SSD Controller Market Size & Trends:

The SSD Controller Market was valued at USD 14.73 billion in 2025 and is expected to reach USD 49.61 billion by 2035, growing at a CAGR of 12.91% from 2026-2035.

The global market covers SSD controller market analysis, in terms of market size, key segment performance, regional outlook, and competitive landscape across consumer and enterprise applications. Diminished SSD controller will present the technological advancement and high performance globally over the upcoming period owing to increasing adoption of NVMe and PCIe interfaces, stronger demand for higher performance storage class memory, NAND technology developments, particularly in data-induced and HPC environments.

For instance, AI and HPC workloads now account for over 30% of enterprise SSD controller deployments due to their IOPS and parallel processing needs.

SSD Controller Market Size and Forecast

-

Market Size in 2025: USD 14.73 Billion

-

Market Size by 2035: USD 49.61 Billion

-

CAGR: 12.91% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on SSD Controller Market - Request Free Sample Report

SSD Controller Market Trends

-

Rising demand for high-speed data storage in data centers, enterprise IT, and cloud infrastructure is driving the SSD controller market.

-

Growing adoption of NVMe and PCIe-based SSDs is boosting demand for advanced, low-latency controller technologies.

-

Expansion of AI, big data, and high-performance computing workloads is fueling the need for efficient data handling and parallel processing.

-

Increasing focus on power efficiency and thermal management is shaping controller design, especially for mobile and edge devices.

-

Advancements in error correction, wear leveling, and security features are improving SSD reliability and lifespan.

-

Growing use of SSDs in consumer electronics, gaming consoles, and automotive systems is supporting market growth.

-

Collaborations between semiconductor vendors, SSD manufacturers, and cloud service providers are accelerating innovation and market expansion.

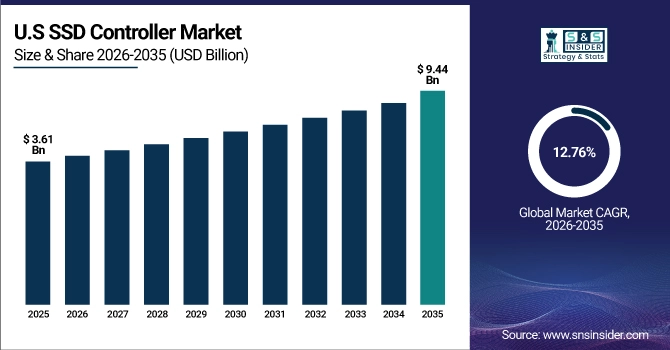

The U.S. SSD Controller Market was valued at USD 3.61 billion in 2025 and is expected to reach USD 9.44 billion by 2035, growing at a CAGR of 12.76% from 2026-2035.

The U.S. market is booming, fueled by demand for high-performance storage in the data center, hyperscale cloud infrastructure, and enterprise servers. The adoption of PCIe, Gen4 and Gen5 SSDs and AI-enabled storage systems are accelerating. In addition, a healthy presence of most of the SSD manufacturers and early penetration of cutting-edge storage technologies are driving the momentum in the market, making U.S. as one of the prominent contributors towards global SSD controller market growth.

For instance, over 60% of new enterprise SSD deployments in the U.S. utilize PCIe Gen4, and 25% are adopting Gen5.

SSD Controller Market Growth Drivers:

-

Explosive Growth in Data Centers and Cloud Infrastructure Globally is Fueling SSD Controller Adoption Across Applications

One significant driver for growing demand for SSD controllers is the fast-growing data centers and hyperscale cloud infrastructure. As workloads move to the cloud, the need for ultra-fast storage solutions with low latencies increases. This is especially true when dealing with advanced SSD controllers, such as NVMe and PCIe SSD controllers which possess the ability to utilize higher performance tools to move larger data quantities. For instance, Cloud service providers, such as AWS, Google Cloud, and Microsoft Azure are also pouring many things into storage upgrade. The size of this infrastructure development directly correlates with the increased deployment of SDDSs and thus controllers, pushing global market penetration.

For instance, over 80% of cloud servers deployed by AWS, Microsoft Azure, and Google Cloud use SSDs as primary storage, with NVMe SSDs accounting for more than 65%.

