Advanced IC Substrate Market Size & Trends:

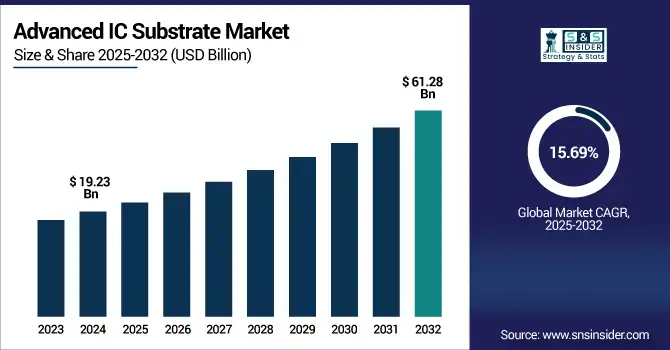

The Advanced IC Substrate Market Size was valued at USD 19.23 billion in 2024 and is expected to reach USD 61.28 billion by 2032 and grow at a CAGR of 15.69% over the forecast period 2025-2032.

To Get more information on Advanced IC Substrate Market - Request Free Sample Report

The global market report includes market size and forecast, market share analysis, segmentation by type and application, regional performance along with key market dynamics including drivers, restraints, opportunities and challenges. The growing adoption of IC substrates in AI, 5G technology, high-performance computing, and electric vehicles is one of the most prominent contributors to the growth across the world with rising requirements for high speed, improved power efficiency, and advanced packaging from different end-use industries. Advanced IC Substrate Market analysis highlights evolving substrate technologies supporting next-gen applications across multiple electronics verticals.

For instance, more than 50% of smartphones shipped globally in 2025 are expected to be 5G-enabled, requiring more advanced substrate integration.

The U.S. Advanced IC Substrate Market size was USD 2.92 billion in 2024 and is expected to reach USD 9.07 billion by 2032, growing at a CAGR of 15.29% over the forecast period of 2025–2032.

The U.S. market is growing rapidly, driven by the presence of largest semiconductor manufacturers, increasing technology investments based on advanced packaging solutions, and the adoption of AI, 5G, and autonomous systems. The industry is also benefitting from government initiatives to grow domestic semiconductor manufacturing. Together, these factors set the U.S. as a strategic location for next-generation IC substrate development, acting as a key enabler of the next generation of the global semiconductor ecosystem.

For instance, over 75% of AI datacenter chips deployed in 2025 are expected to be designed or packaged in the U.S.

Advanced IC Substrate Market Dynamics:

Key Drivers:

-

Surging Electric Vehicle (EV) Adoption and Automotive Electronics Integration Fuel Demand for Reliable and Robust IC Substrates

Growing electrification of vehicles and integration of several intelligent features such as ADAS, infotainment systems and autonomous driving technologies have spurred the need for high-reliability substrates. Next-generation IC substrates provide these thermal stability, signal integrity, and miniaturization features needed for these applications. The changing automotive ecosystem requires the performance and durability of substrate support therefore, automotive OEMs and Tier 1 suppliers are represented with substrate providers, which is expected to drive the market growth.

For instance, by 2026, over 70% of new vehicles globally are expected to be equipped with some form of ADAS, requiring high-performance substrates.

Restraints:

-

High Manufacturing Complexity and Capital Investment Limit Accessibility for Small and Mid-Sized Enterprises in the IC Substrate Market

The production of modern IC substrates such as FC BGA and FC CSP is complicated by multilayering, die alignment, and exotic materials. It requires cleanroom infrastructure, advanced machinery suited for such precision work, and highly specialized labor. It requires huge capital to invest which keeps smaller players into their boundaries from making further entry or expansion. This has led to very few, large-scale manufacturers occupying the entire landscape, reducing competition and squeezing out the innovation that smaller firms, with limited means to address the required scale and yield, could have added.

