Clamshell Packaging Market Report Scope & Overview:

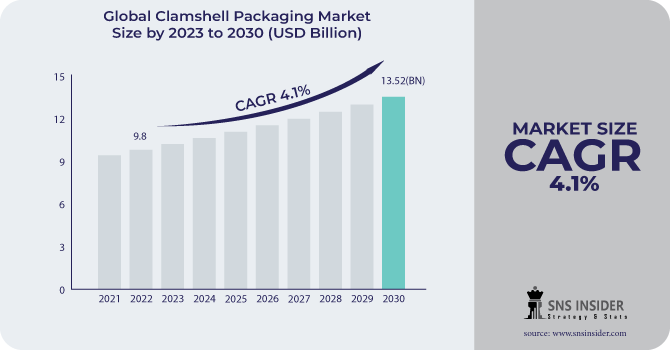

The Clamshell Packaging Market size was USD 10.21 billion in 2023 and is expected to Reach USD 14.32 billion by 2031 and grow at a CAGR of 4.3 % over the forecast period of 2024-2031.

The key factors expected to boost the growth of the global market over the forecast period are a strong increase in demand from the food industry around the world and an increasing trend among consumers and producers towards transparent clamshell packaging, which increases consumer interaction with the actual product. Moreover, market growth is expected to be significantly stimulated by the increasing demand for different types of convenience foods services as a result of changes in consumer attitudes and eating habits, especially among people living in cities.

To Get More Information on Clamshell Packaging Market - Request Sample Report

For example, nearly 55% of the world's population live in cities and this figure is expected to grow to 68% by 2050 according to a United Nations report. The population of the world's cities is growing fast, from 751 million in 1950 to 4.4 billion by 2021. India is projected to have about 416 million people living in cities by 2050; China around 255 million, and Nigeria 189 million.

MARKET DYNAMICS

KEY DRIVERS:

-

Transparent packaging has led to increased demand.

With a striking design, customers also want to be assured that the goods they purchase are in their promised condition without defects or irregularities. A growing demand for clamshell containers because they provide customers peace of mind and allow them to be clearly seen is a factor in this increase. Packaging designers may also be able to come up with strategically cut outs for displays of specified parts of the product, in order to improve their visibility when consumers buy a product such as food or clothing from retail outlets and clamshell packaging.

-

Increasing demand in the food sector.

RESTRAIN:

-

A strict set of rules for the use of plastic clamshells

The global market for clamshell packaging is hampered by strict regulatory rules imposed on governments around the world. The use of plastic materials, such as PE, PET, PVC, and others, which are considered to be harmful to the environment. The growth rate of the market will be slowed down by this major restriction on the market.

OPPORTUNITY:

-

Increasing activity in the e commerce sector and research

The growth of clamshell packaging has been driven by the rising demand for protecting products from external environment, which is expected to generate attractive opportunities over the coming years, as a result of an increasing e commerce sector and rapid development in research activities.

CHALLENGES:

-

Fluctuation in raw material prices

The key barriers to market growth over the forecast period are rising raw material prices and high production costs of shell packaging.

IMPACT OF RUSSIAN UKRAINE WAR:

The Russia Ukraine war has had a material impact on commodities, economic development and the environment. The Russian Ukraine war also has an impact on the world supply chain market. It reduced the transport of goods which had been carried out with great volume and this led to a rise in raw material prices. Russia is the main source of raw materials imported by Indian paper industry, but due to war delays have occurred in imports. The cost of raw materials jumped by about 40 % as a result of the war. The price of paper went up to around 70000 rupees per ton before the war started, and then increased to about 100000 Rupees per ton after it.

