Smart Light Control Market Size

Get more information on Smart Light Control Market- Request Free Sample Report

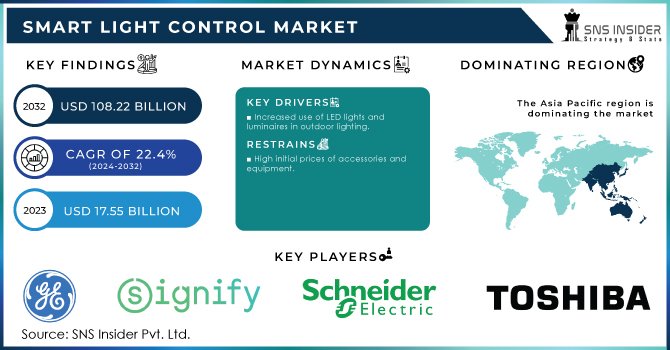

The Smart Light Control Market size was valued at USD 17.55 billion in 2023 and is expected to grow to USD 108.22 billion by 2032 and grow at a CAGR of 22.4% over the forecast period of 2024-2032.

The introduction of smart technologies in public lighting systems has resulted in a large increase in research and development investments for infrastructure development. For example, in March 2022, the UK Department for Business, Energy & Industrial Strategy (BEIS) allocated money totaling more than USD 30.3 billion to UKRI to assist diverse R&D operations. Furthermore, end-users' desire for cost-effective and energy-saving solutions is expanding, prompting the development of OLED lighting. Furthermore, the development of smart cities in developing countries will have a positive impact on the sector progress.

The global market is divided into several product categories, including LED drivers and ballasts, sensors, switches, dimmers, transmitters and receivers, and others. The switches sector generated the most revenue in 2022 due to increased adoption of lighting control systems, and this trend is expected to continue during the forecast period due to increased use of connected devices and the Internet of Things. During the forecast period, the sensors segment will offer considerable development prospects, followed by the transmitters and receiver’s segment. Dimmers, transmitters and receivers, and others (timers and photo sensors) are experiencing moderate growth as a result of the increased usage of modern technology in smart home projects.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Offering (Hardware, Software, Services) • By Installation Type (New Installations, Retrofit Installations) • By Communication Technology (Wired, Wireless) • By End Use Application (Indoor, Outdoor) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Electric Company (U.S.), Signify Holding (Philips Lightings) (Netherlands), Cisco Systems Inc. (U.S.), Schneider Electric (France), Toshiba (Japan), Legrand S.A. (France), Lutron Electronics Co., Inc. (U.S.), Eaton Corporation PL (Ireland), Honeywell International Inc, (U.S.), OSRAM Licht AG (Germany) |

KEY DRIVERS:

-

Increased use of LED lights and luminaires in outdoor lighting

The primary benefits of using LEDs over traditional lighting include energy and cost savings. In outdoor lighting applications, LEDs are replacing traditional light sources such as fluorescent, high-intensity discharge (HID), incandescent, and high-pressure sodium lamps. Highways, roadways, public places, and other outdoor lighting uses are the most common stadiums. According to the US DOE, LED lighting will account for 86% of all lighting sales by 2035 due to the advantages that LED lights have over their conventional counterparts.

-

Growing Preference for Energy-Efficient Lighting Solutions

RESTRAIN:

-

High initial prices of accessories and equipment

Despite the fact that smart lighting systems are energy-efficient lighting solutions that can save money in the long term, the high initial cost is significant owing to the cost of Dimmers, switches, sensors, control systems, and software are all components of smart lighting systems. The smart lighting installation costs more than traditional lighting systems. This is mostly owing to the high cost of smart lighting solutions' software, control systems, and LED light sources. This aspect impedes the implementation of smart lighting control systems. However, factors such as lowering LED prices and energy savings from implementing energy-efficient lighting control systems

OPPORTUNITY:

-

Create human-centric lighting solutions

Humans are affected biologically and emotionally by lighting solutions. Human-centric lighting solutions that can be modified in terms of orientations, correlated color temperatures (CCTs), and illuminance can improve people's well-being, happiness, and health. These lighting solutions can help increase concentration, safety, and efficiency in the workplace and classroom. Human-centric lighting solutions in healthcare applications can aid healing processes, avoid chronic diseases in those with irregular daily patterns, and increase patients' overall sense of well-being. The growing need for human-centric lighting solutions has opened new opportunities for smart lighting solution manufacturers. Leading smart lighting manufacturers such as Signify (the Netherlands) and Hubbell (the United States) are producing luminaires that allow for the adjusting of illumination.

