Home Automation Market Report Scope & Overview:

To Get More Information on Home Automation Market - Request Sample Report

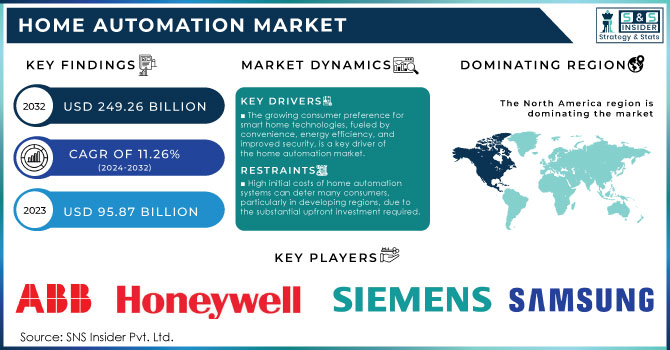

The Home Automation Market Size was estimated at USD 95.87 Billion in 2023 and is expected to reach USD 249.26 Billion by 2032 at a CAGR of 11.26% during the forecast period of 2024-2032.

The home automation market has gained significant momentum in recent years, driven by advancements in technology and increasing consumer demand for smart home solutions. This growth is fueled by a desire for enhanced convenience, security, and energy efficiency in residential settings. As more consumers recognize the benefits of integrating technology into their homes, smart devices have become increasingly prevalent, from smart thermostats and lighting systems to security cameras and voice-activated assistants. Key players in the market, including major tech companies and specialized firms, are constantly innovating to create seamless integration of smart devices within homes. This competition has led to the development of diverse solutions that cater to various consumer preferences and lifestyles. Furthermore, the proliferation of the Internet of Things (IoT) has enabled devices to communicate with one another, creating interconnected ecosystems that improve user experience.

|

Technology |

Description |

Commercial Products |

|---|---|---|

|

Smart Lighting |

Uses connected technology to control lighting remotely, often with dimming and scheduling features. |

Philips Hue, LIFX, Wyze Bulbs |

|

Smart Thermostats |

Allows users to control heating and cooling systems remotely and learn user preferences over time. |

Nest Learning Thermostat, Ecobee Smart Thermostat |

|

Home Security Systems |

Provides surveillance and security features, including cameras and alarms, controllable via apps. |

Ring Video Doorbell, Arlo Pro, ADT Security |

|

Smart Locks |

Allows for keyless entry and remote locking/unlocking through smartphones or keypads. |

August Smart Lock, Yale Assure Lock |

|

Smart Home Hubs |

Centralizes control of various smart home devices, enabling communication between them. |

Amazon Echo, Samsung SmartThings Hub |

|

Smart Appliances |

Integrates technology into appliances for remote control and monitoring of usage. |

Samsung Smart Fridge, LG Smart Oven |

|

Voice Assistants |

Enables hands-free control of smart home devices through voice commands. |

Amazon Alexa, Google Assistant |

|

Smart Sensors |

Detects and monitors environmental conditions like temperature, humidity, or motion. |

Aqara Motion Sensor, Fibaro Flood Sensor |

Notably, the demand for energy-efficient solutions is a driving force behind the growth of home automation. Smart thermostats, for example, allow homeowners to optimize heating and cooling schedules, resulting in significant energy savings. According to a report, smart thermostats can lead to energy savings of up to 10-15% annually, making them an attractive investment for eco-conscious consumers. Additionally, research shows that smart lighting systems can reduce energy consumption by approximately 30%, while smart security systems enhance safety with features such as remote monitoring and alerts. Consumer awareness regarding the benefits of home automation is steadily increasing, with many homeowners recognizing that smart technology can enhance their quality of life. According to research 45% of households in the U.S. have adopted some form of home automation, reflecting a growing trend toward smart living. Furthermore, a survey revealed that over 70% of consumers expressed interest in integrating more smart devices into their homes, indicating a robust market potential.

Home Automation Market Dynamics:

DRIVERS

-

The growing consumer preference for smart home technologies, fueled by convenience, energy efficiency, and improved security, is a key driver of the home automation market.

The rising demand for smart homes is a significant factor propelling the home automation market. As consumers increasingly seek convenience, energy efficiency, and enhanced security, smart home technologies have become more appealing. According to a recent survey, over 70% of consumers expressed interest in integrating smart devices into their homes, highlighting the shift toward connected living. The convenience of controlling various home functions from lighting and heating to security systems through a smartphone or voice command resonates well with tech-savvy individuals and busy families alike. Furthermore, smart home systems offer energy-efficient solutions that can lead to substantial cost savings

Additionally, heightened security concerns play a crucial role in this trend. With over 60% of homeowners prioritizing home security, automated solutions like smart locks, surveillance cameras, and motion sensors are increasingly in demand. These technologies provide peace of mind and greater control over home security, allowing homeowners to monitor their properties remotely. Government initiatives promoting energy-efficient solutions further bolster this trend, as they encourage consumers to adopt smart home technologies for environmental and economic benefits. As more people recognize the advantages of smart homes, the demand for home automation systems is expected to continue rising, paving the way for innovation and growth in the sector.

