Automotive Electronics Market Report Scope & Overview

Get More Information on Automotive Electronics Market - Request Sample Report

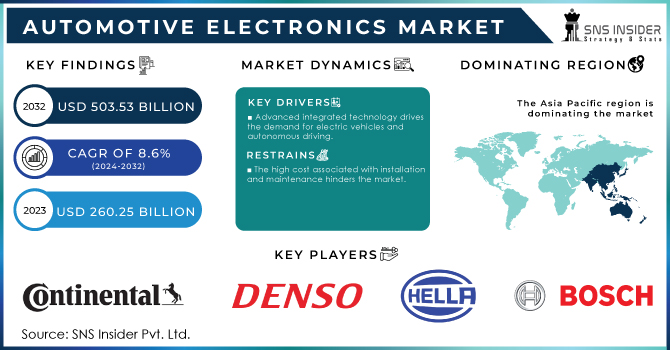

The Automotive Electronics Market was size was recorded at USD 260.25 Billion in 2023 and is been estimated to reach USD 503.53 Billion by 2032. The expected CAGR is 8.6% over the forecast period of 2024-2032.

The growing penetration and deployment of advanced safety systems which are composed of automatic emergency braking, airbags, parking assistance systems & lane departure, and warnings to reduce road mishaps is anticipated to bode well for market growth in the upcoming years. Furthermore, the integration of emergency call systems, alcohol ignition interlocks, and accident data recorder systems to protect in-vehicle occupants is being adopted faster and this trend will sustain market growth over the forecast period.

As per the overall electric car sales in 2024, more than 3 million electric cars were sold globally between January and March (25% higher YOY), compared to the previous year's sales record. Most of the sales came from China, which saw more than a half-million additional electric car sales compared to over that period in 2023. China also leads the world in electric truck sales: it sold 36,000 electric trucks in 2022. Furthermore, it also tops the market in battery swapping: 49.5% of the electric trucks it sold in 2022 were capable of swapping.

In Addition to that, a US, Startup Company called Ample is partnering with Japan’s Mitsubishi Fuso to manufacture battery-swappable last-mile delivery trucks. According to the company’s founder, “These trucks amount to 25-30% of global urban emissions, and they had also designed a new type of swapping station where the trucks could pull right through one without having to back out”.

Market Dynamics

Drivers

-

Advanced integrated technology drives the demand for electric vehicles and autonomous driving.

2023 has shown a new trend of surge in electric vehicle sales which has increased from last year by 35% Growth for these cars is being driven by the falling price of batteries, greater choice on the market, and government policies/incentives. New cars are being developed for ADAS and automotive-grade autonomy, consisting of high-end software for lane-keeping assistance, adaptive cruise control, and automated emergency braking to numerous sensors (cameras, radar, etc.), which has made this market attractive for customers. Rapidly growing production of vehicles without a driver from automakers gives an increased demand for current modern electronics components such as processors, sensors, and actuators.

According to a study on demand and sales over the region, in 2023, 60% of new electric car registrations were in the People’s Republic of China, just under 25% in Europe, and 10% in the United States – corresponding to nearly 95% of global electric car sales combined. In these countries, electric cars account for a large share of local car markets: more than one in three new car registrations in China was electric in 2023, over one in five in Europe, and one in ten in the United States. In line with that, in 2024, electric car sales in the United States are forecasted to rise by 20% compared to the previous year, converting to almost half a million more sales, relative to 2023.

Restrain

-

The high cost associated with installation and maintenance hinders the market.

Opportunity

-

The rising technological advancement in the automotive industry and growing startups, making this market popular.

Various companies are investing in the startups in this market that have made this market popular as compared to other alternatives. For example, CAPSolar, a startup in Canada, focuses on the efficiency of batteries by reducing the draining issue of the battery by developing solar modules for Light electric vehicles. Another example is EPowerlab, in Spain which focuses on providing product development and maintenance services for e-mobility powertrains through its advanced technology called Proprietary DeveLinkSTUDIO Technology.

