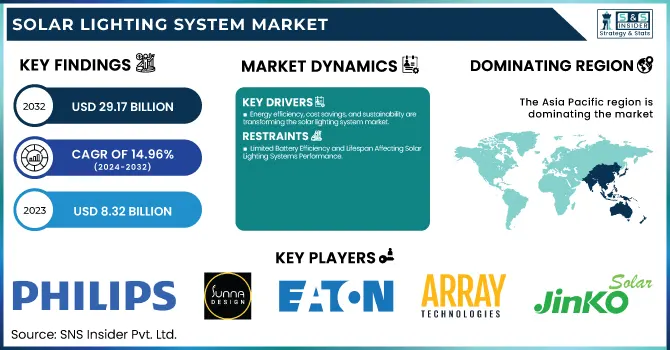

Solar Lighting System Market Size & Trends:

The Solar Lighting System Market was valued at USD 8.32 billion in 2023 and is projected to reach USD 29.17 billion by 2032, growing at a CAGR of 14.96% from 2024 to 2032. The demand for solar powered lighting systems is increasing at a high rate with advancements and integration of solar lighting in the smart cities and urban development, an integration where solar lighting system promotes efficient lighting solutions for street lighting and other sustainable infrastructure. As solar power technology continues to develop to allow for higher efficiency and longer-lasting storage systems, solar lighting becomes a more viable alternative to traditional lighting systems.

To Get more information on Solar Lighting System Market - Request Free Sample Report

The growing emphasis on energy efficiency, sustainability, and the reduction of carbon emissions also drives the demand for solar lighting systems. We continue to see growth from electrification and rural development in off-grid areas where cost effective solar lighting is a sustainable solution. In the U.S., the solar lighting system market was valued at USD 1.35 billion in 2023 and is expected to reach USD 1.89 billion by 2032, growing at a CAGR of 15.44%. This growth is fueled by technological innovations, government incentives, and a shift toward renewable energy solutions for off-grid, energy-efficient lighting systems.

Solar Lighting System Market Dynamics:

Drivers:

-

Energy efficiency, cost savings, and sustainability are transforming the solar lighting system market.

The solar lighting system market is driven by the significant potential for energy and operational cost savings. Solar panels, while requiring an initial investment, provide long-term benefits by generating "free" electricity, with typical savings of around $62,219 over 25 years. For example, a 10-kilowatt system costs about $28,241 in 2025, which drops to USD 19,873 after the federal solar tax credit. Additionally, solar energy systems can lower utility bills substantially, making them attractive to both residential and commercial sectors. The increasing affordability and efficiency of solar solutions, particularly when considering incentives like the federal tax credit, drive adoption. Furthermore, the shift towards energy-efficient LED lighting, which is widely used in solar lighting systems, reduces energy consumption and maintenance costs, with LEDs offering a much longer lifespan and less waste heat compared to traditional lighting solutions. This combination of cost savings, energy efficiency, and technological advancements fuels the growth of the solar lighting system market.

Restraints:

-

Limited Battery Efficiency and Lifespan Affecting Solar Lighting Systems Performance

While solar lights are eco-friendly and reduce energy costs, the batteries used to store solar power often have limited lifespans and can degrade over time, reducing their overall performance. This issue is particularly evident in extreme weather conditions and regions with inconsistent sunlight, where battery efficiency can significantly drop. Solar batteries require periodic maintenance and replacements, which adds to the long-term costs. Moreover, low-efficiency batteries can result in shorter lighting durations, leading to compromised performance, especially in areas requiring continuous lighting. These challenges highlight the need for advancements in battery technology to ensure more reliable and durable solar lighting solutions.

Opportunities:

-

Solar Lighting Systems as a Sustainable Solution for Rural Electrification and Socio-Economic Development

Solar lighting systems offer a sustainable and cost-effective solution for electrifying off-grid, rural, and remote areas where conventional electricity infrastructure is absent or unreliable. These regions are often too remote to connect to the electrical grid, either geographically or for the cost of installation. Solar-powered lighting, therefore, presents the perfect alternative, providing sustainable, renewable energy solutions that don’t depend on the local grid systems. Furthermore, these systems are easy to install, low maintenance, and lower energy costs over time. One trend is solar lighting, which increases safety and quality of life in remote communities by extending productive hours, improving security, and providing important services (lighting for schools, health centers and public spaces) that will promote socio-economic development.

