Smart Insulin Pens Market Report Scope & Overview:

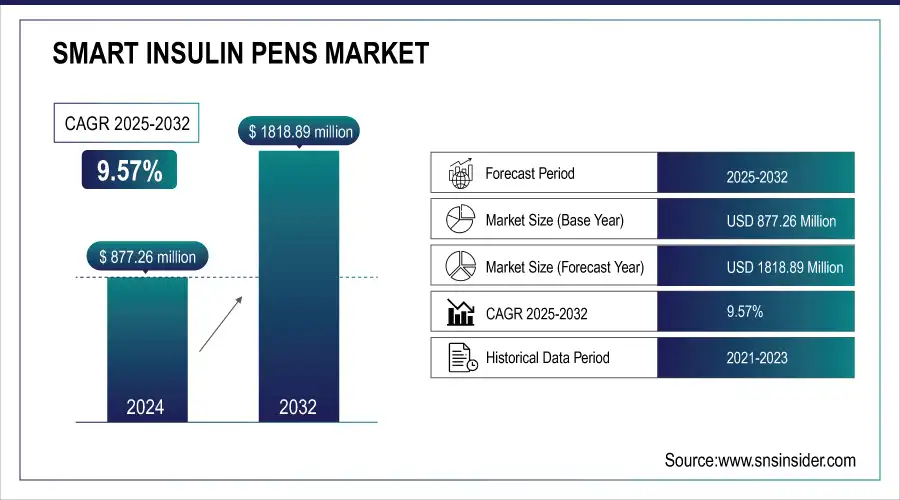

The Smart Insulin Pens Market size was valued at USD 877.26 million in 2024 and is expected to reach USD 1818.89 million by 2032, growing at a CAGR of 9.57% over the forecast period of 2025-2032.

To Get more information on Smart Insulin Pens Market - Request Free Sample Report

Growing diabetes prevalence and government policies supporting worldwide help to drive notable expansion of the global smart insulin pen market. The U.S. Centers for Disease Control and Prevention (CDC) estimate that 38.4 million Americans will have diabetes by 2024, which emphasizes the critical need of sophisticated diabetes management tools including smart insulin pens.

Smart Insulin Pens Market Trends

-

Rising prevalence of diabetes is driving demand for smart insulin pens for precise dosing.

-

Integration with digital health apps and continuous glucose monitoring is enhancing patient adherence and data tracking.

-

Advancements in connectivity, Bluetooth, and IoT-enabled pens are improving usability and monitoring.

-

Growing focus on personalized diabetes management and telemedicine is boosting market adoption.

-

Expansion of home healthcare and self-administration trends is increasing accessibility.

-

Collaborations between pharmaceutical companies, device manufacturers, and digital health platforms are accelerating innovation.

-

Supportive reimbursement policies and patient awareness programs are fostering wider adoption globally.

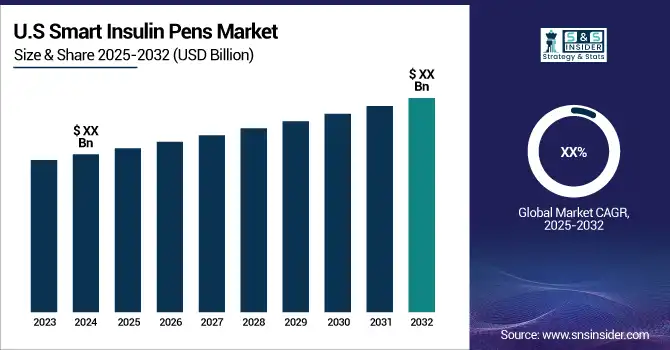

Strong healthcare infrastructure and Medicare Part D coverage extension for linked insulin pens since 2023 caps insulin costs at USD 35 monthly for many patients, hence the U.S. smart insulin pens market held a dominant share of about 34% with a value of USD 301.83 million in 2024 and it’s projected to reach USD 620.78 million by 2032 and is growing with a CAGR of 9.46% over the forecast period. Governments all around are funding digital health projects that support smart diabetes devices, such as Bluetooth insulin pens and digital insulin pens, to help with diabetes management and insulin dosage tracking. Regulatory agencies, including the FDA, which authorized Biocorp's Mallya smart sensor in late 2022, support the combination of a smart pen for diabetes with glucose monitoring integration and insulin tracking apps. These innovations mirror a larger smart insulin pens market trend toward connected insulin pens and reusable insulin pens, improving patient adherence and lowering complications.

Smart Insulin Pens Market Growth Drivers:

-

Increasing FDA Approvals and Integrating Smart Insulin Pens with Continuous Glucose Monitoring Systems Drive Market Expansion.

