Smart Hydrogen Meter Market Report Scope & Overview:

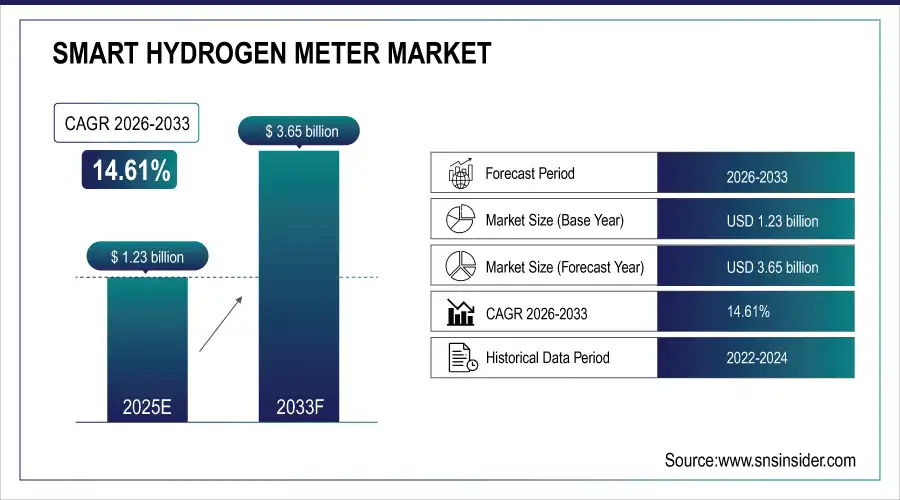

The Smart Hydrogen Meter Market size was valued at USD 1.23 Billion in 2025E and is projected to reach USD 3.65 Billion by 2033, growing at a CAGR of 14.61% during 2026-2033.

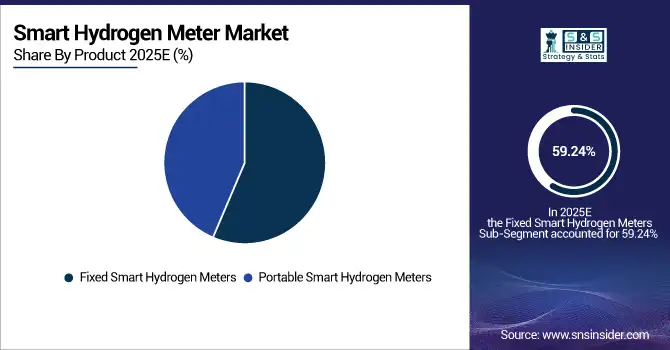

The Smart Hydrogen Meter Market analysis highlights the sales from industrial, residential, and commercial applications. Currently, fixed smart hydrogen meters are leading the market for their reliability in permanent installations; however portable meters are increasingly used for field use. The development of sensors for formaldehyde is still dominated by electrochemical principals, and thermal conductivity sensors are emerging as a popular technology.

By 2025, the industrial segment is projected to account for ~68% of global smart hydrogen meter installations, driven by scaling green hydrogen production, ammonia synthesis, and refinery decarbonization projects

Market Size and Forecast:

-

Market Size in 2025: USD 1.23 Billion

-

Market Size by 2033: USD 3.65 Billion

-

CAGR: 14.61% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Smart Hydrogen Meter Market - Request Free Sample Report

Smart Hydrogen Meter Market Trends

-

Growing Adoption of Smart Hydrogen Meters to Promote Safe Appliance Use Gas and chemical industries continue to utilize smart hydrogen meters for monitoring the flow of hydrogen, boosting demand.

-

Portable intelligent hydrogen meters have been increasingly investigated, because of their portable monitoring capabilities and convenient operating experiences, especially for use in field measurements and temporary setups.

-

Most are electrochemical based, although thermal conductivity and catalytic sensors are gaining traction with their potential for greater levels of accuracy, reduced service requirements, and application flexibility in a variety of different hydrogen applications.

-

Strict safety and environmental regulations force manufacturers to make meters that comply with ISO, IEC, and regional standards affecting product design and the global market penetration rate.

-

Intelligent hydrogen meters are now increasingly being connected to IoT platforms for industrial and utility applications to provide real-time monitoring, predictive maintenance as well as data driven decision making.