Opportunities:

-

Expansion of 5G Infrastructure and Edge Computing Drives New Demand for High-Performance IC Substrate Technologies

The high demand for components that can operate at higher frequencies, higher data rates, and offer greater thermal management with the global 5G rollout is forcing engineers to think out of the box. IC substrates are essential components of RF modules, base stations, and edge devices that rely on signal integrity and thermal dissipation. Similarly, the trend towards edge computing and real-time data processing require substrate designs capable of multi-chip integration. Advanced IC Substrate Market growth is fueled by rising 5G and edge computing needs. Such trends create opportunities for high-end IC substrate suppliers to offer innovative, high-throughput, and low thermal resistance solutions.

For instance, high-performance edge processors can generate thermal loads exceeding 100 W/cm², requiring substrates with low thermal resistance and efficient heat spreading.

Challenges:

-

Technological Complexity in Meeting Miniaturization, Signal Integrity, and Multi-Chip Integration Requirements Strains Development Cycles

High-performance packaging with better thermal dissipation and signal fidelity to support highly miniaturized applications for AI, 5G, and HPC in advanced system configurations These requirements are at the extreme end of existing substrate technologies, this has led to technical challenges in layer stacking, warpage control, and material compatibility. Their development encompasses long and expensive R&D cycles, extremely costly prototyping, and extensive testing, thus making the process tedious and requiring a hefty chunk of resources. The trick is to retain speed for innovation while ensuring it is manufacturable, scalable, and reliable in performance-critical environments.

Advanced IC Substrate Market Segmentation Analysis:

By Type

In 2024, demand for FC BGA segment for Advanced IC Substrate Market accounted for largest revenue share of approximately 61.5% as compared to other technology segment. Such dominance is due to its very good thermal and electrical performance, which has led to widespread adoption in high-end applications such as servers, gaming consoles, and networking equipment. A number of the leading players, including Ibiden Co., Ltd. supply advanced FC BGA substrates with multilayer integration capability. For performance-driven systems in computing and telecom, the segment continues to be preferred for high pin count processors and SoCs.

The FC CSP segment is projected to grow at the highest CAGR of over 15.92% during the forecast period due to the increasing adoption of compact and lightweight consumer electronics products including smartphones, tablets, and other wearable devices. The significant investment example is FC CSP technology which has been heavily invested by companies such as Samsung Electro-Mechanics as volume pile up. The miniaturized approach provided by these substrates delivers robust performance within space-constrained devices, ideal for next-gen mobile electronics at a low-cost and small-form factor implementation.

By Application

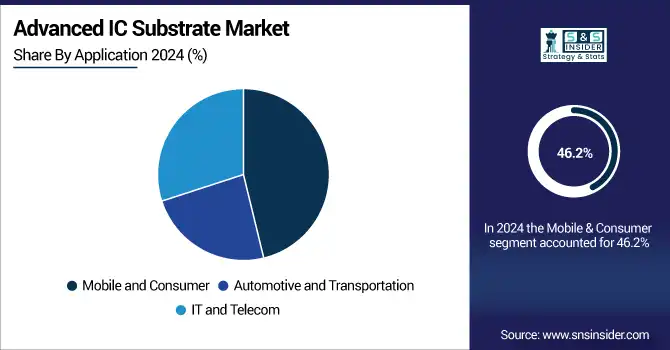

Mobile & Consumer segment held the largest Advanced IC Substrate Market share of approximately 46.2% in 2024. This is due to the high production rates of smartphones, tablets, and AR/VR devices would need to keep shrinking to be lightweight and low-cost in packaging. Shinko Electric Industries Co., Ltd., a leading supplier to this demand, provides substrates with high I/O in a small footprint. Smartphone IC substrate market demand is well supported by constant innovation and upgrade cycles for mobile devices. Advanced IC Substrate Market trends show increasing miniaturization and integration in consumer electronics.