A main driver of the smart insulin pens market growth is the FDA's recent approval of improved smart insulin pens, together with their connection with continuous glucose monitoring (CGM) systems. For its new InPen app, which can suggest insulin dose adjustments in real-time including for missed or erroneous doses Medtronic, for example, got FDA approval in November 2024 Part of Medtronic's Smart MDI system, this app integrates the InPen with the Simplera CGM to provide patients using numerous daily injections individualized insulin dosage insights. This technology is the first on the market to offer such real-time, customized dose advice, therefore greatly enhancing diabetes control and adherence. Approved by the FDA in 2024 as well, the Simplera CGM is a small, throwaway gadget improving user comfort and data accuracy. Strong worldwide adoption of comparable sensors, acknowledged by Medtronic's CEO, points to business potential.

Further increasing acceptance are other businesses such as Insulcloud, whose smart insulin pen caps convert conventional pens into networked devices. This has FDA approval. These technical integrations and legislative benchmarks highlight the increasing focus on digital health solutions in diabetes treatment, hence improving glycemic control and lowering complications. The FDA's endorsement of biosimilar insulins, including Merilog's approval in early 2025, also fits this trend by increasing reasonably priced therapy alternatives fit for smart pen technology. These advances, taken together, are driving smart insulin pens into mainstream diabetes treatment, particularly in developed nations with robust regulatory systems.

Smart Insulin Pens Market Restraints:

-

High Cost and Limited Reimbursement Policies Continue to Restrict Smart Insulin Pen Accessibility Globally

Particularly in low- and middle-income countries, the great expense of smart insulin pens and limited reimbursement coverage remain major obstacles to general adoption despite technological developments. These devices significantly lower manufacturing and retail costs than conventional insulin delivery systems by including sophisticated technologies, including Bluetooth connectivity, dose tracking, and integration with mobile apps and CGM systems. Many patients, particularly in developing countries, have financial difficulties since insurance plans usually do not cover these sophisticated gadgets or offer only a partial refund. Even if smart pens provide better dose accuracy and adherence benefits, this expensive load determents patients from switching to them.

Furthermore, aggravating access problems in these areas are the absence of thorough government subsidy schemes and uneven healthcare infrastructure. The cost reason also limits the capacity of healthcare providers to suggest these devices generally, therefore limiting market penetration and digital health acceptance. Industry statistics show that, whereas affluent nations like Germany and the United States gain from good insurance policies and government programs boosting smart pen use, many other nations lag. Expanding the market worldwide and guaranteeing fair access to creative diabetes treatment technologies depend on overcoming these financial and political obstacles.

Smart Insulin Pens Market Segment Analysis

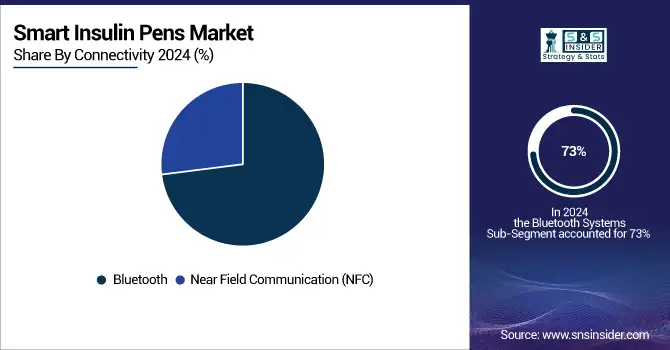

By Connectivity, Bluetooth segment dominated the smart insulin pens market in 2024 with over 73% revenue share, NFC segment is expected to grow fastest CAGR

With over 73% of the revenue share, the Bluetooth segment held the global smart insulin pens market in 2024. Bluetooth insulin pens provide real-time insulin dose tracking and data exchange with healthcare providers using flawless wireless communication to insulin tracking apps and smart diabetic equipment. Using reminders and bolus calculators, this connectivity helps to increase patient adherence and enable individualized diabetes care. Government regulatory agencies, including the U.S. FDA, have sped approvals for Bluetooth-enabled smart insulin administration devices, best shown by Biocorp's Mallya sensor clearance in December 2022, which transforms conventional pens into linked devices. Medicare's inclusion of smart insulin pens in Part D coverage since 2023 has also lowered patient expenses, hence increasing acceptance of the smart insulin pens market in the United States. Bluetooth pen proliferation is also supported by the worldwide emergence of digital health policies and reimbursement systems in Europe and North America.

The Near Field Communication (NFC) segment is expected to rise significantly, with its user-friendly, contactless data transfer, particularly appealing in emerging nations with rising smartphone penetration and digital health adoption. In line with industry trends stressing simplicity of use and accessibility, NFC-enabled pens streamline insulin dose tracking without requiring ongoing Bluetooth pairing.

