Specialty Food Ingredients Market Report Scope & Overview:

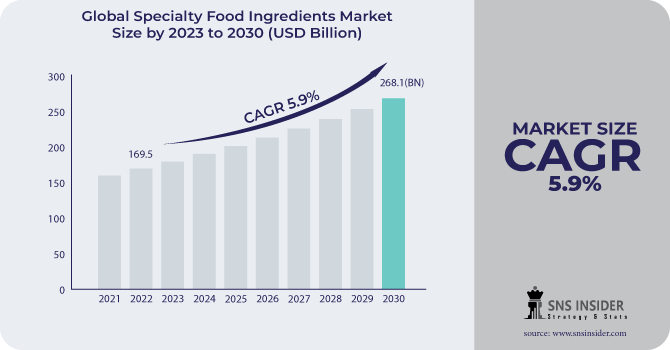

The Specialty Food Ingredients Market size was USD 169.5 billion in 2022 and is expected to Reach USD 268.1 billion by 2030 and grow at a CAGR of 5.9% over the forecast period of 2023-2030.

Specialty food ingredients are ingredients that have unique functional or technological properties that improve the quality, taste, nutrition, or other characteristics of food and beverages.

Based on application, the market is categorized into Food & Beverage, Pharmaceutical, Personal Care, and Other. The food and beverage segment led the market, accounting for 69.5% of total revenue in 2022. This is due to changing consumer lifestyles and eating tastes, which have contributed to the expansion of the processed food production sector, which is expected to drive demand for specialized food ingredients. Additionally, Specialty food ingredients are used in a wide variety of food and beverage applications to improve the taste, texture, nutritional value, and shelf life of products.

The pharmaceutical application sector is rapidly utilizing the importance of specialty food ingredients in the development of new products. Pharmaceutical applications for specialty food ingredients Increased bioavailability of drugs, Reduced side effects of drugs.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing awareness of the need for the safety of food

consumers prefer food and beverage items with healthy and natural components since they are very careful about the food they eat. It is possible to employ some specialized food additives to prevent the growth of bacteria and other germs. Others can be employed to increase food products' nutritional value, which can assist in strengthening the immune system and lower the chance of contracting a foodborne infection. As a result, the food and beverage industry has a tremendous demand for nutraceutical components. A wide variety of nutraceutical ingredients are available from numerous market vendors and can be employed in a variety of foods and beverages. As a result, the necessity for food safety is growing, which will support the market growth.

RESTRAIN

-

Limited shelf life and stability

Specialty food ingredients frequently have a shorter shelf life than conventional food components and are more fragile. This is due to the fact that they are frequently produced using natural components, which are more prone to spoiling. It may be challenging for food makers to market and deliver their goods due to the specialty food ingredients' short shelf lives. As customers might not be able to use an entire product before it expires, it might also result in food waste. Specialty food additives can also be challenging to stabilize. This is because they are frequently intricate compounds with unpredictable interactions. As a result, the look, flavor, texture, and nutritional content of food products may alter.

OPPORTUNITY

-

Growing Demand for Fortified Processed Food

Deficiency of Nutrients in consumers are more common issue that drives the need for Foods that have been fortified with key elements that have a higher nutritional value and can aid those who are nutrient deficient. Consumers are becoming more and more conscious of the value of having a balanced diet. As a result, there is a rise in demand for processed foods that have been fortified to meet dietary requirements. Manufacturers now have a market for fortified meals, which in turn is driving up demand for specialized functional ingredients including minerals, vitamins, omega-3, protein, and others. Customers are choosing foods and drinks with specific healthful ingredients more frequently.

CHALLENGES

-

High prices of Specialty Food Ingredients

The price and total cost of production of nutraceutical ingredients are influenced by variables including the supply and availability of the raw materials. Additionally, some plants and fruits that are used to make ingredients are only grown in specific areas; an example of this is the profusion of acai berries in Brazil. These berries must be purchased and transported at significant expense, which drives up the cost of the finished ingredients even more. During the projected period, such factors are anticipated to have a negative effect on the market under consideration.

IMPACT OF RUSSIA-UKRAINE WAR

The conflict between Russia and Ukraine has had a negative impact on the specialized food ingredients sector. Russia and Ukraine are significant exporters of wheat, sunflower oil, and other agricultural commodities. Because of the war, the global supply of these products has been affected, resulting in higher costs and shortages. The war, being a confrontation between two major agricultural powers, has a variety of severe socioeconomic consequences that are now being felt internationally and may increase, particularly for global food security. The food crisis will intensify if the war continues, offering a challenge to many countries, particularly those that rely on imports of food, such as those in the MENA region. Wheat prices have risen by more than 30% since the beginning of the conflict, and global wheat production is anticipated to fall by 4% in 2022.

