Outdoor Solar LED Market Key Insights:

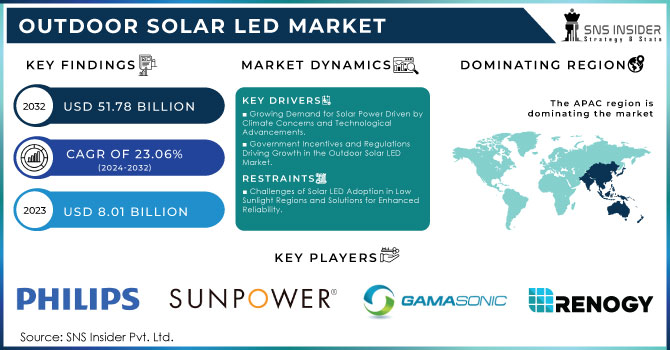

The Outdoor Solar LED Market size was valued at USD 8.01 Billion in 2023 and is expected to reach USD 51.78 Billion by 2032, growing at a CAGR of 23.06% over the forecast period 2024-2032. Recent years have seen a substantial increase in the outdoor solar LED market, fueled by the rising need for renewable energy solutions and efficient outdoor lighting. This new technology decreases carbon emissions and also cuts energy expenses for both consumers and businesses. In 2023, global energy-related CO2 emissions reached a record high of 37.4 billion tonnes, marking a 1.1% increase of 410 million tonnes compared to the previous year. Coal accounted for over 65% of this increase, significantly impacting emissions.

Get More Information on Outdoor Solar LED Market - Request Sample Report

A notable contributor was the global shortfall in hydropower generation due to droughts, which alone added approximately 170 million tonnes to emissions. Advanced economies experienced a remarkable divergence, with GDP growing by 1.7% while emissions fell by 4.5%, reflecting a decline driven by renewable energy adoption and coal-to-gas switching. In contrast, emissions in China surged by 565 million tonnes, continuing its post-pandemic economic growth, with a significant portion attributed to adverse hydro conditions. India also saw emissions rise by around 190 million tonnes, driven by strong economic growth and reduced hydro production. Overall, the interplay of economic growth and clean energy advancements highlights a complex landscape for global emissions in 2023.

Many cities are now incorporating solar streetlights into their infrastructure as they acknowledge the advantages of solar LED lighting technology. These streetlights powered by the sun are created to work without needing the grid, lowering electricity expenses for local authorities. Equipped with motion sensors and dimming capabilities, they have advanced features that lead to higher efficiency and lower energy usage. Moreover, solar streetlights can be set up in remote or rural regions where it is not feasible or expensive to extend grid power. The Biden-Harris Administration disclosed more than USD 31 million in clean energy funding in November 2023, to back projects in 19 states. This funding is a component of the EECBG program and is intended to improve energy efficiency in different local initiatives. Major initiatives consist of street lights powered by solar energy, upgrades to community structures to eliminate carbon emissions, and enhanced availability of clean energy options. Furthermore, there is a focus on promoting policies and incentives for solar street lighting to increase the adoption of eco-friendly technologies.

Market Dynamics

Drivers

-

Growing Demand for Solar Power Driven by Climate Concerns and Technological Advancements.

Growing worries about climate change and environmental damage are driving the global transition towards renewable energy sources. Governments, institutions, and individuals are all looking for sustainable options to fossil fuels and this has resulted in a growing demand for renewable energy choices, specifically solar power. The increasing demand for outdoor solar LED lights greatly contributes to the growth of the market, as more individuals and companies are seeking to utilize solar energy for their lighting requirements. A key factor pushing this change is the acknowledgment of the harmful impact of conventional energy sources on the environment. The burning of fossil fuels releases greenhouse gases that cause global warming, leading governments around the world to enact policies to lessen carbon emissions. Solar power, due to its cleanliness and renewable nature, offers a feasible solution that is in line with these sustainability objectives. Furthermore, improvements in solar technology have increased the affordability and accessibility of solar energy to unprecedented levels. The price of solar panels has greatly decreased in the last ten years, allowing a wider group of consumers to afford solar installations. With a growing number of individuals embracing solar energy options, the economies of scale lead to additional price decreases, which in turn fuel market expansion.

-

Government Incentives and Regulations Driving Growth in the Outdoor Solar LED Market.

Government incentives and regulations are essential in molding the outdoor solar LED market. Many governments globally are putting in place policies to promote the use of solar technologies as they work towards renewable energy goals and environmental sustainability. These efforts reduce financial obstacles for customers and also foster an environment that is supportive of market expansion. For example, in the U.S., the ITC provides a tax credit of 26% of the cost of installing solar panels for residents. This credit is available for installations completed in 2023 and 2024. In addition to tax credits, different governments offer rebates and grants for backing renewable energy initiatives. These additional financial benefits help reduce the financial strain on consumers and businesses, motivating them to consider solar choices. Certain local governments provide targeted initiatives that concentrate on installing solar lighting in public areas, promoting community involvement in sustainability projects. These programs not only increase exposure to solar technologies but also prove their efficiency in real-world usage.