Challenges:

-

Challenging Factors in Integrating Solar Lighting Systems with Grid Power for Seamless Energy Transfer

Connecting solar lighting systems with grid power where infrastructure exists for both energy sources can be technically and logistically complex. Advanced components, including inverters, charge controllers, and hybrid systems, are needed to maximize performance and facilitate energy transfer. Moreover, maintaining steady performance in the face of power variations and controlling backup energy systems introduces additional intricacies. Off-grid systems must be coupled with additional measures to ensure that the solar lighting system remains functional. This is costly and requires more maintenance, making the solar lighting solutions increasingly unaffordable and less flexible. This, in turn, makes the proper combination of solar lighting systems with the grid a vital focus mechanism for users and developers seeking to implement both solar energy and traditional energy solutions.

Solar Lighting System Market Segment Analysis:

By Light Source

The LED segment held the largest revenue share in the solar lighting system market, accounting for approximately 78% in 2023. This dominance is due to the many benefits of LED technology including high energy efficiency, long life and low maintenance. LEDs emit 95% light from the energy consumed and are the most energy-efficient lighting technology, which substantially decreases electrical utilization as well. As well as their durability — they will last up to 100,000 hours — which lowers the number of replacements, encouraging their adoption. However, LEDs will be the fastest-growing segment in the solar lighting system market in the forecast period from 2024 to 2032 due to the growing demand for sustainable and cost-effective lighting solutions. Despite this competition, LED lights are expected to gain an even larger share of the market in the next few years, due to continued improvements in terms of luminance as well as incorporation in smart systems.

By Grid Type

The off-grid segment dominated the solar lighting system market with a revenue share of approximately 65% in 2023. This is primarily due to the growing demand for sustainable and reliable lighting solutions in remote and rural areas without access to traditional grid power. Off-grid solar lighting systems provide a cost-effective and environmentally friendly alternative, offering lighting solutions in regions where infrastructure is limited or unavailable. These systems are crucial for rural electrification and are increasingly favored for their ease of installation, low operational costs, and minimal maintenance requirements. As the focus on renewable energy and energy access continues to rise, the off-grid solar lighting segment is expected to maintain its strong market position.

The hybrid segment of the solar lighting system market is expected to be the fastest-growing segment during the forecast period from 2024 to 2032. Hybrid systems integrate solar energy with traditional grid power, offering increased flexibility and reliability, particularly for regions with unreliable grid power. Renewable solar energy, with the auxiliary service of a constant supply of power through grid backup during cloudy days or high-demand periods, makes for an innovative, reliable way to power up their life. In urban and suburban areas, hybrid systems are gaining popularity as residents look for reliable, cost-effective and energy-efficient ways to light their homes. Their quick adoption and key growth driver for the solar lighting market is the ability to optimize energy usage and lowering dependence on grid power.

By Application

The commercial segment dominated the largest share of revenue in the solar lighting system market, accounting for around 50% in 2023. This dominance is driven by the increasing demand for energy-efficient lighting solutions in commercial spaces, including offices, retail establishments, and industrial areas. Solar lighting offers businesses significant cost savings on electricity bills while supporting sustainability goals. Additionally, the ability to reduce energy consumption and the lower maintenance requirements make solar lighting a preferred choice for commercial applications. As businesses focus more on green energy solutions, the commercial segment is expected to continue growing rapidly.

