Smart Pulse Oximeters Market Report Scope & Overview:

Get more information on Smart Pulse Oximeters Market - Request Sample Report

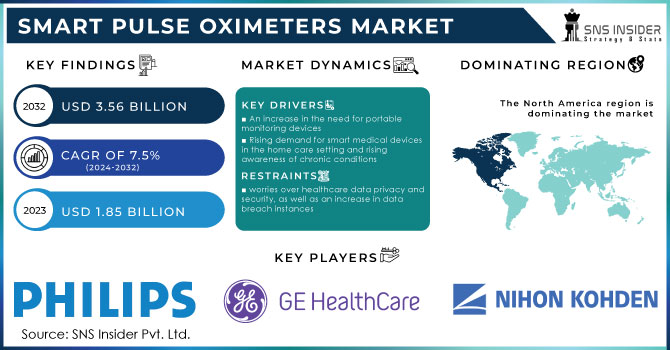

The Smart Pulse Oximeters Market size was valued at USD 1.9 Billion in 2023 and is expected to reach USD 3.6 billion by 2032, growing at a CAGR of 7.3% over the forecast period 2024-2032.

The smart pulse oximeters market is growing with the surging adoption of wearable health technologies attributable to rising awareness towards preventive healthcare. According to the World Health Organization (WHO), over 400 million individuals globally suffer from respiratory diseases, with chronic obstructive pulmonary disease (COPD) accounting for more than 3 million deaths annually. Private transportation must be avoided and prompt clinical help should be given if you test positive for any sickness whether it be COVID-19, a flu bug, and so forth. This disturbing information has brought about states to make accentuation even and incessant checking of health testing. For example, the U.S. government also reported a 15% rise in insurance payments for telemedicine services, such as remote oxygen level monitoring in 2023 through its Medicare program. Likewise, the Indian government included smart health devices under its scheme to make affordable healthcare, Ayushman Bharat, which led to a 30% increase in the mobilization of portable monitoring devices. The market growth is further boosted high with low-cost integration of advanced features like wireless connectivity, real-time data sharing, and use of artificial intelligence. This boom has also been fuelled by public health campaigns sweeping European cities, backed by the European Commission funding of €60 million on wearable health technologies. The global smart pulse oximeter market is expected to grow significantly as healthcare systems around the world adopt smart solutions.

The smart pulse oximeters market is booming owing to the development of new smart technology along with pulse oximeters that facilitate the remote monitoring of patients. The World Health Organisation (WHO) states that non-communicable diseases (NCDs) including cardiovascular and respiratory disorders are responsible for almost 74% of annual global deaths, revealing the urgent for early diagnostics and health monitoring. Governments across the globe are introducing policies to improve the reach of healthcare and facilitate the use of new-age healthcare devices. For instance, in 2023, the FDA approved more than 120 new digital health technologies which indicates the agency's commitment towards proprietary monitoring solutions in the healthcare sector. Likewise, India’s Ministry of Health and Family Welfare announced that they are going to enhance the public investment in telemedicine and remote health monitoring solutions to growth of 24% further driving the adoption of smart pulse oximeters.

Market Dynamics

Drivers

-

The increasing prevalence of conditions like COPD and asthma elevates the demand for monitoring devices such as smart pulse oximeters.

-

Innovations, including miniaturization and integration with smartphones, enhance device accuracy and user convenience, boosting market growth.

-

Growing healthcare investments in countries like India and China create significant opportunities for market expansion.

The growing prevalence of respiratory diseases is a significant driver for the smart pulse oximeters market. Conditions such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and pneumonia require continuous monitoring of oxygen saturation levels, making pulse oximeters a critical tool in patient management. According to the World Health Organization (WHO), over 235 million people globally suffer from asthma, while COPD caused approximately 3.23 million deaths in 2019, ranking as the third leading cause of death worldwide. These statistics highlight the increasing burden of respiratory conditions on healthcare systems, emphasizing the demand for efficient and user-friendly monitoring solutions.

