Solar Inverter Market Report Scope & Overview:

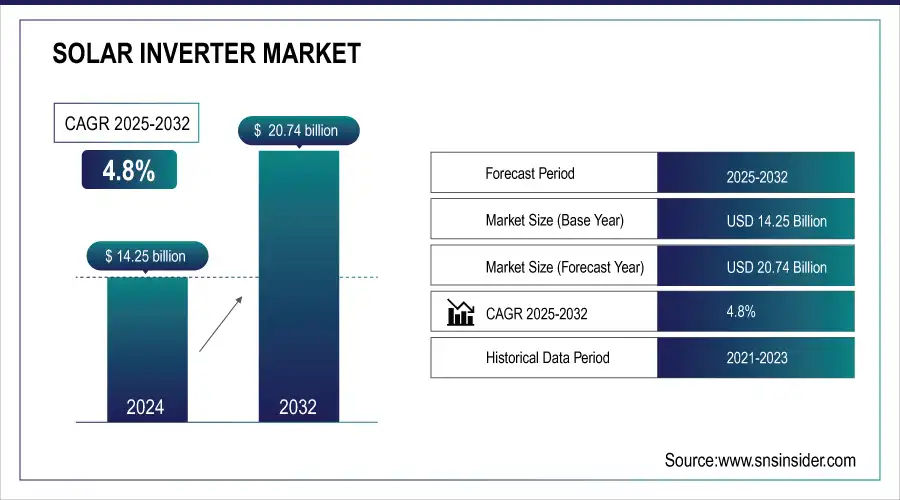

The Solar Inverter Market Size was valued at USD 14.25 billion in 2024 and is expected to reach USD 20.74 billion by 2032 and grow at a CAGR of 4.8% by 2025-2032.

The rapid development in the renewable energy sector is a key driver. Governments around the world are setting ambitious renewable energy targets, driving significant investments in solar power generation. According to the International Renewable Energy Agency (IRENA), global solar PV capacity reached a staggering 1,337 Gigawatts (GW) at the end of 2022 [IRENA], and this number is only expected to climb. This surge in solar installations necessitates a proportional increase in solar inverters, the brains of the operation that convert direct current (DC) electricity from solar panels into usable alternating current (AC) for powering homes and businesses. the ease of installation, particularly for string inverters, is another major growth factor.

Get More Information on Solar Inverter Market - Request Sample Report

Solar Inverter Market Size and Forecast:

-

Market Size in 2024: USD 14.25 Billion

-

Market Size by 2032: USD 20.74 Billion

-

CAGR: 4.8% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Solar Inverter Market Highlights:

-

Rising Adoption of Solar Energy: Growing use of solar power across residential, commercial, and utility-scale projects drives demand for solar inverters.

-

Technological Advancements: High-efficiency string inverters, microinverters, and hybrid inverters with energy storage integration boost performance and reliability.

-

Government Support: Incentives, subsidies, and favorable policies accelerate solar inverter deployment globally.

-

Cost and Accessibility: Declining PV system costs and simpler installation of string inverters make solar power more accessible to a wider audience.

-

Market Restraints: High initial investment and perceived installation complexity can deter adoption, especially in emerging markets.

-

Opportunities with Battery Integration: Growing integration of energy storage systems increases demand for smart, hybrid, and battery-compatible inverters.

String inverters are a popular choice for residential and small commercial solar systems due to their affordability and simpler installation process compared to other inverter types. This ease of use makes solar power systems more accessible to a wider range of customers, further accelerating market expansion. Finally, technological advancements are playing a crucial role. Manufacturers are constantly innovating to create more efficient inverters with higher power conversion rates. This translates to increased energy production from solar panels, making solar power systems even more cost-effective. Research by Mercom Capital Group suggests that global solar inverter shipment volume is expected to reach 430 Gigawatts (GW) by 2030, highlighting the anticipated market boom

Solar Inverter Market Drivers:

- Driving the Future of Solar Energy with Key Market Drivers and User Segments for Solar Inverters

The global solar inverter market is primarily driven by the growing adoption of renewable energy, especially solar power, across residential, commercial, and utility-scale projects. Increasing government incentives, subsidies, and favorable policies for clean energy are accelerating deployment. Technological advancements in inverters, such as high-efficiency string inverters, microinverters, and hybrid inverters with energy storage integration, are boosting system performance and reliability. The rising demand for energy-efficient and smart grid-compatible solutions further fuels market growth. Additionally, declining costs of solar PV systems and growing awareness about carbon footprint reduction encourage adoption of solar inverters globally. The market also benefits from expansion in emerging economies with high solar potential.

Solar Inverter Market Restraints:

-

Despite cost reductions, the initial investment for a solar power system, including the inverter, can still be a barrier for some potential customers.

