Sports & Energy Drinks Market Report Scope & Overview:

Get More Information on Sports & Energy Drinks Market - Request Sample Report

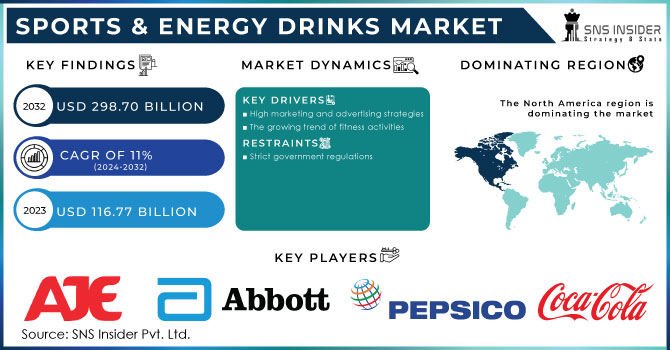

The Sports & Energy Drinks Market size was valued at USD 116.77 billion in 2023 and is expected to reach USD 298.70 billion by 2032 and grow at a CAGR of 11% over the forecast period of 2024-2032.

Sports and energy drinks can replenish glucose, fluids, and electrolytes such as sodium, potassium, magnesium, and calcium which are lost during hard exercise, as well as increase endurance.

Professional and amateur athletes utilize sports and energy drinks to increase their performance and recovery. Sports beverages contain carbohydrates, electrolytes, and fluids that assist athletes stay hydrated and energized while exercising. Casual Sports Drink Users take sports drinks on occasion, such as when they are weary or agitated. Casual sports drink users are not often aiming for the same level of performance benefits as sportspersons/athletes or recreational users. People who drink sports drinks as part of their entire health and wellness practice are classified as Lifestyle Users. Sports drinks may be used by lifestyle users to help them stay hydrated, raise their energy levels, or improve their overall mood.

MARKET DYNAMICS

KEY DRIVERS

-

High marketing and advertising strategies

-

The growing trend of fitness activities

Due to the rise of problems like high blood pressure, obesity, and many others, consumers have grown more active and participate in sports and athletic activities. Earlier, Sports and energy drinks used to be reserved for athletes and other sports professionals. But now, Consumers are looking for quick and practical dietary solutions. The demand for sports drinks and cans is increasing as a result of rising disposable income and an increase in the working population. Sports drink producers are being encouraged to develop new products that cater to changing consumer preferences by the shift in market patterns. The younger generation is particularly involved in sports and fitness.

RESTRAIN

-

Strict government regulations

Strict regulations on sports and energy drinks restrict sales of drinks to children below the age of 16. The Canadian government regulates these drinks under the Food and Drug Act. The act sets limits on the caffeine content of these drinks. The U.S. Food and Drug Administration (FDA) regulates sports and energy drinks under the Dietary Supplement Health and Education Act. The act does not require sports and energy drinks to be approved by the FDA before they are marketed, but it does require manufacturers to provide the FDA with knowledge about the ingredients of their products. The European Union regulates clear and accurate information about the ingredients and nutritional content of its products.

OPPORTUNITY

-

A growing number of fitness centers

-

Raising participation in sports and athletic events

The sports and energy drinks industry is constantly innovating and introducing new and innovative products. This is helping to keep the market growing by providing consumers with more choices and options. There is also rising participation in sports and athletic events, such as marathons, triathlons, and cycling races. This has further increased the demand for sports and energy drinks to help athletes perform better and recover faster.

CHALLENGES

-

Increase counterfeit drinks in the market

-

High cost of Sports & Energy Drinks

High costs can contribute to a decrease in demand for sports and energy drinks, as customers may opt for cheaper alternatives or avoid them entirely. This is especially true for low-income or budget-conscious consumers. High prices may also cause consumers' tastes to shift away from sports and energy drinks. Water, juice, or coffee are examples of beverages that consumers may convert to because they believe they are more inexpensive or healthier.

IMPACT OF RUSSIAN UKRAINE WAR

The Ukraine-Russia conflict has had an impact on the food and beverage industry. Ukraine is widely regarded as Europe's breadbasket, and the crisis there was expected to have a substantial impact on sports and energy drinks. The battle has disrupted the supply chain of materials required by manufacturers. As a result, the epidemic has raised demand for and sales of energy drinks. Despite the war in 2022, energy drink sales increased by over 15%.

IMPACT OF ONGOING RECESSION

Recession has declined the sales of sports and energy drinks. Energy drinks are deeply embedded in people's daily lives, which may explain why they are so resilient in a country where categories such as beer and carbonates have been steadily dropping. However, the high cost of drinks may lead to a shift in consumer preferences toward other beverages. Energy drinks sold $6 billion in the Natural Enriched and Conventional outlets in the 52 weeks ending July 16, 2023 (a 14.1% increase from 2022). The price rise of energy drinks has lessened demand; hence, production capacity may be delayed.

