Dialysis Market Report Scope & Overview:

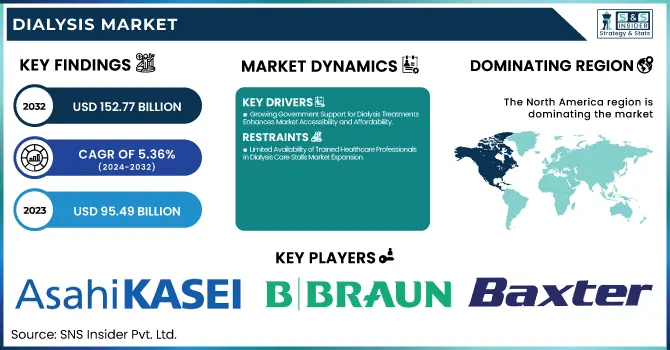

The Dialysis Market Size was valued at USD 95.49 Billion in 2023 and is expected to reach USD 152.77 Billion by 2032, growing at a CAGR of 5.36% over the forecast period of 2024-2032.

To Get more information on Dialysis Market - Request Free Sample Report

The Dialysis Market is undergoing a transformation driven by innovation, policy shifts, and emerging treatments. Dialysis costs fluctuate across regions, influenced by infrastructure and reimbursement models. Telemedicine is revolutionizing patient care, enabling remote monitoring and virtual consultations for improved accessibility. Evolving regulatory frameworks for dialysis equipment and services are fostering innovation while ensuring patient safety. Meanwhile, gene therapy and stem cell research are emerging as potential game-changers, reducing long-term dialysis dependency. Government and non-governmental funding for dialysis research is accelerating advancements, driving cost efficiency and better outcomes. Our report provides an in-depth analysis of these crucial factors, offering valuable insights into market trends, challenges, and opportunities shaping the future of dialysis care worldwide.

The US Dialysis Market Size was valued at USD 4.42 Billion in 2023 and is expected to reach USD 7.07 Billion by 2032, growing at a CAGR of 5.35% over the forecast period of 2024-2032. The United States dialysis market is experiencing significant growth due to an aging population, increasing prevalence of chronic kidney disease, and advancements in dialysis technologies. According to the National Kidney Foundation, around 37 million Americans are affected by chronic kidney disease, driving demand for dialysis treatments. The rise of home dialysis options, such as those offered by companies like Fresenius Medical Care and DaVita Inc., has contributed to greater patient accessibility and convenience. Additionally, government initiatives like Medicare coverage for dialysis treatments have expanded access, fueling market expansion. Enhanced treatment options and technological innovations continue to drive growth in the sector.

Market Dynamics

Drivers

-

Growing Government Support for Dialysis Treatments Enhances Market Accessibility and Affordability

The U.S. government’s extensive support for dialysis treatments, primarily through Medicare, has been instrumental in making dialysis more accessible and affordable for a large segment of the population. Medicare covers dialysis treatment for individuals with end-stage renal disease (ESRD), a condition that requires life-sustaining dialysis or kidney transplantation. This government backing ensures that a substantial portion of the U.S. population can access essential care without facing financial strain. Additionally, the Centers for Medicare & Medicaid Services (CMS) continuously works on improving the quality of dialysis care through value-based care initiatives and payment reforms. As the U.S. population continues to age, the demand for dialysis services is expected to rise, and government policies are adapting to accommodate this increase by encouraging more efficient, cost-effective, and patient-centered care models. Government-funded programs also support research and innovation in the dialysis field, helping to improve treatments and outcomes. This strong government presence enhances the market's growth prospects, making dialysis care more universally accessible and sustainable for patients across the U.S.

Restraints

-

Limited Availability of Trained Healthcare Professionals in Dialysis Care Stalls Market Expansion

One of the primary restraining factors faced by the U.S. dialysis market is the shortage of trained healthcare professionals, including nephrologists, dialysis nurses, and technicians. As the prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) increases, the demand for skilled professionals to administer dialysis treatments is rapidly outpacing supply. In rural and underserved areas, this shortage is particularly severe, leading to longer wait times for patients and, in some cases, inadequate care. Dialysis treatments require specialized training, and the limited number of professionals entering this field is making it difficult to meet the growing demand for dialysis services. Furthermore, dialysis centers are facing challenges in recruiting and retaining qualified staff, as the training and certification process can be time-consuming and costly. This shortage of skilled professionals hampers the expansion of dialysis services, affecting patient access and care quality. The solution to this challenge lies in the development of more robust training programs, increased incentives for healthcare workers in the dialysis field, and the adoption of technology to improve treatment delivery.