-

Technological advancements in IoT, AI, and machine learning enhance the sophistication and usability of home automation systems, driving consumer interest and adoption.

Technological advancements are significantly reshaping the Home Automation Market, primarily driven by innovations in the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). These technologies enable the development of more sophisticated and user-friendly home automation systems, enhancing the overall consumer experience. IoT facilitates seamless connectivity between devices, allowing users to control various home functions-such as lighting, heating, and security-remotely via smartphones or voice-activated systems. A study indicates that 70% of consumers are willing to invest in smart home devices that simplify their daily routines.

AI and ML contribute by enabling systems to learn user preferences and behaviours, resulting in personalized automation solutions. For example, smart thermostats can adjust temperature settings based on historical usage patterns, potentially reducing energy costs by 10-15%. Additionally, advancements in natural language processing have improved voice recognition technology, making it easier for consumers to interact with their home systems. According to research, over 50% of smart home device users report improved convenience due to voice-activated controls. The integration of these technologies not only boosts the functionality of home automation systems but also appeals to tech-savvy consumers seeking enhanced lifestyle solutions. As a result, home automation is becoming an integral part of modern living, with consumers increasingly valuing the efficiency, security, and convenience offered by these innovative technologies.

RESTRAIN

-

High initial costs of home automation systems can deter many consumers, particularly in developing regions, due to the substantial upfront investment required.

High initial costs pose a significant barrier to the adoption of home automation systems, particularly in developing regions where disposable incomes may be lower. The upfront expenses associated with purchasing smart devices, installation, and integration can deter potential buyers who may be unsure of the return on investment. The cost of comprehensive home automation systems can range from a few hundred to several thousand dollars, depending on the complexity and range of features offered. According to research about 55% of consumers cite cost as a major concern when considering smart home technology.

In developing countries, where economic constraints are more pronounced, this issue is even more critical. Many consumers prioritize essential expenses over luxury or convenience items like home automation systems. Furthermore, there can be a lack of access to financing options that would allow consumers to spread the cost of installation and equipment over time, making these technologies seem even less accessible. Additionally, the perceived complexity of integrating multiple devices into a cohesive system may lead to hesitation among potential buyers. As a result, education and awareness initiatives aimed at illustrating the long-term benefits of energy savings, enhanced security, and convenience could play a crucial role in overcoming these barriers.

Home Automation Market Segmentation Overview

By Component

The Security and Safety segment dominating the market share over 32% in 2023, reflecting a robust shift towards enhanced monitoring and safeguarding of industrial operations. This growing focus is fueled by stringent regulatory requirements, which mandate compliance with safety standards across various sectors. 70% of industrial organizations report prioritizing safety measures due to potential operational hazards, highlighting the critical need for effective security solutions. Additionally, the increasing incidence of industrial accidents has led to a surge in demand for advanced monitoring systems, with 60% of companies stating that enhanced safety measures directly contribute to operational efficiency. By integrating sophisticated security and safety solutions, organizations can significantly mitigate risks, ensure compliance with regulations, and reduce the likelihood of costly disruptions.

By Network Technology

The wireless segment dominated the market share over 58.2% in 2023. This growth is driven by the increasing adoption of smart home devices and IoT technologies, which provide consumers with convenience, efficiency, and enhanced security. Wireless technologies, such as Wi-Fi, Zigbee, and Z-Wave, facilitate seamless connectivity between various smart devices, allowing users to control their home environments remotely through smartphones and voice-activated assistants.

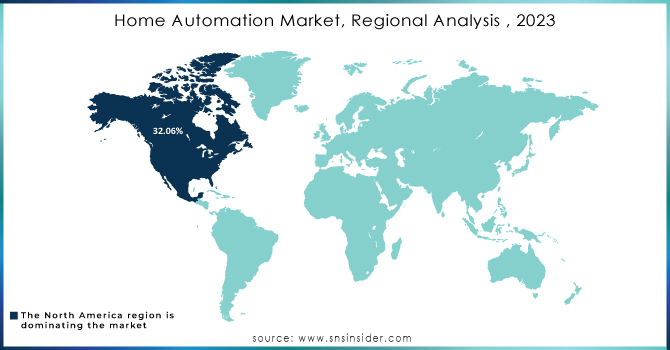

Home Automation Market Regional Analysis

North America region dominated the market share over 32.06% in 2023. The region is characterized by widespread adoption of technologies like voice assistants, smart thermostats, and home security systems. More than 80% of homeowners in the U.S. prioritize energy efficiency, making smart lighting and heating solutions popular choices. Additionally, around 70% of consumers consider smart home security systems a key factor when investing in home automation, reflecting a growing demand for safety. The availability of high-speed internet and 5G infrastructure also facilitates the seamless integration of smart devices. Continuous advancements by tech giants such as Amazon and Google further accelerate market growth.