By Indication, Type 1 diabetes segment dominated in 2024, Type 2 diabetes segment is expected to grow fastest CAGR

The type 1 diabetes segment dominated the smart insulin pens market in 2024 because of the great demand for exact insulin delivery in patients depending on insulin treatment. According to the U.S. National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), type 1 diabetes affects around 1.6 million Americans, which increases demand for smart insulin delivery devices that lower dosing errors and enhance glycemic control. Government initiatives stress digital health technologies and funding schemes that enable type 1 diabetics to have access to smart pens.

Driven by the increasing global incidence of type 2 diabetes connected with obesity and inactive lifestyles, the sector on type 2 diabetes segment is predicted to show the fastest growth during the forecast period. The CDC notes a huge potential market since over 90 million persons in the United States have prediabetes or type 2 diabetes. Adoption among type 2 diabetes sufferers is growing as knowledge of linked insulin pens and integration with continuous glucose monitoring (CGM) devices and insulin tracking applications rises. Recognizing the potential of smart pens to lower diabetes complications and healthcare costs, governments all around are giving type 2 diabetes management top priority through digital health projects and financing. By extending the user base outside type 1 diabetes, this change helps to drive the smart insulin pens market.

By Distribution Channel, Hospital pharmacies dominated in 2024, Retail and online pharmacies are expected to grow fastest CAGR

Hospital pharmacies led the smart insulin pens market in 2024, reflecting their function as the main point of care for insulin-dependent patients. Hospitals guarantee that patients obtain the newest smart insulin delivery devices using government-supported reimbursement systems, clinical knowledge, and improved diabetes care devices. The U.S. Centers for Medicare & Medicaid Services (CMS) advises that starting and controlling insulin treatment using smart pens still depends critically on hospital-based delivery.

The retail and online pharmacies are seeing the fastest CAGR, thanks to growing customer demand for quick access to diabetes management tools and the development of telehealth. Government measures supporting digital health and home care, such as Medicare's increased coverage for smart insulin pens and digital diabetes management tools, have sped this trend. Growing e-commerce platforms and insulin tracking apps improve patient autonomy and adherence outside of a medical environment. Supported by wearable health technology and connected insulin pens, this change fits the trends in the smart pen market toward patient-centric treatment and remote diabetes control.

Smart Insulin Pens Market Regional Analysis

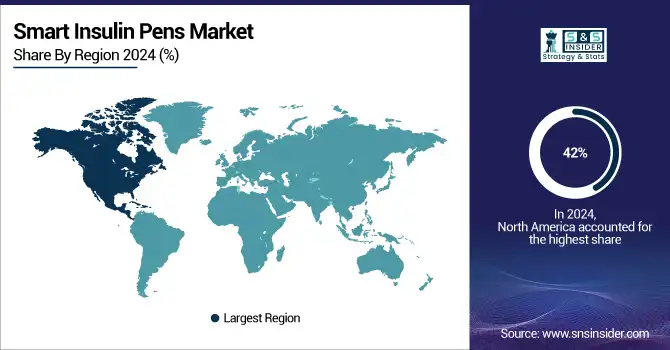

North America Smart Insulin Pens Market Insights

North America is the dominating region in 2024, with around 42% of the market revenue share. The U.S. smart insulin pens market, which gains from a high diabetes prevalence, sophisticated healthcare infrastructure, and strong government support, helps to explain this leadership. The expansion of Medicare Part D coverage by the U.S. Centers for Medicare & Medicaid Services to include connected insulin pens has greatly reduced patient expenses, hastened the acceptance of Bluetooth insulin pens, and reusable insulin pens. Furthermore, supporting North America's market domination are the regulatory approvals of the U.S. FDA, including Biocorp's Mallya smart sensor clearance in 2022, which has stimulated innovation and raised the availability of digital insulin pens.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Smart Insulin Pens Market Insights

The Asia-Pacific area is expected to grow with the fastest CAGR throughout the projection period, driven by a fast-growing diabetes population and improving healthcare accessibility. Because of their high diabetic populations, more than 116 million in China and 77 million in India, as well as government programs meant to improve diabetes treatment, China and India dominate this area. With around 15% of diabetes patients in the area adopting smart devices as per the International Diabetes Federation, the emergence of smart diabetes devices, including Bluetooth insulin pens and digital insulin pens, is encouraged by growing digital health acceptance. Thanks to urbanization, changing lifestyles, and improved healthcare infrastructure, markets in Southeast Asia and Oceania are also expanding. Affordable product offers and increasing awareness through government campaigns help to further support the expansion of reusable insulin pens and linked insulin pens in this area.