SSD Controller Market Restraints:

-

High Design Complexity and Integration Challenges Are Slowing SSD Controller Innovation and Time-to-Market

Developing sophisticated SSD controllers supporting PCIe Gen5 high-speed interfaces, 3D NAND, and AI acceleration in many cases involves significant technical challenges. They need design time and cost for integration of error correction, thermal management, power efficiency, and compatibility. However, the firmware development is also delayed along with NAND vendor gearing up for launch. Such technical restrictions, lead to higher R&D cycles, lower efficiency of customization and pose entry barriers for newer, smaller players looking to enter the high–performance SSD controller landscape. These technical complexities continue to shape SSD controller market trends globally.

SSD Controller Market Opportunities:

-

Emerging Demand in Automotive and Industrial IoT Offers Untapped Growth Avenues for SSD Controllers

New use cases for rugged storage performing at the edge via smart vehicles, industrial automation and real-time edge computing are creating new storage needs. SSD controllers implemented in these segments should include wide temperature ranges, strong error correction, and low latency operations. Fast and reliable storage is key, spurring SSD controller integration in autonomous vehicles, ADAS systems, and factory automation equipment. With connected and intelligent devices transforming how the world works in these industries, opportunities abound for SSD controller vendors to diversify and grow the company beyond consumer and enterprise.

For instance, over 60% of modern manufacturing lines are adopting smart automation platforms with integrated edge SSD systems to ensure low-latency control loops.

SSD Controller Market Challenges:

-

Rapid Interface Evolution and Need for Backward Compatibility Strain Controller Development Cycles

While the SSD industry is quickly moving to faster interfaces, such as PCIe Gen5 and beyond, consumers often find themselves using older systems. This creates a design decision for the controller developers, which are pressured to support several generations of interfaces in parallel. It costs more and gets complicated further as they are keeping backward compatibility while squeezing best performance is not so easy. Manufacturers then need to balance trade-offs in interface support as this complicates market reach, leading to the creation of multiple controller variants per product generation.

SSD Controller Market Segmentation Analysis:

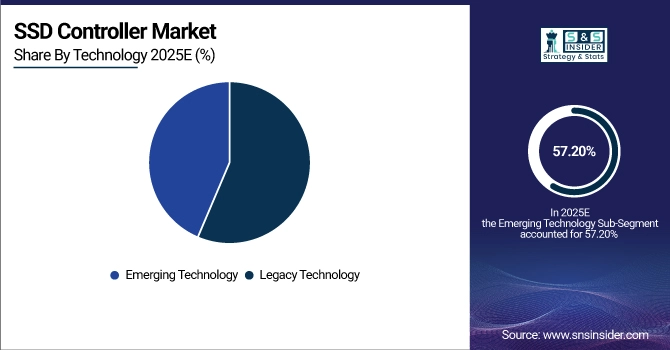

By Technology, Emerging Technologies held the largest market share in 2025 and are projected to grow at the fastest CAGR

In the year 2025, Emerging Technology segment led the SSD controller market in terms of revenue share, at approximately 57.20%, owing to increasing utilization of PCIe Gen4/Gen5 controllers, AI-enhanced chips, and compatibility with 3D NAND, and DRAM-less architectures. With its newest SSD controllers using cutting edge technology, Phison Electronics is one of the enablers of this new trend. In terms of the average revenue growth rate, the Emerging Technology segment is poised to expand at the most rapid CAGR of nearly 13.02% during 2026–2035 as enterprises advance to more intelligent, speedy, and storage controller types to satisfy the future data throughput requirement.

By Type, NVMe SSD Controllers dominated the market in 2025 and are expected to register the fastest growth

NVMe SSD Controllers segment lead the market in terms of revenue share at about 34.70% in 2025 mainly due to their faster speeds, improved parallelism, and reduced latency, which are necessary for modern data center, and high product-performance devices. Already, NVMe-based SSDs with cutting-edge controller technology have led to strong footprints for companies, such as Samsung Electronics. NVMe SSD Controllers segment is also expected to achieve the highest growth rate of approximately 13.73% CAGR during 2026-2035, driven by maturation of enterprise workloads, continued expansion of gaming systems and next-gen AI computing environments requiring ultra-fast and scalable storage interfaces.

