Sound Component Market Report Scope & Overview:

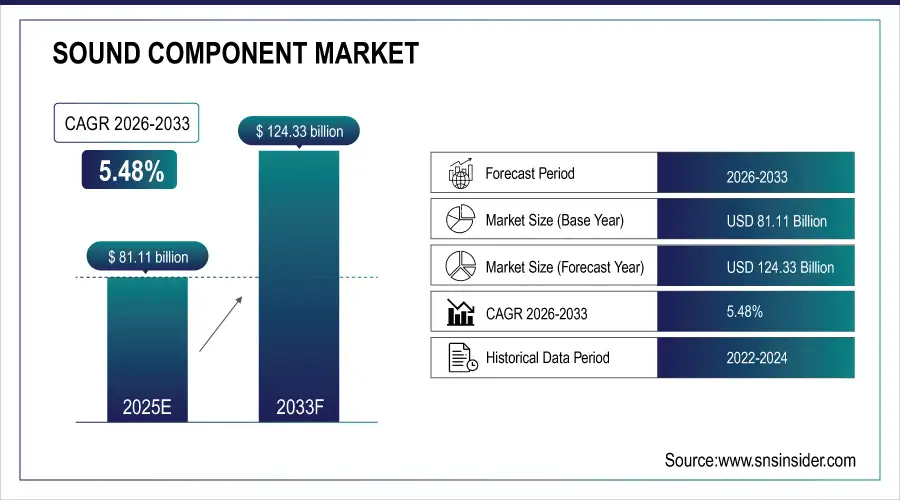

The Sound Component Market Size was valued at USD 81.11 Billion in 2025E and is expected to reach USD 124.33 Billion by 2033, growing at a CAGR of 5.48% over the forecast period of 2026-2033.

The Sound Component Market is witnessing robust growth, driven by increasing demand for high-quality audio solutions across consumer electronics, automotive, and industrial applications. Rising adoption of wireless and smart sound technologies, coupled with innovations in miniaturized components and IoT integration, is enhancing audio performance, energy efficiency, and connectivity across multiple industries worldwide.

Market Size and Forecast:

-

Market Size in 2025E: USD 81.11 Billion

-

Market Size by 2033: USD 124.33 Billion

-

CAGR: 5.48% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Sound Component Market - Request Free Sample Report

Key Sound Component Market Trends

-

Growing demand for smart audio solutions is driving innovation in AI-integrated sound systems, offering features like voice assistance, adaptive sound, and noise cancellation.

-

Rising adoption of wireless and Bluetooth technologies is transforming home entertainment and automotive audio experiences, enhancing user convenience and connectivity.

-

Miniaturization of components is enabling compact, high-performance audio devices for wearables, smartphones, and IoT applications.

-

Increasing focus on high-fidelity and immersive sound quality is boosting demand for advanced speakers and amplifiers across consumer and professional markets.

-

Sustainability in audio manufacturing is gaining traction, with companies adopting eco-friendly materials and recyclable designs for sound components.

-

Growing integration of sound sensors in industrial automation and healthcare is creating new growth avenues for precision monitoring and acoustic analysis technologies.

U.S. Sound Component Market Insights

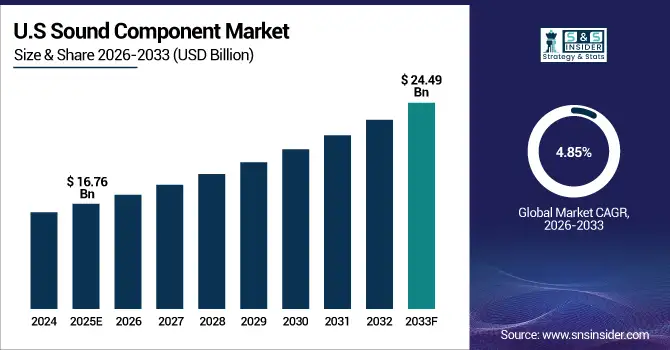

The U.S. Sound Component Market size was USD 16.76 billion in 2025 and is expected to reach USD 24.49 billion by 2033 growing at a CAGR of 4.85% over the forecast period of 2026-2033. The increasing integration of AI-enabled audio systems and wireless connectivity is significantly enhancing sound quality and user experience across consumer electronics and automotive sectors. This shift toward smart, adaptive sound technologies is driving product innovation, with over 60% of new devices incorporating intelligent acoustic features.

