Sodium Chlorite Market Size & Overview:

The Sodium Chlorite Market size was USD 258.76 million in 2023 and is expected to reach USD 415.61 million by 2032 and grow at a CAGR of 5.41% over the forecast period of 2024-2032.

To Get more information on Sodium Chlorite Market - Request Free Sample Report

The report offers in-depth statistical insights and trend analysis tailored to industry-specific metrics. It includes data on production capacity and utilization by country and purity grade for 2023, highlighting regional manufacturing strengths. The report also analyzes raw material and feedstock price trends, offering a comparative overview by region. Regulatory impacts on sodium chlorite production and application are assessed, especially in water treatment and textiles. Additionally, the report evaluates environmental metrics such as emissions, disposal standards, and sustainability practices across key regions. Insights into R&D investments and innovations, particularly in eco-friendly sodium chlorite derivatives, are also included. Lastly, adoption rates across key end-use sectors including healthcare, food, and municipal sanitation are analyzed to understand market penetration trends.

The United States held the largest market share in the sodium chlorite market primarily due to its robust demand across water treatment, healthcare, and food processing sectors. In 2023, the U.S. market was valued at USD 54.34 million and is projected to reach USD 88.34 million by 2032, growing at a CAGR of 5.55% from 2024 to 2032. This growth is driven by stringent regulations from the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), which promote the use of high-purity sodium chlorite for disinfection and sanitation. Additionally, increasing investments in municipal water treatment infrastructure and the consistent rise in processed food consumption further accelerate product demand. Technological advancements and strong distribution networks by key domestic players also contribute to the country’s leading position in the global market.

Sodium Chlorite Market Dynamics

Drivers

-

Rising demand for clean water and disinfection solutions drives the sodium chlorite market growth globally across sectors.

The increasing global emphasis on clean water access and sanitation is significantly driving the demand for sodium chlorite, especially in municipal and industrial water treatment sectors. With the growing burden of waterborne diseases and heightened hygiene concerns government bodies across the U.S., India, and EU are investing heavily in disinfection infrastructure. Sodium chlorite, as a precursor to chlorine dioxide, is widely used for its efficiency in microbial control without forming harmful by-products. Additionally, stringent environmental and public health regulations by organizations such as the EPA and WHO further stimulate adoption in water treatment, healthcare sanitation, and food processing. Its effectiveness in eliminating pathogens while maintaining eco-safety makes it a critical compound in various industries, thereby fueling consistent growth in the global sodium chlorite market.

Restrain

-

Stringent transportation and handling regulations of sodium chlorite hinder its widespread market adoption across various industrial applications.

Despite its extensive use, the sodium chlorite market faces restraint due to stringent regulations around storage, transportation, and handling owing to its reactive and hazardous nature. Regulatory bodies such as the U.S. Department of Transportation (DOT) and the European Chemicals Agency (ECHA) classify sodium chlorite as a hazardous chemical, requiring special safety protocols, certified handling professionals, and dedicated infrastructure for transport. This adds to operational costs and limits its adoption, especially among small and medium-scale manufacturers who lack adequate resources. Moreover, potential health risks linked to exposure such as irritation to the eyes, skin, and respiratory tract further restrict large-scale use. These limitations affect the supply chain and often result in delays and increased costs, ultimately slowing market growth in regions with strict chemical transport compliance.

Opportunity

-

Increasing demand for high-performance oxidizing agents in food safety and healthcare creates lucrative growth opportunity for sodium chlorite market.

The rising demand for high-performance, non-toxic oxidizing agents in food safety and healthcare is opening up significant opportunities for the sodium chlorite market. With the growing awareness about microbial contamination and chemical residues in food processing and medical sterilization, sodium chlorite has emerged as a preferred solution. It efficiently generates chlorine dioxide, which is effective at low concentrations and leaves minimal residual toxicity, making it ideal for these sensitive applications. Additionally, regulatory support from agencies like the FDA for its use in disinfecting poultry, fruits, and vegetables further bolsters its credibility in food safety. In the healthcare sector, increased focus on infection control in hospitals and clinics drives the need for advanced surface sanitizers and sterilants, making sodium chlorite a promising product with expanding demand across developed and emerging economies.