Opportunities

-

Emergence of Home Dialysis Solutions Opens New Market Growth Avenues for Dialysis Providers

One of the most promising opportunities in the U.S. dialysis market is the growing adoption of home dialysis solutions. Advancements in dialysis technology have made home dialysis treatments more feasible and accessible to patients, reducing the need for in-center visits. Companies such as Fresenius Medical Care and NxStage Medical Inc. are leading the way in developing compact, user-friendly machines that allow patients to administer dialysis treatments in the comfort of their own homes. Home dialysis provides patients with greater flexibility, control over their treatment schedules, and an improved quality of life. For healthcare providers, home dialysis presents an opportunity to reach a broader patient base, particularly those who live in remote areas or have limited access to healthcare facilities. Additionally, home dialysis offers cost-saving benefits by reducing hospital visits and related healthcare expenditures. As patient awareness of home dialysis options increases, and technology becomes more refined, the home dialysis market is expected to experience significant growth, offering opportunities for both providers and patients to benefit from this convenient and efficient solution.

Challenge

-

Data Security Concerns Around Digital Health Solutions in Dialysis Care Pose Risks to Patient Trust

The increasing use of digital health solutions, including telemedicine and remote monitoring, in dialysis care presents both opportunities and challenges. As more dialysis patients rely on digital platforms for treatment management and monitoring, the risk of data breaches and cyberattacks becomes a significant concern. The collection, storage, and transmission of sensitive patient data via digital platforms raise questions about data privacy and security. Inadequate data protection measures can erode patient trust, leading to reluctance in adopting digital health solutions. Healthcare providers and dialysis companies must ensure that robust cybersecurity measures are in place to protect patient information and maintain trust in these digital systems. Failure to safeguard data could lead to regulatory scrutiny, financial penalties, and reputational damage, ultimately limiting the adoption of digital solutions in dialysis care. Therefore, addressing data security risks is essential for ensuring the successful integration of digital health technologies into the dialysis market.

Segmental Analysis

By Dialysis Type

In 2023, hemodialysis dominated the Dialysis Market with a market share of 72.4%. This segment's dominance can be attributed to its established presence in the healthcare system and widespread acceptance among healthcare providers and patients. Hemodialysis involves filtering the blood through a machine and is commonly performed in specialized clinics or dialysis centers, making it the preferred choice for many patients requiring regular treatments. According to the United States Renal Data System, the majority of dialysis patients in the U.S. receive hemodialysis, with a robust infrastructure of facilities offering these services. Additionally, government programs like Medicare provide comprehensive coverage for hemodialysis treatments, further incentivizing its use. The high prevalence of end-stage renal disease, coupled with advancements in hemodialysis technology, such as improved dialysis machines and monitoring systems, has also contributed to its market leadership.

By Product and Services

In 2023, the consumables segment dominated the Dialysis Market with a market share of 42.5%. This segment is primarily driven by the high demand for essential products such as dialyzers, catheters, and concentrates used in dialysis procedures. As dialysis treatments require a range of consumables for effective and safe patient management, this segment remains critical to the overall market. For instance, according to the National Kidney Foundation, a significant portion of the treatment process relies on consumables, which are essential for both hemodialysis and peritoneal dialysis. Additionally, the continuous advancements in consumable products, such as improved dialyzer designs and materials that enhance biocompatibility, contribute to their sustained demand. Government initiatives aimed at improving patient care and outcomes in renal disease management further highlight the importance of consumables in maintaining effective dialysis treatments.

By End Use

In 2023, the in-center dialysis segment dominated the Dialysis Market with a market share of 80.6%. This dominance is largely due to the traditional model of care for patients with end-stage renal disease, where hemodialysis is performed at specialized clinics or hospitals under professional supervision. The infrastructure of dialysis centers across the United States is well-established, and they provide essential medical support, including trained staff and emergency care, ensuring patient safety during treatments. According to the Centers for Medicare & Medicaid Services, in-center dialysis remains the most common treatment modality for patients, especially those who are new to dialysis. The extensive resources available in these centers, including access to advanced dialysis machines and immediate medical attention, further reinforce their popularity among patients and healthcare providers alike. Although home dialysis options are growing, the reliability and support of in-center services make them the dominant choice for many patients.

Regional Analysis

In 2023, North America dominated the Dialysis Market with an estimated market share of 41.7%. This dominance is primarily attributed to the high prevalence of chronic kidney disease and end-stage renal disease, with the United States having approximately 37 million adults affected, according to the Centers for Disease Control and Prevention. The robust healthcare infrastructure in the region supports advanced dialysis services, including a large number of dialysis centers equipped with state-of-the-art technology. The U.S. government plays a significant role through Medicare coverage, which provides comprehensive support for dialysis treatments, ensuring accessibility for patients. Additionally, leading companies such as Fresenius Medical Care and DaVita Inc. are based in North America, driving innovation and providing quality care. Within the region, the United States is the largest market, significantly contributing to the overall growth, followed by Canada, which is also expanding its dialysis services. The emphasis on patient-centric care and technological advancements, such as home dialysis solutions, further solidifies North America’s leading position in the dialysis market.

