Online Food Delivery Services Market Overview:

Get More Information on Online Food Delivery Services Market - Request Sample Report

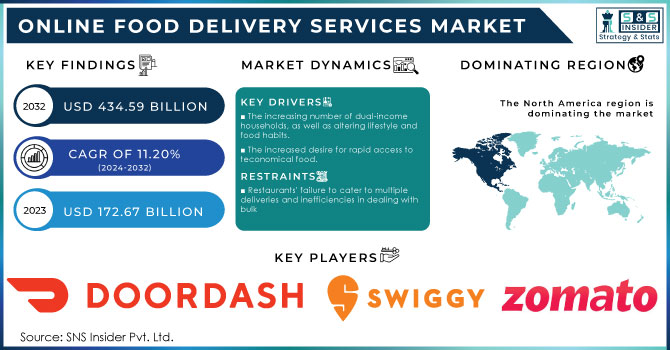

The Online Food Delivery Services Market Size was valued at USD 172.67 billion in 2023 and is expected to grow to USD 434.59 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 11.20% over the forecast period from 2024 to 2032

Online food delivery is the process of ordering and delivering meals to clients' homes who have made their orders through various food delivery websites and applications on their computers or smartphones. A consumer will search for a favorite restaurant, choose items from the menu, select a payment method, and complete the transaction. Customers may register and maintain accounts on food delivery apps to make future ordering easier. Online meal delivery is gaining popularity since it helps both customers and food service businesses. Online meal delivery is a service that allows users to order food via a website or application over a digital platform. These systems make ordering meals simple and convenient by building and managing user accounts.

The online food delivery services market consists mostly of sales of online meal delivery services and related services for domestic usage. The online food delivery services industry includes all firms that send packages obtained from hospitality establishments and have an online portal or application for their sales. Food might be ready-to-eat or must be cooked ahead of time for immediate consumption. The food business has changed drastically over the previous decade, especially since the advent of the online delivery model.

MARKET DYNAMICS

KEY DRIVERS

-

The increasing number of dual-income households, as well as altering lifestyle and food habits.

-

The increased desire for rapid access to economical food.

-

Online delivery businesses include enticing discounts, incentives and cashback programs, doorstep delivery, and a variety of payment choices.

RESTRAINTS

-

Restaurants' failure to cater to multiple deliveries and inefficiencies in dealing with bulk

-

When the volume of meal orders is excessive, the quality of the food supplied suffers.

OPPORTUNITY

-

Rising infrastructure investment in developing economies.

-

The rise of virtual restaurants and delivery-only kitchens is projected to open up new business opportunities.

IMPACT OF COVID-19

During the 2019 novel coronavirus (COVID-19) pandemic, which saw increased demand for home delivery during government-mandated stay-at-home times, online meal delivery usage skyrocketed. COVID-19's consequences may jeopardize decades of development progress. Companies restarting operations and adjusting to the "new normal" produced by the Coronavirus disease (COVID-19) epidemic are driving growth in food delivery. Previous rigorous containment measures and commercial activity closures caused operating issues for the majority of 2020.

MARKET ESTIMATION

The online meal delivery services industry is divided into two types: restaurant-to-consumer and platform-to-consumer. The platform-to-consumer category is expected to rise throughout the projection period. The platform-to-consumer approach handles the logistical and resource components of food delivery while also providing shipment services to restaurants without in-house delivery capabilities. In 2023, the restaurant-to-consumer type category held a significant market share. Restaurants handle the shipment component in this approach, while internet meal delivery service companies handle the ordering procedure. In order to penetrate the market, firms using this strategy offer consumers loyalty and subscription programs.

The market for online meal delivery services is divided into two channels: websites/desktop and mobile applications. The mobile apps category is expected to increase throughout the projected period. The segment's expansion may be attributable to rising smartphone adoption as well as technical developments like 3G and 4G networks. In 2023, the website/desktop category held a sizable market share. The rising number of restaurants attempting to enhance foot traffic by developing their online presence through websites can be contributed to the segment's rise.

The market for online meal delivery services is divided into two segments based on payment method: cash on delivery and online payment. Over the projected period, the online payment category is predicted to increase significantly. Payments made via payment portals, net banking, or credit/debit cards are examples of online payment services. In 2023, the cash-on-delivery sector held the biggest market share. The segment's expansion may be ascribed to the fact that many consumers choose to pay in cash since they are concerned about the security of their online payment transactions. Banks, on the other hand, are focused on improving security and providing extra services to customers, which is expected to help transform the situation in the future years.

KEY MARKET SEGMENTATION

On The Basis of Type

-

Restaurant-to-Consumer

-

Platform-to-Consumer

On The Basis of Channel Type

-

Websites/Desktop

-

Mobile Applications

On The Basis of Payment Method

-

Cash on Delivery

-

Online

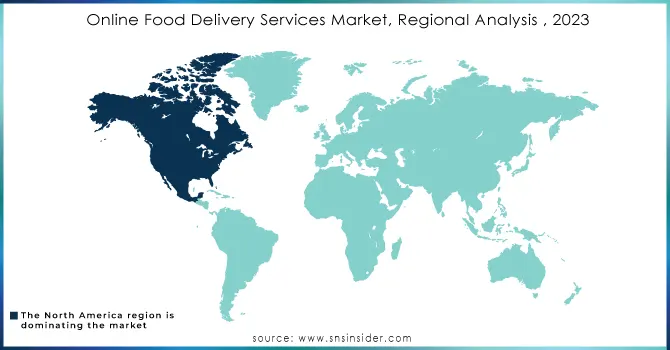

REGIONAL ANALYSIS

Because of high user penetration rates in the United States, the North American market has a large market share in the worldwide market. It is one of the world's major marketplaces for online meal delivery. It is now the world's largest online meal delivery market. Several reasons are now driving the online meal delivery sector in North America. Significant urban population, busy lifestyles, and rising internet and smartphone penetration are some of the primary variables driving the region's online meal delivery industry development. Furthermore, the United States' enormous young population, which accounts for the majority of the customer base, has aided this expansion. Various online food delivery service providers are experimenting with novel food delivery methods such as self-driving cars, drones, and robots, which is positively impacting the market growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The major key players are DoorDash, Just Eat Holding Limited, Swiggy, Takeaway.com, Uber Technologies Inc., Grubhub Holdings Inc., Delivery Hero SE, Deliveroo Plc, Zomato Limited, FoodPanda & Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 172.67 Billion |

| Market Size by 2032 | US$ 434.59 Billion |

| CAGR | CAGR 11.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Restaurant-to-Consumer and Platform-to-Consumer) • by Channel Type (Websites/Desktop and Mobile Applications) • by Payment Method (Cash on Delivery and Online) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DoorDash, Just Eat Holding Limited, Swiggy, Takeaway.com, Uber Technologies Inc., Grubhub Holdings Inc., Delivery Hero SE, Deliveroo Plc, Zomato Limited, FoodPanda |

| Key Drivers | •The increasing number of dual-income households, as well as altering lifestyle and food habits. •The increased desire for rapid access to economical food. |

| Market Restraints | •Restaurants' failure to cater to multiple deliveries and inefficiencies in dealing with bulk •When the volume of meal orders is excessive, the quality of the food supplied suffers. |