Challenge

-

Rising environmental concerns over chlorine-based compounds pose a major challenge to the sodium chlorite market expansion.

While sodium chlorite offers several industrial advantages, its classification as a chlorine-based compound raises environmental and safety concerns that challenge its market growth. Environmental agencies across regions like the European Union are tightening restrictions on chlorine-derived chemicals due to their potential to form harmful by-products under certain conditions. This has led to increased scrutiny in both usage and waste disposal, compelling industries to explore alternative green oxidizing agents. Additionally, public perception about chemical sanitation versus natural or bio-based alternatives is shifting, especially in sectors like food and personal care. These factors put pressure on manufacturers to invest in greener formulations or risk market share loss. As sustainability becomes a global priority, the sodium chlorite market must navigate regulatory, environmental, and consumer-driven challenges to sustain long-term growth.

Sodium Chlorite Market Segmentation Analysis

By Application

Disinfectant segment accounted for the largest share around 42% in the sodium chlorite market owing to its large-scale applications in water treatment and food processing industries and also used for healthcare sanitation. Sodium chlorite is an important precursor to chlorine dioxide, a powerful disinfectant with a broad-spectrum antimicrobial activity and a low production of harmful by-products. The growth of this segment is attributed to its widespread implementation for municipal disinfection of water systems, particularly driven by an increase in the incidence of waterborne diseases in various countries including U.S., China, and India, and increasing government mandates for the provision of safe drinking water. Compound’s stability, long shelf life and excellent efficacy in both liquid disinfection and gas disinfection method further cements its predominant position in this segment with growing adoption and preference for large-scale disinfection operations in all the industries.

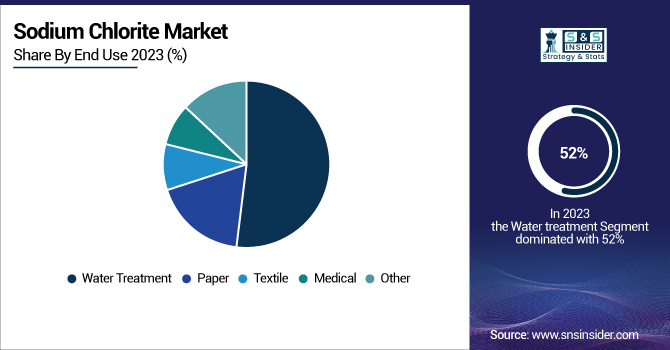

By End Use

Water treatment held the largest market share around 52% in 2023. It is owing to the fact that sodium chloride is essential to produce chlorine dioxide, a strong and selective oxidizing agent, commonly used for the disinfection of both municipal and industrial water supplies. Growing global concerns regarding safe drinking water with robust environmental regulations and public health regulations are expected to force governments and industry to move toward sodium chlorite-based treatment solutions. Sodium chlorite to generate chlorine dioxide is preferred since it is potent against a broad spectrum of pathogens, including bacteria, viruses, and protozoa, and without the formation of toxic chlorinated by-products such as trihalomethanes (THMs). As the manufacture and energy sectors expands, its applications also increased on cooling towers, wastewater and industrial process water. All of these factors together result in the segment being in the lead particularly in regions that focus on clean water access and sustainable water management.

Sodium Chlorite Market Regional Outlook

Asia Pacific held the largest market share, around 44%, in 2023. It is due to significant industrialization, population expansion, and rising demand of clean water in countries like China, India, and other Southeast Asian countries. The increasing applications of sodium chlorite for the municipal and industrial water treatment sector in the region is a key factor contributing to the market growth, owing to the characteristics of sodium chlorite in generation of chlorine dioxide, an efficient water disinfectant. Furthermore, the rapid growth of the textile and paper & pulp industries in China, Indonesia and other countries also drives the amount of sodium chlorite used for bleaching and oxidization. The demand was further boosted by government initiatives to enhance sanitation, environmental and public health. In addition, low-cost availability of raw materials and labor cost coupled with high investment on the manufacturing infrastructure makes Asia Pacific as the leading region in the global sodium chlorite market.

