Diabetes Devices Market Report Scope & Overview:

Get More Information on Diabetes Devices Market - Request Sample Report

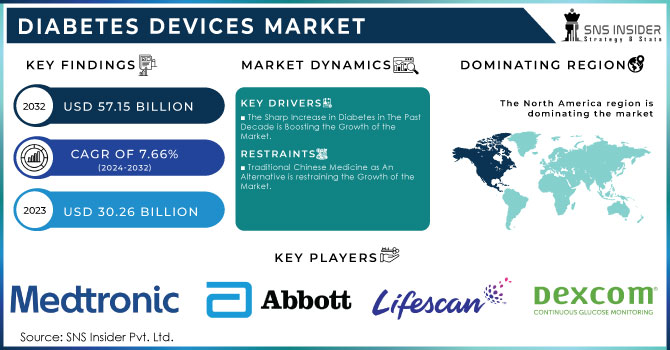

The Diabetes Devices Market Size was valued at USD 30.26 Billion in 2023, and is expected to reach USD 57.15 Billion by 2032, and grow at a CAGR of 7.66%.

The diabetes products market is expanding significantly, driven by several key factors including the rising prevalence of diabetes, technological advancements, increased use of insulin-delivery devices, and escalating obesity rates. These factors are collectively shaping the market and influencing its growth trajectory. Diabetes is becoming a major global health concern. In 2023, it was reported that over 500 million people worldwide are living with diabetes, making it one of the top ten causes of death and disability. The prevalence of diabetes is projected to increase to 6.1% globally, with particularly high rates in North Africa, the Middle East, and Latin America. This rising prevalence underscores the urgent need for effective diabetes management solutions. Technological progress is a significant driver of market growth. Companies are focusing on developing and launching innovative diabetes management products. For example, in 2023, Insulet Corporation acquired Automated Glucose Control LLC, a company specializing in automated insulin delivery technology. This acquisition highlights the emphasis on enhancing diabetes management through advanced technology, which aims to improve patient outcomes and streamline diabetes care.

The adoption of insulin-delivery devices, including insulin pumps and continuous glucose monitors (CGMs), is growing. These devices provide precise control over insulin delivery and continuous monitoring of blood sugar levels, which are crucial for effective diabetes management. The increasing use of these devices reflects their importance in managing diabetes and reducing related complications. Rising obesity rates are contributing to the growing incidence of type 2 diabetes, as obesity is a major risk factor for the condition. The global increase in obesity amplifies the demand for diabetes products designed to manage and treat diabetes effectively. Diabetes devices enhance patient care by providing continuous monitoring and precise control over blood sugar levels, which helps reduce hospitalizations and mortality rates. Advanced technology in diabetes management is expected to influence future treatments and improve overall patient care. In summary, the diabetes products market is being driven by the high prevalence of diabetes, ongoing technological innovations, increasing use of insulin-delivery systems, and rising obesity rates, all contributing to enhanced patient care and better management of diabetes.

MARKET DYNAMICS:

Key Drivers:

-

The Sharp Increase in Diabetes in The Past Decade is Boosting the Growth of the Market.

-

Favorable National Health Strategies is Fueling the Growth of the Market.

Restraints:

-

Traditional Chinese Medicine as An Alternative is restraining the Growth of the Market.

-

The High Cost of Advanced Diabetes Management Devices is Hampering the Growth of the Market.

Opportunity:

-

Technological Innovations to Drive the Growth of Self-Monitoring Blood Glucose Monitoring Systems.

-

Increasing Collaborations, Partnerships, and Agreements Between Companies to Develop Integrated CGM Systems to Drive the Growth of this Market.

KEY MARKET SEGMENTATION:

By Type

In 2023, the insulin delivery devices segment generated the highest revenue and is projected to grow at a rate of 7.89% during the forecast period. The blood glucose monitoring devices segment is also expected to experience substantial growth during the forecast period due to the availability of affordable monitoring devices and their high level of accuracy in reading glucose levels. Companies are introducing cost-effective, technologically advanced, and user-friendly products through the use of emerging technologies and product launches. For instance, Dexcom plans to launch its new continuous glucose monitor, Stelo, in January 2024. This monitor is designed for individuals with Type 2 diabetes who do not require insulin. The FDA is currently reviewing the submission, which was made in the fourth quarter of 2023, and this is anticipated to drive the demand for blood glucose monitoring devices.