Automotive and Transportation segment is predicted to achieve the highest CAGR of throughout the anticipated duration, via way of means of around 16.84% from 2024 to 2032. The shift to EVs and autonomous driving will drive higher substrate requirements in radar, ADAS, and power electronics. In response to these increased demands, AT&S (Austria Technologie & Systemtechnik AG) has broadened its automotive-based substrate solutions. The thermal performance, reliability, and miniaturization-related factors keep the automotive sector as the main growth engine with strengthening sales for automotive electronics.

Advanced IC Substrate Market Regional Analysis:

North America accounted for a significant revenue share in the Advanced IC Substrate Market due to the presence of robust technological infrastructure, large semiconductor companies, and rapid adoption of AI, 5G, and autonomous systems. North America has become central to innovation and next-gen IC substrate development with the U.S. spending heavily on advanced packaging and government support for domestic semiconductor fabrication.

-

The U.S. dominates North America’s Advanced IC Substrate Market due to its strong semiconductor manufacturing base, advanced R&D capabilities, and significant investments in AI, 5G, and autonomous technologies, supported by favorable government policies and industry-leading companies such as Intel and AMD.

In 2024, Asia Pacific led the Advanced IC Substrate Market with a 42.7% share owing to strong foundry and packaging hubs in Taiwan, South Korea, China, and Japan. Global supply chains are spearheaded by key players such as TSMC, ASE Group, and Samsung. The region will continue to lead the way in manufacturing advanced substrates, growing at a 16.24% CAGR amid increasing demand for AI, 5G and EVs, and investments across India and Vietnam.

-

China leads the Asia Pacific market with its massive electronics manufacturing ecosystem, rising domestic semiconductor demand, and strategic government initiatives such as “Made in China 2025,” boosting investments in advanced IC packaging and substrate production for consumer electronics, telecom, and automotive sectors.

Europe holds a significant position in the Advanced IC Substrate Market, backed by increasing investment in semiconductor R&D, automotive electronics, and industrial automation. Countries such as Germany and France aim to bolster chip production capabilities. Europe is progressing its geopolitical presence in the global markets of high-reliability substrate technologies for strategic industrial applications among a demand-charged environment of electric vehicles and IoT applications.

-

Germany dominates the European Advanced IC Substrate Market due to its strong semiconductor ecosystem, leadership in automotive electronics, and significant investments in advanced packaging technologies. Its robust industrial base and innovation in EV and automation sectors drive substantial substrate demand.

The UAE leads the way in Advanced IC Substrate Market in Middle East & Africa due to smart infrastructure related projects as well as rising electronics demand. Although Brazil leads in the region–it has the rapidly expanding electronics and automotive sectors–a renewed emphasis on semiconductor production will drive market growth for both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Advanced IC Substrates Companies are ASE Group, TSMC, Ibiden Co., Ltd., Unimicron Technology Corp., AT&S (Austria Technologie & Systemtechnik AG), Shinko Electric Industries Co., Ltd., Samsung Electro-Mechanics, Kyocera Corporation, Kinsus Interconnect Technology Corp. and Simmtech Co., Ltd and others.

Recent Developments:

-

In January 2025, Ibiden is expanding its Gifu FC‑BGA production facility, targeting 25% output by late 2025 and 50% by March 2026, servicing AI semiconductor demand.

-

In March 2024, Samsung Electro‑Mechanics announced ramp-up in high-performance FC‑BGA substrate production for AI and automotive chips to meet escalating demand from cloud service providers and EV manufacturers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.23 Billion |

| Market Size by 2032 | USD 61.28 Billion |

| CAGR | CAGR of 15.69% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (FC BGA, FC CSP) • By Application (Mobile and Consumer, Automotive and Transportation, IT and Telecom) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ASE Group, TSMC, Ibiden Co., Ltd., Unimicron Technology Corp., AT&S (Austria Technologie & Systemtechnik AG), Shinko Electric Industries Co., Ltd., Samsung Electro-Mechanics, Kyocera Corporation, Kinsus Interconnect Technology Corp. and Simmtech Co., Ltd. |