Sound Component Market Growth Driver

-

Growing Integration of Smart and AI-Driven Audio Systems Enhances Innovation in the Sound Component Market

The increasing integration of artificial intelligence (AI) and smart connectivity in sound components is significantly driving market growth. The demand for adaptive audio systems in smartphones, home theaters, and automotive infotainment units is accelerating due to consumers’ preference for personalized and high-fidelity sound experiences. AI-powered processors allow sound components to analyze ambient noise, optimize acoustic output, and enhance speech clarity, improving overall sound performance. In March 2025, Sony Corporation launched its new “360 Reality Audio Processor,” enabling real-time sound field adjustments through AI algorithms, reinforcing the trend toward intelligent sound solutions. As a result, the industry is witnessing a transformation where hardware innovation merges seamlessly with software-driven acoustic intelligence.

For instance, Samsung Electronics integrated AI-powered noise optimization into its Galaxy Buds series, improving sound clarity and environmental adaptability. This innovation not only elevated user satisfaction but also set a benchmark for next-generation smart audio devices, influencing other manufacturers to adopt similar AI-driven sound enhancement systems.

Sound Component Market Restraint

-

High Manufacturing and Component Integration Costs Restrain Sound Component Market Expansion

Despite robust technological advancement, the high cost associated with precision audio component manufacturing remains a key market restraint. Developing advanced microphones, amplifiers, and sensors requires complex fabrication processes and high-quality raw materials, leading to elevated production expenses. Additionally, integrating multiple miniaturized sound components in compact consumer devices poses engineering challenges, further increasing costs. Small and mid-sized manufacturers often face financial barriers to adopting new production technologies, limiting their competitiveness in global markets. The limited availability of cost-effective testing and calibration systems also adds to the overall expenditure, slowing large-scale adoption of premium sound systems in entry-level products.

For example, smaller sound equipment manufacturers in Asia-Pacific struggle to compete with major players like Yamaha and Bose due to high setup and R&D costs. This disparity affects supply chain balance and results in limited access to high-quality audio components for low-cost electronic products.

Sound Component Market Opportunity

-

Expanding Applications in Automotive Audio Systems Create Growth Opportunities for Sound Component Manufacturers

The growing integration of advanced sound components into automotive infotainment and driver assistance systems presents a major market opportunity. The rise in electric and connected vehicles is driving the need for premium, immersive in-car audio solutions that enhance the driving experience. Automotive manufacturers are increasingly collaborating with audio technology firms to deliver intelligent acoustic environments. In June 2025, Harman International Industries partnered with BMW to develop adaptive 3D sound systems that adjust dynamically to vehicle speed, cabin acoustics, and ambient noise levels. This trend signifies a shift toward smart, experience-driven vehicle interiors, where sound becomes an essential element of comfort and brand differentiation.

For instance, Bose’s “PersonalSpace 360” system implemented in Nissan models demonstrates how directional audio and noise control technologies improve cabin ambience. Such integrations not only elevate user experience but also open new revenue streams for sound component manufacturers focusing on automotive-grade innovations.

Sound Component Market Segmentation Highlights:

-

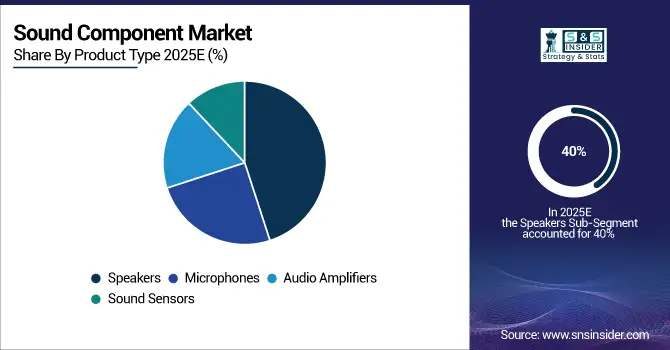

By Product Type: Speakers – 40% (largest), Microphones – 28%, Audio Amplifiers – 22%, Sound Sensors – 10%

-

By Technology: Wireless – 38% (largest), Bluetooth – 30%, Wired – 22%, Wi-Fi – 10%

-

By Application: Consumer Electronics – 35% (largest), Automotive – 25%, Industrial – 20%, Healthcare – 15%, Others – 5%

-

By End-User: Residential – 42% (largest), Commercial – 33%, Industrial – 20%, Others – 5%

Sound Component Market Segment Analysis

By Product Type, Speakers Lead the Market with Expanding Smart Technology Integration

The Speakers segment leads the Sound Component Market with a 40% share, driven by their extensive use in consumer electronics, home entertainment systems, and automotive infotainment solutions. Advancements in smart speaker technologies and voice‐assistant integration continue to boost demand globally. Microphones, accounting for 28%, are witnessing strong growth due to their increasing application in smartphones, hearing aids, and professional recording equipment. The Audio Amplifiers segment holds 22%, supported by rising adoption in portable devices, home theaters, and automotive audio systems. Meanwhile, Sound Sensors, representing 10%, are gaining traction in industrial automation and healthcare monitoring, as they enable sound detection and vibration analysis in smart systems.