North America held a significant market share. It is owing to its superior water treatment infrastructure coupled with strict environmental regulations, which require effective disinfection and sanitation practices. Demand is also boosted by use of sodium chlorite in the production of chlorine dioxide in many municipal & industrial water treatment plants in the U.S. & Canada. Moreover, sodium chlorite also finds application in disinfectants and surface sanitation; therefore, presence of large-scale food processing, healthcare, and pharmaceutical industries in the region is propelling the market growth. The market observes steady growth due to advancements in technologies and the early adoption of innovative chemical treatment solutions. In addition, regulatory monitoring carried out by several agencies including the U.S. Environmental Protection Agency (EPA) demands quality and safety adherence, which will maintain sodium chlorite consumption for commercial & industrial uses in North America driven by higher consumption (both regional).

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

OxyChem (Purox S, OxyChlorite)

-

Dupont (Chlorine Dioxide Generator, Oxidizing Biocide)

-

Kemira (FennOx 250, FennOx 150)

-

Shree Chlorates (Sodium Chlorite 80%, Sodium Chlorite Solution 31%)

-

Ercros S.A. (Sodium Chlorite ER-80, Chlorine Dioxide ER-S)

-

American Elements (AE Sodium Chlorite Powder, AE Sodium Chlorite Solution)

-

Akzo Nobel N.V. (Dioxychlor, Eka Chlorine Dioxide)

-

Gulbrandsen Chemicals (Sodium Chlorite Technical Grade, GCI-Chlorite 31%)

-

Arkema S.A. (Sodium Chlorite High Purity, Chlorate Disinfectant)

-

Ankine Pharmaceuticals (Sodium Chlorite USP Grade, Ankine Chlorite Liquid)

-

Triveni Interchem Pvt. Ltd. (Triveni Sodium Chlorite 80%, Triveni Chlorite Solution)

-

Surpass Chemical Company, Inc. (Surpass Sodium Chlorite, Surpass Chlorine Dioxide Base)

-

Shandong Gaomi Gaoyuan Chemical Co., Ltd. (Gaoyuan Sodium Chlorite Powder, Gaoyuan Chlorite Solution)

-

OxyChem Corporation (Occidental Chemical Corporation) (OxyChem Chlorite 25%, OxyChem Chlorite 80%)

-

Jinan Realfine Chemical Co., Ltd. (Realfine Sodium Chlorite Solution 31%, RF-SC Powder)

-

Sigma-Aldrich (a part of Merck Group) (Sodium Chlorite Reagent Grade, Sodium Chlorite ACS)

-

Carus Group Inc. (Carusol, Carus 8500)

-

Yancheng Longshen Chemical Co., Ltd. (Longshen Chlorite Liquid, Longshen Sodium Chlorite 80%)

-

BASF SE (Oxidant SC-90, Chlorite Clean)

-

Nanjing Kaimubo Pharmatech Co., Ltd. (KM-Sodium Chlorite 80%, KM-Chlorite Liquid 31%

Recent Development:

-

In February 2024, Tata Chemicals partnered with the IITB-Monash Research Academy to advance research in the perovskite and clean energy space. This collaboration is focused on driving innovation in clean energy technologies and accelerating the development of sustainable energy transition solutions.

-

In December 2023, Arkema entered into a 20-year agreement with EDF Renewables to procure 20 GWh of renewable electricity annually, beginning in 2026. This long-term contract is set to supply 70% of the electricity needs for Bostik’s operations in France, underscoring Arkema’s dedication to sustainability and cleaner energy usage.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 258.76 Million |

| Market Size by 2032 | USD 415.61 Million |

| CAGR | CAGR of 5.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent, Others) •By End Use (Water treatment, Paper, Textile, Medical, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | OxyChem, Dupont, Kemira, Shree Chlorates, Ercros S.A., American Elements, Akzo Nobel N.V., Gulbrandsen Chemicals, Arkema S.A., Ankine Pharmaceuticals, Triveni Interchem Pvt. Ltd., Surpass Chemical Company, Inc., Shandong Gaomi Gaoyuan Chemical Co., Ltd., OxyChem Corporation (Occidental Chemical Corporation), Jinan Realfine Chemical Co., Ltd., Sigma-Aldrich (a part of Merck Group), Carus Group Inc., Yancheng Longshen Chemical Co., Ltd., BASF SE, Nanjing Kaimubo Pharmatech Co., Ltd. |