Challenges

-

The lack of efficient infrastructure for transportation in developing and under-developed economies.

Market Segmentation

By Application

-

ADAS

-

Infotainment

-

Body Electronics

-

Safety Systems

-

Powertrain Electronics

The safety systems segment held the largest market revenue share of more than 35% in 2023. The increasing demand for a mix of infotainment solutions that include entertainment, connectivity, and navigation features is leading the rise in the automotive electronics market size. Furthermore, several car makers & tech providers are teaming up to create cars loaded with powerful infotainment systems. On the other hand, Toyota has announced an expansion in its collaboration with Google Cloud to bring next-generation in-vehicle multimedia for Tesla and Lexus vehicles using AI-based speech services from Google Cloud. At the same time, Mercedes-Benz AG and Qualcomm Technologies Inc. announced that they will extend their strategic partnership to deploy Snapdragon Digital Chassis-based solutions in luxury cars of technology designed to transform high-density information into user-friendly displays quickly with pictures or text presented at driving speed without drivers feeling overwhelmed by data overload.

By Sales Channel

-

OEM

-

Aftermarket

OEM is the largest segment of the automotive electronics market with more than 55% of revenue share in 2023, owing to its ability to incorporate electronic systems easily during vehicle manufacturing. In addition, OEMs and tech. Giants are collaborating to provide smart features in the new next-gen models that will help spur further calls for cutting-edge automotive electronics. For example, a partnership between Ford Motors and Google to supply connected car apps. Ford Motors is innovating its connected vehicle business integration through this partnership. In addition, much stronger safety and emissions rules require advanced electronics to keep up with requirements.

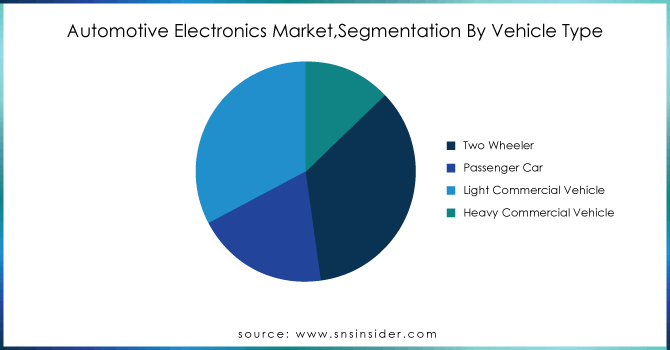

By Vehicle Type

-

Two Wheeler

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

Get Customized Report as per your Business Requirement - Request For Customized Report

By Propulsion

-

ICE

-

Electric

The electric segment dominated the market with more than 53.5% of market share in 2023. vehicles have many different car electronics, incorporating battery management, electric motor control, regenerative braking, and charging infrastructure integration electronics. Therefore it provides a source of growth in the electric/hybrid segment. For Example, Sony created a partnership with Honda, under its inaugural brand “Afeela”, in January 2023. The Electronic Control Unit (ECU) controls the other various engine parameters such as fuel injection timing, ignition timing, and air-fuel ratio to control combustion efficiency and get maximum power. This is stoking the market for the ICE propulsion segment.

By Component

-

Electronic Control Unit

-

Sensors

-

Current Carrying Devices

-

Others

The current-carrying devices led the market and occupied 40% of the share in 2023. In automobiles, current-carrying devices are highly important to pass through electrical power and signals between different parts of the vehicle circuit. This segment of the market is expected to drive demand for current-carrying devices since electronic components are expensive, and vehicles typically use many such components (e.g., switches, fuses, sensors), as well as connectors and wiring harnesses. The sensors segment is projected to be the fastest-growing of its line over the forecast period. These factors contribute to the growing automotive electronics market likely booming constantly as more people are inclined towards vehicles for their car safety, energy saving and also is a smart connected vehicle.

