VIBRATION SENSOR MARKET KEY INSIGHTS:

To get more information on Vibration Sensor Market - Request Sample Report

The Vibration Sensor Market Size was valued at USD 4.29 Billion in 2023 and is expected to reach USD 8.19 Billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

This Vibration Sensors Market has been growing rapidly over the last couple of years and is expected to continue at a high pace in the future decade. Accelerometers, also known as vibration sensors, find tremendous importance in forming an integral part of several industries for measuring changes in vibration, shock, and acceleration. They play a crucial role in monitoring health issues in machinery, integrity of structural elements, and overall operational safety in industries such as automotive, aerospace, healthcare, consumer electronics, and manufacturing.

Specifically, such concepts as digital twins and predictive maintenance make vibration sensors more in demand with uses related to real-time monitoring, early fault detection, and optimization of equipment performance. Predictive maintenance that employs vibration sensors will reduce downtime by up to 30% and extend the lifespan of machinery by up to 20-25%, hence saving around 15-20% of the repair and operations cost. These factors are being further accelerated by the increasing Industry 4.0 and smart manufacturing systems, especially in heavy machinery, where unexpected failures can cost millions, thus causing operational disruptions. By 2024, this need will be most intense in mining, construction, and energy; it's an industry that requires condition monitoring for safety and efficiency due to environmental stressors.

MARKET DYNAMICS

KEY DRIVERS:

-

Harnessing Predictive Maintenance and Vibration Sensors for Enhanced Efficiency in Industry 4.0

As industries start adopting smart manufacturing, predictive maintenance has become crucial for monitoring machinery health and avoiding costly downtimes. Here, vibration sensors are most important in detecting abnormalities in vibrations, which would otherwise be symptoms of impending wear or malfunction of equipment. The Industrial Internet of Things only adds to demand since it is critical in real-time machine monitoring, operational efficiency, and cost reduction through maintenance.

With industries shifting to smart manufacturing, the vibration sensors detecting defects in the operation of equipment are widely expected to rise to great heights. For instance, it was mentioned that 80% of manufacturers are increasingly focusing on predictive maintenance aimed at improved efficiency, reduction in downtime, and optimization of costs on maintenance. Additionally, the adoption of IIoT in routine maintenance is driving up demand for vibration sensors. Sensors are integral for real-time monitoring and account for an improved and significant saving of 10-20% maintenance cost and a 25-30% reduction in equipment downtime. Moreover, it is projected that companies implementing predictive maintenance would reduce the cost of maintenance by as much as 30%, which speaks of the huge economic benefits vibration sensors provide.

RESTRAIN:

-

Challenges in Data Management Hinder the Effectiveness of Vibration Sensors

The data generated by vibration sensors requires sophisticated analytics for effective interpretation, many businesses will not possess the infrastructure, skills, or competency to carry out such analysis, so interpreted data from vibration sensors may not be turned into actionable insights. In general, the subsystem complexity might reduce the effectiveness of vibration monitoring systems and underutilize some of these technologies.

Data management challenges, in the context of the vibration sensor market, are a significant constraint on efficiency. The number of data centres that would be required to process and analyze the data emanating from the vibration sensors is expected to increase significantly. The energy utilized by data centres is reportedly dedicated to cooling systems, 40% of its total energy usage. This is integral for maintaining proper operating conditions in a data centre so that sensitive vibration sensors installed are kept within an appropriate range. In addition, advanced cooling solutions are also integral for preventing overheating of the equipment in a data centre as power density continues to rise. The average power density of servers has increased by more than two times in the last six to seven years. This calls for an urgent need for efficient data management solutions that should be driven into optimizing the performance of vibration sensors.

KEY SEGMENTATION ANALYSIS

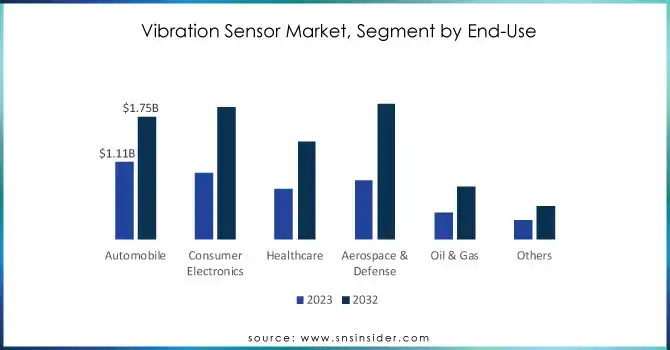

BY END-USE

In 2023, the Automotive segment held the largest market share, accounting for 25% of the total revenue. This is mainly due to the ever-growing use of vibration sensors in vehicles to measure mechanical vibrations inside an engine, such as knocking. In recent years, there has also been a growth in the use of vibration sensors for NDT on automobiles. These sensors have been quite crucial in monitoring the vibration that results from parts that are spinning in an engine before problems can come up and become exacerbated. With an increasing number of automobile accidents worldwide blamed on engine failures, most governments have come up with strict measures concerning safety aspects that require the vibration sensor as a measure of ensuring the optimum state of an engine.