Energy prices have increased in response to Russia's invasion of Ukraine, especially in countries that import large quantities of natural gas from Russia. In particular, between 2022 and 2022, the costs of Doing Business in Germany went up by 60% year on year from 10 cents to 30 cents per kilowatt hour. Russia's invasion of Ukraine had negative consequences for the supply of packaging materials across Europe. As a result, the main timber suppliers are Ukraine and Russia, especially with their export turnover of more than EUR 12 billion. The volume of the world's pulp is 20% dominated by Russia. Russia supplies 40% of the natural gas and oil consumed in Europe. The result is a sharp increase in the price of petrol across Europe since the beginning of the conflict.

IMPACT OF ONGOING RECESSION:

In times of economic recession, companies tend to search for cost reduction strategies in order to survive. As companies negotiate reduced prices with their suppliers or seek alternatives to cheaper packaging solutions, price pressure on packaging materials such as flexible packaging can arise. The profitability of flexible packaging producers can therefore be affected.

During downturns, companies frequently look for ways of innovating and increasing their efficiency. This could increase the availability of more cost-effective packaging options, as well as provide a wider range of eco and sustainability material to the Flexible Packaging Market. New technologies and approaches may be explored by manufacturers, to reduce costs and maintain competitiveness.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Paper & Paperboard

By Product Type

-

2-Piece Clamshells

-

Tri-Fold Clamshells

-

Mock Clamshells

By Packaging Type

-

Trays

-

Box & Containers

-

Bowls

-

Others

Trays segment is expected to be dominant and was holding the market share of 62% in the year 2022. Clamshell trays offer various functional benefits such as shelf appeal, product protection which make it useful for various end use industries.

By End Use

-

Food

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Electrical & Electronics

-

Gifts, Toys & Stationery

-

Household Goods

-

Others

.png)

To Get Customized Report as per your Business Requirement - Request For Customized Report

Food & Electrical & Electronics segment is the dominating end use segment. This both segment hold the maximum market share.

REGIONAL ANALYSIS:

In 2022, North America is the largest market for clamshell packaging with a share of 33 % worldwide. The growing demand for clamshell packaging within the food, electronics and pharmaceutical sectors is leading to growth in this region. US is the dominating market in the region. Food industry in the region is the dominant one which is driving the market for the clamshell packaging market.

The Asia Pacific region, accounting for 28% of the global market in 2022, is the second largest market for clamshell packaging. The growth of this region is driven by the rising economies in China and India, which account for a significant percentage of shell pack consumption.

Europe, accounting for 21% of the global market in 2022, is the third largest market for clamshell packaging. The growing demand for clamshell containers in the food and pharmaceutical industries is a major growth factor of this region.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Clamshell Packaging market are Footprint US, Amcor Plc, Westrock Company, Sonoco Products Company, Novoflex Company, Placon Corporation Inc, Prime Packaging LLC, Dordan Manufacturing Company, VisiPak Inc, Smurfit Kappa Group plc and other players.

Westrock Company-Company Financial Analysis

RECENT DEVELOPMENT

-

Compostable clamshell packaging solutions were launched in the food sector by Footprint, an American Sustainable Technology Company.

-

With the launch of a new line of clamshell containers, Novoflex Company announced the expansion of its portfolio.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.21 Bn |

| Market Size by 2031 | US$ 14.32 Bn |

| CAGR | CAGR of 4.3 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Paper & Paperboard) • by Product Type (2-Piece Clamshells, Tri-Fold Clamshells, Mock Clamshells) • by Packaging Type (Trays, Box & Containers, Bowls, Others) • by End Use (Food, Cosmetics & Personal Care, Pharmaceuticals, Electrical & Electronics, Gifts, Toys & Stationery, Household Goods, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Footprint US, Amcor Plc, Westrock Company, Sonoco Products Company, Novoflex Company, Placon Corporation Inc, Prime Packaging LLC, Dordan Manufacturing Company, VisiPak Inc, Smurfit Kappa Group plc |

| Key Drivers | • Transparent packaging has led to increased demand. • Increasing demand in the food sector. |

| Key Opportunities | • Increasing activity in the e commerce sector and research |