The highways and roadways segment is expected to be the fastest-growing segment in the solar lighting system market from 2024 to 2032. . This is mainly due to the growing need for energy-efficient and sustainable lighting solutions for street lighting in urban and rural regions. The systems harness the energy of the sun making them perfectly suited to high traffic highways and roadways by removing reliance on the electrical grid, reducing operational costs, and providing energy efficient lighting all at once even in remote locations. Moreover, enhancements in solar technology, including better battery storage and long-lasting LEDs are further enhancing the efficiency of solar streetlights in these regions. The highways and roadways segment is the most lucrative segment, with an increasing focus on eco-friendly infrastructure from governments and municipalities.

Solar Lighting System Market Regional Insights:

The Asia-Pacific region dominated the solar lighting system market with the largest share of around 43% in 2023. This dominance is attributed to rapid urbanization, growing infrastructure development, and increasing government initiatives promoting renewable energy solutions. Countries like China, India, and Japan are heavily investing in solar technologies to enhance energy efficiency and sustainability. The region's vast rural areas, which lack reliable grid access, are also driving the adoption of off-grid solar lighting systems. Moreover, the Asia-Pacific market benefits from advancements in solar energy, affordable manufacturing costs, and favorable policies supporting green energy initiatives, further solidifying its leading position in the market.

The North America region is expected to be the fastest-growing market for solar lighting systems during the forecast period from 2024 to 2032. A variety of factors including growing investments in renewable energy solutions, a surge in government incentives for sustainable infrastructure, and the increasing need for energy-efficient lighting solutions across residential and commercial sectors is driving this growth. The North American market for solar lighting systems is growing in urban and rural areas due to advancements in solar technologies and an increased focus on reducing carbon footprints. Also, this rapid growth is fuelled by increasing demand for off grid and hybrid solar lighting systems in remote regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Solar Lighting System Market along with their Product:

-

Philips (Netherlands) – Solar LED street lights, solar-powered outdoor lighting solutions.

-

Sunna Design Inc. (France) – Solar-powered streetlights and smart lighting solutions.

-

Solar Electric Power Company (USA) – Solar street lighting systems, solar energy solutions.

-

Solar Street Lights USA (USA) – Solar street lighting solutions for commercial and residential applications.

-

Shenzhen Jiawei Solar Lighting (China) – Solar street lights, solar garden lights, and solar lanterns.

-

Eaton Corporation (USA) – Solar-powered LED street lighting, energy-efficient lighting systems.

-

Greenshine New Energy (USA) – Solar street lighting, solar-powered outdoor lighting systems.

-

Yingli Solar (China) – Solar panels, solar lighting solutions for urban and rural areas.

-

Array Technologies (USA) – Solar tracking systems, solar energy products.

-

Sungrow Power Supply Co., Ltd. (China) – Solar lighting systems, photovoltaic inverters, solar energy solutions.

-

Para Light Electronic (China) – Solar street lighting components, LED lighting solutions.

List of players providing raw materials and components for the Solar Lighting System Market include:

-

Trina Solar Limited (China)

-

First Solar (USA)

-

LONGi Solar (China)

-

JinkoSolar (China)

-

GCL-Poly Energy Holdings (China)

Recent Development:

-

On November 18, 2024, Taiwan-based Para Light Electronic launched the PD-BJ200W compact solar LED streetlight with integrated PV panels and a 50 Ah battery, offering up to 15 hours of illumination for pedestrian walkways and roads.

-

On March 4, 2025, Array Technologies announced that it is on track to deliver 100% domestic content PV trackers in the first half of 2025, supported by the commissioning of its new solar tracker manufacturing facility in Albuquerque, New Mexico, which began construction in April 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.32 Billion |

| Market Size by 2032 | USD 29.17 Billion |

| CAGR | CAGR of 14.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Light Source (LED, Others) • By Grid Light Source (On-grid, Off-grid, Hybrid) • By Application (Highways & Roadways, Industrial, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips (Netherlands), Sunna Design Inc. (France), Solar Electric Power Company (USA), Solar Street Lights USA (USA), Shenzhen Jiawei Solar Lighting (China), Eaton Corporation (USA), Greenshine New Energy (USA), Yingli Solar (China), Array Technologies (USA), Sungrow Power Supply Co., Ltd. (China), Para Light Electronic (China). |