By Storage Capacity, High-Capacity SSD Controllers led revenue share in 2025 and are projected to grow at the fastest CAGR

High-Capacity SSD Controllers segment is projected to hold the largest revenue share of 38.20% in the SSD controller industry in 2025, due to an increasing trend for data-intensive applications including video editing, big data analytics, and cloud storage. Western Digital offers high-capacity SSDs equipped with advanced controllers that cater to enterprise needs. High-Capacity SSD Controllers segment is estimated to rise at the fastest CAGR of nearly 13.16% throughout 2026–2035 due to the growing requirements for enterprise storage needs, AI workloads, along with the availability of multi-terabyte SSD options across prosumer and business environments.

By End-User, Enterprise Applications dominated the SSD controller market and are expected to grow at the highest rate

Enterprise Applications segment leads the SSD controller market share by acquiring approximately 44.80% of the revenue in 2025, which is mainly attributed to institutes involved in servers, high-speed storage systems, virtualization platforms, and hyperscale cloud infrastructure. Intel Corporation has played an important role in the enterprise SSD controller innovation process with its enterprise-grade SSD controller innovations. Enterprise Applications segment is also projected to witness highest CAGR of 13.56% during 2026–2035, owing to persistent investment in cloud data centers, AI training clusters, and mission critical applications which all need reliable, scalable and high-throughput storage solutions.

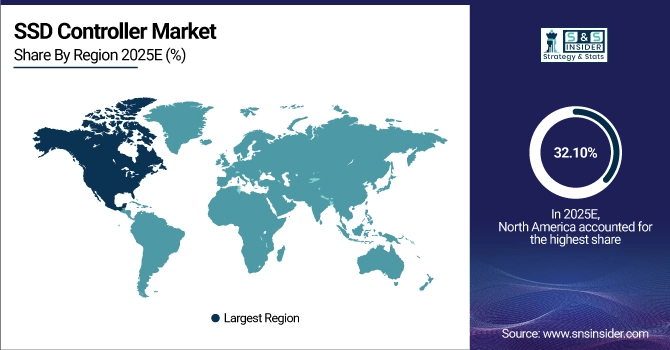

SSD Controller Market Regional Analysis

North America SSD Controller Market Insights

In 2025, North America accounted for the largest revenue share at around 32.10% of the SSD controller market. This leadership is a result of heavy presence from large-scale data centers, leading technology companies, and higher rates of early adopters of advanced SSD technologies across the U.S. This goes to strengthen the position of the region in SSD controller ecosystem through well-established infrastructure, usage of enterprise demand, and high R&D investment from global storage solution providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American SSD controller market due to its extensive data center infrastructure, early adoption of PCIe and NVMe technologies, and the strong presence of major SSD manufacturers including Intel, Micron, and Western Digital.

Asia Pacific SSD Controller Market Insights

The Asia Pacific is anticipated to register the fastest CAGR of approximately 13.76% over the forecast period 2026-2035. The booming electronics manufacturing industries of China, Taiwan, and South Korea, plus a growing tendency to adopt cloud computing and storage solutions, are, therefore, fueling this rapid growth. At the same time, digital transformation initiatives and rising demand for consumer and enterprise-based SSDs in markets, such as India and Southeast Asia are creating solid momentum for SSD controller adoption throughout the region.

-

China leads the Asia Pacific SSD controller market owing to its massive electronics manufacturing base, aggressive investments in cloud infrastructure, and domestic demand for high-speed storage across consumer devices, enterprise systems, and government-led digital transformation initiatives.

Europe SSD Controller Market Insights

Europe holds a significant position in the SSD controller market, driven by growing adoption of high-performance storage in automotive electronics, industrial automation, and enterprise data centers. Countries including Germany, U.K., and France are investing in advanced digital infrastructure, fueling SSD demand. Additionally, increasing focus on data security and edge computing accelerates the need for efficient and reliable storage controllers.

-

Germany dominates the European SSD controller market due to its leadership in automotive electronics, industrial automation, and strong digital infrastructure. Significant investments in data centers and the presence of key semiconductor manufacturers further strengthen its position in the regional market.

