Factory Automation Sensor Market Report Scope & Overview:

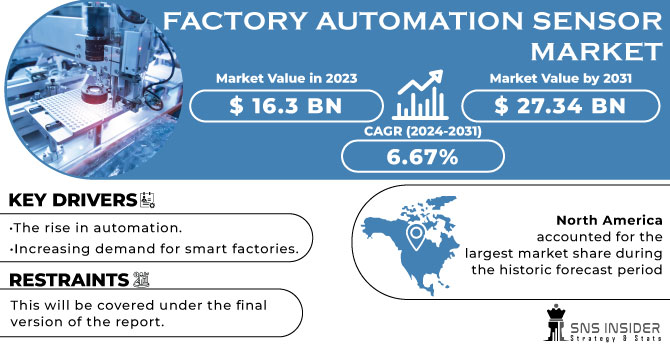

The Factory Automation Sensor Market Size was valued at USD 15.98 billion in 2023 and is expected to reach USD 26.26 billion by 2032 and grow at a CAGR of 5.68% over the forecast period 2024-2032.

Get more information on Factory Automation Sensor Market - Request Sample Report

The Factory Automation Sensor Market is seeing significant growth, driven by the rise of Industrial Internet of Things (IIoT) technologies and a growing need for energy-efficient solutions. Sensors are integral to IIoT applications, enabling real-time data collection, accurate monitoring, and seamless communication, which in turn boost productivity and operational efficiency in industrial processes. Advancements such as ultra-reliable low-latency communication (URLLC) for wireless control are enhancing sensor performance while minimizing power consumption. The integration of AI and machine learning in smart manufacturing technologies further accelerates this growth by enabling predictive maintenance, automated quality control, and process optimization. These innovations align with the broader trends in automation and energy efficiency across industries. The increased adoption of smart factories, powered by AI and decentralized manufacturing, is enhancing operational efficiency and helping manufacturers stay competitive in a dynamic industry. This shift is evident in sectors like LNG, where automation technologies are playing a crucial role in optimizing energy efficiency, managing risk, and reducing emissions. For example, companies like Emerson are leveraging advanced automation and intelligent sensors in LNG projects to improve plant performance and reduce energy consumption, contributing to sustainability goals. Similarly, industrial AI’s power demands, though initially high, are being managed more efficiently in sectors like factory automation, where energy consumption is optimized. The adoption of AI-powered systems and energy-efficient sensors is poised to help manufacturers navigate challenges like labor shortages and volatile material costs. As manufacturers anticipate increased revenues in 2025, as indicated by a recent Institute for Supply Management survey, the integration of smart factory technologies promises to boost energy efficiency, reduce operational costs, and enable businesses in increasingly complex market, positioning them to capitalize on emerging opportunities.

Market Dynamics

Drivers

-

Advancements in Sensor Technology Driving Industrial Automation Market Growth

The rapid evolution of sensor technology is a key driver in the expansion of the industrial automation market. Innovations such as miniaturized sensors, wireless connectivity, and AI integration are transforming automation systems, making them more efficient, versatile, and essential for modern manufacturing processes. This technological progression has fueled the increasing demand for industrial automation cables, which are critical for connecting advanced sensors and ensuring high-speed data transmission. The rise in industrial robot adoption has significantly boosted the demand for current sensors, enabling more precise data collection and improving operational efficiency. Miniaturized sensors are reducing the size and cost of automation systems, while wireless connectivity ensures seamless communication between machines and centralized control units. Additionally, AI integration enhances sensor capabilities by enabling predictive maintenance, real-time monitoring, and optimized machine performance. AI-powered quality control systems further contribute to the manufacturing process by improving precision and reducing operational costs. The growing implementation of Industry 4.0 technologies is driving the need for smart manufacturing solutions, where interconnected systems, data analytics, and automation converge to create highly efficient and adaptive production environments. Automation cables play a central role in this transformation, as they facilitate the communication necessary for smart factories to operate effectively. As companies increasingly adopt automation systems, IoT, and data analytics to optimize industrial processes, the demand for advanced industrial automation cables continues to rise.

Restraints

-

Cybersecurity Risks and Challenges in the Evolution of Industrial Automation Systems.