IMPACT OF ONGOING RECESSION

The recession's impact is also likely to differ depending on the type of specialty food components used. Specialty food ingredients are frequently utilized to create functional foods that have been fortified with nutrients or other health-promoting components. The price and total cost of producing food ingredients are impacted by variables such as raw material supply and availability. Sunflower oil prices have risen by more than 50% since the beginning of the conflict, and global sunflower oil production is predicted to fall by 25% by 2022. The high cost of food ingredients has an indirect impact on the demand for specialty ingredients.

MARKET SEGMENTATION

by Product Type

-

Functional Food Ingredient

-

Sweeteners

-

Food Flavors and Enhancers

-

Acidulants

-

Preservatives

-

Emulsifiers

-

Colorants

-

Enzymes

-

Proteins

-

Specialty Fats and Oils

-

specialty Starches

-

others

by Nature

-

Organic

-

Conventional

by Application

-

Food & Beverage

-

Pharmaceutical

-

Personal Care

-

Other

.png)

REGIONAL ANALYSIS

Asia Pacific region dominated the specialty food ingredients market with a revenue share of 32.6% in 2022. China is now the largest market for emulsifiers in the Asia Pacific due to the rise in popularity of convenience foods, which has increased demand for emulsifiers in the food industry. The country's younger population is emphasizing food component transparency and seeking healthier, all-natural food products. In addition, the large population of the nation encourages the growth of the personal care, pharmaceutical, and food and beverage sectors, which are predicted to be important industry drivers in the nation.

Europe was the second-biggest regional market for specialized food ingredients in 2022. Europe has a long history of producing delicious foods, and when customer preferences shift, novel cuisines are frequently developed. Some of the biggest importers of specialty ingredients are nations in the area, including France, Italy, and Belgium. The production and demand for specialty food ingredients are increased by the presence of a respectable number of processing and confectionary businesses in Germany and the United Kingdom.

North America had a large market share in the forecast period. The growth is attributed to the rising prevalence of chronic and lifestyle health conditions across a major portion of the population, as well as the growing adoption of better lifestyles, which has spurred the region's desire for food products containing functional and specialty ingredients. The U.S. dominated the market due to the rising demand for items that are secure and made from plants.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Specialty Food Ingredients Market are Naturex, Wild Flavors GmbH, Givaudan, KF Specialty Ingredients, Associated British Foods Plc, Agropur Cooperative, Chr. Hansen, Archer Daniels Midland Company, Kerry Group, Tate & Lyle, Cargill Inc., Ingredion, DSM, Univar Solutions, and other key players.

Naturex-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Univar Solutions, the world's largest supplier of specialty ingredients and chemical solutions, announced that it has become a registered distributor for Camlin Fine Sciences aroma ingredients in the United States and Canada. Univar Solutions broadens its offering of food ingredients in North America.

In 2023, Celanese Corporation of the United States and Mitsui & Company, Ltd. of Japan signed an official agreement to launch Nutrinova, a food ingredients joint venture.

In 2022, Royal DSM has agreed to pay USD 453 million to acquire First Choice Ingredients, a renowned distributor of dairy-based savory flavorings. First Choice Ingredients creates clean-label, fermented dairy and dairy-based savory flavorings for taste and functionality in a variety of applications.

| Report Attributes | Details |

| Market Size in 2022 | US$ 169.5 Billion |

| Market Size by 2030 | US$ 268.1 Billion |

| CAGR | CAGR of 5.9 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Functional Food Ingredient, Sweeteners, Food Flavors and Enhancers, Acidulants, Preservatives, Emulsifiers, Colorants, Enzymes, Proteins, Specialty Fats and Oils, specialty Starches, and others) • By Nature (Organic, Conventional) • By Application (Food & Beverage, Pharmaceutical, Personal Care, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Naturex, Wild Flavors GmbH, Givaudan, KF Specialty Ingredients, Associated British Foods Plc, Agropur Cooperative, Chr. Hansen, Archer Daniels Midland Company, Kerry Group, Tate & Lyle, Cargill Inc., Ingredion, DSM, Univar Solutions |

| Key Drivers | • Increasing awareness of the need for the safety of food |

| Market Restrain | • Limited shelf life and stability |