Middle East & Africa and Latin America SSD Controller Market Insights

Middle East & Africa and Latin America SSD controller markets are expanding due to rising demand for data centers, laptops, and enterprise storage. Growth is driven by digital transformation, cloud adoption, and infrastructure investments. Increasing deployment in telecom and government sectors boosts controller shipments. Challenges include economic variability and supply chain constraints, but long-term prospects remain strong with tech upgrades and affordability improvements.

SSD Controller Market Competitive Landscape:

Phison Electronics Corporation

Phison Electronics is a leading fabless semiconductor company specializing in NAND flash controllers and complete storage solutions for consumer, enterprise, industrial, and automotive markets. Founded in 2000, the company is known for its in-house controller design, firmware development, and deep integration with NAND technologies. Phison focuses on high-performance PCIe SSD controllers, AI-optimized storage, and automotive-grade solutions, enabling reliable, scalable, and intelligent storage architectures across next-generation computing platforms.

-

2025 – Phison’s PS5022 PCIe Gen4x4 SSD controller achieved ISO 26262 ASIL-B automotive functional-safety certification, marking the world’s first SSD controller certified for automotive safety systems.

-

2025 – Phison’s E28 6 nm AI-computing SSD controller and module won the COMPUTEX 2025 Best Choice Golden Award, recognizing its AI-ready architecture and high-performance design.

Samsung Electronics Co., Ltd.

Samsung Electronics is a global technology leader in semiconductors, consumer electronics, and enterprise IT solutions. Through its semiconductor division, Samsung designs and manufactures advanced NAND flash, in-house SSD controllers, and storage solutions for data centers, PCs, and automotive applications. Leveraging proprietary V-NAND technology and controller innovation, Samsung focuses on high-bandwidth PCIe SSDs, AI-optimized storage, and automotive-grade reliability, supporting next-generation computing, AI workloads, and software-defined infrastructure.

-

2025 – Samsung expanded its 9100 PRO SSD lineup with an 8 TB PCIe 5.0 model delivering up to ~14.8 GB/s performance, powered by advanced in-house controller and V-NAND technology.

-

2024 – Samsung began mass development and production of high-performance PCIe 5.0 SSDs aimed at enterprise servers and AI workloads.

-

2024 – Samsung introduced its first PCIe 4.0 automotive SSD (AM9C1) featuring a 5 nm in-house controller and V-NAND technology for automotive AI and high-reliability environments.

SSD Controller Companies are:

Some of the SSD Controller Market Companies

-

Samsung Electronics

-

Intel Corporation

-

Western Digital Corporation

-

Micron Technology, Inc.

-

SK hynix Inc.

-

Kioxia Corporation

-

Phison Electronics Corporation

-

Marvell Technology, Inc.

-

Silicon Motion Technology Corporation

-

Broadcom Inc.

-

Realtek Semiconductor Corp.

-

Seagate Technology Holdings PLC

-

NXP Semiconductors

-

Renesas Electronics Corporation

-

Toshiba Corporation

-

VIA Labs, Inc.

-

ASMedia Technology Inc.

-

Kingston Technology Company, Inc.

-

ADATA Technology Co., Ltd.

-

Transcend Information, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.73 Billion |

| Market Size by 2035 | USD 49.61 Billion |

| CAGR | CAGR of 12.91% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (SATA SSD Controllers, NVMe SSD Controllers, PCIe SSD Controllers and M.2 SSD Controllers) • By Storage Capacity (Low-Capacity SSD Controllers, Medium-Capacity SSD Controllers and High-Capacity SSD Controllers) • By Technology (Legacy Technology and Emerging Technology) • By End-User (Consumer Electronics, Enterprise Applications and Industrial Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics, Intel Corporation, Western Digital Corporation, Micron Technology, Inc., SK hynix Inc., Kioxia Corporation, Phison Electronics Corporation, Marvell Technology, Inc., Silicon Motion Technology Corporation, Broadcom Inc., Realtek Semiconductor Corp., Seagate Technology Holdings PLC, NXP Semiconductors, Renesas Electronics Corporation, Toshiba Corporation, VIA Labs, Inc., ASMedia Technology Inc., Kingston Technology Company, Inc., ADATA Technology Co., Ltd. and Transcend Information, Inc. |