Europe and LAMEA (Latin America, Middle East, and Africa) Smart Insulin Pens Market Insights

Europe and LAMEA (Latin America, Middle East, and Africa) regions are also growing rapidly. Supported by strong R&D activities and the presence of major smart insulin pen market manufacturers, European governments have developed digital health initiatives and reimbursement regulations that enable smart pens for diabetes, thereby driving considerable Europe's smart insulin pens market growth. Rising diabetes prevalence and bettering healthcare infrastructure have LAMEA seeing the fastest growth rate; governments investing in smart diabetes devices and digital insulin pens will help to improve diabetes management access. These regional trends highlight how government policies and technology developments are driving the worldwide smart insulin pen market expansion.

Smart Insulin Pens Market Competitive Landscape:

Ypsomed

Ypsomed, founded in 1984, is a leading manufacturer of innovative injection and infusion systems, holding a strong presence in the Smart Insulin Pens market. The company specializes in autoinjectors, pen needles, and infusion systems, integrating digital technologies to enhance diabetes management. Ypsomed’s focus on connectivity, precision dosing, and patient-centric solutions enables improved adherence, therapy tracking, and overall treatment outcomes for individuals with diabetes worldwide.

- 2025: Ypsomed received FDA 510(k) clearance for SmartPilot, an add-on that transforms the YpsoMate autoinjector into a connected smart device for seamless dose tracking and therapy management.

Medtronic

Medtronic, founded in 1949, is a global leader in medical technology and diabetes care, holding a significant position in the Smart Insulin Pens market. The company develops advanced insulin delivery solutions, including connected pens and integrated systems, to improve therapy adherence and patient outcomes. Medtronic focuses on combining innovation, digital health, and patient-centric design to enable precise dosing, real-time monitoring, and enhanced diabetes management worldwide.

-

2024: Medtronic received FDA clearance for a new InPen™ app featuring missed-dose detection, enabling its upcoming Smart MDI system integrated with the Simplera™ CGM for real-time dosing insights.

Biocorp

Biocorp, founded in 2004, is a pioneering company in connected medical devices, focusing on enhancing diabetes care through smart insulin solutions. The company develops innovative devices like smart caps and sensors that transform traditional insulin pens into connected systems. Biocorp’s technologies enable accurate dose tracking, data integration, and improved patient adherence, supporting healthcare providers and patients with advanced digital solutions for effective diabetes management.

-

2025: Biocorp opened its APAC headquarters in Thailand, bolstering manufacturing and distribution of its Mallya smart sensor and other connected diabetes devices across the Asia-Pacific market.

-

2024: Biocorp received FDA 510(k) clearance for SoloSmart®, a smart cap that turns Sanofi’s SoloStar insulin pens into connected devices, capturing dose, date, and time data for streamlined digital tracking.

-

2023: Biocorp entered a strengthened partnership with Novo Nordisk to commercialize the Mallya smart sensor globally, enabling insulin dose tracking via mobile apps when attached to FlexTouch pens.

Key Players

Some of the Smart Insulin Pens Market Companies

-

Jiangsu Delfu Medical Device Co., Ltd.

-

InjexUK

-

Cambridge Consultants Ltd.

-

Eli Lilly and Company

-

Novo Nordisk

-

Emperra GmbH

-

Biocorp

-

Medtronic plc

-

Smiths Medical

-

Ypsomed Group

-

NIPRO Medical Corporation

-

Companion Medical

-

Sanofi

-

Roche Diabetes Care

-

Ascensia Diabetes Care

-

Bayer AG

-

Dexcom, Inc.

-

AgaMatrix, Inc.

-

Abbott Laboratories

-

Tandem Diabetes Care

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 877.26 Million |

| Market Size by 2032 | USD 1818.89 Million |

| CAGR | CAGR of 9.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Indication (Type 1 Diabetes, and Type 2 Diabetes) • By Connectivity (Bluetooth, and Near Field Communication (NFC)) • By Distribution Channel (Hospital Pharmacies, and Retail & Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Jiangsu Delfu Medical Device Co., Ltd., InjexUK, Cambridge Consultants Ltd., Eli Lilly and Company, Novo Nordisk, Emperra GmbH, Biocorp, Medtronic plc, Smiths Medical, Ypsomed Group, NIPRO Medical Corporation, Companion Medical, Sanofi, Roche Diabetes Care, Ascensia Diabetes Care, Bayer AG, Dexcom, Inc., AgaMatrix, Inc., Abbott Laboratories, Tandem Diabetes Care. |