By Technology, Wired Solutions Dominate, While Wireless and Bluetooth Drive Rapid Innovation

The Wired segment continues to dominate the market, favored for its reliability, low latency, and superior sound quality in professional and industrial setups. Wireless technology is rapidly expanding due to the convenience and flexibility it offers, especially in modern consumer applications like wireless headsets and portable speakers. The Bluetooth segment is experiencing significant growth as it underpins most personal audio devices, driven by trends toward cord-free and wearable technologies. Wi-Fi enabled sound components are emerging as a high‐end solution, offering multi‐room connectivity, smart home integration, and seamless streaming across devices, thus expected to capture a notable share in the coming years.

By Application, Consumer Electronics Remain the Largest Application as Automotive and Industrial Demand Surges

The Consumer Electronics segment holds the largest market share, propelled by widespread demand for smartphones, smart TVs, laptops, and audio accessories. Continuous innovation in audio quality and miniaturization fuels steady growth. The Automotive segment is expanding rapidly, supported by rising adoption of advanced infotainment systems, in‐car voice assistants, and noise cancellation technologies. Industrial applications account for a significant portion of demand, as sound components play a crucial role in predictive maintenance, machine diagnostics, and acoustic monitoring systems. The Healthcare segment, though smaller, is growing steadily due to the use of sound‐based devices in diagnostics, hearing aids, and patient monitoring equipment.

By End-User, Residential Adoption Drives Market Growth Amid Rising Smart Home Trends

The Residential segment dominates the market, driven by rising smart home adoption and growing consumer preference for high‐fidelity home entertainment systems. Commercial users follow closely, accounting for substantial demand in offices, event venues, recording studios, and retail environments where reliable sound quality and communication systems are essential. The Industrial segment contributes significantly, leveraging sound components for machinery monitoring, process optimization, and workplace safety through acoustic sensors and communication systems. Overall, end‐user growth is reinforced by digital transformation, increasing disposable income, and expanding integration of AI and IoT in sound technologies.

Sound Component Market Regional Analysis

Asia-Pacific Sound Component Market Insights

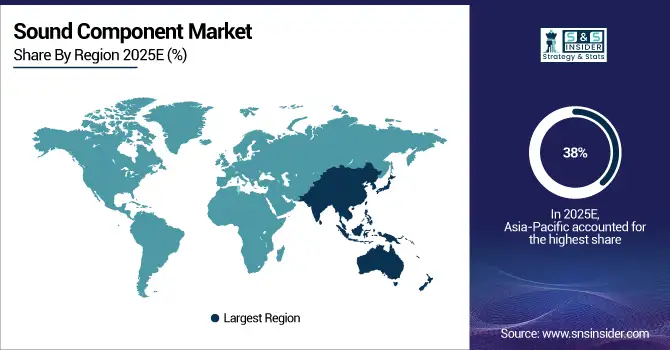

Asia-Pacific dominates the Sound Component Market with a 38% share in 2025, emerging as the fastest-growing region globally. The growth is primarily driven by the rapid expansion of consumer electronics, automotive, and industrial manufacturing sectors across China, Japan, South Korea, and India. Increasing adoption of smart devices, high-quality audio systems, and IoT-enabled sound technologies is accelerating market demand. Government-led initiatives promoting industrial automation, semiconductor production, and R&D investments further strengthen the region’s growth outlook. Additionally, collaborations between domestic manufacturers and global technology leaders are boosting innovation, quality standards, and production efficiency, reinforcing Asia-Pacific’s position as a global hub for advanced sound component development.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Sound Component Market Insights

North America accounts for 27% of the Sound Component Market in 2025, supported by strong technological adoption across the United States and Canada. The region benefits from a mature electronics industry, extensive R&D infrastructure, and increasing demand for high-performance sound systems in residential and commercial applications. Growth is further propelled by innovations in wireless and Bluetooth-enabled devices, integration of AI in sound systems, and strong consumer spending on premium audio products. The U.S. leads the region with significant advancements in semiconductor design, entertainment technologies, and automotive sound engineering. Strategic partnerships between OEMs, universities, and tech firms continue to foster product innovation and market competitiveness.

Europe Sound Component Market Insights

Europe holds a 22% share of the Sound Component Market in 2025, driven by the region’s commitment to high-quality engineering, sustainable manufacturing, and innovation in acoustics technology. Germany, France, and the U.K. remain the key contributors, with a strong focus on precision sound engineering for industrial, healthcare, and automotive applications. The European market benefits from the presence of leading OEMs and component manufacturers who emphasize energy efficiency, durability, and compliance with environmental regulations. The EU’s ongoing digitalization and “Green Deal” initiatives are stimulating demand for smart and eco-friendly sound solutions, positioning Europe as a hub for technological refinement and sound system integration.