As industrial automation systems become more interconnected through the Internet of Things (IoT) and wireless communication, cybersecurity concerns are emerging as a significant challenge. The vulnerabilities in sensor systems, networks, and data transmission channels are increasingly targeted by cybercriminals, exposing businesses to risks such as data breaches, theft, and operational disruptions. The integration of IoT and AI in industrial sensors intensifies these security risks, as the interconnectivity of devices creates numerous entry points for potential hackers. These vulnerabilities can result in compromised data collection, equipment malfunctions, and even production process disruptions. Automation systems that lack proper security measures are prone to causing substantial financial losses and prolonged operational downtime. Additionally, managing and securing the vast amounts of data generated by industrial sensors becomes a complex task, as organizations strive to protect their systems from evolving cyber threats. The growing demand for AI-powered cybersecurity solutions to secure smart factories reflects this concern. However, the absence of standardized cybersecurity frameworks and inadequate regulation in operational technology (OT) systems slow the implementation of effective security protocols. With industrial automation increasingly reliant on wireless communication, establishing a robust cybersecurity infrastructure is vital to ensure the protection and smooth operation of these advanced technologies.

Segment Analysis

By Sensor Type

The temperature sensors segment is leading the Factory Automation Sensor Market, holding a 25% share in 2023. These sensors are crucial in factory automation for monitoring and controlling temperatures within manufacturing processes, ensuring optimal performance, safety, and product quality. They are widely used across industries such as automotive, food and beverage, pharmaceuticals, and chemicals. Temperature sensors help in preventing equipment damage, improving energy efficiency, and maintaining system reliability by providing real-time temperature data. The increasing demand for automation and the push for more precise control over manufacturing processes are driving the growth of temperature sensors. Furthermore, advancements in sensor technology, such as wireless temperature sensors and integration with IoT, are contributing to the segment's dominance, offering better connectivity and ease of use in complex factory environments.

By Application

The manufacturing segment is the dominant application in the Factory Automation Sensor Market, accounting for approximately 20% of the market share in 2023. Sensors in manufacturing play a critical role in enhancing operational efficiency, product quality, and process automation. They are employed in various stages of production, from assembly lines to quality control, to monitor variables such as temperature, pressure, proximity, and vibration. These sensors help manufacturers optimize their operations by ensuring precision, reducing downtime, and improving safety. As industries continue to embrace Industry 4.0 and smart factories, the need for advanced sensors in manufacturing applications is expected to rise. The integration of IoT and AI-driven analytics is further boosting sensor usage in manufacturing, allowing real-time monitoring and predictive maintenance to improve overall productivity and reduce operational costs.

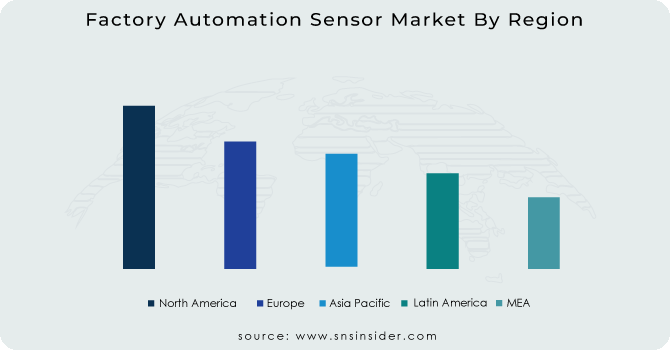

Regional Analysis

North America holds a dominant share of approximately 36% in the Factory Automation Sensor Market in 2023. The region’s leadership is driven by significant advancements in industrial automation, the widespread adoption of Industry 4.0, and the presence of leading sensor manufacturers. The United States, in particular, is at the forefront of automation adoption, with industries such as automotive, aerospace, and electronics heavily investing in automation technologies. Canada's industrial sector is also experiencing rapid growth, driven by its focus on smart manufacturing and sustainability. North America's robust technological infrastructure, high investments in R&D, and increasing demand for efficient production systems further contribute to the dominance of the region in the factory automation sensor market. Government initiatives and policies that encourage automation and technological innovation are fostering the growth of sensor markets in this region.