Restraints

-

Challenges of Solar LED Adoption in Low Sunlight Regions and Solutions for Enhanced Reliability.

The outdoor solar LED market is also significantly constrained by the restricted access to sunlight in some areas. Regions that experience regular cloud cover, precipitation, or extended winter seasons may face challenges in producing adequate solar energy to effectively operate outdoor lighting systems. This restriction may raise doubts about the dependability and effectiveness of solar lighting options, particularly in areas where consistent operation is crucial. Consumers in areas with less sunlight may be reluctant to buy solar lighting due to concerns about the system's performance and possible extra expenses for grid power supplementation. This doubt can impede the spread of solar LED technology in regions that could otherwise gain from its benefits. To tackle this obstacle, manufacturers and developers need to investigate creative options, like energy storage systems or hybrid models blending solar energy with conventional power sources, to guarantee consistent effectiveness in varied environmental circumstances.

Market Segmentation Analysis

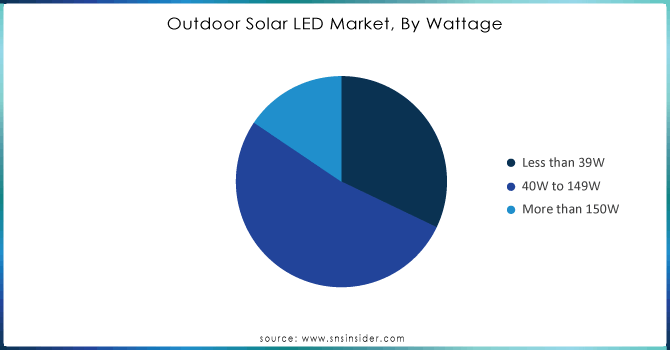

By Wattage

The 40W to 149W segment dominated the market in 2023 with over 52.34%. These medium-wattage lights are appropriate for bigger situations such as street lighting, parking lots, and commercial outdoor areas. They provide a mix of light and energy efficiency, suitable for urban and suburban areas needing brighter illumination. As more cities incorporate smart lighting solutions, companies such as Philips and Sierra Solar have created solar LED lights in this power range, featuring smart technology for remote monitoring and management.

The less than 39W segment is accounted to have the fastest CAGR during 2024-2032. This group stands out for its energy efficiency and affordability, making it ideal for use in homes and small businesses. With the growing importance of sustainability, more and more homeowners and businesses are choosing eco-friendly solutions that provide functionality and aesthetic appeal. Ring and GigaTera have unveiled solar LED lights with motion sensors to improve safety and reduce energy usage.

Need Any Customization Research On Outdoor Solar LED Market - Inquiry Now

By Application

Solar LED streetlights led the market with over 36% market share in 2023, mainly because they are widely used for both urban and rural infrastructure. These lights are very effective, resulting in substantial energy savings and lowering electricity expenses for local governments. The increasing focus on sustainable city planning and the importance of improving public safety contribute to their rise in popularity. Philips Lighting and Signify have installed solar street light solutions in many cities globally, demonstrating the efficiency of the technology.

Solar garden LED lights are expected to grow rapidly during 2024-2032 with the fastest CAGR, reflecting an increasing interest in residential landscaping and outdoor beauty. Increasing consumer awareness of eco-friendly options and the need for low-maintenance outdoor decoration are fueling growth in this category. GKOLED and Sunco Lighting are working on creating advanced solar garden lights with smart functions like motion sensors and remote controls to enhance user convenience.

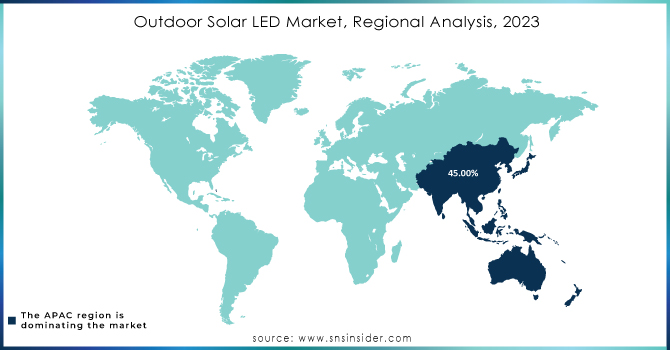

Regional Analysis

The APAC region led the market in 2023 with 45.00% because of its large population, rapid urbanization, and growing energy needs. China and India are at the forefront by making substantial investments in solar infrastructure to meet their energy demands sustainably. Companies such as Sunna Design and SolarOne Solutions are taking advantage of these opportunities by installing solar LED lighting in urban areas, parks, and rural regions. Moreover, the increasing popularity of smart cities in nations like Singapore and Japan is spurring advancements in solar LED technologies, resulting in improved energy efficiency and lessened environmental footprint.