Despite significant cost reductions in solar technology over the past decade, the upfront investment required for a complete solar power system—including panels, inverters, and installation—remains substantial for many potential customers. High initial costs can deter residential and small commercial users from adopting solar energy, even when long-term savings and government incentives are available. Financing options, such as loans, leases, and power purchase agreements, help mitigate this barrier but may not be accessible to all. Additionally, the perceived complexity of installation and maintenance, along with uncertainty about return on investment, can further discourage adoption, particularly in emerging markets where awareness and infrastructure are still developing.

Solar Inverter Market Opportunities:

-

The increasing integration of battery storage with solar power systems creates a need for inverters compatible with battery technology.

The growing integration of battery storage with solar power systems is driving demand for inverters that are fully compatible with energy storage technology. Hybrid and smart inverters capable of managing both solar generation and battery charging or discharging are increasingly sought after by residential, commercial, and utility-scale users. This trend enables greater energy self-consumption, load management, and grid stability, while supporting backup power solutions during outages. As battery adoption rises due to declining costs and enhanced energy independence, inverter manufacturers are innovating to provide efficient, reliable, and intelligent solutions that seamlessly integrate with various battery chemistries and capacities, fueling market growth globally.

Solar Inverter Market Segment Analysis:

By Type

In 2024, central inverters dominate the solar inverter market, accounting for around 49% of revenue, mainly due to their efficiency in utility-scale projects. String inverters, widely used in residential and commercial setups, are projected to grow to over 30% market share by 2032 with a CAGR of approximately 10.6%. Microinverters, ideal for module-level monitoring and enhanced energy yield in homes, are expected to expand rapidly, reaching over 20% share by 2032 with a CAGR of about 19.9%, driven by technological advancements and rising decentralized solar adoption.

By System Type

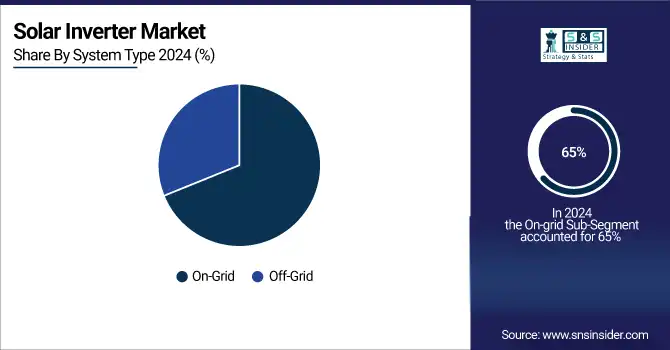

On-grid solar inverters dominate the market in 2024, accounting for roughly 65% of installations due to their efficiency and grid connectivity for residential, commercial, and utility-scale projects. Off-grid inverters, used in remote areas without reliable grid access, are projected to grow steadily, reaching about 35% market share by 2032. The off-grid segment is driven by increasing demand for energy independence, rural electrification, and hybrid solutions with battery storage, while on-grid systems continue to benefit from declining costs, government incentives, and widespread adoption in urban and industrial applications.

By Phase

In 2024, single-phase solar inverters dominate the market, accounting for approximately 60% of installations, primarily in residential and small commercial applications due to their lower cost and simpler integration. Three-phase inverters, commonly used in larger commercial and industrial projects, are expected to grow at a faster rate, with a projected CAGR of around 11% from 2024 to 2032, reaching about 40% market share by 2032. The growth of three-phase systems is driven by increasing large-scale solar deployments and rising demand for stable, high-capacity energy distribution.

By Application

In 2024, the residential segment dominates the solar inverter market, accounting for around 50% of installations due to widespread rooftop solar adoption and supportive government incentives. The commercial segment is expected to grow faster, with a projected CAGR of approximately 11% from 2024 to 2032, driven by increasing energy cost savings, sustainability goals, and mid-sized business adoption. The utility segment, while slower-growing, remains significant for large-scale solar farms, contributing stable demand and benefiting from ongoing investments in grid-connected renewable energy infrastructure.

Solar Inverter Market Regional Analysis:

Asia-Pacific Solar Inverter Market Trends:

The Asia Pacific region currently dominating the Solar Inverter Market with around 43 to 45% of the global market share. particularly China and India, is experiencing a surge in solar power generation due to factors like government initiatives promoting renewable energy, growing energy demand, and abundant sunshine. This increase in solar installations translates to a proportional increase in demand for solar inverters. Also, The Asian market is price-sensitive, and manufacturers are constantly innovating to create cost-effective inverter solutions. This focus on affordability makes solar power systems more accessible to a wider range of customers in the region. Several leading solar inverter manufacturers, including Huawei, Sungrow, and GoodWe, are headquartered in Asia. This proximity to the rapidly growing market allows them to efficiently cater to regional needs and offer competitive solutions.

Need any customization research on Solar Inverter Market - Enquiry Now

North America Solar Inverter Market Trends:

North America holds a significant share of the solar inverter market, driven by the United States and Canada. The region benefits from strong government incentives, renewable energy mandates, and corporate sustainability initiatives. Residential and commercial rooftop installations are growing steadily, increasing demand for string and microinverters. Technological advancements, including smart grid integration and energy storage compatibility, are key trends. Market players focus on reliability, efficiency, and long-term warranties to attract customers, while policy support and declining costs continue to drive adoption.

