Smart Lock Market Size & Overview:

Get more information on Smart lock Market - Request Sample Report

The Smart Lock Market Size was valued at USD 2.38 Billion in 2023 and is expected to reach USD 8.71 Billion by 2032, growing at a CAGR of 15.58% over the forecast period 2024-2032.

The smart lock market has experienced significant growth in recent years, fueled by the widespread adoption of home automation technologies and the increasing demand for enhanced security solutions in smart homes. The surge in smart home adoption is evident with a 43% in 2023. Despite this growth, concerns about data privacy remain a challenge, as 63% of users express worries about data breaches and almost 75% of broadband households are cautious about data security. Additionally, 65% of Americans are hesitant to install devices that collect personal data even if it means receiving insurance discounts. The average cost of smart home installation is around USD 927, but it can range from basic setups to USD 150,000 for luxury homes. Smart home security systems, a key driver of the smart lock market growth, have an average installation cost of about USD 2,850. As smart home technologies continue to advance, smart locks have become an essential part of the smart home ecosystem, offering integration with other devices like video doorbells, security cameras, and virtual assistants such as Amazon Alexa and Google Assistant. This integration allows homeowners to monitor and control their locks remotely, boosting security and convenience. Advanced features like fingerprint recognition, voice command compatibility, and personalized access codes have made smart locks especially attractive to tech-savvy consumers.

The residential segment is a key application area for smart locks, as homeowners seek to enhance property security with advanced access control. Smart locks offer the ability to provide temporary or permanent access to guests, family members, or service providers capabilities that traditional lock-and-key systems cannot match. For instance, homeowners can issue one-time access codes to visitors or set schedules for specific access times. This is particularly advantageous for vacation rental owners, as it simplifies access management without the need for physical key exchanges. The hospitality industry has also widely adopted smart locks, especially in hotels and vacation rental properties. These locks allow hotel operators to offer contactless check-in experiences, where guests can access their rooms using digital keys on their smartphones, providing convenience and enhanced security.

Smart Lock Market Dynamics

Drivers

-

As urbanization continues to rise, particularly in developing countries, there has been a surge in the number of rental properties.

Smart locks are being more and more utilized in rental properties and shared living spaces due to their ability to provide property owners with an easy way to control access for numerous tenants. For instance, in 2023, some of the markets with the most demand for rental properties included Austin, Washington DC, New York, and Orlando. In August, the rental market calmed after two years of rapid increases in rental prices, when rents rose annually by up to 18%. Landlords can enhance property management by assigning and revoking digital access codes instead of changing locks or issuing keys when tenants leave. Smart locks offer both flexibility and security for communal living situations like co-living setups, allowing individualized access for various occupants that can be readily monitored and managed. This technology is especially beneficial for Airbnb and other platforms for short-term rentals where hosts can control guest access without needing to be there in person. With the growth of the gig economy and the expansion of short-term rental platforms, the need for smart locks is expected to increase, driving market growth. Furthermore, the fast urban growth in nations such as China, India, and Brazil has sparked the creation of smart cities, where contemporary housing options like smart locks are being more commonly utilized. The prevalent use of smart locks in city areas, where security, convenience, and efficient property management are crucial, acts as a strong force for the market.

-

The commercial and enterprise sectors have become increasingly important in driving the demand for smart locks.

Businesses, hotels, hospitals, and government institutions are increasingly implementing smart lock systems to guarantee top-level security and streamline access control management. Conventional key-centric systems are being replaced by modern digital locks that offer easy management and auditing capabilities. Smart locks in workplaces allow employees to enter without keys, allowing businesses with different locations or shifts to control access based on time. Highly advanced smart lock systems at the enterprise level can easily connect with identity management solutions, enabling access to be given or taken away depending on user credentials. This is especially beneficial for big companies, as handling access for many employees can be difficult and susceptible to mistakes when using conventional systems. The hospitality industry has also adopted smart locks to improve the guest experience. Hotels currently utilize smart locks that allow guests to utilize their smartphones as room keys, which simplifies the check-in and check-out process. Smart locks are being utilized in the healthcare industry to protect important areas like medication storage or patient rooms, where access must be closely regulated and observed. The increasing adoption of smart locks in these industries is a major factor fueling the market.

Restraints

-

Smart locks are electronic devices that require power to operate, typically through batteries.