-

The current global energy crisis

CHALLENGES:

-

Interoperability concerns between different network components

The most difficult task for lighting control systems is merging multiple compatible technologies under one roof. When it comes to lighting control, users have a variety of options to select from; but, because there are no common standards, it is difficult to combine the solutions they have. End users are hampered by a lack of interoperability and compatibility among components. Traditional lighting control system hardware and software are often manufactured by the same company, however controls for connected lighting solutions are developed by multiple companies. Lighting systems have interoperability issues, which cause communication issues between different network components. Standard protocols must be established in order to develop compatible goods.

IMPACT ANALYSIS

IMPACT OF ONGOING RECESSION

The impact on greenhouse gas emissions will be determined by how the crisis affects investment in various types of energy technology. In the short term, slower economic growth will reduce emissions increase. However, in the medium and long term, the crisis may result in increased emissions as low fossil fuel prices and finance challenges limit investment in renewable energy technology, increasing reliance on fossil fuel capacity. At the same time, investors will remain risk adverse, limiting funding for renewable energy projects to proven technology in appealing markets. Once the crisis is finished, the probable surge of "economic growth" or "catch-up effect" may cancel out any short-term gains. Shipments of smart home gadgets are predicted to fall by 2.6 percent globally. Smart speakers and video entertainment devices such as TV and streaming gadgets will bear the brunt of the loss in 2022, falling by 10% to 874 million units. According to the International Data Corporation's (IDC) "Worldwide Quarterly Smart Home Device Tracker," worsening macroeconomic conditions have reduced the prognosis for worldwide smart home device shipments.

MARKET SEGMENTATION

By Offering

-

Hardware

-

Software

-

Services

By Installation Type

-

New Installations

-

Retrofit Installations

By Communication Technology

-

Wired

-

Wireless

By End Use Application

-

Indoor

-

Outdoor

REGIONAL ANALYSIS

The Asia Pacific market was worth USD 8.98 billion in 2022 and is predicted to grow as the world's leading region throughout the forecast period. The region's market is likely to be driven by the increasing use of linked devices and the Internet of Things in smart homes and smart cities. Furthermore, leading firms are implementing a variety of business tactics, which are aiding in the region's market progress.

China is the country with the biggest revenue generation. China has the world's most advanced manufacturing facilities, and it is rapidly embracing developing technologies such as loT and automation in everyday industrial and household operations, which will increase the country's market. According to the data, it is also expected to be the fastest expanding country during the predicted period.

The growing number of small and medium-sized manufacturers in emerging markets like as India, Japan, and South Korea is driving the expansion of the lighting controls industry. North America earned considerable income in 2022, with the United States accounting for the lion's share of the area due to rising demand for wireless lighting fixtures. The advantages of these products include long-distance control, programming flexibility, energy efficiency, and an extended lifespan, which has prompted firms in North America to develop wireless lighting fixtures.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some of key players are General Electric Company (U.S.), Signify Holding (Philips Lightings) (Netherlands), Cisco Systems Inc. (U.S.), Schneider Electric (France), Toshiba (Japan), Legrand S.A. (France), Lutron Electronics Co., Inc. (U.S.), Eaton Corporation PL (Ireland), Honeywell International Inc, (U.S.), OSRAM Licht AG (Germany)and other players are listed in a final report.

RECENT DEVELOPMENT

-

May 2022: URC collaborated with FX Luminaire, a manufacturer of landscape and architectural lighting, to develop a smart home automation and control solution for residential and commercial applications. Customers of FX luminaires will benefit from this collaboration by receiving a smart lighting solution.

-

February 2022: Legrand, a producer of smart lighting systems and solutions, collaborated with URC, a provider of commercial and residential automation systems. This collaboration will enable Legrand to create a more advanced and automated smart lighting system for its view and climate lighting systems.

-

July 2022: Wipro, a provider of smart home and connected device solutions and services, has teamed up with Siemens to offer advanced loT-based smart lighting solutions for commercial buildings and workspaces.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 17.55 Bn |

|

Market Size by 2032 |

US$ 108.22 Bn |

|

CAGR |

CAGR of 22.4% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Market Challenges |

• Interoperability concerns between different network components |

|

Market Opportunities |

• Create human-centric lighting solutions |