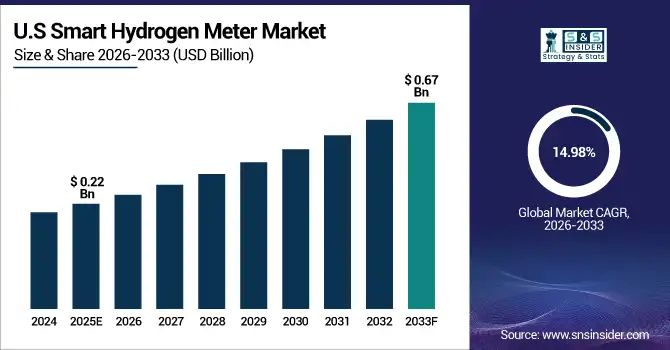

The U.S. Smart Hydrogen Meter Market size was valued at USD 0.22 Billion in 2025E and is projected to reach USD 0.67 Billion by 2033, growing at a CAGR of 14.98% during 2026-2033. Smart Hydrogen Meter Market growth is driven by growing acceptance of hydrogen technologies in industrial, power and water treatment categories. Elevating safety and environ- mental standards are leading to the adoption of precise monitoring equipment. The development in electrochemical and thermal conductivity sensors help to improve precision and shortens response time. Increase in demand for real-time monitoring in renewable energy, hydrogen-based fuel systems drive the demand.

Smart Hydrogen Meter Market Growth Drivers:

-

Rising Industrial Adoption and Safety Regulations Fuel Demand for Smart Hydrogen Meters Globally

Smart Hydrogen Meter Market is mainly driven by industrial used in oil, gas and water treatment industry. Strict safety and environmental specifications require reliable hydrogen monitoring, driving the need for advanced meters. Moreover, sensor accuracy, real-time data analytics and integration with IoT platforms have advanced through technology, thus improving operational efficiency and market expansion.

By 2025, over 70% of smart hydrogen meter deployments will occur in industrial settings, with the oil & gas sector alone accounting for ~30%, driven by hydrogen use in refining (hydrotreating) and methane pyrolysis pilots

Smart Hydrogen Meter Market Restraints:

-

High Costs and Maintenance Challenges Limit Wide-Scale Adoption of Smart Hydrogen Meters

However, high initial and operational costs threaten the Smart Hydrogen Meter Market growth. The adoption of the system is restricted by complicated adjustment, difficult maintenance and replacement of sensors etc., particularly among small and medium-sized companies. In addition, the absence of a standardized infrastructure and trained staff for operating high-tech hydrogen monitoring systems also hinders scaling up in developing markets.

Smart Hydrogen Meter Market Opportunities:

-

Emerging Portable Meters and IoT Integration Create Significant Growth Opportunities in Hydrogen Monitoring

The market offers opportunities in the form of portable smart hydrogen meters for on-site, flexible monitoring across various industries. Integration with the IoT, cloud and predictive analytics delivers enhanced services for real-time tracking and operational efficiencies. Further, increasing investments in renewable energy, hydrogen fuel cells and clean energy infrastructure across the world offer substantial market opportunities for expansion and technology adoption.

By 2025, over 50,000 portable smart hydrogen meters are expected to be deployed globally for field use—up from ~20,000 in 2021—primarily by maintenance crews, safety inspectors, and first responders in hydrogen refueling, chemical, and power generation sectors

Smart Hydrogen Meter Market Segment Analysis

-

By product, fixed smart hydrogen meters led the market with a 59.24% share in 2025, while portable smart hydrogen meters were the fastest-growing segment, with a CAGR of 10.20%.

-

By application, the industrial segment dominated with 41.38% share in 2025, whereas the residential segment was the fastest-growing, registering a CAGR of 13.54%.

-

By technology, electrochemical meters led the market with 52.01% share in 2025, while thermal conductivity meters showed the fastest growth at a CAGR of 12.34%.

-

By end-user, the oil & gas sector held the largest share at 35.90% in 2025, while the water treatment segment recorded the fastest growth with a CAGR of 9.25%.

By Product, Fixed Smart Hydrogen Meters Leads Market While Portable Smart Hydrogen Meters Registers Fastest Growth

Fixed smart hydrogen meters dominate the market, due to it is used broadly in permanent industrial and utility applications. These monitors provide dependable, round-the-clock driving force behind safety and regulatory compliance. The portable smart hydrogen meters segment growing fastest due to most rapid gains will be recorded. It’s benefiting from rising requirements for flexibility in field service work, temporary build projects and on-site testing. Their portability, transportability and possibility to measure in real time present an interesting advantage for mobile sectors, such as research laboratories or remote industrial plants or maintenance activities.