Europe Solar Inverter Market Trends:

Europe accounts for a substantial portion of the market, with Germany, Spain, and Italy leading installations. Government policies, feed-in tariffs, and renewable energy targets strongly support solar adoption. High awareness of sustainability, energy efficiency, and smart grid initiatives drives demand for advanced inverters. Both residential and utility-scale projects contribute, with string inverters widely used. Manufacturers emphasize energy-efficient, durable, and technologically advanced solutions to meet stringent regional standards.

Latin America Solar Inverter Market Trends:

Latin America is experiencing moderate growth, led by Brazil, Mexico, and Chile. Expanding solar power capacity, supportive regulations, and falling PV system costs encourage adoption. Commercial and utility-scale projects dominate, increasing demand for central and string inverters. Price sensitivity is a key factor, prompting manufacturers to offer cost-effective and reliable solutions. Regional players are also collaborating with global brands to meet growing energy demands efficiently.

Middle East & Africa Solar Inverter Market Trends:

The Middle East and Africa (MEA) region is witnessing rapid solar adoption due to high solar irradiance, growing energy demand, and government renewable energy programs. Utility-scale projects dominate, creating demand for central inverters and hybrid solutions with battery integration. Countries like UAE, Saudi Arabia, and South Africa are key markets. Affordability, efficiency, and durability are crucial due to harsh environmental conditions. International and regional manufacturers focus on robust, scalable inverter solutions to capitalize on the expanding solar energy infrastructure.

Solar Inverter Market Key Players:

-

Huawei Technologies

-

Sungrow Power Supply

-

SolarEdge Technologies

-

Enphase Energy

-

SMA Solar Technology

-

Fronius International

-

GoodWe Power Supply Technology

-

Ginlong Technologies (Solis)

-

Growatt New Energy Technology

-

TMEIC (Toshiba Mitsubishi-Electric)

-

Delta Electronics

-

ABB Ltd.

-

Mitsubishi Electric Corporation

-

Siemens AG

-

Power Electronics S.L.

-

SofarSolar

-

KACO New Energy GmbH

-

TBEA Co., Ltd.

-

Chint Power Systems (CPS)

-

SMA Solar Technology AG Power-one Inc-Company Financial Analysis

Solar Inverter Market Competitive Landscape:

SMA Solar Technology AG is a leading German company specializing in solar inverters and energy management solutions. Established in 1981, the company provides reliable and efficient inverter products for residential, commercial, and utility-scale solar installations worldwide. SMA focuses on technological innovation, offering solutions that enhance energy yield, integrate with smart grids, and support energy storage systems. With a strong global presence, robust R&D capabilities, and commitment to sustainability, SMA continues to play a pivotal role in advancing solar energy adoption and delivering high-performance, durable, and cost-effective inverter solutions.

-

In April 12, 2024, SMA Solar Technology AG, a global leader in photovoltaic inverters, announced a collaboration with sonnen, a German battery storage provider. This partnership aims to develop integrated solar and battery storage solutions for residential and commercial customers in Europe.

Huawei Technologies Co., Ltd. was established in 1987 and is a global leader in smart PV solutions and solar inverter technology. Headquartered in China, Huawei offers high-efficiency string inverters, hybrid inverters, and energy management systems for residential, commercial, and utility-scale solar projects. Known for its FusionSolar platform, the company emphasizes innovation, reliability, and intelligent energy solutions. With strong R&D capabilities and a worldwide presence, Huawei continues to drive solar energy adoption by delivering advanced, cost-effective, and scalable inverter solutions that optimize energy yield and integrate seamlessly with smart grids and storage systems.

-

In March 1, 2024, Huawei, a major player in the solar inverter market, announced it would be showcasing its latest FusionSolar inverters at the SNEC 2024 PV Power Expo. These inverters are designed for utility-scale solar power plants and offer features like high efficiency and intelligent grid management capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.25 Billion |

| Market Size by 2032 | USD 20.74 Billion |

| CAGR | CAGR of 4.8% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Central Inverter, Micro Inverter, String Inverter) • By System Type (On-Grid, Off-Grid) • By Phase (Single-Phase, Three-Phase) • By Application (Residential, Commercial, Utilities) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Huawei Technologies, Sungrow Power Supply, SolarEdge Technologies, Enphase Energy, SMA Solar Technology, Fronius International, GoodWe Power Supply Technology, Ginlong Technologies (Solis), Growatt New Energy Technology, TMEIC (Toshiba Mitsubishi-Electric), Delta Electronics, Schneider Electric SE, ABB Ltd., Mitsubishi Electric Corporation, Siemens AG, Power Electronics S.L., SofarSolar, KACO New Energy GmbH, TBEA Co., Ltd., Chint Power Systems (CPS) |