Asia-Pacific (APAC) region, urbanization is occurring at a rapid pace, with over 50% of the population now living in urban areas. China leads the APAC smart home market, with 25% of households adopting smart technologies. Government-driven smart city projects, like India’s "100 Smart Cities Mission" and Japan’s energy-efficient housing initiatives, significantly boost demand. Consumers are increasingly aware of energy efficiency, with over 60% seeking solutions to reduce utility bills. In addition, rising internet penetration in the region and smartphone accessibility support smart home technology adoption. This expanding demand makes APAC the fastest-growing market, poised for further growth due to its diverse population and supportive governmental policies.

Do You Need any Customization Research on Home Automation Market - Enquire Now

Key Players in Home Automation Market

Some of the major key players of Home Automation Market

-

ABB Ltd. (ABB-free@home®, ABB i-bus® KNX)

-

Control4 Corporation (Smart Home OS 3, Control4 Smart Lighting)

-

Crestron Electronics, Inc. (Crestron Home, DigitalMedia™ NVX)

-

Honeywell International, Inc. (Honeywell Home, Lyric Controller)

-

Ingersoll-Rand plc (Nexia Home Intelligence, Trane ComfortLink™ II)

-

Johnson Controls (Tyco Smart Home Solutions, LUX KONO Smart Thermostat)

-

Legrand SA (Intuity Home Automation System, RF Lighting Control)

-

Leviton Manufacturing Company, Inc. (Decora Smart®, Omni Security & Automation Systems)

-

Lutron Electronics Co., Inc. (Caséta Wireless, RadioRA 2)

-

Schneider Electric (Wiser Energy, KNX Automation Systems)

-

Siemens AG (Synco IC, Desigo CC)

-

Samsung Electronics Co., Ltd. (SmartThings, Family Hub)

-

Google LLC (Google Nest, Google Home)

-

Amazon.com, Inc. (Amazon Alexa, Echo Devices)

-

Apple Inc. (HomeKit, Apple TV 4K)

-

Alarm.com (Smart Home Security, Alarm.com Smart Thermostat)

-

Vivint Smart Home, Inc. (Vivint Smart Hub, Vivint Doorbell Camera Pro)

-

ADT Inc. (ADT Pulse, ADT Command)

-

Resideo Technologies, Inc. (Resideo ProSeries, T9 Smart Thermostat)

-

Cisco Systems, Inc. (Cisco Smart+Connected Home Solutions)

Suppliers for Affordable, voice-controlled smart home devices for seamless integration of lighting, entertainment, and security of Home Automation Market:

-

Control4

-

Crestron Electronics

-

Honeywell International Inc.

-

Lutron Electronics

-

Savant Systems

-

ABB

-

Siemens AG

-

Legrand

-

Schneider Electric

-

Amazon (Alexa Smart Home)

RECENT DEVELOPMENT

-

In September 2023: BT and Johnson Controls formed a partnership to support business clients in the U.K. and globally with smart building technology. This collaboration focuses on digitally managing, analyzing, and optimizing energy usage in workplaces such as offices and factories.

-

In February 2024: Keus Smart Home, a smart home automation startup, raised INR 100 crore (USD 12 million) in a funding round led by mid-market private equity firm OAKS Asset Management. OAKS' Consumer Fund contributed INR 80 crore, while the company's founders, Subram Kapoor and Brijesh Chandwani, provided the remaining amount.

-

In April 2023: iPlug Control System Pvt. Ltd., a leading home automation company, opened India’s first Experience Centre at Xion Mall in Hinjewadi, Pune, in May 2023. The center showcases automation-centric lifestyle products, offering consumers a unique opportunity to experience tech-powered living before making a purchase, marking the first technology-driven experience center in the country.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 95.87 Billion |

| Market Size by 2032 | USD 249.26 Billion |

| CAGR | CAGR of 11.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Product (Security and Safety, HVAC, Wellness Monitoring, Smart Appliances, Smart Entertainment, Smart Lighting, Others (Energy Management, etc.) (Services (Consulting, Installation or Implementation, Support and Maintenance) • By Network Technology (Wired, Wireless, Power Line-Based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Control4 Corporation, Crestron Electronics, Inc., Honeywell International, Inc., Ingersoll-Rand plc, Johnson Controls, Legrand SA, Leviton Manufacturing Company, Inc., Lutron Electronics Co., Inc., Schneider Electric, Siemens AG, Samsung Electronics Co., Ltd., Google LLC, Amazon.com, Inc., Apple Inc., Alarm.com, Vivint Smart Home, Inc., ADT Inc., Resideo Technologies, Inc., Cisco Systems, Inc. |

| Key Drivers | • The growing consumer preference for smart home technologies, fueled by convenience, energy efficiency, and improved security, is a key driver of the home automation market. • Technological advancements in IoT, AI, and machine learning enhance the sophistication and usability of home automation systems, driving consumer interest and adoption. |

| RESTRAINTS | • High initial costs of home automation systems can deter many consumers, particularly in developing regions, due to the substantial upfront investment required. |