The Aerospace and Defence segment is projected to experience the highest growth rate, with a CAGR of 9.62% during the forecast period. Accelerometers play a prime role in a wide range of applications in the aerospace market, including inertial navigation, industrial measurement, guidance, and control systems. Finally, vibration sensors are critical in monitoring turbine engine failures: these constitute the main sources of mechanical problems responsible for the increase in maintenance costs in this industry. Due to the urgent need of aerospace and defence organizations to prevent mechanical failures and reduce the cost of maintenance, Prognostic and Health Management (PHM) systems are being more and more adopted. Since vibration is the prime health monitoring parameter in aerospace engine applications, the growth of the market is likely to be highly influenced by the development of PHM systems.

BY TYPE

In 2023, the Accelerometer Segment significantly dominated the vibration sensor market, capturing a substantial revenue share of 41%. This growth can be linked to the rising demand for advanced motion-sensing technologies in various industries. In the automotive sector, accelerometers are increasingly integrated into vehicle stability control and advanced driver-assistance systems (ADAS), with an expected growth rate of 15% in demand over the next few years. The consumer electronics market also contributes significantly, with over 1.5 billion accelerometer units shipped globally in 2022, reflecting their essential role in smartphones, smartwatches, and fitness trackers.

The Displacement Sensors segment is witnessing the highest CAGR of 9.33% during the forecast period. As people refer to displacement sensors for their strength, accuracy, and cost-effectiveness various industries look at, what is driving such a position. The growth in the usage of displacement sensors for the proper detection of defects on stacked Printed Circuit Boards as well as placing electronic components on those PCBs has also been a major contributor. Add to that that the portion of displacement sensors also has a very great place in elevator systems: synchronization of doors on an elevator car with levels on building floors, serving for further expansion of this segment.

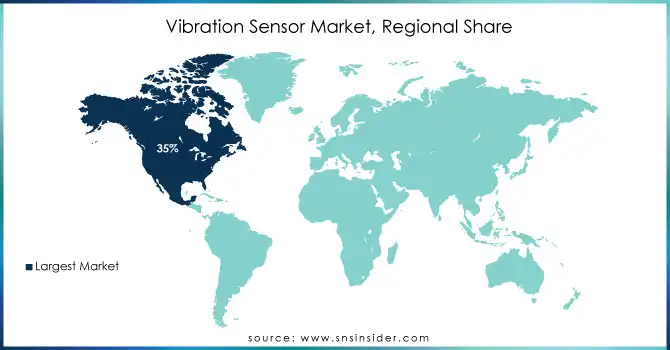

REGIONAL ANALYSIS

The North American region was estimated to hold the highest market share of around 35% in 2023. This is largely because of strong industrialization, a strong automotive sector, and huge investment in aerospace and defence applications. Advanced manufacturing landscapes in the region coupled with the wide adoption of automation technologies provide a boost to the demand for vibration sensors. For instance, in the North American automotive industry, vibration sensors are constantly used to monitor the performance of engines and improve safety aspects in vehicles. It is primarily driven by the regulatory requirements coupled with consumer wishes for safety. Similarly, in the aerospace segment of the US, the demand for vibration sensors is increasing at a significant rate due to the monitoring of turbine engine health. There is now more emphasis on predictive maintenance approaches to avoid or minimize downtime while lowering costs across industries. Major players, such as Honeywell and Rockwell Automation, are very actively involved in the development of new vibration sensor technology, and North America remains the largest market.