Smart pulse oximeters are gaining traction due to their convenience, accuracy, and integration with mobile health platforms. For example, devices like Masimo's MightySat Finger Pulse Oximeter and Wellue O2Ring not only measure oxygen levels but also provide real-time data synchronization with smartphones. This enables healthcare providers and patients to monitor trends remotely, ensuring timely intervention during emergencies. Furthermore, the COVID-19 pandemic underscored the importance of pulse oximeters in detecting silent hypoxia, a condition where oxygen levels drop dangerously low without noticeable symptoms. In countries like the United States, the Centers for Disease Control and Prevention (CDC) recommended pulse oximeters for home monitoring of COVID-19 patients, driving a surge in adoption. These factors collectively highlight the critical role of smart pulse oximeters in addressing the growing respiratory health challenges.

Restraints

-

The emergence of multifunctional health monitoring devices, such as smartwatches with SpO2 measurement capabilities, poses a challenge to the traditional pulse oximeter market.

-

Navigating the complex regulatory landscape for medical devices can impede the swift introduction of new products to the market.

-

High penetration rates in developed markets may limit growth opportunities, prompting companies to seek expansion in emerging economies.

Increasing adoption of multifunctional health monitoring devices including smartwatches and fitness trackers with SpO2 sensors is the major restraining factor for growth of the smart pulse oximeters market. These alternatives may come with added functions such as heart rate monitoring, activity monitoring, and fitness ecosystem pairing, offering one-stop health monitoring for users into a single piece of kit. Wearable devices are becoming more and more popular with health-conscious consumers and fitness enthusiasts due to their convenience and portability. In addition, improvements in wearable technology bring better SpO2 measurement accuracy and reliability even for the wearable technology which might pose a threat to single-use pulse oximeter market share. Dedicated pulse oximeters should still be an important part of a clinical setting and for certain types of patients, especially those with specific medical needs; however, the proliferation of multifunctional devices in the consumer segment will mean that in the future, fewer people will seek dedicated pulse oximeters or versions of it. This shift in consumer preference underscores the need for innovation in the standalone device segment.

Segmentation Insights

By Type

Due to its ease of use, portability, and cost-effectiveness, the fingertip segment accounted for the largest smart pulse oximeters market share, at 36%, in 2023. Finger oximeters are popular and suitable for personal or clinical use because of their ease of use and reliability. The FDA conducted a literature review in 2023, which noted that over 50% of the devices being used in an outpatient setting to facilitate treatment were fingertip pulse oximeters due to their ease of use and fast results.

Moreover, the governments have been talking about the approval and standardization of these devices. Examples of this include the European Medicines Agency (EMA) revised its guidelines in early 2023 to regulate the quality of fingertip oximeters to improve consumer confidence. Their subprocessor weights and disposable nature when contrasted with wrist-worn and handheld counterparts have increased their penetration in the market, particularly in middle-income economies.

By end user

The hospitals and clinics segment held the largest market share in 2023, attributed to the increasing number of patients who need continuous oxygen monitoring and are being admitted as inpatients. According to the World Bank, hospital admissions for respiratory conditions increased by 15% globally between 2018 and 2023. This segment is also driven by a high dependency on advanced pulse oximetry solutions in hospitals for effective critical patient monitoring.

Government statistics from the past also underscore this trend. As an example, in India, the Ministry of Health and Family Welfare observed a rise in smart pulse oximeters for public hospitals and noted a 20% increase in advanced monitoring devices that were procured for public hospitals in 2022. Identical patterns of rapid promotion of smart pulse oximeters were also recorded in the U.S. between 2021 and 2023 with federal funding, firstly through the HHS, was rapidly increased by 18% enhancing the pace of the hospital transition into calibrating oxygen saturation monitoring through novel smart pulse oximeters.

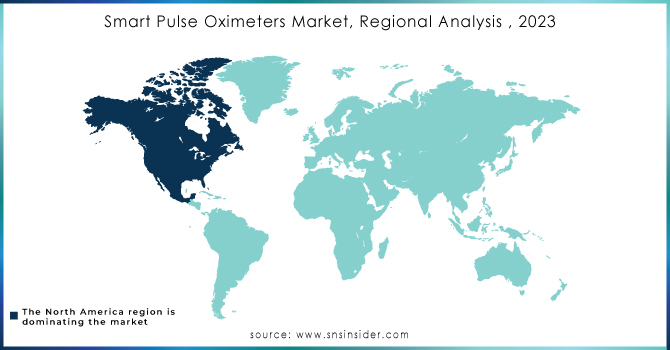

Regional Analysis

North America dominated the smart pulse oximeters market in 2023, and it accounted for a 39% market share. The rapid adoption of advanced medical technology is fostered by the presence of a highly sophisticated healthcare infrastructure in the region. Further, disposable incomes are high making consumers invest in advances in health monitoring technology. The market is fortified by the supportive Government policies. A good example is the budget of 2023 adopted by the U.S. government, which has dedicated $50 billion to digital health technologies-integrated care, some of which will be dependent on remote patient monitoring devices like smart pulse oximeters. These projects attest to the commitment of the region to technology-based healthcare resources.