Middle East & Africa (MEA) Sound Component Market Insights

The Middle East & Africa (MEA) region represents 7% of the Sound Component Market in 2025, showing steady progress driven by rising infrastructure development, expanding commercial spaces, and investments in entertainment and communication technologies. The UAE and Saudi Arabia lead regional adoption, leveraging smart city projects, large-scale event hosting, and industrial automation to increase demand for sound systems and audio components. Local initiatives to diversify economies and encourage technology transfer from global players are also fostering gradual innovation adoption. Growing interest in high-quality consumer audio and public communication systems supports long-term market potential across MEA.

Latin America Sound Component Market Insights

Latin America captures a 6% share of the Sound Component Market in 2025, supported by the growing presence of the consumer electronics and automotive industries. Brazil and Mexico are the primary growth drivers, witnessing rising demand for wireless audio devices, infotainment systems, and industrial automation tools. Government-backed digitalization programs and investment in smart infrastructure are fostering market expansion. Increasing collaboration with global manufacturers and technological training initiatives are helping enhance local production capabilities. Despite economic fluctuations, the region shows positive long-term prospects as urbanization and digital connectivity accelerate adoption of advanced sound technologies.

Competitive Landscape for Sound Component Market:

Sony Corporation

Sony Corporation is a global leader in consumer electronics, audio technology, and sound innovation, offering a wide portfolio of high-fidelity speakers, microphones, and amplifiers for residential and commercial applications.

-

In February 2025, Sony introduced its next-generation 360 Reality Audio Pro Series, featuring AI-driven sound optimization and immersive spatial audio technology designed for professional studio and home entertainment environments.

Bose Corporation

Bose Corporation specializes in audio systems, noise-cancellation technology, and advanced sound engineering solutions for automotive and consumer markets.

-

In April 2025, Bose launched its Smart Ultra Sound Component Line, integrating adaptive sound control and wireless connectivity for luxury vehicles and smart home ecosystems, enhancing audio clarity and system responsiveness.

Harman International (a Samsung Company)

Harman International focuses on automotive sound systems, professional audio solutions, and connected sound technologies across multiple industries.

-

In June 2025, Harman unveiled its Infinity Sound Architecture Platform, designed for next-generation electric vehicles, offering dynamic acoustic zoning and voice-activated sound control to improve in-cabin user experience.

Yamaha Corporation

Yamaha Corporation is a key innovator in music and sound technology, manufacturing amplifiers, microphones, and wireless audio systems for commercial and industrial use.

-

In January 2025, Yamaha introduced a new Hybrid Audio Amplifier Series that combines analog warmth with digital precision, enabling improved sound accuracy for professional broadcasting and studio environments.

Sound Component Market Key Players

Some of the SOUND COMPONENT Companies

-

Sony Corporation

-

Samsung Electronics Co., Ltd.

-

Bose Corporation

-

Panasonic Corporation

-

Harman International Industries, Inc.

-

Sennheiser Electronic GmbH & Co. KG

-

Yamaha Corporation

-

LG Electronics Inc.

-

Pioneer Corporation

-

Shure Incorporated

-

Qualcomm Technologies, Inc.

-

Knowles Corporation

-

Texas Instruments Incorporated

-

Analog Devices, Inc.

-

Dolby Laboratories, Inc.

-

Goertek Inc.

-

TPV Technology Limited

-

Toshiba Corporation

-

Onkyo Corporation

-

Vifa Sound Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 81.11 Billion |

| Market Size by 2033 | USD 124.33 Billion |

| CAGR | CAGR of 5.48% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Speakers, Microphones, Audio Amplifiers, Sound Sensors) • By Technology (Wired, Wireless, Bluetooth, Wi-Fi) • By Application (Consumer Electronics, Automotive, Industrial, Healthcare) • By End User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Sony Corporation, Samsung Electronics Co., Ltd., Bose Corporation, Panasonic Corporation, Harman International Industries, Inc., Sennheiser Electronic GmbH & Co. KG, Yamaha Corporation, LG Electronics Inc., Pioneer Corporation, Shure Incorporated, Qualcomm Technologies, Inc., Knowles Corporation, Texas Instruments Incorporated, Analog Devices, Inc., Dolby Laboratories, Inc., Goertek Inc., TPV Technology Limited, Toshiba Corporation, Onkyo Corporation, Vifa Sound Co., Ltd. |