By Application, Industrial Dominate While Residential Shows Rapid Growth

Industrial segment holds largest share in smart hydrogen meter market as there is extensive use of hydrogen in oil refining, chemical processing and power generation plants. In the industrial setting, monitoring must be both accurate and be continuously performed to prevent accidents, maximize efficiency, and maintain regulatory compliance. As for residential applications, growing fastest due to hydrogen energy systems, fuel cells and home energy storage systems. Growing adoption of clean energy and smart home penetration is driving residential demand. This is an upward trend which we can also anticipate accelerating as hydrogen-based solutions become more affordable and consumer-friendly.

By Technology, Electrochemical Lead While Thermal Conductivity Registers Fastest Growth

Electrochemical segment currently holds largest share of smart hydrogen meter market, with high measuring accuracy, reliability and stability for long-term detection of hydrogen concentration. Such sensors are widely used in industrial and commercial environments to provide continuous surveillance to ensure safety. Thermal conductivity sensors, however, are projected to have the fastest growth; due to their ability to detect hydrogen in a wide range of environmental conditions and low maintenance as well as portability for the fixed meters market. Increasing needs of accuracy, online measurement and free maintenance devices will propel the demand for thermal conductivity-based smart hydrogen meters.

By End-User, Oil & Gas Lead While Water Treatment Grow Fastest

Oil and gas segment dominates the market, due to the necessity of these kinds of meters in safety monitoring, leak detection and process regulatory optimization. Large consumption of hydrogen, safety regulation and complicated operation method make this industry the biggest user of intelligent hydrogen meter. The fastest growth, however, will be in water treatment since of increasing use of hydrogen-based technology for the purification of water and necessity to monitor disinfection at treatment plants around the clock. Growing environmental compliance and process efficiency awareness is fueling the quick uptake in this emerging end-user category.

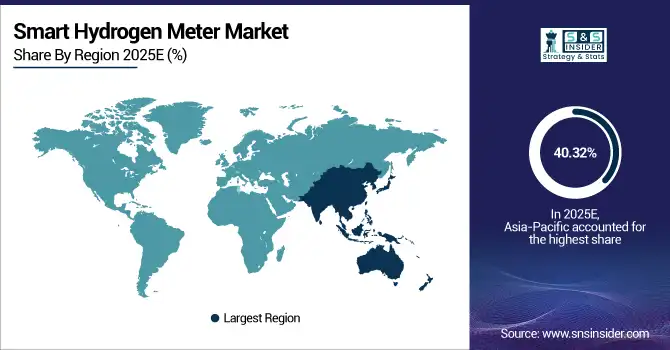

Smart Hydrogen Meter Market Regional Analysis:

Asia-pacific Smart Hydrogen Meter Market Insights

In 2025E Asia-Pacific dominated the Smart Hydrogen Meter Market and accounted for 40.32% of revenue share, this leadership is due to the rapid industrialization and increasing hydrogen usage in power generation, chemicals and manufacturing industries. The demand for electrochemical and thermal conductivity meters is growing in the region due to technology investments. Governments are creating incentives for clean energy and the expansion of hydrogen infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Smart Hydrogen Meter Market Insights

Chinas growing hydrogen energy and fuel cell industries place it at the top of the Smart Hydrogen Meter Market in Asia-Pacific. High government regulation for industrial and commercial hydrogen infrastructure is required. Local production facilities and use of novel electrochemical sensors benefit the market

North America Smart Hydrogen Meter Market Insights

North America is expected to witness the fastest growth in the Smart Hydrogen Meter Market over 2026-2033, with a projected CAGR of 15.26% due to high share of smart hydrogen meter market is held by North America North America has large well-developed industrial base resulting into increased demand for material and chemicals. The U.S. is the biggest donor, as power generation and industry have strong hydrogen applications. Meter adoption is driven by technological advancement, IOT integration and predictive maintenance features.

U.S. Smart Hydrogen Meter Market Insights

The U.S. owing to developments in the oil, gas, water treatment, and power generation industries. U.S. authorities have also mandated the installation of meters for safety and environmental concerns; portable and fixed meters are used in field and permanent installations.

Europe Smart Hydrogen Meter Market Insights

The European smart hydrogen meter market is increasing with investment in renewable energy and hydrogen fuel cell-based technology as the meters are also integrated with smart energy grids. The biggest users of the fixed smart hydrogen meters sector are industrial and utility sectors. EU’s strong regulations towards safety and environment promote compliance and the use of safe and reliable meters.

Germany Smart Hydrogen Meter Market Insights

Germany has incorporated both fixed and portable meters in several industrial and research facilities. Factors contributing to the use of smart meters across Germany are regulatory measures, government incentives, and technological advancements that cut across the country.