On the other hand, the Asia-Pacific region has exhibited the highest CAGR in the smart pulse oximeters market over the forecast period. Demand for rapid tests that can be carried out in laboratories and patient care is this market segment's growing rate and the feature, such justification in growth associated with increasing demand for investing in healthcare and the prevalence of respiratory diseases. Digital health solutions are the highest priority for the region's governments to meet the needs presented by these challenges. The National Health Commission of China found a sharp increase of 8% in the COPD disease burden in 2023 vs 2018, which has attracted attention to the need for innovative health monitoring systems. In 2023, China’s healthcare expenditure saw a notable 12% growth, with Emerging Monitoring Devices as a Main Target. This focus on strengthening the healthcare capabilities along with increasing awareness towards respiratory health, makes Asia Pacific a significant growth belt for the smart pulse oximeters market. These trends indicate that the world is moving towards tech-driven healthcare solutions adapted to market preferences.

Need any customization research on Smart Pulse Oximeters Market - Enquiry Now

Recent Developments

-

In March 2023, Philips Healthcare announced next-generation smart pulse oximeters with AI capabilities to improve accuracy in diverse populations.

-

In May 2024 GE Healthcare Technologies, Inc., announced the launch of the GE OxiSense 2000, an advanced-pulse oximeter with wireless Bluetooth communication capabilities, designed for integration with remote patient monitoring systems and electronic health records.

-

In March 2024, Medtronic purchased HealthData Solutions, one of the top remote patient monitoring tech developers. This acquisition allows Medtronic to complement its solutions around pulse oximetry with advanced data analytics to boost remote monitoring of patients suffering from chronic respiratory diseases.

Key Players

Key Service Providers/Manufacturers

-

Masimo Corporation (Rad-97, MightySat Rx)

-

Medtronic plc (Nellcor Bedside, Capnostream 35)

-

Nonin Medical Inc. (Onyx Vantage 9590, WristOx2 3150)

-

Koninklijke Philips N.V. (SimplyGo Pulse Oximeter, IntelliVue MX40)

-

Beurer GmbH (PO 60, PO 80)

-

Omron Healthcare Inc. (OXY200, iOxy)

-

GE Healthcare (Carescape SpO2, TruSignal Sensors)

-

Welch Allyn (Hillrom) (Connex Spot Monitor, SureTemp Plus)

-

ResMed Inc. (S9 Series, AirSense 10)

-

ChoiceMMed (MD300C29, MD300W)*

Key Users:

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Hospital

-

Mount Sinai Health System

-

Massachusetts General Hospital

-

Apollo Hospitals

-

Fortis Healthcare

-

Kaiser Permanente

-

Medanta - The Medicity

-

Narayana Health

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.9 Billion |

| Market Size by 2032 | USD 3.6 Billion |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Finger Pulse Oximeters {Ring Type, Non-ring Type}, Handheld Pulse Oximeters, Wrist Pulse Oximeters, Pediatric Pulse Oximeters) • By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Home Care Setting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Masimo Corporation, Medtronic plc, Nonin Medical Inc., Koninklijke Philips N.V., Beurer GmbH, Omron Healthcare Inc., GE Healthcare, Welch Allyn (Hillrom), ResMed Inc., ChoiceMMed |

| Key Drivers | • The increasing prevalence of conditions like COPD and asthma elevates the demand for monitoring devices such as smart pulse oximeters. • Innovations, including miniaturization and integration with smartphones, enhance device accuracy and user convenience, boosting market growth. |

| Restraints | • The emergence of multifunctional health monitoring devices, such as smartwatches with SpO2 measurement capabilities, poses a challenge to the traditional pulse oximeter market. • Navigating the complex regulatory landscape for medical devices can impede the swift introduction of new products to the market. |