Regularly replacing or recharging batteries can be a hassle for users, particularly if the lock malfunctions due to low battery power, causing them to be locked out. Dependence on battery power brings up concerns about the dependability of smart locks, especially in crucial times. Furthermore, individuals may not regularly check the battery level, which can lead to being locked out at an inconvenient moment. While some smart locks offer backup power choices and low-battery alerts, the upkeep needed to ensure the locks work at their best may be viewed as burdensome, reducing their appeal to specific groups of consumers.

Smart Lock Market Segmentation Overview

by Type

Deadbolt locks led the smart lock market in 2023 with a 37% market share because of their strong security features and extensive use in both residential and commercial settings. Recognized for their durable build, deadbolts are incredibly difficult to break into, providing a substantial improvement in security compared to regular locks. Advanced features like remote access, voice activation, and biometric authentication are included in smart deadbolts, offering users improved security and convenience. Major companies in the industry such as August Home and Schlage have introduced smart deadbolts that enable users to control door locking and unlocking through smartphone applications or voice-controlled devices such as Amazon Alexa.

Level handles are projected to become the fastest-growing segment during 2024-2032, due to their easy-to-use design and adaptability. Smart-level handles, as opposed to traditional locks, provide simple entry via a push-down mechanism, making them perfect for those with limited mobility or disabilities. Many times, these intelligent locks offer keyless entry features, like fingerprint recognition and integration with smartphones, which improve convenience. Level Lock is a prominent company that provides cutting-edge smart level handles that easily blend in with current door hardware, offering a stylish and contemporary option.

by Communication Protocol

Wi-Fi held the highest market share of over 35% in 2023 because of its extensive compatibility with different smart home systems and strong connectivity reliability. Wi-Fi smart locks give users the ability to manage access and track it from a distance via smartphones, providing instant alerts and easy compatibility with home automation setups. For example, August Home and Schlage are among the companies that offer Wi-Fi smart locks, which offer increased security and convenient remote access control, appealing to residential and commercial users alike.

Bluetooth is expected to experience the fastest CAGR during 2024-2032 in the smart lock market because of its energy efficiency, reduced cost, and simple installation process. In contrast to Wi-Fi, Bluetooth smart locks do not need a continuous internet connection, making them perfect for users who want straightforward, local control without depending on Wi-Fi connectivity. Yale and Kwikset use Bluetooth technology in their smart locks to offer secure keyless entry options, catering to the needs of homeowners and property managers with strong security features.

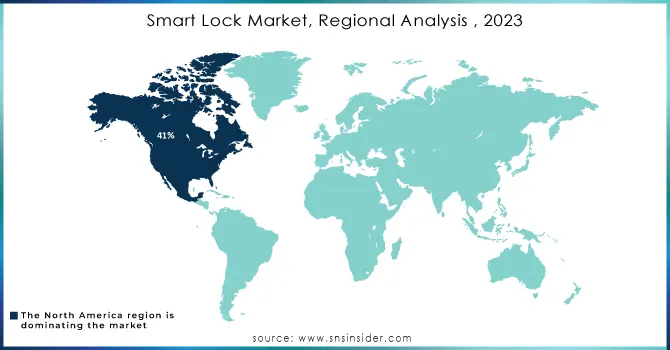

Smart Lock Market Regional Analysis

North America dominated in 2023 with a 41% market share due to its advanced technology infrastructure, widespread use of IoT devices, and increasing popularity of smart homes and offices. This dominance is fueled by the region's robust economic conditions and increased consumer spending on home automation systems. Moreover, the increasing implementation of smart city projects in nations such as the United States and Canada drives the need for smart lock technologies. Prominent companies like August Home, Yale, and Kwikset dominate the market in North America, providing a variety of smart locks for homes and businesses. For example, August Home offers smart locks that work with home automation platforms such as Amazon Alexa, while Yale provides specialized security and convenience solutions for multi-family residences and home construction.

The Asia-Pacific is anticipated to grow at a faster CAGR during 2024-2032, due to fast urbanization, rising disposable incomes, and heightened consumer knowledge of modern security options. Nations such as China, Japan, and South Korea dominate the industry because of their robust technological manufacturing abilities and widespread use of smart home gadgets. Increased funding in smart city initiatives and the expanding adoption of digital transformation in the real estate industry continue to drive market expansion. Companies such as Samsung SmartThings and Xiaomi have made a big impact on the APAC market with their cost-effective and creative smart lock options. Xiaomi offers smart lock options for those who are cost-conscious, and Samsung SmartThings works with different IoT devices to offer a complete security solution for homes and businesses.