Asia-Pacific is the fastest-growing region in the Factory Automation Sensor Market from 2024 to 2032, driven by rapid industrialization and technological advancements in countries like China, Japan, South Korea, and India. China, as a global manufacturing hub, leads with heavy investments in smart factories and robotics. Japan and South Korea are at the forefront of automation, with innovations in robotics and industrial systems. India’s expanding manufacturing sector also accelerates sensor adoption for enhanced productivity and cost savings. Government initiatives, such as Industry 4.0 and smart manufacturing, are further supporting market growth. The region's demand for advanced automation solutions is spurred by increased IoT adoption, automation in industries like automotive and electronics, and the need for high-performance, reliable sensors. Asia-Pacific's growth is fueled by technological progress and strategic investments in automation.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Factory Automation Sensor Market with their product:

-

SICK AG (LiDAR Sensors, Safety Sensors, Vision Sensors)

-

Siemens (Proximity Sensors, Temperature Sensors, Vision Sensors)

-

Omron (Inductive Sensors, Vision Sensors, Temperature Sensors)

-

Turck (Inductive Sensors, Pressure Sensors, RFID Sensors)

-

Rockwell Automation (Photoelectric Sensors, Proximity Sensors, Vibration Sensors)

-

Balluff (Inductive Sensors, Optical Sensors, Pressure Sensors)

-

Schneider Electric (Temperature Sensors, Pressure Sensors, Proximity Sensors)

-

ABB (Ultrasonic Sensors, Temperature Sensors, Proximity Sensors)

-

Keyence (Laser Displacement Sensors, Vision Sensors, Optical Sensors)

-

Bihl+Wilfing (Safety Sensors, RFID Sensors, Vision Sensors)

-

Teledyne Technologies (Environmental Sensors, Pressure Sensors, Vibration Sensors)

-

Phoenix Contact (Inductive Sensors, Pressure Sensors, Temperature Sensors)

-

IFM Electronic (Proximity Sensors, Temperature Sensors, Vibration Sensors)

-

Honeywell (Temperature Sensors, Pressure Sensors, Gas Sensors)

-

Eaton (Pressure Sensors, Proximity Sensors, Temperature Sensors)

-

Festo (Flow Sensors, Pressure Sensors, Vision Sensors)

-

Bosch Rexroth (Position Sensors, Proximity Sensors, Force Sensors)

-

Panasonic (Inductive Sensors, Optical Sensors, Pressure Sensors)

-

National Instruments (Temperature Sensors, Pressure Sensors, Vibration Sensors)

-

Pepperl+Fuchs (Inductive Sensors, Photoelectric Sensors, Vibration Sensors)

List of Suppliers who supplies raw material and component in Factory Automation Sensor Market:

-

3M

-

Dow Chemical Company

-

DuPont

-

Mitsubishi Materials

-

Saint-Gobain

-

Nippon Steel Corporation

-

LG Chem

-

Infineon Technologies

-

Samsung SDI

-

TE Connectivity

Recent Development

-

Dec 2024, Aeva and SICK Expand Collaboration for Advanced Sensor SolutionsAeva has deepened its partnership with SICK to integrate its frequency-modulated continuous wave (FMCW) technology into SICK’s portfolio of high-accuracy contactless sensors for industrial applications. This development enhances precision in factory automation through Aeva’s CoreVision module and advanced signal processing algorithms.

-

Oct 2024 , Siemens and Microsoft Transform Industrial Automation with AI-Powered CopilotSiemens, in collaboration with Microsoft, has advanced its Industrial Copilot by integrating Microsoft Azure OpenAI Service, enabling enhanced performance for manufacturing and automation environments. The Gen AI-powered assistant is set for a global rollout with thyssenkrupp Automation Engineering in early 2025.

-

Aug 2024, ABB to Strengthen Emission Monitoring with Födisch Group Acquisition, ABB announced its agreement to acquire the Födisch Group, enhancing its Continuous Emission Monitoring Systems (CEMS) portfolio with advanced measurement and analysis solutions tailored for the energy and industrial sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.98 Billion |

| Market Size by 2032 | USD 26.26 Billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Temperature Sensors, Vibration Sensors, Humidity Sensors, Proximity Sensors, Pressure Sensors, Vision Sensors, Others) • By Application (Manufacturing, Automotive, Chemicals, Energy & Power, Food & Beverages, Oil & Gas, Aerospace And Defense, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SICK AG, Siemens, Omron, Turck, Rockwell Automation, Balluff, Schneider Electric, ABB, Keyence, Bihl+Wilfing, Teledyne Technologies, Phoenix Contact, IFM Electronic, Honeywell, Eaton, Festo, Bosch Rexroth, Panasonic, National Instruments, and Pepperl+Fuchs. |

| Key Drivers | • Advancements in Sensor Technology Driving Industrial Automation Market Growth |

| Restraints | • Cybersecurity Risks and Challenges in the Evolution of Industrial Automation Systems. |