The Asia Pacific will have the highest CAGR of 9.7% through the forecast period. The increasing automation within several regional industries creates a need for advanced vibration sensors. Low labour costs encourage global manufacturers to expand their production bases in India, China, and South Korea. In a recent report from Rockwell Automation, it was found that 44% of APAC manufacturers have plans to embrace smart manufacturing technologies in the next year. Furthermore, the region with the highest adoption rates is China, where 80% have already adopted the said technologies, 60% of whom are in Australia, and 59% in India. This should widely open much market demand for vibration sensors, given the critical role these sensors play in ensuring equipment health and guaranteeing that such equipment functions efficiently.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Vibration Sensor Market are:

-

Baumer (Baumer Inductive Proximity Sensors, Baumer Capacitive Proximity Sensors)

-

Bosch Sensortec GmbH (Bosch Sensortec MEMS Accelerometers, Bosch Sensortec MEMS Gyroscopes0

-

TE Connectivity (TE Connectivity Vibration Sensors, TE Connectivity Vibration Switches)

-

NATIONAL INSTRUMENTS CORP (NI LabVIEW Vibration Analysis Software, NI CompactDAQ Vibration Measurement System)

-

Honeywell International Inc. (Honeywell Vibration Sensors, Honeywell Vibration Monitoring Systems)

-

SAFRAN (Safran Vibration Sensors, Safran Vibration Monitoring Systems)

-

Hansford Sensors (Hansford Vibration Sensors, Hansford Vibration Monitoring Systems)

-

DYTRAN INSTRUMENTS INCORPORATED (DYTRAN Vibration Sensors, DYTRAN Vibration Monitoring Systems)

-

Analog Devices, Inc. (Analog Devices Vibration Sensors, Analog Devices Vibration Monitoring Systems)

-

ASC GmbH (ASC Vibration Sensors, ASC Vibration Monitoring Systems)

-

Endress+Hauser (Endress+Hauser Vibration Sensors, Endress+Hauser Vibration Monitoring Systems)

-

Murata Manufacturing Co., Ltd. (Murata Vibration Sensors, Murata Vibration Monitoring Systems)

-

Omron Corporation (Omron Vibration Sensors, Omron Vibration Monitoring Systems)

-

Pepperl+Fuchs (Pepperl+Fuchs Vibration Sensors, Pepperl+Fuchs Vibration Monitoring Systems)

-

IFM Electronic GmbH & Co. KG (IFM Vibration Sensors, IFM Vibration Monitoring Systems)

-

Sick AG (Sick Vibration Sensors, Sick Vibration Monitoring Systems)

-

Banner Engineering Corp. (Banner Vibration Sensors, Banner Vibration Monitoring Systems)

-

Rockwell Automation Inc. (Rockwell Automation Vibration Sensors, Rockwell Automation Vibration Monitoring Systems)

-

Siemens AG (Siemens Vibration Sensors, Siemens Vibration Monitoring Systems)

-

ABB Group (ABB Vibration Sensors, ABB Vibration Monitoring Systems)

-

IMI Sensors

RECENT TRENDS

-

in March 2023, Dytran Instruments Incorporated partnered with ENMO Sound & Vibration Technology to solidify their mutual expansions in Belgium, the Netherlands, and Luxembourg. This is a significant strategic step toward advancing for the two companies as they forge ahead through the shifting sands of testing and measurement. As ENMO and Dytran pool their strengths, it is apt to push their businesses forward simultaneously even as they advance technological development in the industry.

-

In February 2023, IMI Sensors, a subsidiary of PCB Piezotronics Inc., introduced the Model 655A91 affordable 4-20 mA velocity transmitter. With a 4-pin M12 connector, the Model 655A91 makes integration into existing industrial monitoring systems easy. The built-in piezoelectric component improves accuracy and features an expanded frequency response range from 3.5 Hz to 2 kHz.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.29 Billion |

| Market Size by 2032 | US$ 8.19 Billion |

| CAGR | CAGR of 7.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Typee (Accelerometers, Velocity Sensor, Displacement Sensor) • By Technology Type (Piezoresistive, Strain Gauge, Variable Capacitance, Hand Probe, Optical Sensor, Tri-Axial Sensors, Others) • By Material Type (Doped Silicon, Piezoelectric Ceramics, Quartz) • By End-use (Automobile, Consumer Electronics, Healthcare, Aerospace & Defense, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Baumer, Bosch Sensortec GmbH, TE Connectivity, NATIONAL INSTRUMENTS CORP, Honeywell International Inc., SAFRAN, Hansford Sensors, DYTRAN INSTRUMENTS INCORPORATED, Analog Devices, Inc., ASC GmbH, Endress+Hauser, Murata Manufacturing Co., Ltd., Omron Corporation, Pepperl+Fuchs, IFM Electronic GmbH & Co. KG, Sick AG, Banner Engineering Corp., Rockwell Automation Inc., Siemens AG, ABB Group |

| Key Drivers | • Harnessing Predictive Maintenance and Vibration Sensors for Enhanced Efficiency in Industry 4.0 |

| Restraints | • Challenges in Data Management Hinder the Effectiveness of Vibration Sensors |