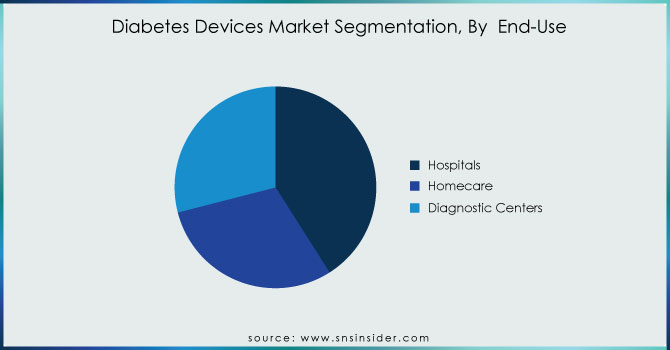

By End-Use

By end-use, the hospital segment dominated the market with a revenue share of 41% in 2023. Rising hospital admissions for diabetes patients are driving the sector, as those with diabetes are at three times higher risk of being ill than non-diabetic individuals. In the past few years, technology for diabetes has grown rapidly, with a strong emphasis on improving diabetes treatment in the medical sector. As a result, insulin pump usage has seen an explosive rise in hospitals and clinics. To illustrate, when the insulin is exposed to air and light for three days, patients must replace their insulin pumps with new ones, according to University Hospitals.

Meanwhile, with an approximated CAGR of 6.44% from 2023 to 2032, the diagnostic centers segment is expected to grow at the fastest speed during the projection period. In different healthcare settings, such as diagnostic centers, Glucose Monitoring Devices are being increasingly used. Patients with diabetes prefer to consult them at diagnostic centers to get results the same day and avoid long waiting times. In these diagnostic services, SMBG devices are widely used.

Need any customization research on Diabetes Devices Market - Enquiry Now

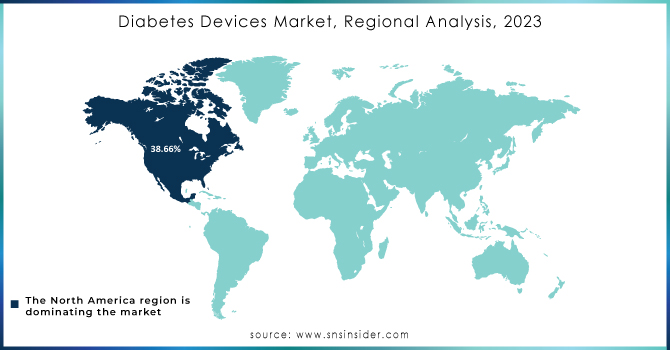

REGIONAL ANALYSIS:

The market in North America boasted a significant revenue share of 38.66% in 2023. The market is primarily driven by an increase in the number of older people, who are more likely to catch the disease, as well as the increase in diabetes afflicted by dietary changes leading to sedentary lifestyles, increased obesity prevalence, and the high cost of therapy. Many of the notable players, such as their operational headquarters in Abbott, Medtronic, Dexcom, and Insulet Corporation, are based in this area.

The US diabetes devices market is slated to register the highest CAGR in the forthcoming period. Abbott, Medtronic, Dexcom, and Insulet Corporation are some of the market players in the country. According to the Centers for Disease Control and Prevention report in November 2023, in the US, approximately 136 million adults are either currently diagnosed with diabetes or in a pre-diabetes state.

KEY PLAYERS:

The key market players are Medtronic plc, Abbott Laboratories, F.Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Companion Medical, Sanofi, Valeritas Holding Inc, Novo Nordisk, and others.

RECENT DEVELOPMENTS

-

Medtronic acquired EOFlow, a manufacturer of well-designed insulin devices, in May 2023. EOFlow has a fully functional web-based technology used for monitoring food consumption variations via smartphones. The incorporation of EOFlow’s product with Medtronic’s Meal Detection Technology algorithm and highly developed CGM is likely to increase the new company’s ability to cater to a wider range of consumers.

-

In April 2023, Undbio revealed that it is spending up to USD 100 million on the construction of a US-based insulin product plant. The South Korean corporation announced plans to set up a new production facility in West Virginia that would produce and market insulin across the US.

-

In July 2023, My Diabetes Tutor, a newly established enterprise aimed at improving the lives of people living with diabetes, received investments from CharmHealth and Bioverge.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 30.26 Billion |

|

Market Size by 2032 |

US$ 57.15 Billion |

|

CAGR |

CAGR of 7.66% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Blood Glucose Monitoring Devices, Continuous Glucose Monitoring Devices, Insulin Delivery Devices) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Medtronic plc, Abbott Laboratories, F.Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Companion Medical, Sanofi, Valeritas Holding Inc, Novo Nordisk and other players |

|

Key Drivers |

•The Sharp Increase in Diabetes in The Past Decade is Boosting the Growth of the Market. |

|

RESTRAINTS |

•Traditional Chinese Medicine as An Alternative is restraining the Growth of the Market. |