards and regulatory frameworks drive adoption. Manufacturing, chemicals, and oil & gas sectors are major users of fixed and portable monitors. Increasing awareness of occupational safety and integration of smart IoT devices boost market expansion.

Germany Smart Hazardous Gas Monitoring Market Insights

Germany is a major contributor in Europe, with strict workplace safety laws and highly regulated industrial practices. The automotive, chemical, and energy sectors drive demand for smart gas monitoring. High adoption of IoT-enabled, connected, and multi-gas detectors enhances market penetration.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Hazardous Gas Monitoring Market Insights

The Smart Hazardous Gas Monitoring Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing industrialization and oil & gas projects. Countries like Brazil, Saudi Arabia, and UAE are investing in workplace safety solutions. Demand for portable and wearable monitors is rising in mining and manufacturing sectors. Smart, IoT-enabled, and wireless systems are gaining traction.

Smart Hazardous Gas Monitoring Market Competitive Landscape:

Honeywell International is a global leader in industrial safety solutions, offering a wide range of fixed, portable, and wearable gas monitors. Its smart hazardous gas detection devices integrate IoT and wireless connectivity for real-time monitoring. The company focuses on chemical, oil & gas, and manufacturing sectors. Honeywell’s advanced sensor technologies enhance workplace safety and compliance.

-

In March 2025, Honeywell launched the Rosemount™ 625IR Fixed Gas Detector, utilizing advanced optical absorption technology for ultra-fast response times and factory calibration for life, reducing maintenance complexity and enhancing worker safety.

Siemens AG provides smart gas monitoring solutions as part of its industrial automation and safety portfolio. Its devices are widely adopted in manufacturing, chemical, and energy industries. Siemens emphasizes integration with IoT, cloud analytics, and predictive maintenance for enhanced operational efficiency. The company’s solutions comply with international safety standards like ATEX and IECEx.

-

In December 2024, Siemens introduced the FDA241 detector, employing dual-wavelength detection technology to identify smoldering or off-gas particles from lithium-ion batteries up to five times earlier than conventional spot detectors, enhancing safety in environments where early detection of battery malfunctions is critical.

Emerson Electric Co. specializes in hazardous gas detection systems for industrial applications, including oil & gas, chemicals, and power generation. Its solutions include fixed, portable, and wearable monitors with real-time data connectivity. Emerson integrates advanced sensors and automation for predictive maintenance and early hazard detection. Compliance with international safety regulations enhances adoption.

-

In March 2025, Emerson announced the release of the Rosemount 625IR Fixed Gas Detector, designed to provide reliable and fast gas detection in all plant environments using advanced optical absorption detection technology.

Drägerwerk offers high-precision smart hazardous gas monitors for industrial and healthcare environments. Its devices include fixed, portable, and wearable monitors with wireless connectivity and real-time alerts. Dräger focuses on improving worker safety in chemicals, oil & gas, and mining sectors. Compliance with global safety standards such as ATEX and IECEx drives adoption.

-

In December 2024, Drägerwerk AG & Co. KGaA introduced an upgraded multi-gas detection device with improved sensor accuracy and extended battery life, enhancing safety in industrial environments.

Smart Hazardous Gas Monitoring Market Key Players:

Some of the Smart Hazardous Gas Monitoring Market Companies are:

-

Honeywell International Inc.

-

Siemens AG

-

Emerson Electric Co.

-

Drägerwerk AG & Co. KGaA

-

MSA Safety Incorporated

-

Industrial Scientific Corporation

-

RKI Instruments, Inc.

-

Teledyne Technologies Incorporated

-

General Electric Company

-

ABB Ltd.

-

Yokogawa Electric Corporation

-

Thermo Fisher Scientific Inc.

-

Trolex Ltd.

-

Sensidyne, LP

-

Gastron Co., Ltd.

-

Crowcon Detection Instruments Ltd.

-

Hanwei Electronics Group Corporation

-

Tyco International plc (Johnson Controls)

-

Figaro Engineering Inc.

-

Xylem Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.38 Billion |

| Market Size by 2033 | USD 6.64 Billion |

| CAGR | CAGR of 8.84% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fixed Gas Monitors, Portable Gas Monitors, Wearable Gas Monitors) • By Application (Industrial, Commercial, Residential, Mining, Healthcare and Others) • By Type (Combustible Gases, Toxic Gases, Oxygen, Others) • By End-User (Manufacturing, Oil & Gas, Chemicals, Utilities and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., Siemens AG, Emerson Electric Co., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Industrial Scientific Corporation, RKI Instruments, Inc., Teledyne Technologies Incorporated, General Electric Company, ABB Ltd., Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Trolex Ltd., Sensidyne, LP, Gastron Co., Ltd., Crowcon Detection Instruments Ltd., Hanwei Electronics Group Corporation, Tyco International plc (Johnson Controls), Figaro Engineering Inc., Xylem Inc. |