On the other hand, the Asia Pacific region emerged as the fastest-growing segment in the Dialysis Market, with a significant CAGR during the forecast period. This rapid growth can be attributed to the rising prevalence of chronic kidney diseases, primarily due to increasing diabetes and hypertension rates in countries like China and India. According to the World Health Organization, kidney disease rates in Asia are climbing, necessitating improved dialysis services and infrastructure. The growing middle class in these countries is also driving demand for better healthcare facilities and technologies, including dialysis treatments. Countries like China are investing heavily in healthcare infrastructure, with initiatives to expand access to dialysis services across rural areas, significantly boosting market growth. Furthermore, India is witnessing a surge in private dialysis centers, enhancing accessibility and availability. The increasing awareness of kidney health and the need for regular check-ups among the population further fuel demand for dialysis services. As a result, the Asia Pacific region is emerging as a vital market for dialysis providers, showcasing substantial opportunities for growth and expansion in the coming years.

Need any customization research on Dialysis Market - Enquiry Now

Key Players

-

Asahi Kasei Medical Co., Ltd. (APS dialyzers, Hemofeel dialyzers, Cureflow blood tubing sets)

-

B. Braun Melsungen AG (Diacap dialyzers, Dialog+ hemodialysis machine, Hemodialysis Blood Tubing System)

-

Baxter International Inc. (AK 98 hemodialysis machine, Theranova dialyzers, HomeChoice peritoneal dialysis system)

-

Becton, Dickinson and Company (Angiocath dialysis catheters, PowerFlow tunneled dialysis catheter, BD PeritX peritoneal catheter system)

-

Cantel Medical Corporation (Medivators hemodialysis water system, EndoPure dialyzer reprocessing system, Renatron dialyzer reprocessing system)

-

Fresenius Medical Care AG & Co. KGaA (4008S hemodialysis machine, FX CorDiax dialyzers, NxStage System One home hemodialysis machine)

-

Guangdong Biolight Meditech Co., Ltd. (BL-1000 hemodialysis machine, BL-2000 portable dialysis machine, Dialysis Blood Tubing Set)

-

JMS Co. Ltd. (Sureflux dialyzers, HDF hemodiafilters, JMS blood tubing sets)

-

Kawasumi Laboratories, Inc. (Bloodline tubing sets, Arterial venous fistula needles, Dialysis catheters)

-

Medtronic Plc (Mahurkar chronic dialysis catheter, Palindrome hemodialysis catheter, Argyle peritoneal dialysis catheter)

-

Nikkiso Co., Ltd. (DBB-EXA hemodialysis machine, DBB-27 dialysis machine, Blood Tubing System)

-

Nipro Corporation (Elisio dialyzers, Surdial-X hemodialysis machine, Nipro blood tubing sets)

-

NxStage Medical, Inc. (part of Fresenius Medical Care) (System One home hemodialysis machine, PureFlow SL dialysate preparation system, NxStage Cartridge Express)

-

SWS Hemodialysis Care Co., Ltd. (Hemo-Master dialyzers, SWS blood tubing sets, SWS dialysate concentrates)

-

Shenzhen Landwind Industry Co., Ltd. (LD-10 hemodialysis machine, Blood Tubing System, Dialysis Catheters)

-

Shandong Weigao Group Medical Polymer Co., Ltd. (Weigao dialyzers, Bloodline systems, Hemodialysis concentrate solutions)

-

Toray Industries Inc. (Toralpha dialyzers, Toraylight dialyzers, TR series hemodialysis machine)

-

Medica S.p.A. (Polyflux dialyzers, D150 hemodiafilter, Medisulfone dialyzers)

-

Ningbo Tianyi Medical Devices Co., Ltd. (Tianyi blood tubing sets, Dialysis catheters, Hemodialysis dialyzers)

-

Allmed Medical Products Co., Ltd. (Allmed dialyzers, Blood tubing sets, Hemodialysis catheters)

Recent Developments

-

March 2025: The Assam government established 32 new dialysis centers to improve kidney disease treatment accessibility and address the rising prevalence of kidney ailments. Opposition parties also urged the government to enact legislation regulating tobacco use in the state.

-

September 2023: A research team from Vanderbilt University developed a new paradigm for dialysis membranes, aiming to enhance the efficiency of kidney dialysis treatments. This breakthrough sought to improve patient outcomes and advance dialysis therapy technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 95.49 Billion |

| Market Size by 2032 | USD 152.77 Billion |

| CAGR | CAGR of 5.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Dialysis Type (Hemodialysis, Peritoneal Dialysis) •By Product and Services (Equipment [Dialysis machines, Water treatment systems, Others], Consumables [Dialyzers, Catheters, Access products, Concentrates, Others], Services) •By End Use (In-center Dialysis, Home Dialysis) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., DaVita Inc., B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical Co., Ltd., Nikkiso Co., Ltd., Medtronic Plc, Toray Industries Inc., Diaverum and other key players |