Hospital Furniture Market Report Scope & Overview:

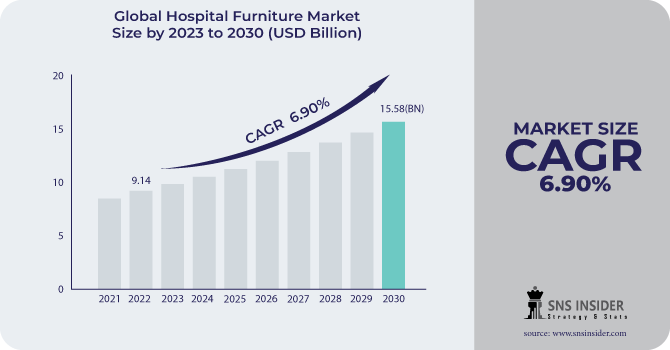

The Hospital Furniture market size was USD 9.06 billion in 2023 and is expected to reach USD 16.34 billion by 2032 and grow at a CAGR of 6.83% over the forecast period of 2024-2032. This report provides in-depth statistical insights and trends in the Hospital Furniture Market, covering key aspects beyond market size and CAGR. It includes production and utilization rates, highlighting manufacturing trends and hospital adoption levels. Trade statistics showcase import-export patterns, while regulatory impact analysis evaluates compliance rates with industry standards. The study also explores technological adoption, emphasizing the rise of smart and IoT-integrated furniture. Additionally, sustainability metrics analyze the use of eco-friendly materials in hospital furniture production. Price trends and cost analysis provide a comparative view of pricing fluctuations, while healthcare infrastructure investments highlight government and private sector funding in this space. These insights offer a comprehensive market overview, aiding stakeholders in strategic decision-making.

To Get More Information on Hospital Furniture Market - Request Sample Report

The United States dominated the Hospital Furniture Market, holding a 74% market share, valued at USD 2.68 billion, due to its advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key manufacturers. The U.S. boasts well-established hospitals, clinics, and specialty healthcare centers, driving consistent demand for high-quality hospital furniture. Additionally, government initiatives and investments in modernizing healthcare facilities further fuel market growth. The rising prevalence of chronic diseases and an aging population also accelerates the demand for patient-centric furniture such as adjustable beds, ergonomic chairs, and mobile ty aids. Furthermore, the presence of major players, including Stryker Corporation and Hill-Rom Holdings, Inc., strengthens market dominance through continuous innovation and product advancements.

Market Dynamics

Drivers

-

Rising investments in healthcare infrastructure and hospital expansion drive the growth of the hospital furniture market.

The hospital furniture market is witnessing significant growth due to increasing investments in healthcare infrastructure and the expansion of hospitals and healthcare facilities worldwide. Governments and private healthcare organizations are allocating substantial budgets to enhance medical facilities, particularly in developing regions. According to the World Health Organization (WHO), global healthcare infrastructure investments have surged, with major economies such as the United States, China, and India focusing on hospital upgrades and new construction projects. The rise in medical tourism and demand for specialized healthcare services has also fueled the need for advanced hospital furniture, including patient beds, operating tables, and examination chairs. Additionally, technological advancements in smart and ergonomic hospital furniture are improving patient comfort and healthcare efficiency, further boosting market growth.

Restrain

-

High costs of advanced and ergonomic hospital furniture limit market growth in developing regions.

The high cost of specialized and technologically advanced hospital furniture remains a major restraint in market expansion, especially in developing and underdeveloped regions. Hospitals in these areas often struggle with budget constraints, limiting their ability to invest in high-quality, durable medical furniture. According to industry reports, premium hospital beds with electronic adjustments and pressure-relieving mattresses can cost several thousand dollars per unit, making them unaffordable for smaller hospitals and clinics. Additionally, import duties and transportation costs further inflate prices, restricting access to essential hospital furniture. Many healthcare facilities in low-income nations rely on refurbished or locally manufactured alternatives, which may not meet international quality standards. This cost barrier slows market penetration and affects the adoption of modern, patient-centric hospital furniture solutions in price-sensitive markets.

Opportunity

-

The growing demand for smart and IoT-enabled hospital furniture presents significant growth opportunities.