KEY MARKET SEGMENTS

By Type

-

Sports Drinks

-

Energy Drinks

By distribution channel

-

Convenience Stores

-

Online Retailers

-

Supermarkets & Hypermarkets

-

other

By End-user

-

Sportspersons/Athletes

-

Recreational users

-

Casual sports drink users

-

Lifestyle users

REGIONAL ANALYSIS

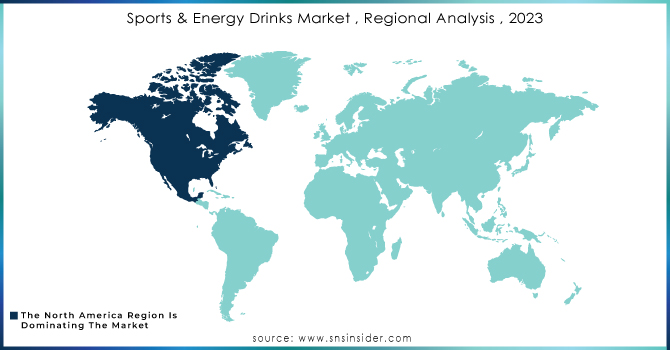

North America is the largest market for sports and energy drinks, followed by Asia Pacific. Increased engagement in sports and other physical activities, as well as the increased popularity of energy drinks, are driving the market. The U.S. is North America's largest market for sports and energy beverages. Because of the increased popularity of sports and fitness activities in North America, market participants are introducing sports drinks with added benefits such as no sugar, low-calorie, and plant-based products.

Asia Pacific is the fastest-growing market for sports and energy drinks. The increasing disposable income of consumers in the region, as well as the growing popularity of sports and other physical activities, are driving market expansion. Consumers are dealing with difficulties such as high blood pressure, diabetes, obesity, and many others. China, India, and Japan are the Asia Pacific's major markets for sports and energy beverages.

Europe has seen significant development in sports and energy drinks, owing to increased engagement in sports and other physical activities, as well as the growing popularity of sports beverages. Germany, the United Kingdom, and France have Europe's largest sports and energy drink markets. Furthermore, when food habits and lifestyle modifications changed, customers' appetite for health and energy beverages increased.

Latin America, the Middle East, and Africa are emerging beverage markets. Brazil is Latin America's largest market for sports and energy beverages. Growing worries about health and fitness among the younger generation are prompting market participants to develop nutritionally beneficial and low-calorie goods.

Need any customization research on Sports & Energy Drinks Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

AJE Group, Abbott Nutrition Co., BA sports nutrition LL, The Coca-Cola Company, PepsiCo Inc., Herbalife And Energy Drinks, Inc., Monster Beverage Corporation, Red Bull GmbH, True and Energy Drinks, Glanbia plc, Now Health Group, Inc., and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2022 Blast Asset LLC, a subsidiary of Monster Beverage Corporation, announced the completion of its acquisition of the assets of Vital Pharmaceuticals, Inc. and some of its subsidiaries for a price of approximately $362 million, subject to adjustments. Bang Energy drinks and a beverage production facility in Phoenix, Arizona are among the assets bought.

In 2022 PepsiCo will introduce hemp seed-infused energy drinks designed to help people relax. The drinks are available in three different flavors and have less caffeine than other Rockstar products.

In 2022 Limca, a brand of The Coca-Cola Company, introduced its first-ever variation of the sports drink "Limca Sportz" in India. The sports drink comes in lemon and lime flavors. Limca Sportz is a glucose and electrolyte-based beverage used by athletes to rehydrate.

| Report Attributes | Details |

| Market Size in 2023 | US$ 116.77 Billion |

| Market Size by 2030 | US$ 298.70 Billion |

| CAGR | CAGR of 11 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sports Drinks, Energy Drinks) • By distribution channel (convenience stores, online retailers, supermarkets & hypermarkets, and other distribution channel types) • By End-user (Sportsperson/Athletes, Recreational users, Casual sports drink users, Lifestyle users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AJE Group, Abbott Nutrition Co., BA sports nutrition LL, The Coca-Cola Company, PepsiCo Inc., Herbalife And Energy Drinks, Inc., Monster Beverage Corporation, Red Bull GmbH, True and Energy Drinks, Glanbia plc, Now Health Group, Inc |

| Key Drivers | • High marketing and advertising strategies • The growing trend of fitness activities |

| Market Challenges | • Increase counterfeit drinks in the market • High cost of Sports & Energy Drinks |