North America is expanding quickly with a rapid CAGR and accounted to become the fastest-growing region during 2024-2032 due to growing government initiatives and consumer focus on sustainable energy solutions. The increase in the use of solar-powered LED lighting systems is a result of the region's focus on cutting carbon footprints and enhancing energy efficiency. Different cities and local governments are putting money into solar LED streetlights and outdoor lighting solutions to improve public safety and lower energy expenses. Philips Lighting and Cree Lighting are actively engaged in creating cutting-edge solar LED technologies for urban and rural areas.

Key Players

The major key players in the Outdoor Solar LED Market are:

-

Philips Lighting (Philips Solar LED Street Light, Philips Solar LED Garden Light)

-

SunPower Corporation (SunPower Solar LED Flood Light, SunPower Solar Pathway Light)

-

Gama Sonic (Gama Sonic Solar LED Lantern, Gama Sonic Solar LED Street Light)

-

Renogy (Renogy Solar LED Flood Light, Renogy Solar LED Street Light)

-

Bovon (Bovon Solar LED String Lights, Bovon Solar LED Garden Light)

-

Hykon (Hykon Solar LED Street Light, Hykon Solar LED Flood Light)

-

Sustainable Solar (Sustainable Solar LED Path Light, Sustainable Solar LED Wall Light)

-

Troy Lighting (Troy Solar LED Lantern, Troy Solar LED Wall Sconce)

-

Solar Light Company (Solar Light Company LED Security Light, Solar Light Company LED Path Light)

-

Energizer (Energizer Solar LED Flood Light, Energizer Solar LED Garden Light)

-

Nature Power Products (Nature Power Solar LED Garden Stake Lights, Nature Power Solar LED Flood Light)

-

Klight (Klight Solar LED Street Light, Klight Solar LED Garden Light)

-

LITOM (LITOM Solar LED Motion Sensor Light, LITOM Solar LED Landscape Lights)

-

Westinghouse Solar (Westinghouse Solar LED Street Light, Westinghouse Solar LED Wall Light)

-

Aootek (Aootek Solar LED Outdoor Motion Sensor Light, Aootek Solar LED Security Light)

-

Moonrays (Moonrays Solar LED Path Light, Moonrays Solar LED Spot Light)

-

InnoGear (InnoGear Solar LED Motion Sensor Light, InnoGear Solar LED String Lights)

-

Blissun (Blissun Solar LED Outdoor Lantern, Blissun Solar LED Umbrella Light)

-

Sunkit (Sunkit Solar LED Flood Light, Sunkit Solar LED Garden Light)

-

Zonkee (Zonkee Solar LED Motion Sensor Light, Zonkee Solar LED Garden Light)

Recent Developments

-

Dusk to Dawn Solar Flood Lights, March 2024: These new solar flood lights feature advanced motion detection technology and a longer battery life, providing enhanced security lighting for residential and commercial areas. They are designed for easy installation and low maintenance.

-

Solar Street Lights by Greenshine New Energy, January 2024: Greenshine introduced an upgraded range of solar street lights that utilize high-efficiency solar panels and LED technology. These lights are optimized for urban infrastructure and are being implemented in various cities to improve public safety and reduce energy costs.

-

Smart Solar Garden Lights, December 2023: A new line of smart solar garden lights was released that can be controlled via a smartphone app. This innovation allows users to adjust brightness and set timers remotely, enhancing user convenience and energy efficiency.

-

Sustainable Solar LED Floodlight Series, November 2023: This series focuses on sustainability, utilizing recycled materials in their construction. They provide powerful lighting for outdoor spaces while reducing environmental impact. The series has garnered attention for its eco-friendly design

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.01 Billion |

| Market Size by 2032 | USD 51.78 Billion |

| CAGR | CAGR of 23.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Wattage (Less than 39W, 40W to 149W, More than 150W) • By End User (Residential, Commercial, Industrial) • By Application (Solar LED Street Lights, Solar Garden LED Lights, Solar LED Floodlights, Solar LED Area Lights, Solar LED Spot Lights) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Lighting, SunPower Corporation, Gama Sonic, Renogy, Bovon, Hykon, Sustainable Solar, Troy Lighting, Solar Light Company, Energizer, Nature Power Products, Klight, LITOM, Westinghouse Solar, Aootek, Moonrays, InnoGear, Blissun, Sunkit, Zonkee |

| Key Drivers | • Growing Demand for Solar Power Driven by Climate Concerns and Technological Advancements. • Government Incentives and Regulations Driving Growth in the Outdoor Solar LED Market. |

| RESTRAINTS | • Challenges of Solar LED Adoption in Low Sunlight Regions and Solutions for Enhanced Reliability. |