Need any customization research on Smart Lock Market - Enquiry Now

Key Players

The major key players in the Smart Lock Market are:

-

August Home (August Smart Lock Pro, August Doorbell Cam)

-

Yale (Yale Assure Lock SL, Yale Real Living Touchscreen Deadbolt)

-

Schlage (Schlage Encode Smart WiFi Deadbolt, Schlage Sense Smart Deadbolt)

-

Kwikset (Kwikset Halo Smart Lock, Kwikset Kevo Smart Lock)

-

Assa Abloy (Yale Linus Smart Lock, August Smart Lock)

-

Level Home (Level Lock, Level Lock Plus)

-

Ring (Ring Smart Lock, Ring Video Doorbell)

-

Samsung SmartThings (Samsung Smart Lock, SmartThings Hub)

-

Danalock (Danalock V3, Danalock V3 Bluetooth)

-

Nuki (Nuki Smart Lock 2.0, Nuki Bridge)

-

Lockly (Lockly Secure Plus, Lockly Vision)

-

Eufy Security (Eufy Smart Lock, Eufy Security Doorbell)

-

Honeywell (Honeywell Smart Lock, Honeywell Home Security System)

-

ZKTeco (ZKTeco Smart Lock, ZKTeco Biometric Lock)

-

Ultraloq (Ultraloq U-Bolt Pro, Ultraloq Bridge)

-

Igloohome (Igloohome Smart Deadbolt 2, Igloohome Smart Keybox)

-

CANDYHOUSE (CANDYHOUSE Sesame Smart Lock, CANDYHOUSE Door Sensor)

-

Zebra Technologies (Zebra Smart Lock, Zebra Smart Keypad)

-

Alfred (Alfred DB2, Alfred T10)

-

FIBARO (FIBARO Smart Implant, FIBARO Door/Window Sensor)

Suppliers of Raw Materials/Components:

-

3M

-

Honeywell

-

Texas Instruments

-

NXP Semiconductors

-

Broadcom

-

STMicroelectronics

-

Infineon Technologies

-

Microchip Technology

-

Maxim Integrated

-

Analog Devices

Recent Development

-

October 2024: Kwikset announced Halo Select, a New Wi-Fi-based smart lock for convenience and versatility with Matter built in to provide integrated home security solutions.

-

October 2024: Aqara announced a new Apple Home Key and Matter-over-Thread-compatible deadbolt called the "Smart Lock U300." Suitable for either indoors or out, the latest lock upgrades a more traditional non-deadbolt mechanism and replaces levers or knobs on single-bore doors.

-

September 2024, Mygate launched its consumer devices in the form of a variety of digital smart lock doors. The lock enables OTP-based remote unlocking, end-to-end data encryption, hassle-free user management, and real-time notifications, the firm said in a statement.

-

March 2024: Indian Institute of Technology, Kharagpur announced the launch of a smart electro-mechanical IOT module (used to lock bicycles) and software for the 4th generation Public Bicycle sharing system.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.38 Billion |

| Market Size by 2032 | USD 8.71 Billion |

| CAGR | CAGR of 15.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Deadbolt, Level Handlers, Padlock, Server Locks & Latches, Knob Locks, Others) • By Communication Protocol (Bluetooth, Wi-Fi, Z-Wave, Zigbee, Others) • By Method (Keypad, Card Key, Touch Based, Key Fob, Smartphone Based, Biometric) • By Application (Residential, Commercial, Industrial, Institutional & Government, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | August Home, Yale, Schlage, Kwikset, Assa Abloy, Level Home, Ring, Samsung SmartThings, Danalock, Nuki, Lockly, Eufy Security, Honeywell, ZKTeco, Ultraloq, Igloohome, CANDYHOUSE, Zebra Technologies, Alfred, FIBARO |

| Key Drivers | • As urbanization continues to rise, particularly in developing countries, there has been a surge in the number of rental properties. • The commercial and enterprise sectors have become increasingly important in driving the demand for smart locks. |

| RESTRAINTS | • Smart locks are electronic devices that require power to operate, typically through batteries. |