The emergence of smart and IoT-enabled hospital furniture is creating new opportunities for manufacturers, driven by the growing focus on hospital automation and patient-centric care. Innovations such as sensor-based hospital beds, remote-controlled adjustable chairs, and AI-powered mobility aids are transforming patient care and hospital management. According to market studies, healthcare providers are increasingly adopting IoT-integrated hospital furniture to enhance patient monitoring and reduce manual intervention by medical staff. These advanced solutions help in real-time tracking of patient vitals, automated adjustments for comfort, and integration with hospital information systems. Additionally, the rise of smart hospitals and digital healthcare trends in countries like Germany, Japan, and the United States is accelerating the adoption of intelligent hospital furniture, making it a lucrative segment for manufacturers to explore.

Challenge

-

Supply chain disruptions and raw material shortages pose a major challenge to the hospital furniture market.

The hospital furniture industry is facing significant challenges due to global supply chain disruptions and raw material shortages, leading to delays in production and higher costs. The fluctuating costs of raw materials, including steel, aluminum, and high-performance polymers, have impacted manufacturing processes, forcing companies to adjust pricing or seek alternative supply sources. Additionally, strict regulatory compliance regarding material quality and safety standards further complicates procurement strategies. With rising freight charges and geopolitical tensions affecting trade routes, hospital furniture manufacturers must adopt local sourcing strategies and diversify supply chains to mitigate the impact of future disruptions in the industry.

Segmentation Analysis

By Product

Bed dominates the market in 2023 with a 30.00% hospital furniture market revenue share due to the increasing number of patient admissions and chronic disease prevalence. Pioneering companies like Stryker Corporation and Hill-Rom Holdings, Inc. have introduced IoT-based patient monitoring systems in the form of life adjustable and smart hospital beds. Example: ProCuity Bed Series from Stryker also uses wireless connectivity to improve patient safety. Segmented revenue on the back of rising demand for intensive care and specialty beds in hospitals has propelled technological innovations.

By Sales Channel

Offline sales channels held the largest market share at around 68% in 2023. Hospital furniture is primarily sold through offline sales channels, owing to the preference of hospitals & healthcare facilities for direct purchase through authorized distributors owing to the need for regulatory compliance and quality approvals. For instance, distribution networks and direct sales partnerships are emphasized by companies such as Invacare Corporation and Getinge Group. Through its acquisition of Voalte, a communication firm focused on healthcare sales, Hill-Rom Holdings has made its offline strategies even stronger. The requirement for verification of product usage and bulk buying further helps offline sales channels to stay dominant.

By Application

The patient application segment accounts for the highest market share of 48% during the forecast period due to an increase in hospitalization rates and the need for patient-centric furniture. The demand for these comforts has resulted in the development of the innovative patient bed, patient blood pressure, and mobility aid with companies involved such as LINET Group and Arjo. Equipped with smart sensors to facilitate monitoring of critically ill patients, the Multicare X ICU Bed by LINET brings enhanced comfort to patients and healthcare streamlining to caregivers. Segment growth is supported by increasing investments in healthcare infrastructures and advanced patient care solutions, asserting its market share.

By End-User

The segment of hospitals and clinics comprised 54% market share in the period of forecast and continue to be the dominant end-user in the market of hospital furniture, due to increasing investment in healthcare infrastructure and expansion of medical facilities. Hence, companies such as Medline Industries and Steris Corporation have developed customized hospital furniture solutions to increase the efficiency of deliveries and the patient care process. The introduction of ergonomic hospital stretchers and modular operating tables by Medline is gaining momentum among big healthcare providers. This segment is expected to hold a majority share in the global healthcare market, owing to the ongoing upgradation of hospital infrastructure and the rising number of patients.

.png)

Do You Need any Customization Research on Hospital Furniture Market - Enquire Now

Regional Analysis

The North America hospital furniture market was led by the region owing to a huge healthcare infrastructure, increasing hospital admissions, and growing investments in medical facilities. Further, the growing innovations of ergonomic and smart hospital furniture solutions/products among key manufacturers such as Stryker Corporation, Hill-Rom Holdings, and Invacare Corporation are expected to create a positive impact on the revenue of the smart hospital furniture global market in the upcoming year. Rising product demand due to the growth of the geriatric population and increasing disease burden of chronic conditions is expected to further propel the demand for hospital beds, stretchers, and examination tables. This, along with the expansion of Medicare and Medicaid services in the U.S., can be attributed to government initiatives that further drive market growth. In addition, North America is projected to continue their leading position in the forecast period as these countries are investing heavily in modernizing hospital infrastructure in Canada and Mexico.