Latin America (LATAM) and Middle East & Africa (MEA) Smart Hydrogen Meter Market Insights

The Smart Hydrogen Meter Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the oil & gas and water treatment industries are initially using meters. The regulatory body has also initiated environment monitoring measures gradually leading to the entry of smart meters. The region, however, presents a challenge in infrastructure and market awareness as the opportunity is driven by energy and hydrogen projects.

Smart Hydrogen Meter Market Competitive Landscape:

Landis+Gyr is a leader in smart metering and energy management solutions, the meters provide precise monitoring of hydrogen. Their smart hydrogen meters stationary and portable are available for industrial and commercial purposes. State of the art sensor technology and IoT integration allows for real time data analytics, predictive maintenance, and overall energy optimization enhancing their presence in an emerging hydrogen market.

-

In April 2025, Andis+Gyr announced a collaboration with Sense to integrate 1MHz edge processing into its Revelo metering platform. This enhancement aims to provide utilities with higher-resolution data for improved grid management and efficiency.

Siemens AG is a key smart hydrogen meter supplier, mainly for industrial and utility use. They offer a model that combines conductive sensors both electro-chemical and thermal with digital monitoring platforms. Siemens focuses on dependability, safety operations and data-driven analytics that serves global power generation, oil and gas, and water treatment providers.

-

In February 2025, Siemens entered into a partnership with Guofu Hydrogen to accelerate global green hydrogen production. Siemens is set to be the preferred supplier and technology partner across the entire value chain of Guofu Hydrogen's expansion plans.

Honeywell International makes intelligent hydrogen meters for accurate measuring of the gas and safety-related uses. Their meters include both fixed and portable solutions to enable real-time analytics and IoT-connected monitoring. Honeywell serves customers in the industrial, commercial, and energy industries with solutions that increase their productivity and profitability, offering a leading portfolio of smart systems across hydrogen monitoring market.

-

In March 2025, Honeywell launched the NXU Residential Smart Gas Meter, designed to enhance automation and remote operability for utilities across North America. This smart gas meter features pressure sensing capabilities and an integrated controller that exceeds guidelines for gas tightness.

Itron Inc. offers technologies and services for hydrogen smart metering, which includes body-wide reporting to ensure precise measurement, energy control, and industrial process enhancements. Their products combine sophisticated sensors, IoT connectivity and analytics server for real time tracking. Itron works to power generation, water treatment and industrial customers to help growth through technology innovation and sustainable monitoring solutions.

-

In March 2025, Itron and CHINT Global introduced the first smart meter based on the DLMS AC Electricity Smart Meter Generic Companion Profile (GCP). This collaboration integrates Itron's Gen5 network interface card into CHINT's electric meters, advancing smart metering technology.

Smart Hydrogen Meter Market Key Players:

Some of the Smart Hydrogen Meter Market Companies are:

-

Landis+Gyr

-

Siemens AG

-

Honeywell International Inc.

-

Itron Inc.

-

Kamstrup A/S

-

Sensus (Xylem Inc.)

-

Diehl Metering GmbH

-

Aclara Technologies LLC

-

EDMI Limited

-

Zenner International GmbH & Co. KG

-

Elster Group GmbH (Honeywell)

-

Apator SA

-

Badger Meter, Inc.

-

Wasion Group Holdings Limited

-

Neptune Technology Group Inc.

-

Iskraemeco d.d.

-

Secure Meters Limited

-

Holley Technology Ltd.

-

Schneider Electric SE

-

Jiangsu Linyang Energy Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.23 Billion |

| Market Size by 2033 | USD 3.65 Billion |

| CAGR | CAGR of 14.61% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Portable Smart Hydrogen Meters, Fixed Smart Hydrogen Meters) • By Application (Industrial, Residential, Commercial, Utilities, and Others) • By Technology (Electrochemical, Thermal Conductivity, Catalytic, and Others) • By End-User (Oil & Gas, Chemical, Power Generation, Water Treatment, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Landis+Gyr, Siemens AG, Honeywell International Inc., Itron Inc., Kamstrup A/S, Sensus (Xylem Inc.), Diehl Metering GmbH, Aclara Technologies LLC, EDMI Limited, Zenner International GmbH & Co. KG, Elster Group GmbH (Honeywell), Apator SA, Badger Meter, Inc., Wasion Group Holdings Limited, Neptune Technology Group Inc., Iskraemeco Group, Secure Meters Limited, Holley Technology Ltd., Schneider Electric SE, Jiangsu Linyang Energy Co., Ltd. |