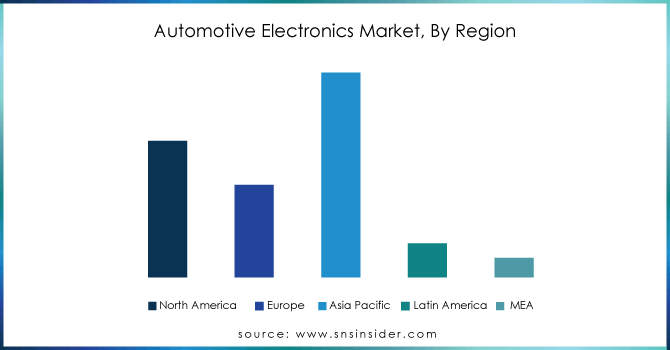

Regional Analysis

With a market share of more than 41% Asia Pacific dominated the automotive electronics market in 2023. The Asia Pacific region is experiencing growth due to several causes, including increased consumer spending power, expanding consumer awareness of safety technology, and an increase in the demand for electronics and innovative features in automobiles. It is the objective of automotive manufacturers to increase their volume of production by applying modern manufacturing technology. For example, Daimler Benz, General Motors, and Volkswagen all moved production plants to developing regions.

For Instance: In 2023, the automotive electronics market in China held a revenue share of more than 50% of Asia Pacific. Rising usage of electric cars due to the high emission taxes and leading government incentives, increasing subsidies towards the development of new energy vehicles is expected to create significant opportunities for growth across the automotive electronics market as well. Additionally, with significant investments from China towards autonomous driving technology sensors / LiDAR/ radar systems and AI algorithms are expected to grow in the region.

In Addition to China, U.S. Automotive Electronics Market is projected to Grow at a significant rate. Connected cars define the new reality for most in the U.S. automotive industry, not only in terms of navigation and infotainment but also in driving habits of Americans towards vehicles that are Internet-accessible communicating with car-to-car communications among other devices such as surrounding infrastructure like streetlights and stop signs, etc. This trend will create an opportunity for the growth of automotive electronics as connected cars need advanced electronic systems to support connectivity.

North America registered a substantial market growth in 2023. Numerous IT companies, academic institutions, and automakers are based in the region, and they are working on creating the next wave of automotive technology and electrical systems. Therefore, the expansion of the automotive electronics market in North America is driven by the increasing need for technical innovations and advances.

Regional Coverage

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

Key Players

The major key players are Continental AG, DENSO Corp, Hella GmbH, Infineon Technologies, Robert Bosch, Valeo, ZF Friedrichshafen, Hitachi Automotive Systems, Xilinx, Visteon, SONY Corporation, Infineon Technology, and others.

Infineon Technologies-Company Financial Analysis

Recent Developments:

- In January 2023, ZF Friedrichshafen AG introduced the Smart Camera 6, a camera for automated driving and safety systems. Smart Camera 6 targets the requirements of a barrel-fish-eye and Interior Monitoring System along with implementing needing for a surround view in the form of 3D.

- In January 2023, Xilinx, Inc. announced that it worked with embedded AI autonomous driving platform provider Motovis to deliver a solution combining its own Zynq Automotive (XA) family of system-on-chip (SoC) devices and an automotive-grade Convolutional Neural Network IP from Motovis for forward camera systems' vehicle control and perception issue. The solution helps customers to empower robust platforms and rapid deployment.

| Report Attributes | Details |

| Market Size in 2023 | US$ 260.25 Billion |

| Market Size by 2032 | US$ 503.53 Billion |

| CAGR | CAGR of 8.6% From 2024 to 2032 |

| Base Year |

2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Continental AG, DENSO Corp, Hella GmbH, Infineon Technologies, Robert Bosch, Valeo, ZF Friedrichshafen, Hitachi Automotive Systems, Xilinx, Visteon |

| Key Drivers | • The need for automotive electronic devices. |

| Market Restraints | • The high-cost constraints. |