Asia Pacific held the significant market share. It is due to the rapid expansion of healthcare infrastructure, increasing medical tourism, and rising healthcare investments. Increasing population and government for care facilities are expected to promote the demand for hospitals in developing economics such as China, India, and Japan rendering a positive impact on overall industry growth. Some of the major growth drivers, such as the surge in the implementation of the Ayushman Bharat scheme in India, along with the ‘Healthy China 2030’ plan in China, are aiding the hospital modernization, thereby increasing the demand for advanced hospital beds, stretchers, and operating room furniture. In addition, the regional medical tourism market, with Thailand, Singapore, and South Korea as the preferred medical tourism centers, is increasing the demand for hospital furniture. This is further bolstered by a rise in industry presence through strategic expansion, with major players such as Paramount Bed Holdings, Godrej Interio, and LINET Group, increasing their presence in the region. It has one of the largest markets in the world owing to rapid economic development along with rising healthcare budget in the region.

Key Players

-

Stryker (Secure II Med-Surg Bed, Prime Series Stretcher)

-

Invacare Corp. (Carroll CS7 Bed, Etude HC Bed)

-

ARJO AB (Enterprise 9000X Bed, Sara Stedy Patient Transfer Aid)

-

Steris Plc. (Hausted Horizon Stretcher, AMSCO 3085 SP Surgical Table)

-

Medline Industries, Inc. (Medlite Full-Electric Bed, Excel K4 Wheelchair)

-

Hill-Rom Holdings, Inc. (Centuris Pro Bed, Progressa ICU Bed)

-

Drive DeVilbiss Healthcare (PrimeCare Adjustable Bed, Delta Ultra-Light 1000)

-

GF Health Products, Inc. (Patriot LX Bed, Everest & Jennings Transport Chair)

-

NAUSICAA Medical (Comfort Plus Recliner, ErgoMed Patient Bed)

-

Sunrise Medical (US) LLC (Quickie Q500 M Wheelchair, Breezy Elegance Recliner)

-

Herman Miller Furniture (Aeron Medical Chair, Compass System Bed)

-

Kovonox (ICU Electric Bed, Emergency Stretcher Trolley)

-

Getinge AB (Maquet Meera Surgical Table, Torin Anesthesia Trolley)

-

LINET Group (Eleganza 5 Bed, Multicare ICU Bed)

-

Paramount Bed Holdings (SYNCA Bed, Active Sleep Bed)

-

Gendron Inc. (BariMaxx II Bed, Advantage Recliner)

-

Malvestio Group (Sprint Stretcher, Euroclini Hospital Bed)

-

Midmark Corporation (Ritter 204 Examination Table, 630 Humanform Chair)

-

Joerns Healthcare (UltraCare XT Bed, Hoyer Presence Lift)

-

Savion Industries (ICU Critical Care Bed, Movi Transport Stretcher)

Recent Development:

-

In February 2023, Stryker unveiled the Smart Medic platform at the 29th Annual Conference of the Indian Society of Critical Care Medicine. This innovative platform enhances ICU bed capabilities by tracking patient weight, monitoring nurse station movements, and enabling in-bed X-rays, ultimately reducing patient discomfort and improving care across various acuity levels.

-

In January 2023, Hill-Rom Holdings, Inc. introduced the Navigo bariatric bed system, designed with wider surfaces, increased weight capacity, and improved exit assistance to enhance patient comfort and safety.

-

In June 2023, Baxter International Inc. introduced the Progressa+ ICU bed in the U.S., equipped with advanced technologies for pulmonary support, skin protection, and early mobility, aimed at reducing the workload of critical care teams and addressing key ICU challenges.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD9.06Billion |

| Market Size by 2032 | USD 16.34 Billion |

| CAGR | CAGR of6.83 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Beds, Tables, Seating Furniture, Trolley and Stretchers, Cabinet and Lockers, Others), • By Sales Channel (Offline, Online) • By Application (Physician, Patient, Staff) • By End-User (Homecare, Hospital and Clinic, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stryker, Invacare Corp., ARJO AB, Steris Plc., Medline Industries, Inc., Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, GF Health Products, Inc., NAUSICAA Medical, Sunrise Medical (US) LLC, Herman Miller Furniture, Kovonox, Getinge AB, LINET Group, Paramount Bed Holdings, Gendron Inc., Malvestio Group, Midmark Corporation, Joerns Healthcare, Savion Industries |